The option market continues to do a horrible job in handicapping risk which is evidenced by the fact that expected move ranges all across the board are repeatedly being taken to the woodshed. We’ve got a situation now in which IV is steadily trickling lower whilst blatantly ignoring the wild moves we keep seeing all across equities. In conjunction with what I’m seeing in the VX futures and other pertinent measures this presents us with a juicy EOY trading opportunity I call ‘the taking candy from a baby’ trade.

The EM for this trading week (#47) is supposed to be ~83 handles in both directions. The ES futures are already busting higher as I’m typing this and I have an inkling it’s going to be another wild ride into Friday.

Now so that you punters can appreciate the beauty of the situation let me explain a few things first.

That’s the market right now: See no evil, hear no evil, and well…. scratch that last monkey as it doesn’t apply to our racket.

‘But why, almighty Market Mole’ do you ask? Quite simple – looking at the progression of the SPX option chain I see a veritable sigh of relief that the first phase of the election train wreck is behind us. In other words, the smoke has subsided, emergency personnel and investigators are on site, but they haven’t gotten around to tallying up the victims yet.

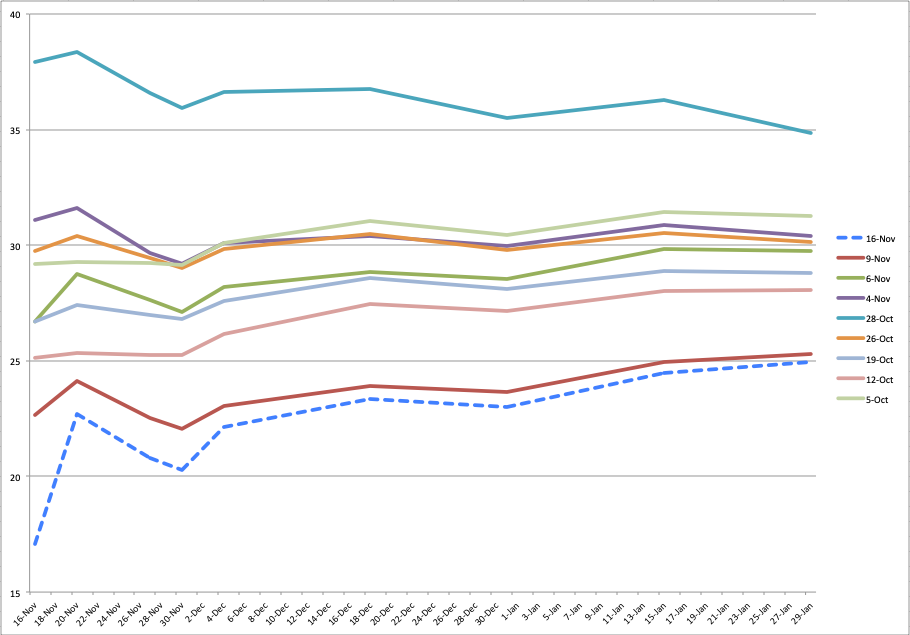

By the way for posterity I would also like you to burn the massive drop in IV between October 28th (pre=election) and the one over the past two weeks (post-election). That’s called vega compression, boys and girls, and if you bought naked puts or calls then you’re hating yourself right now.

For the record this is a pretty typical phenomenon which we experience all the time post earnings announcement and there are various ways to take advantage, e.g. via calendar or diagonal spreads. More advanced stuff but quite a bit of fun if you know what you’re doing. Pro tip: Sign up a a member and go through my Options 101 and Options 201 courses if you want to learn how to peel that particular onion.

But of course that’s not where the story ends. Let’s get to the juicy stuff:

[MM_Member_Decision membershipId='(2|3)’]

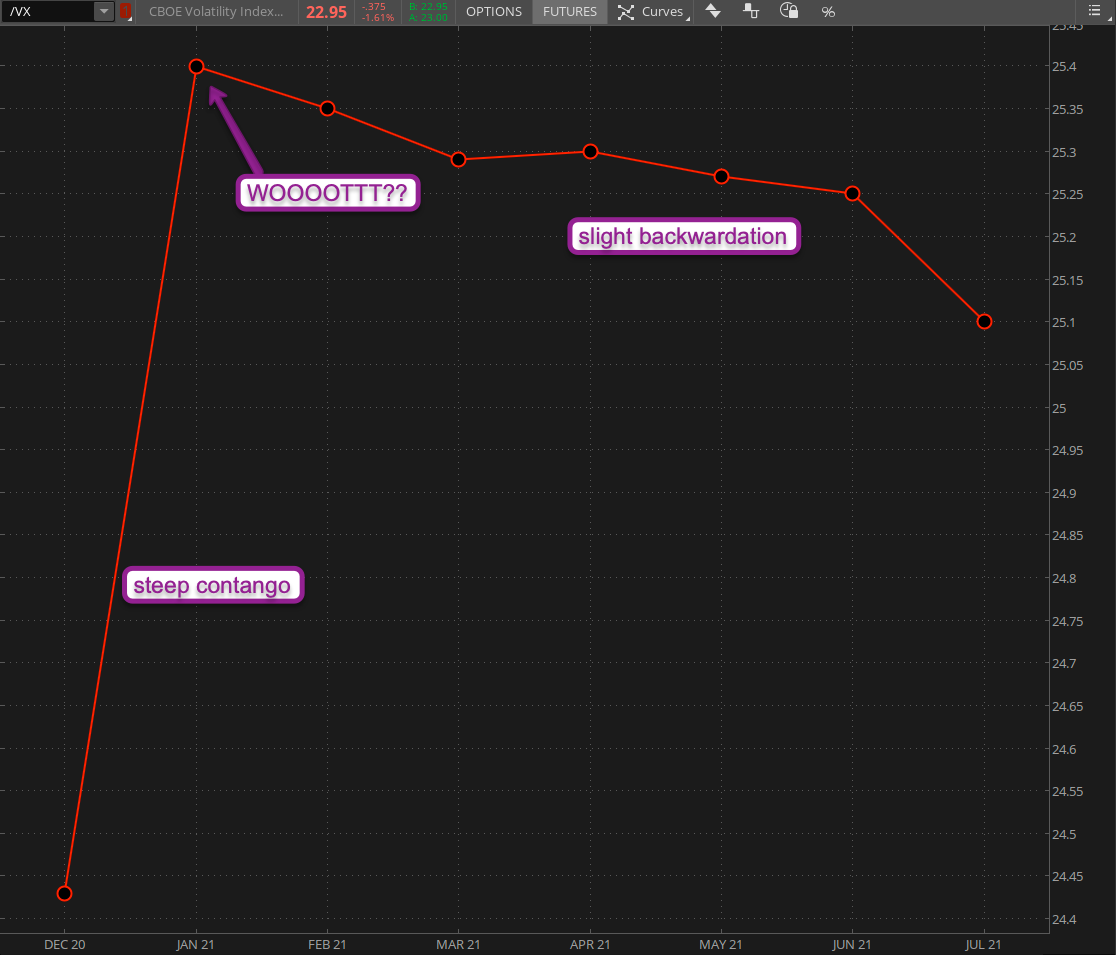

Just take a look at the VX futures product depth graph – I know that’s a mouth full – which pretty much reflects what we’re seeing in the SPX option chains (and not surprisingly so). Very steep contango (a rise in price as you move from the front month into back month contracts) between the December and January, which is followed by slight backwardation (a gradual drop in price as you push into longer term contracts) in the first two quarters of 2021.

Clear? I didn’t think so…

Alright, so what I’m saying is that short term volatility/risk is currently priced much lower than future volatility/risk. And yes, you got to wonder why that is the case. But not as a trader, so dispose of all pertinent mental masturbation and please stick with the task at hand, which is banking coin, people!

The one thing I should point out that IV has no predictive value, all it tells us is what the market thinks/feels right now. I mean if IV did have any predictive value then why does it rise so much pre-earnings or pre-elections and then drops right after?

Simple – because traders and investors are worrywarts by nature and thus hope for the best but always prepare for the worst. No fund manager ever got fired for being overly cautious, only for losing too much money.

So alright – how to go about it? I’ve covered this a few times over the past two weeks and I would in particular recommend last Friday’s post which explains my adjusted hammock strategy in a bit more detail. Follow those instructions and you’ll be just fine.

The purpose of this post is to point you toward the proper victim profile. Which in a nutshell is relatively low IV in the face of recurring historical (or realized) volatility (RV). Or in proper English: you want a symbol that has repeatedly been busting through its expected move range over the past few weeks but continues to predict small ranges as indicated by my IVZ-Score indicator. You can just use a regular impliedvol indicator as it looks very similar.

I already featured IWM last week and I have to do it again as it’s simply irresistible. I mean are you freaking kidding me with this week’s EM range?

CAT also fits the profile as it appears to be a serial offender.

MSFT – couldn’t leave out the original evil tech empire, could I?

Here is an example of what you do NOT want: AAPL has been way too well behaved and it actually makes a good candidate for placing a few butterflies, which is a strategy I explain in detail in my upcoming course.

I just finished editing that one over the weekend and am looking forward to pimping it to you guys in the very near term future. It’s probably the best course I’ve ever produced as it dives deep into criteria which is the most important aspect of trading options.

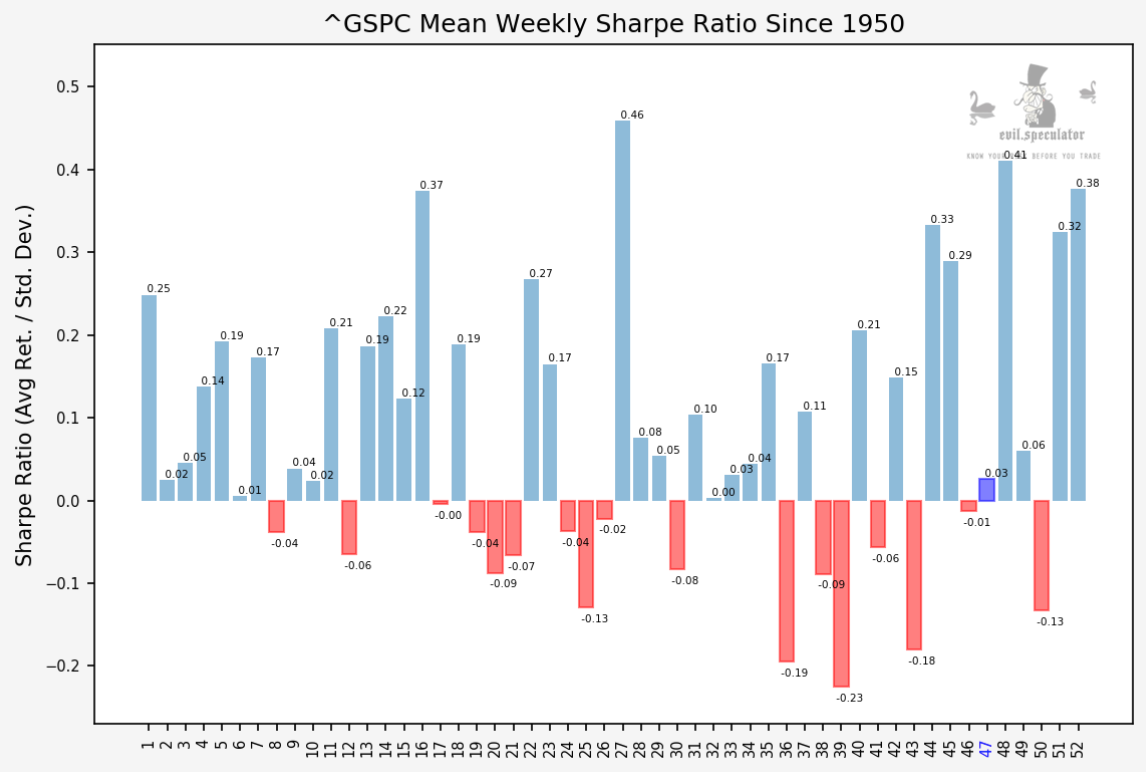

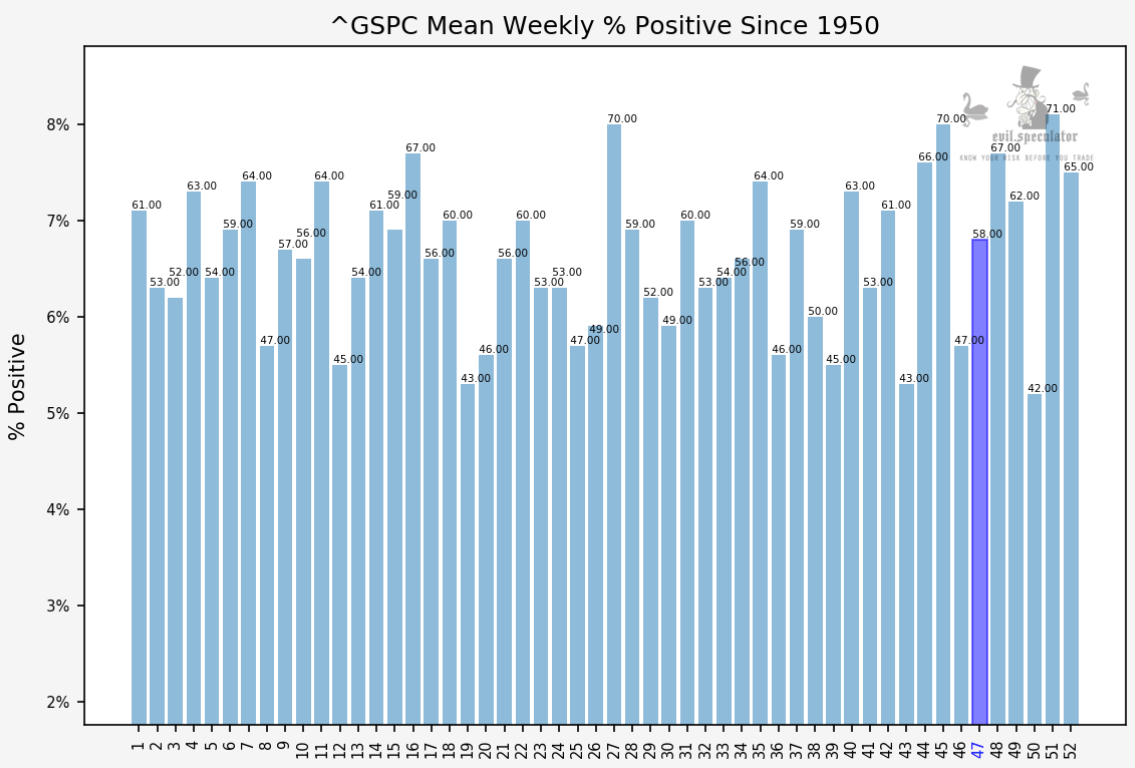

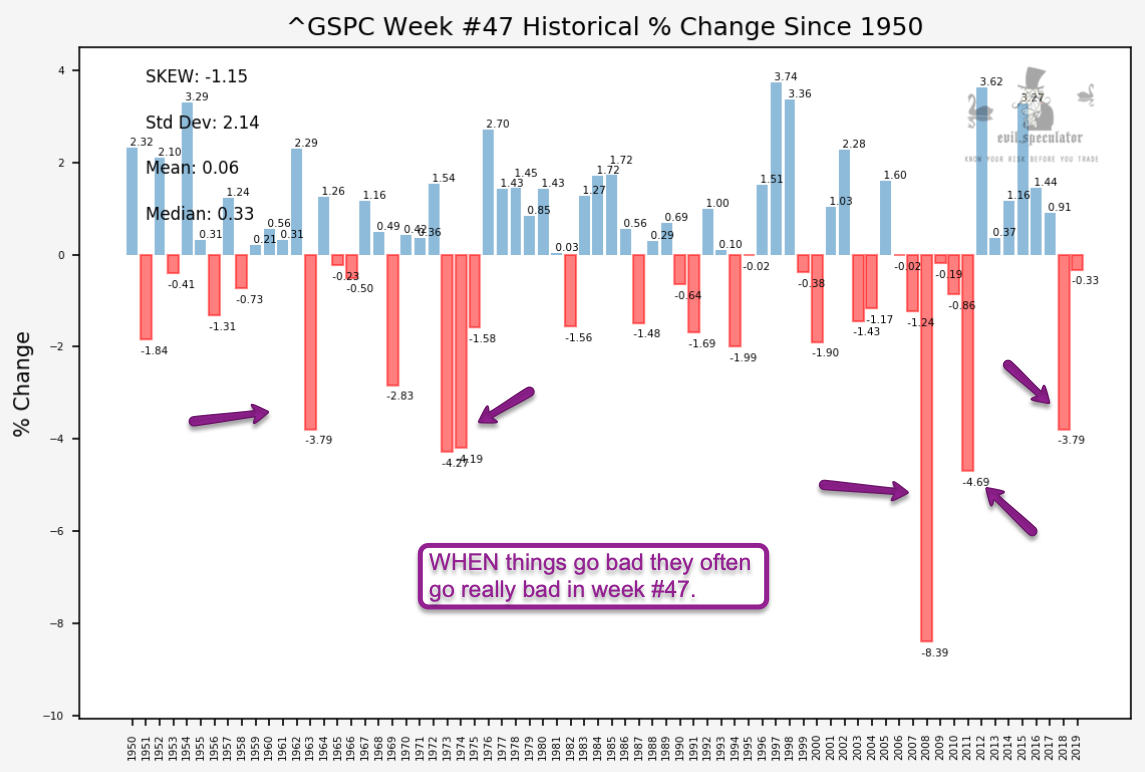

Before I run here are this week’s stats: Nothing to write home about on the Sharpe ratio but we had YUGE moves last week despite a historically flat week, so I guess all bets are off.

Percent positive is much better than last week, and indeed the futures are already pushing higher in early trading.

Just be careful though as sometimes things pop off the rails and bad things can happen in week #47.

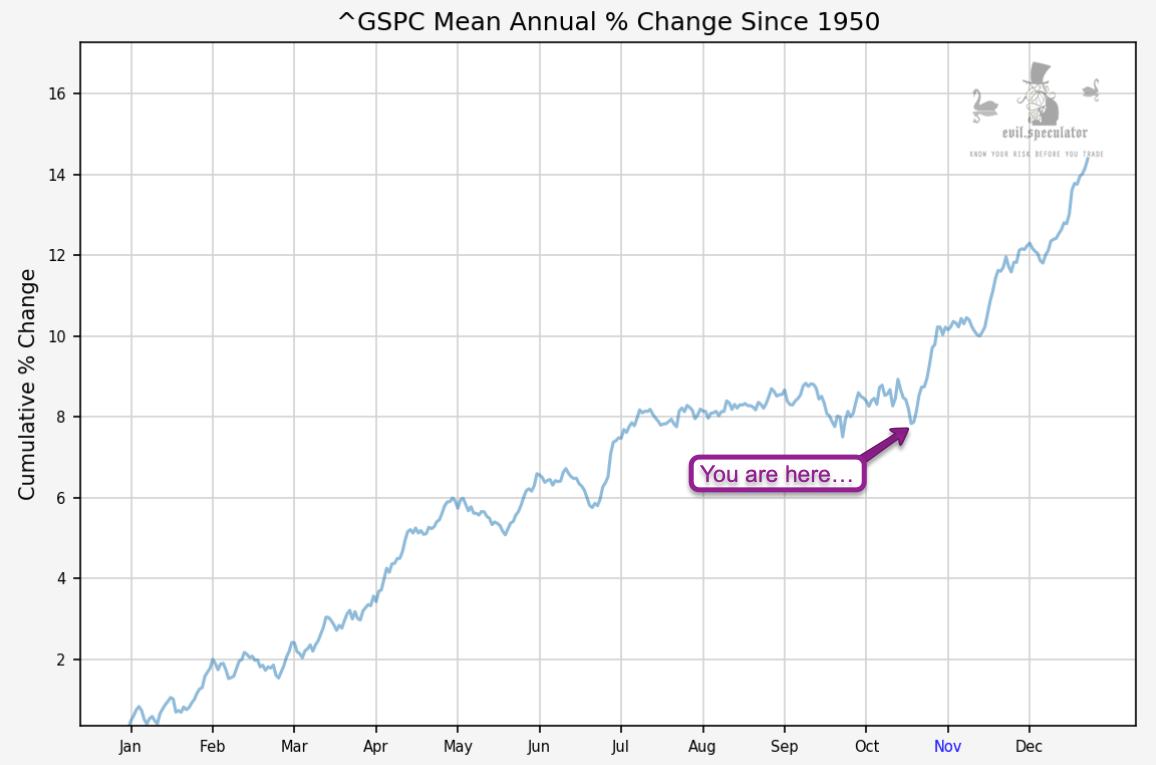

Keeping the best for last: We are now right at the cusp of the coveted ‘Santa Rally’ season which extends all the way into late December. Of course in 2020 everything is a bit screwed up and we’ve seen historical trends rolled over, mainly of course on the bearish end (meaning the bears haven’t had a prayer all year).

However the seasonal bias moving forward and into January is bullish, so if you decide to engage in directional trading keep that in the back of your head.

Alright, the bell is nigh – happy hunting but keep it frosty.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]