Clickbaity enough for you? I think we all can agree that February is bad enough even during regular non-epidemic years. Let’s start with the spelling which makes no sense whatsoever and is impossible to pronounce as a foreigner no matter how long you practice. Ask your Chinese friend. The weather sucks and there are no holidays or vacations to soften the blow. Valentine’s Day is depressing no matter what your relationship status may be. Too much negativity? Wait there’s more, I’m just getting warmed up.

Most likely you already failed at the New Year’s resolutions you committed to a little over a month ago. The occasional mild day may tease you into thinking that spring is just around the corner when BAMM! another arctic cold front descends and freeze-dries your pet in mid motion. Nevertheless there’s no snow on the ground and when it rains the water freezes overnight which is why you drove your car in a ditch this morning.

February is the only month that can’t make up its mind about how many days it actually should have. Three years it’s got 28 and then it flips to 29 just to mix things up. Not that I’m complaining about a short month. After all the only good thing about February is that it’s followed by March.

Oh and did I mention peak flu season? Coughing and sneezing people everywhere – and that’s in a good year! This time around it’s been replaced by a worldwide coronavirus epidemic that over the course of a single year managed to wipe out small business as we know it whilst triggering the biggest wealth transfer the world has ever witnessed.

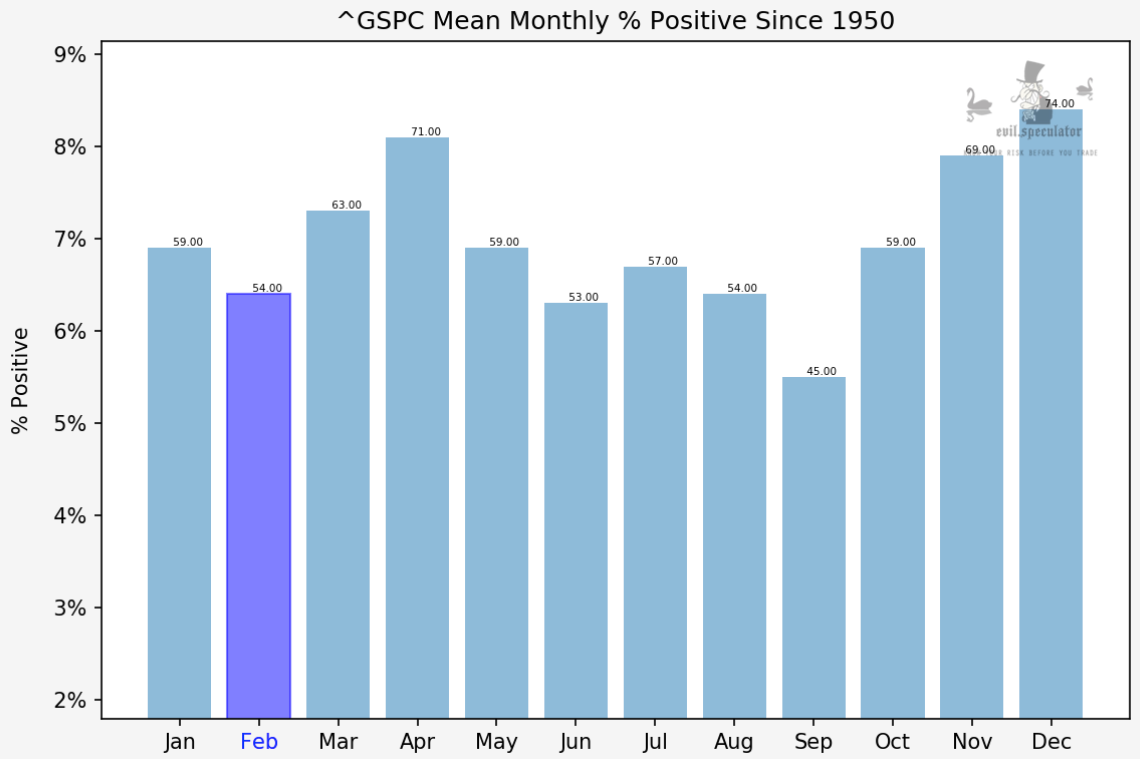

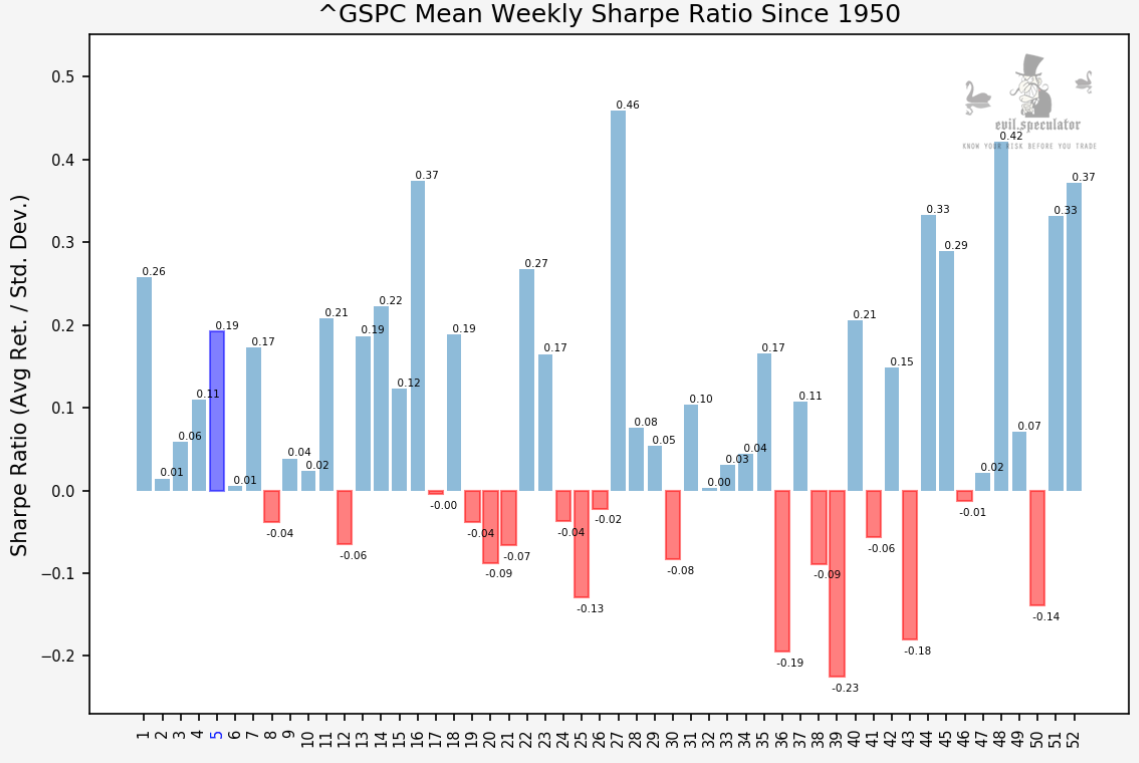

Which of course brings us to the financial markets. Guess what – the market hates February as well and just wishes it could just skip over to March. A Sharpe ratio of -0.01 basically is a complete flatline.

Mean percent positive stands at 54%, a wee bit better than a coin flip and admittedly better than June or September. Talking about bad company though from a trading perspective!

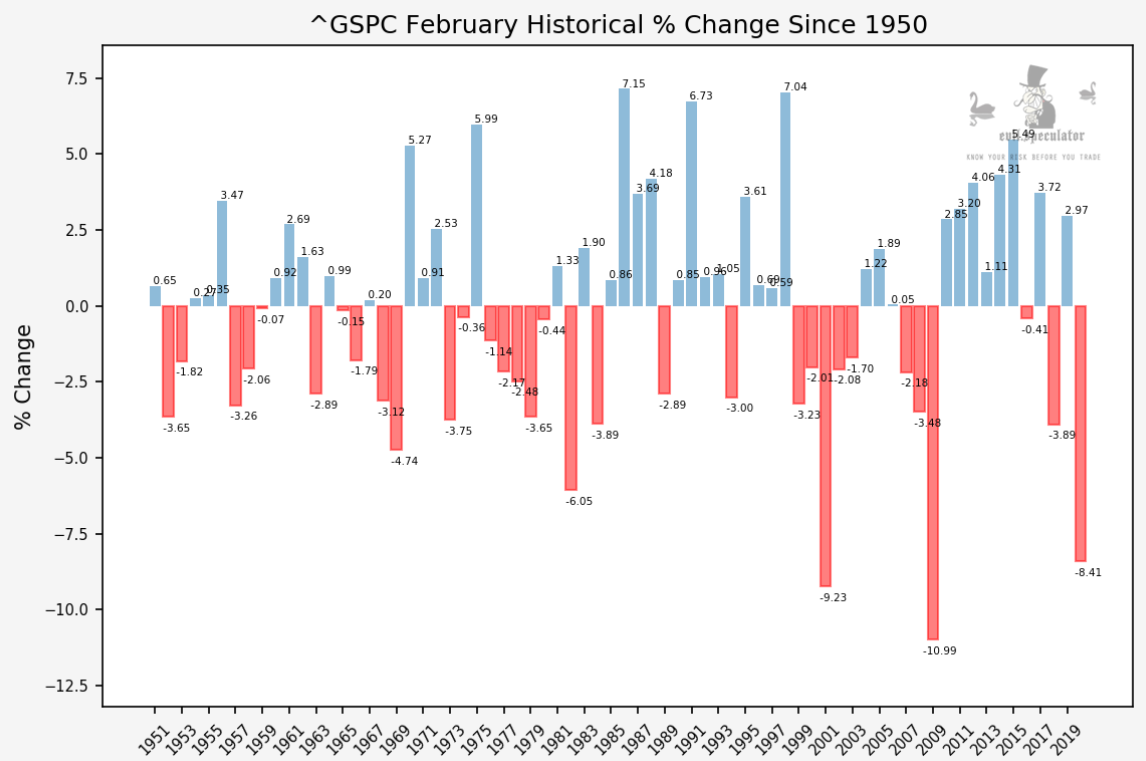

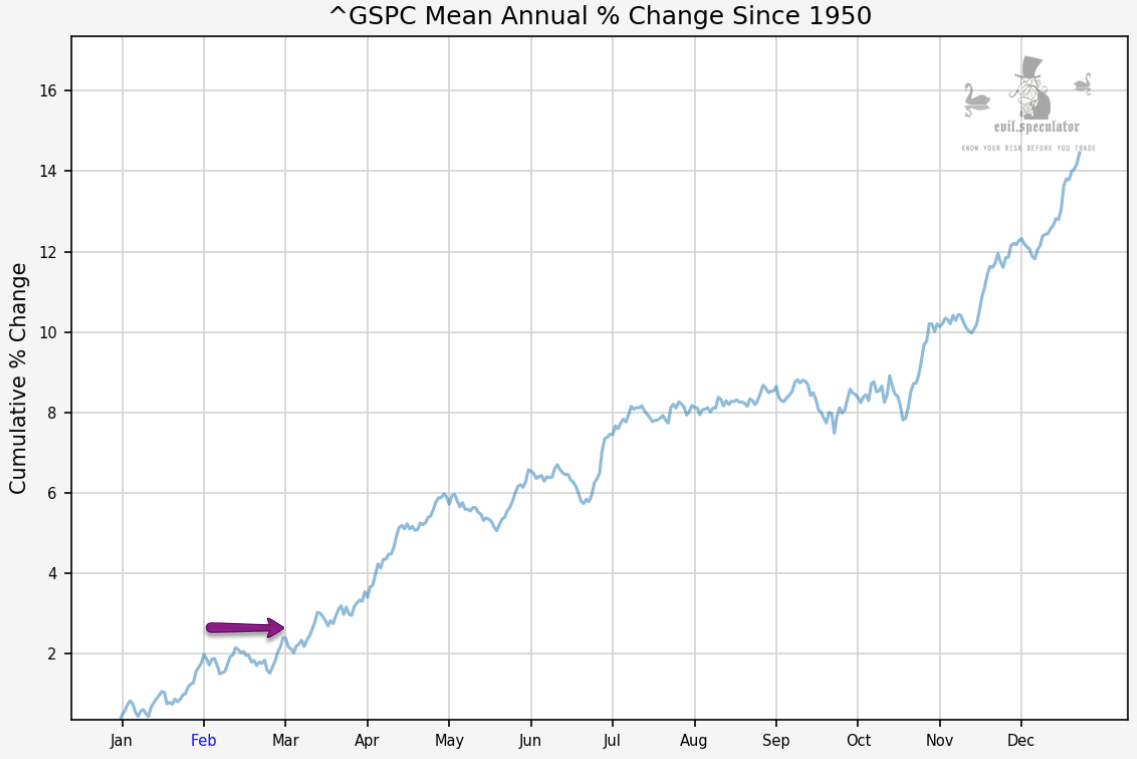

This graph really shows you all you need to know about February in a nutshell. There were a few positive years during the Reagan years and after Greenspan opened the floodgates, but on average it’s as flat as a flounder.

[MM_Member_Decision membershipId='(2|3)’]

This is what you get if you put all those monthly averages next to each other. Alright I admit, the July – October period is as bad – but who cares, we’re all on vacation then.

Here’s a bit more detail for you data nerds. This is actually interesting as the percent change seems to have improved over the past decade, no doubt due to QE buggery.

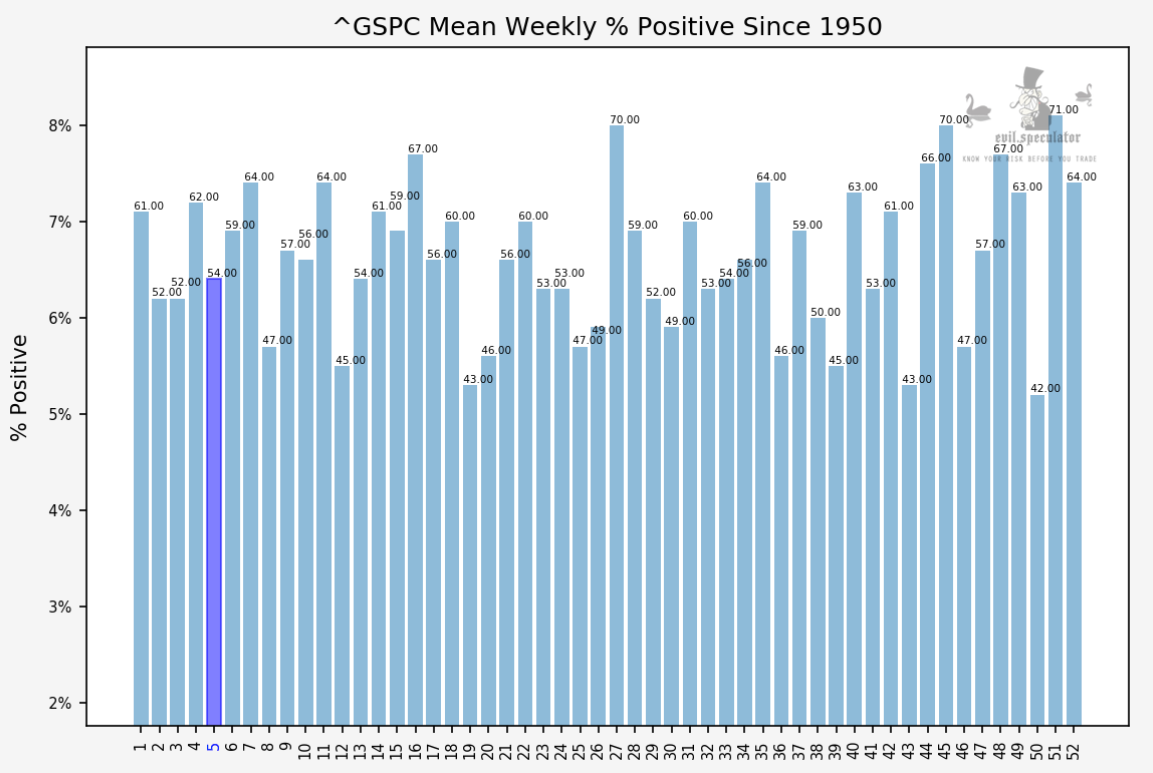

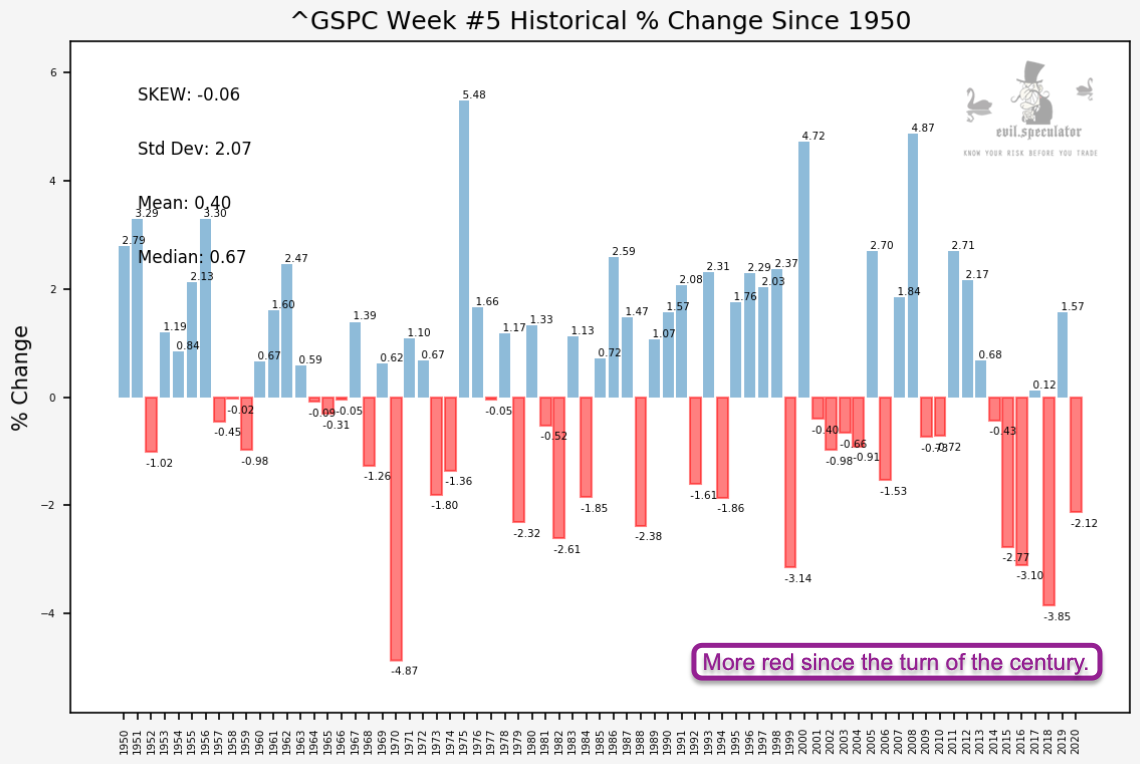

Now week #5 specifically is actually pretty decent. So if there’s a bounce back from the current sell off then this is the best way to stage it IMO. It’s only getting more difficult from here until early March.

Nevertheless it’s not a great week statistically speaking in that the odds of a positive close are around 54%. Not a bet I would want to take.

And once again here’s the percent change for week #5. Interestingly that one is turning more red since the turn of the century, meaning the odds of a positive week have been deteriorating. So the best week of February is actually getting worse. Wonderful!

Bottom Line:

It’s going to be a difficult month no matter what given the Reddit Retail Rat Revolution and the potential market turmoil that may ensue. If things take a tumble then February would be a prime candidate for it to occur. So make sure you are properly hedged to the downside if you are holding a lot of long exposure that you aren’t able to get out of.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]