It has become my sincere belief that the worst market environment for retail traders in fact are low volatility bull markets. Yes you read that right: NOT high volatility bear or endless sideways markets – it’s low volatility bull markets that wears the most on them.

Why is that? A simple question deserves a simple answer: The majority of retail traders are not in the game to make money on a consistent and long term basis. Instead they are in it for the thrill and for the excitement.

Which sounds completely ludicrous at first but starts to make sense once you start following forums and blogs frequented by retail traders. I should know because I’ve run one for going on 13 years now.

Case in point: how much joy and jubilation have you seen in the face of an equities market that effectively has doubled in the span of one single year?

<crickets>

Exactly right. Nothing. Retail seems to completely despise this bull market. While there may be social and political aspects that play some part in all this there is one timeless constant that lies at its core:

On an every day basis trading as a business is boring as hell and to make matters even worse: it is a lot of work!

What sounds a lot more exciting is the prospect of a raging bear market which carries the premise of being able to make small fortunes in a short amount of time whilst at the same time sticking it to ‘the man’.

That’s all fine and dandy but there’s a big problem with approaching the market with this type of mindset: Bear markets happen very rarely – in fact they occur in less than 11% of the time.

And during those bear markets roughly 20% of the price action accounts for 80% of the price change to the downside. So if you do the math those coveted bear market wipeouts constitute roughly 2% of the all the price action you will ever observe.

Quite a sobering thought if you’re one of those perma-bears.

So it’s crucial that you abandon all directional bias and focus on the market that’s right in front of you, and not keep looking or hoping for the market you would like to be trading.

The chart above shows me a clear low volatility bull market cycle. The most boring but in my opinion the most dangerous of all.

Reason being is that it leaves a lot of room for mental masturbation. Ohh – the market is running out of steam – it’s ready for a correction – it’s long overbought.

Seriously gag me with a spoon. What’s wrong with simply betting on long while the market very clearly and easily observably continues to run to the upside? Unimpeded and aided by every political and financial faction I may add.

If you’ve bought my Price Action Masterclass then you ought to be able to interpret the price action on the SPX shown above.

All those opening gaps paint a very clear picture, especially the one that occurred at the top end of a sideways corrective range, which we just abandoned.

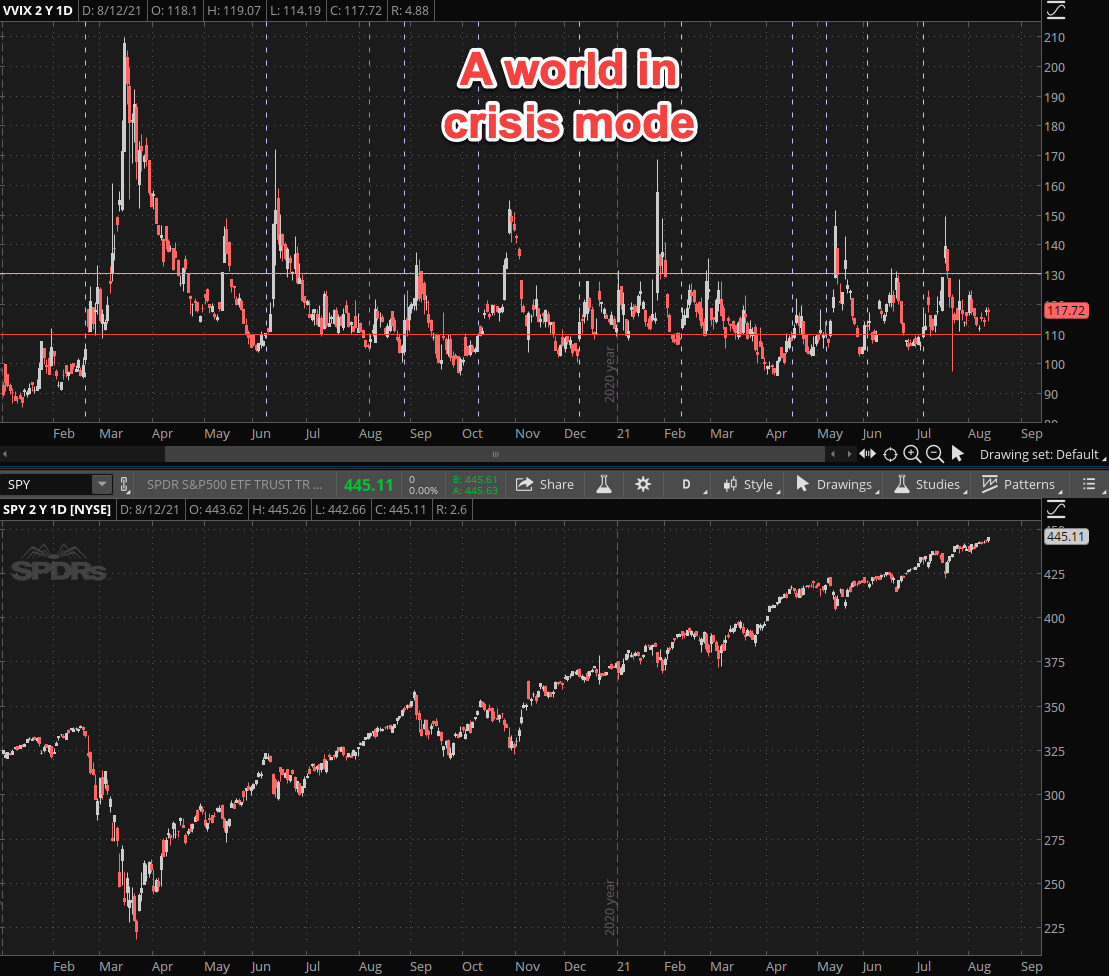

After a brief summer scare the VIX is now reverting back to its established baseline which is shown in the chart above.

Now there’s something very peculiar about this price action. And although it has not affected the direction of the market it has completely changed its inherent nature, and that’s extremely important especially as an options trader:

[MM_Member_Decision membershipId='(2|3)’]

I have covered the VVIX and it’s VOMMA zone on numerous occasion but today something very blatant occurred to me. For the past year the VVIX has spent over 70% of its time > the VOMMA zone.

During a bull market.

Which has been manna from heaven for anyone selling option premiums. Which is exactly what we’ve been doing over at RPQ by the way.

I’ve written about the manic depressive nature of this bull market on various occasions but need to point out that there’s a very profitable aspect to it when it comes to selling overpriced options premium.

For all of you allergic to all things options just keep in mind that this is not your daddy’s volatility anymore. Like it or not – we now live in a world that appears to be in constant crisis mode.

The biggest danger IMO is getting sucked in all the doom and gloom, which may have validity in the real world, but you should not let it affect your trading endeavors.

Fact is that this market continues to bubble higher and if it’s not big tech leading it then it’s finance, and vice versa. As of right now we’re back in finance mode and I hope you didn’t bet against the current advance in the XLF.

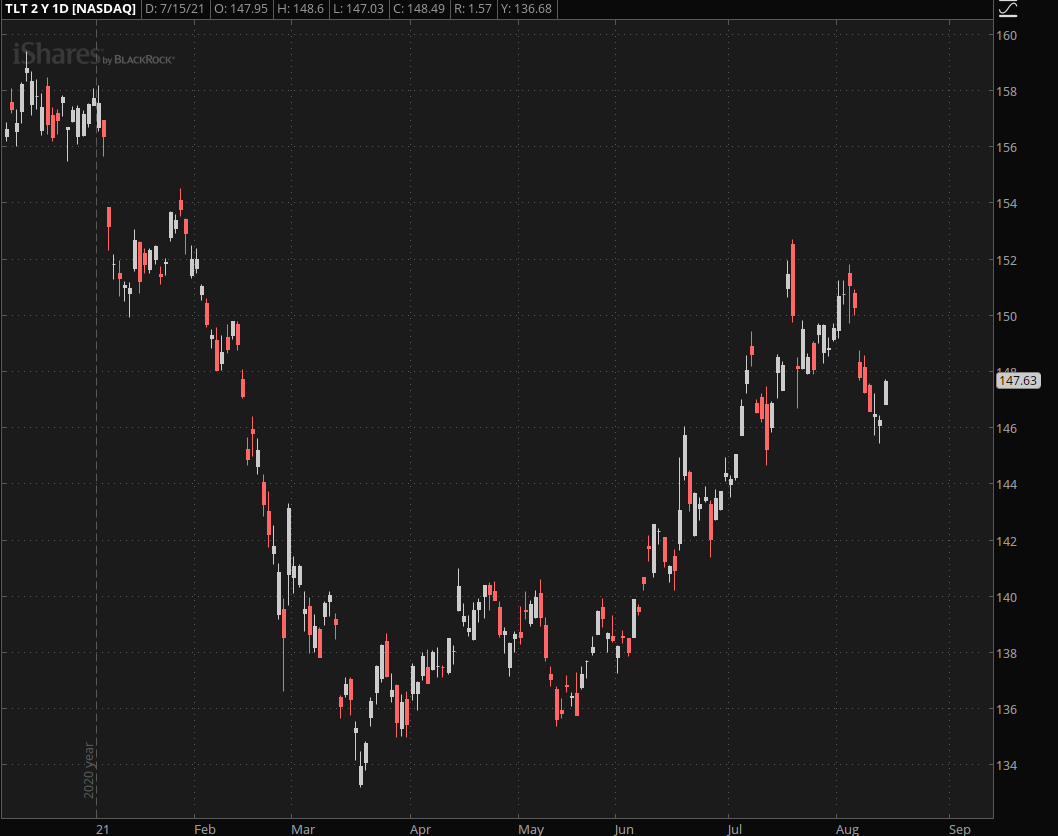

Meanwhile big tech is back in the bullpen. Not surprisingly given the price action in bonds:

What a juicy formation and I can’t help but grab a bit of long exposure here. If you’re not into bonds or prefer options I have an alternative for you:

The TLT may have painted a spike low here. The spreads on the October options aren’t great but they aren’t impossible either especially for a long term spread.

Happy hunting but keep it frosty.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]