If you are one of those people who are chronically allergic to not just Bitcoin but crypto in general then I bet you’ve been feeling pretty damn smug over the last week. Yes, thanks to the Mr. Asbergers Impersonate the entire crypto market was taken to the woodshed in a matter of days. But before you fall in love with your newly acquired your super human market reading abilities here’s just a teeny weeny detail you may have forgotten about:

I don’t really follow this cat but I honestly could not have put it any better.

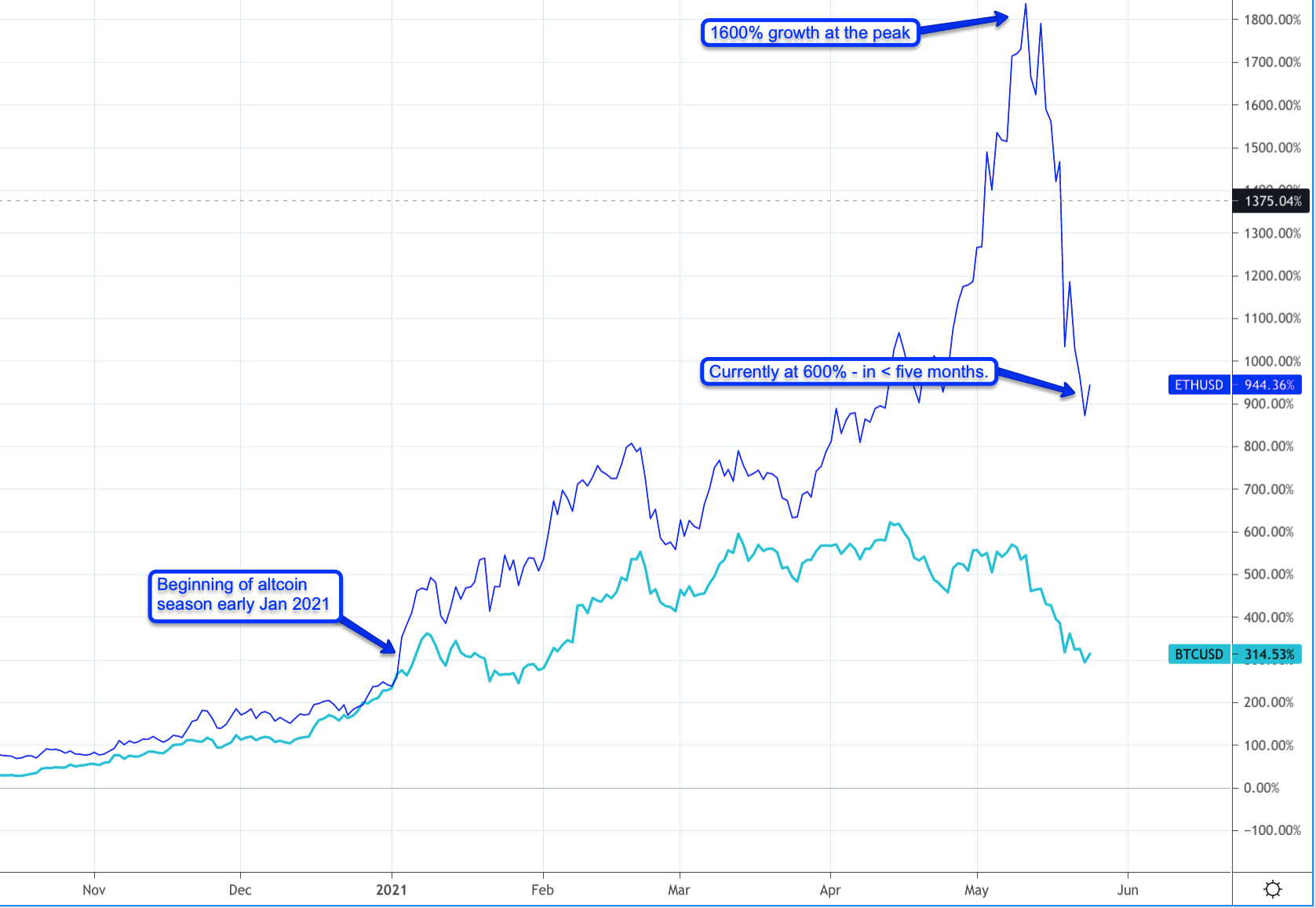

And there’s this little tidbit – let’s zoom in a little. Altcoin season began in week #1 of 2021 and in the course of five months produced over 1600% in profits. After a one week correction it’s down to ‘only’ 600%.

I frankly don’t know how I am going to live with myself.

As I’ve pointed out repeatedly. You can’t expect to enjoy 1600% growth in five months and not run into a violent retracement at some point. If you think you do, then pinch yourself. Remember TINSTAAFL.

Not to belittle the fact that this is a gut shot for anyone who bought BTC or ETH near the top.

I should know because both Scott and I did – quite a significant amount of it.

And then we bought more at 39k and again at 33k yesterday.

Walk the walk so to say.

So what’s going to happen next in crypto?

And the answer is clear.

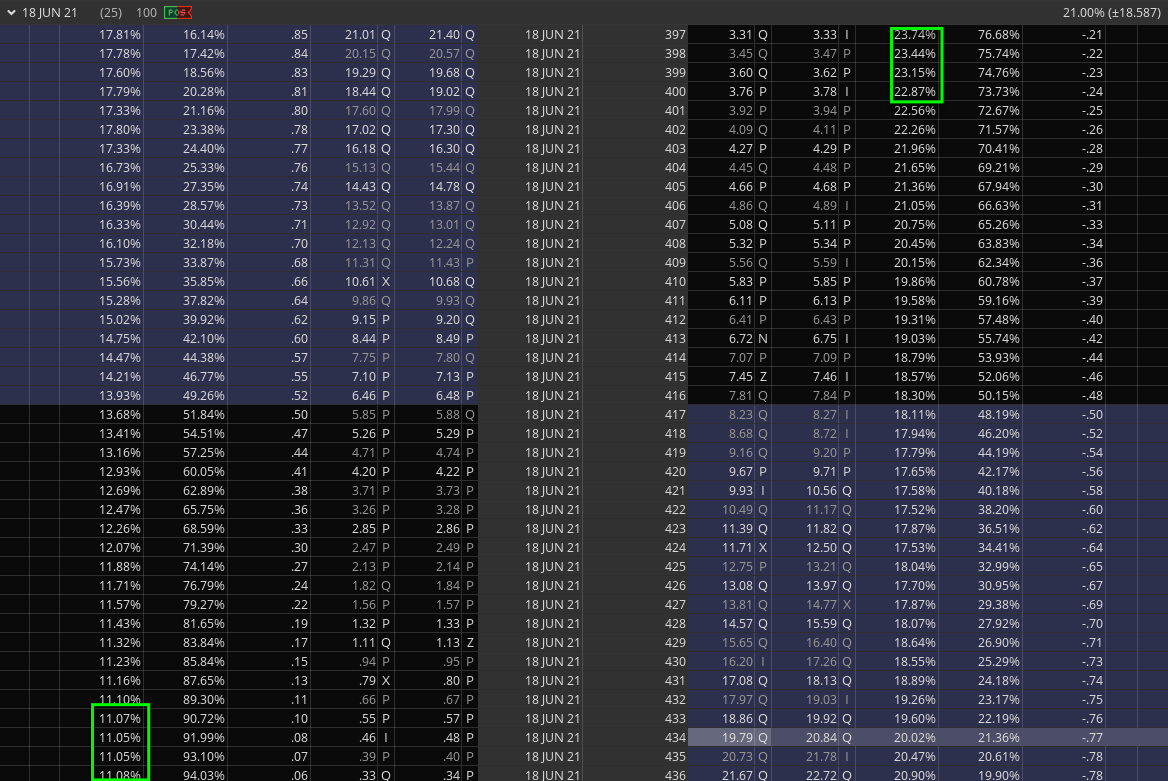

What would fuck everyone over is a choppy trading range.

And trading alts in a range, with transaction costs, would be devastating. Which is why our system just switched us into ETH mode, which I’m overjoyed about.

Everyone is expecting a powerful rally OR a new bear market… Just check the previous comment section right here on EvilSpec.

So BY DEFINITION the highest probability is both those ideas being completely wrong.

Now do not think that sticking in the safe cuddly world of equities is going to be a cake walk moving forward.

Quite to the contrary actually. As a matter of fact I’m seeing alarm lights flashing red hot all across the board. More on that further below.

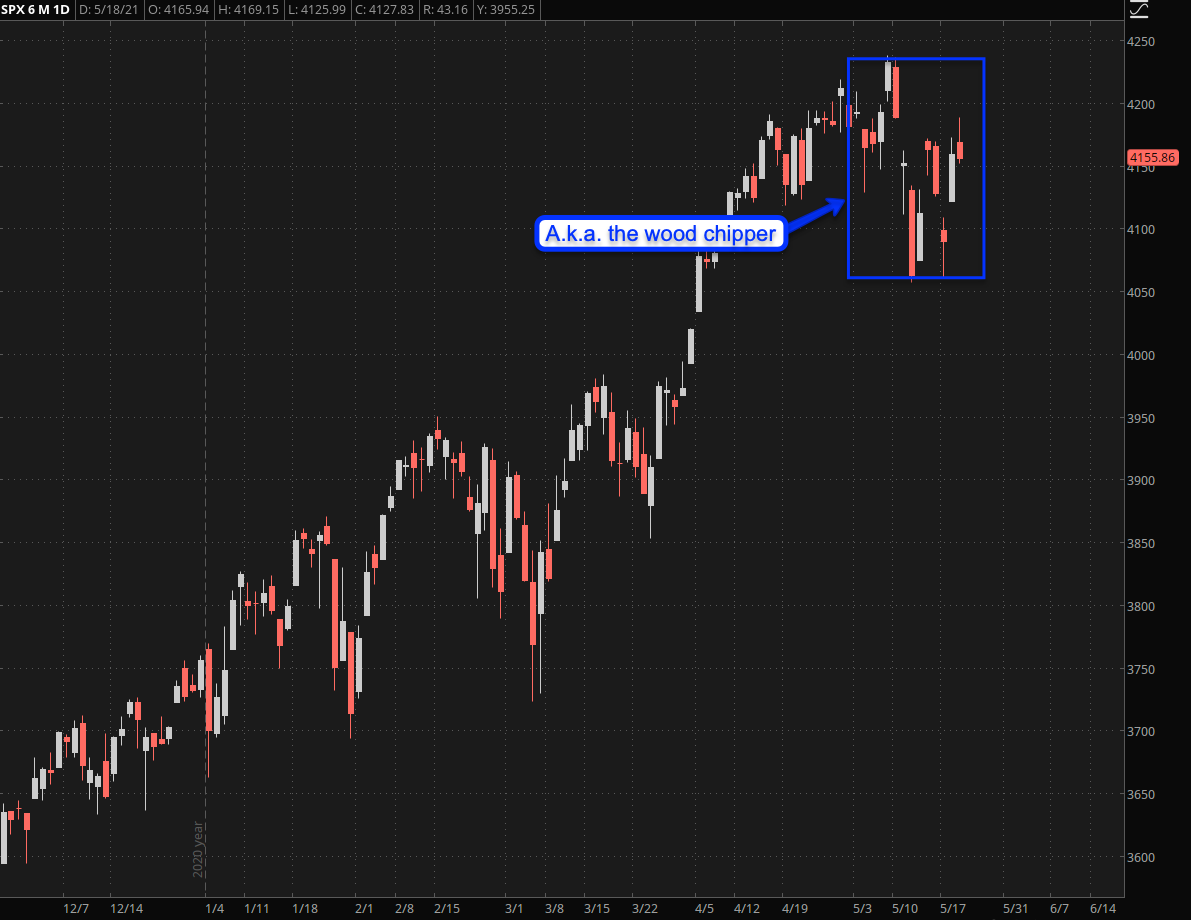

But you don’t have to be a seasoned market analyst to see that the character of the tape has changed profoundly over the past two weeks. On a line chart we’ve gone nearly nowhere. But you could drive an F-150 through those daily gaps on the SPX.

But here’s is the part where it gets really ugly:

[MM_Member_Decision membershipId='(2|3)’]

Remember my VOMMA zone on the VVIX? Nice signal indeed!

But what many miss is the re-entry into earth’s orbit. At the right angle it just dips below and falls back < the 100 mark. Case closed and BTFD opportunity triggered.

But sometimes, just sometimes, what happens is that it bounces right off the atmosphere and gets shot back into orbit. For the record – this is not what I WANT to happen but I’m properly positioned for it anyway.

Now feast your eyes on this LT chart showing SKEW on the SPX. Note how we are once again scraping the all time highs?

Now what is SKEW anyway? I’ve explained it dozens of times already but the nutshell version is that it’s the difference in IV between far OTM calls and far OTM puts.

And as you can see it’s SKY high right now. The premium being charged for puts is insane and if I had not already bought those suckers (see top left) I’d really be kicking myself right now.

Now this could just be another blip that the Fed is going to steamroll over by throwing a mountain of freshly minted cash at it.

But what I can assure you is this: Institutional trading firms are hedged to the hilt and when that happens I usually treat very carefully.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]