Sometimes trading opportunities stare you right in the face but most traders are either unable or unwilling to see them. A lot of that has to do with what many refer to as one’s personal ‘lens’. But honestly the reality is that many traders have a tendency to stick with what they already know and the way they do it, even if that has been proven to not yield positive results on a long term basis.

Simply put many traders do what they do because they like doing things the way the do it. To quote Winston Churchill: “Men occasionally stumble over the truth, but most of them pick themselves up and hurry off as if nothing had happened.”

I’ve always been puzzled by this. Apparently change is hard for most people as their reptilian brain opposes perspectives or approaches that may appear difficult or incompatible with the way they currently do things.

Over the past decade I have observed literally thousands of traders and my takeaway from the experience is that only a small percentage of people are willing to level up their game once a certain threshold of proficiency has been reached.

And just to be clear I don’t exclude myself from any of this. In fact for many years I felt like I was top dog in my own little blogging universe until I ran into a handful of professional traders who were a lot more proficient and successful than I was.

My choice at that time was to either continue to do things as before or to step up my game and become the type of trader I aspired to be. To become part of of a small minority of traders who succeed at trading and are able to make a living off it.

Fortunately for myself as well as for my account principal I decided to choose door #2.

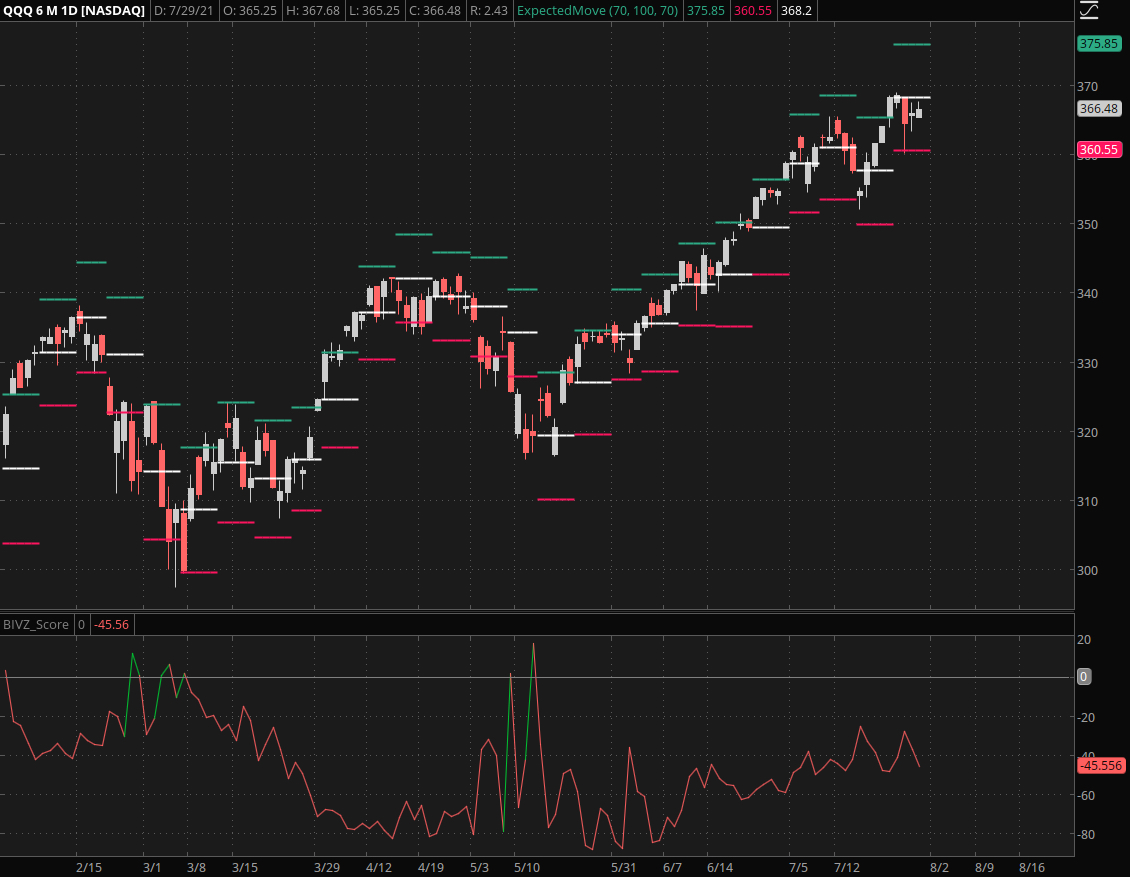

Now speaking of which, once again we are facing a small but potentially very profitable trading opportunity that is staring us right in the face. You have probably noticed that the Spiders have barely budged over the past few sessions which stands in stark contrast with the swings over the past few weeks.

In fact for the past two months we’ve touched or at minimum pushed toward one of the expected move thresholds almost every time. Except for this week apparently 😉

Or have we? Well actually the QQQ already touched its lower EM threshold on Tuesday but immediately bounced back and then did nothing until now.

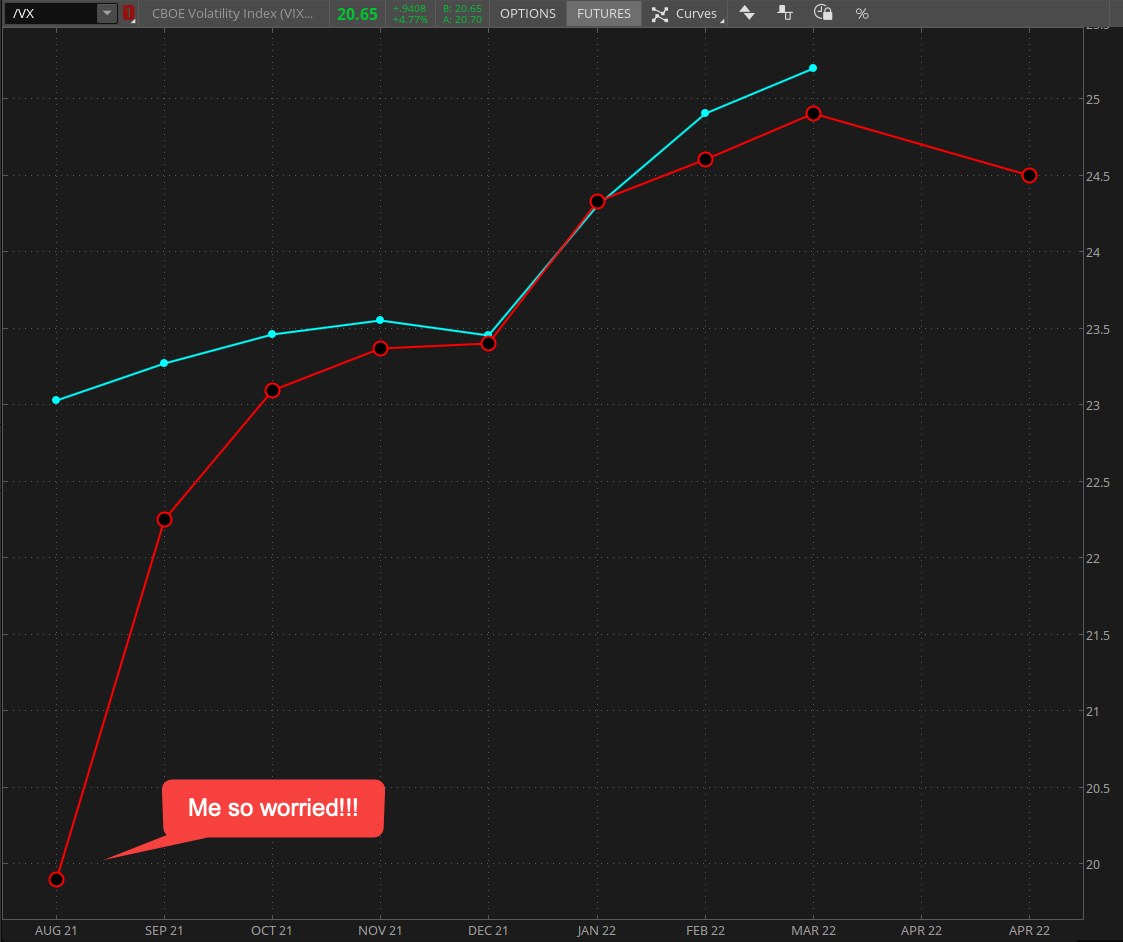

I keep seeing bearish news galore, but the VX futures product depth graph shows me a completely different mindset as contango has steepened significantly over the past two weeks.

So what shall we do about this? Meet me in the lair for the gory details of my cunning plan:

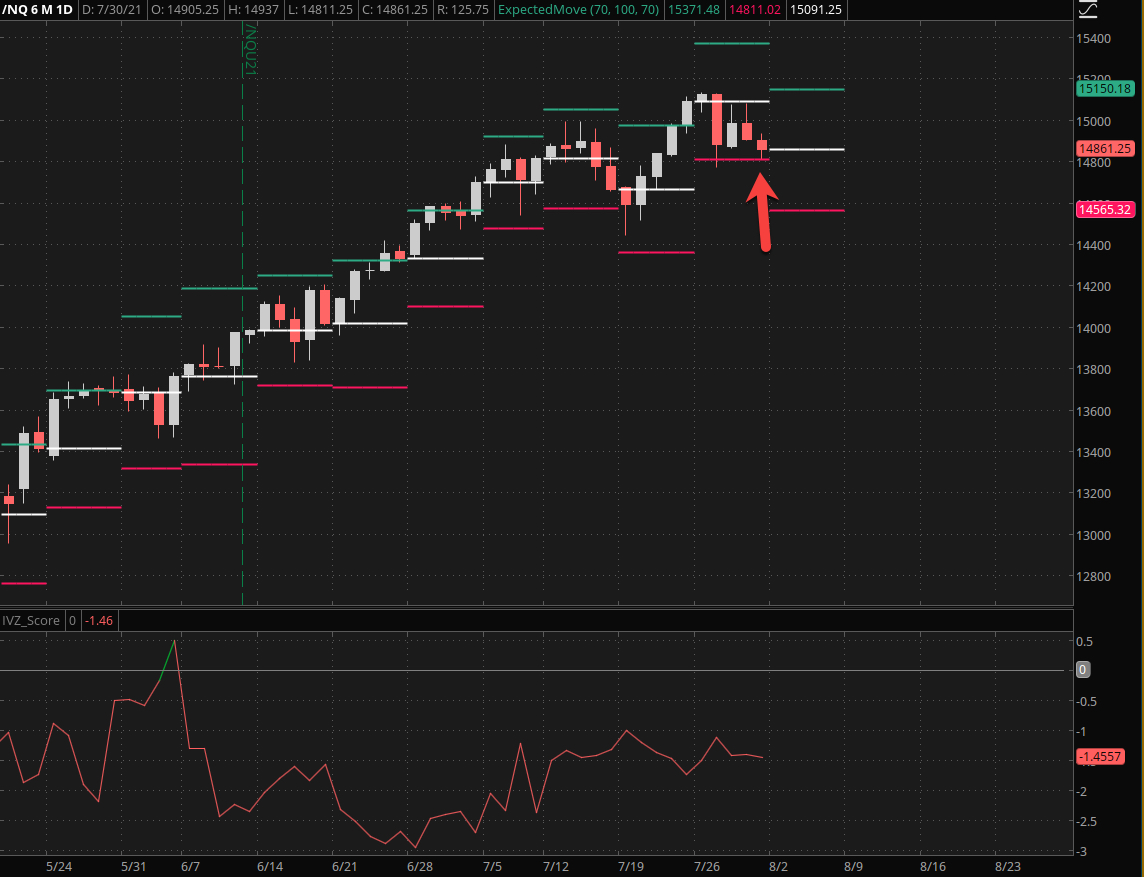

[MM_Member_Decision membershipId='(2|3)’]Given that the NQ keeps riding the lower EM I believe that this range has been successfully defended and that we may see a pop higher into the close.

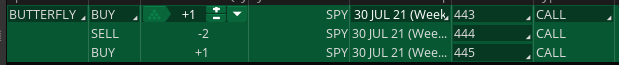

I just got filled on 10 of those suckers at .3 cents. The odds are supposedly infinitesimal and admittedly they are small but IF we see a jump and run toward the center of the range then I’ll make bank.

If you’re a sub here at RPQ then you already took the 445 butterfly on Monday. If I wasn’t in that one I would shoot for 444 as they are currently selling for 2 cents.

Words To The Wise

This is a low probability play so don’t attribute more than 0.3% of your assets – I would probably shoot for less. Look underneath your couch and whatever you find there should be your trading budget.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]