In case you wonder, no I didn’t just pull that one out of my rectum, and yes it’s a real thing. In fact vomma is officially listed as one of the option greeks (check it out over on Investopedia). And it also happens to be one of the more exotic indicators of implied volatility that is very carefully monitored by professional option traders. And let me assure you that they are ALL keeping a very close eye on it this very week. But why?

First let’s understand what vomma is and why we should care. The concept is actually quite simple. You may recall that gamma measures the rate of change in the delta of an option with respect to changes in the underlying price.

If you didn’t know that then don’t fret – it’ll all make complete sense to you in a second.

Basically vomma measures the rate of change in respect to changes in an option’s vega, i.e. implied volatility. So while the VIX – or by extension vega – measures the expected movement in the S&P 500, vomma measures the expected movement in the VIX. That’s the key difference.

Effectively what we are looking at here is volatility in implied volatility, if that makes any sense. Which makes vomma a second order derivative of volatility.

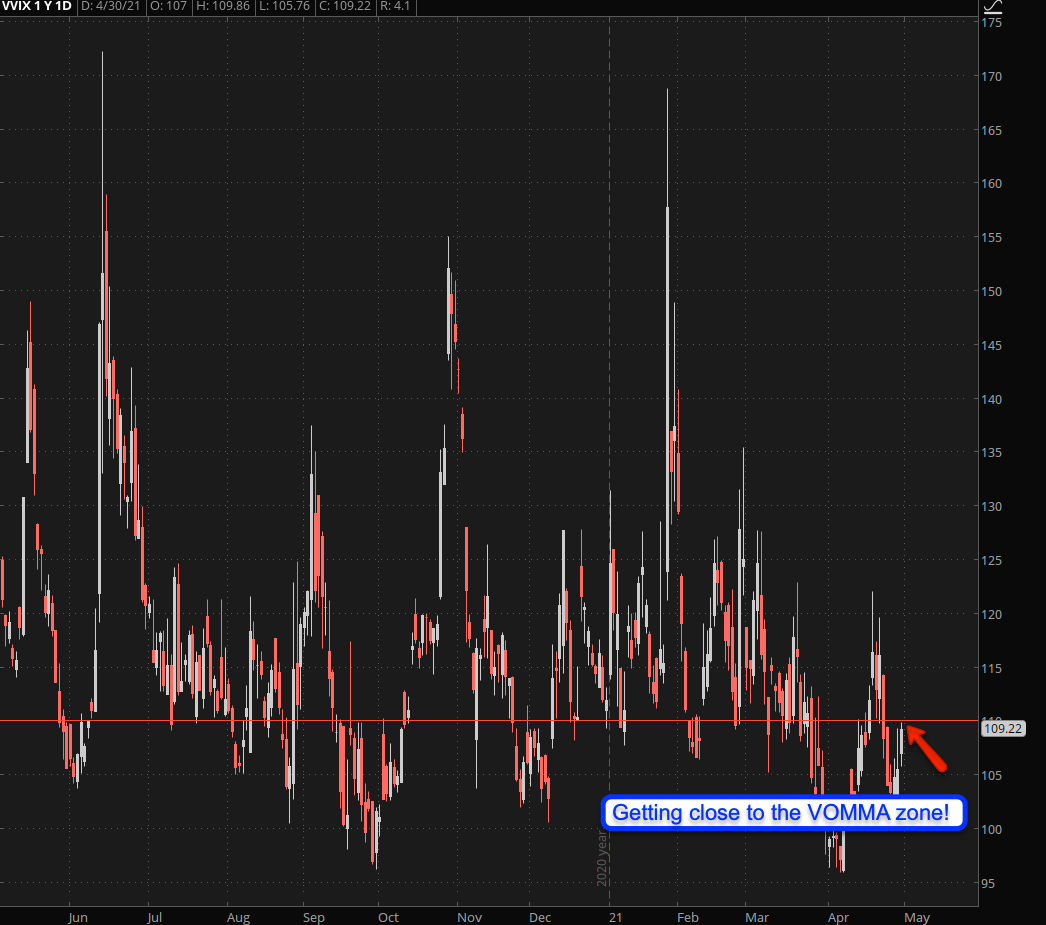

And that in turns brings us to the Vomma Zone. Among institutional option traders the line I have drawn at ~110 is considered a critical area for the VVIX that signals potential for major movement in the VIX and the SPX.

WHY that is I’ll explain further below plus I’ll tell you what usually happens when that line is crossed and what to do about it. Before we get to that let’s paint the picture a little bit as everything seems to be falling into place.

First up equities as a whole have been stuck in park (for non-Americans: that’s a setting in automatic transmissions) for the past three weeks. Which means that gamma risk is accumulating along with open interest around key thresholds of expected move (which also has barely moved for three weeks now).

And why is that? If you have followed the recent earnings reports then you are aware that we’ve seen nothing but stellar reports with the entire cadre of big tech giants beating expectations and then some.

But you wouldn’t know it by looking at a pure price chart – the entire tech sector has been stuck in sideways gear and we saw quite a bit of selling pressure last Friday.

Which begs the question: What holding up this tape? And if you have followed me for a while then you probably have guessed it – the finance sector which was elated when the FOMC announced yet another nothingburger.

Which basically boils down to low interest rates and the Fed’s kitchen sink until kingdom come. Or in other words: moral hazard and record inflation have now become the defacto modus operandi of modern monetary policy.

[MM_Member_Decision membershipId='(2|3)’]

Why then is the Dollar starting to creep higher again? No that’s not a rhetorical question – I’m actually a bit perplexed by that and it’s not what I would have expected to see last week.

It may be just some outlier, but that outlier has now produced a technical support line from which we now can derive clear inflection points for where the Dollar may be heading next.

And I’m glad to see that happen because bonds at this point have become not only untradeable (unless you are selling theta) but IMO the bond market as a whole appears to be in stand-still.

But it only looks that way. I looked at the daily volume in the ZB and YTD average volume is around 250,000 contracts traded (and these are BIG contracts). Well, we are doing over 300,000 on the 5-day and 20-day averages.

Plus as you can see in the snapshot above, implied volatility is near its 52-week high. So it seems the perception among bond traders is that we are getting ready for a big move.

And that brings me back to the VOMMA zone I covered in the intro but my intrepid subs get a lot more meat on the bone. Remember that 110 line I pointed out? Well, look what happened in the past two years when that threshold was crossed AFTER a dip below.

That’s right – we usually got a correction a week or so later. Sometimes a small one and quite often a very meaningful one. So it’s tough to say what would happen this time around.

And let’s also be clear about this: We have not breached that line just yet but often you don’t get much time to grab a seat on the bus once things start moving.

I still see the ES futures push sideways this morning, so we don’t have early clues as to where gamma risk may draw us this week. However given last week’s tape I am tempted to make a play for the downside.

Which effectively means a butterfly at the lower EM threshold, e.g. SPY 411. I may also grab a few more of those juicy CYA spreads I covered two weeks ago. With the VIX still near the 15 mark IV is still in line with our requirements.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]

Before I run back to working on my 2nd webinar a quick update on our gold campaign. Oh boy that was a squeaker – one or two ticks lower and my stop at break/even would have been touched. More luck than skill obviously but thus far the formation looks like it may actually resolve higher.

Happy hunting but keep it frosty.