Another flat week in stocks with crypto crosses shooting toward the moon. The main event on everyone’s radar of course were the congressional hedge fund hearings during which we learned that the entire financial industry was squarely built upon the premise of uplifting retail investors plus each future stock purchase would now qualify for a free copy of the King James bible.

Vlad Tenev, Robinhood’s CEO and self purported philanthropist extraordinaire shared a tear jerking immigration tale whilst assuring everyone that cutting off millions of retail traders from buying their stonks was tantamount to doing God’s work.

I’m sure the rowdy rabble over at Reddit found it difficult to hold back their tears whilst piling into their new favorite stonk of the week – Palantir (PLTR). I actually think it was a decent buy at 25 but you would have to be quick to grab it as it closed near 29 on Friday. Of course none of the diamond hands are going to let it go unless it hits 2500.

Alright now let’s get serious for a moment as events are unfolding that require our undivided attention. So put down your mobile enslavement device for a few moments and check out the long term ZB chart posted above.

Do you notice anything?

YES, it’s dropping Einstein. But what’s more important is that it is dropping whilst picking up velocity while realized volatility is also dropping (I don’t need an indicator to see this but go ahead and drop an ATR).

Bonds are popular among retail traders (or at least among the few who actually trade them). On the institutional side what really matters is the 10-year note and as you can see it has started to follow suit recently.

Which of course has sent 10-year yields flying higher. And that’s no understatement given that the TNX was near the 0.5% mark last summer while it’s now pushing toward 1.4% and possibly beyond giving the current formation.

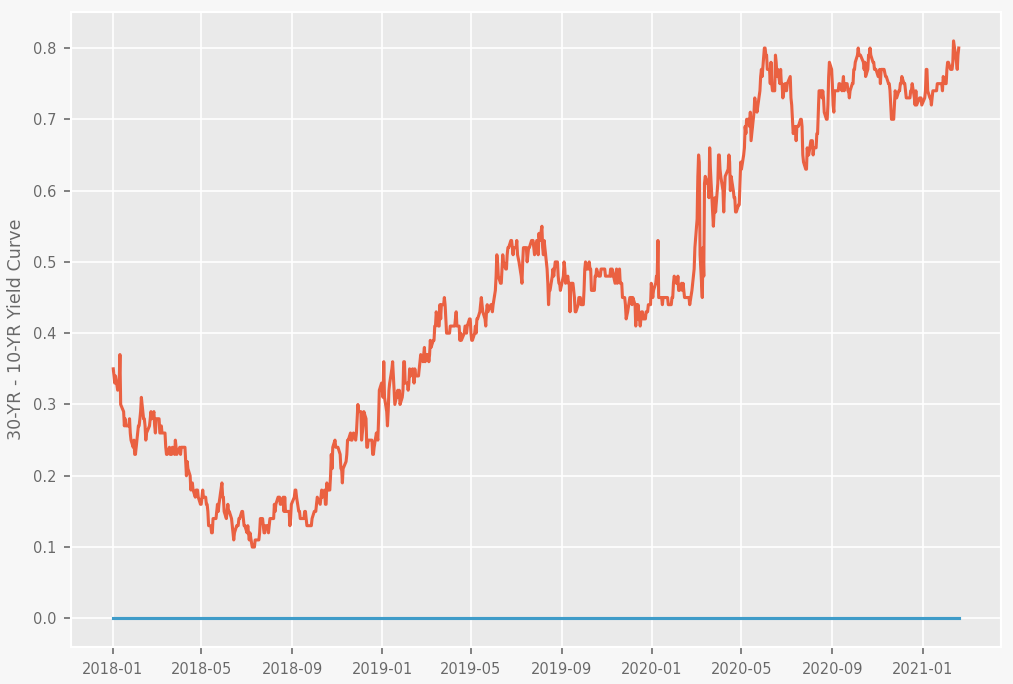

But it gets worse. Not only are bonds and notes dropping fast with their respective yields exploding higher, the spread between them is expanding as well. In January of 2020 (a.k.a. pre-COVID-insanity) the spread was around 0.45%. Now it’s scraping 0.8% and once again that formation looks like it’s ready to explode higher.

So why is that a problem? Higher interest rates – aren’t those great for the banks? Well, that is actually true as evidenced by the massive ramp higher in the FXE since the Biden administration was announced as having won the election last November.

You can tell I phrased this carefully as to not receive angry emails from either camp of the increasingly polarized political spectrum 😉

Anyway, yes higher interests are good for the financial sector – until they aren’t. Let me explain and also show you how we can take advantage as a tectonic shift is in the works that will affect the entire market (stocks, bonds, even crypto) throughout 2021.

[MM_Member_Decision membershipId='(2|3)’]So let me explain it this way. Ask yourself what’s currently driving the market. Until about early fall of 2020 that was mostly the tech sector and although things are still looking positive you can see by just looking at the LT chart above (my synthetic monsters of tech symbol) that things are slowing down on the tech front.

So it’s been the financials that have been driving the overall market since last fall. Everything else is sort of riding the coat tails of the XLF at the moment and that’s partly based on politics, money printing, and rising interest rates.

But how long will rising interest rates be a boon for banks when a good portion of the working populace is scraping the bottom of the barrel while we are heading straight into an economic depression? I mean unless the Biden administration and local governments decide to open up the economy in spring at the latest we are heading for a world of hurt.

Although complacency still reigns sky high the market has been paying attention to some extent which is evidenced by the fact that the VIX has established a solid baseline near the 22 mark while equities collectively continue to print new AHS on a weekly basis (last week obviously not).

Canary In The Coal Mine

Which brings me back to bonds. You may have heard about the Dodd/Frank and the Volcker rule but what you may not know or probably have long forgotten is what they actually mean.

Well in simple terms Dodd/Frank Rule forces many large institutions to remain delta neutral – they are not allowed to take directional positions in the S&P. In fact the law places strict regulations on lenders and banks in an effort to protect consumers and prevent another all-out economic recession.

The Volcker Rule is a federal regulation that generally prohibits banks from conducting certain investment activities with their own accounts and limits their dealings with hedge funds and private equity funds, also called covered funds.

And there’s the rub. Let’s assume for a moment you’re a bank and you’re getting just a wee bit antsy about the growing downside risk you are seeing in the market. What do you do? Sell stock or go short the S&P futures?

Well, you can’t because both rules expressively prohibit you from doing that. But what they do NOT prevent you from doing is what? Trade bonds of course and that’s why we are currently seeing a massive sell off in the bond markets.

Clearly banks and to some extent institutional traders are attempting to offload some risk by selling the bond market. In the old days they would have bought bonds and notes of course but we now officially live in more interesting times.

What To Do About It?

The good news is that you aren’t an institutional trader or a bank. If you are then go in the corner and stay there for the next hour while I wrap things up with my retail subs.

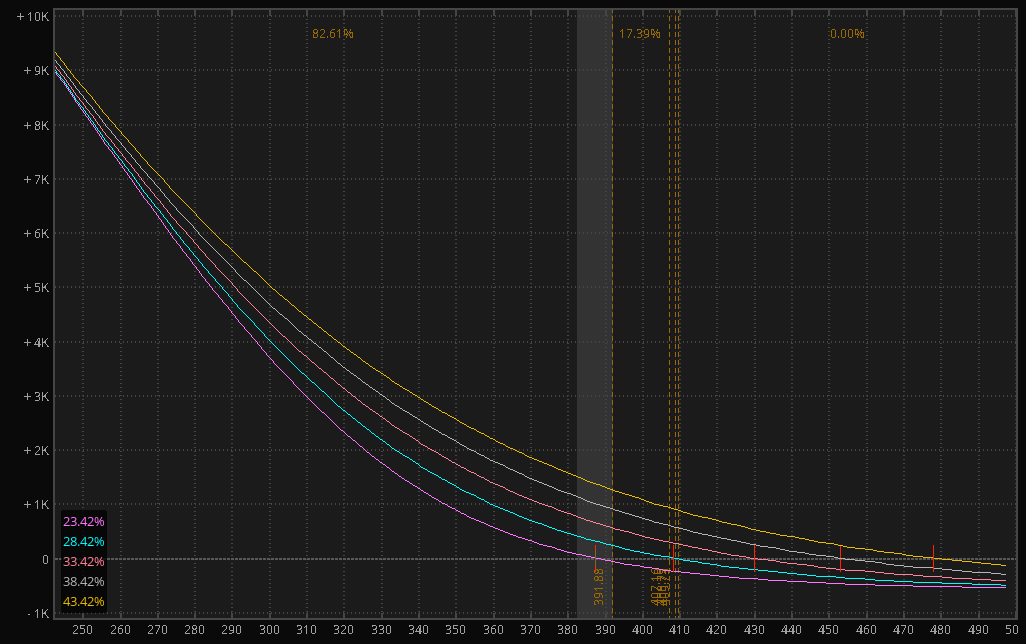

And being a small fly on the wall allows us to play some interesting games. The one I have in mind is the bearish half of what I call my hammock strategy. Effectively it’s a LT put spread that will be held until about 60 days ahead of expiration.

The cool thing about this one is that it really benefits from an increase in IV, especially in the beginning stages (it’s been designed to deal with increasing SKEW further out). This also means that a jump in IV could get us out near b/e even if the market doesn’t move much by late April.

Risk is limited to your debit, which in this case is $6. Not a small amount of money for many retailers but again the expectation is to retain a good chunk of that premium even if the market doesn’t move much. Of course if it continues to push higher and that quick then max loss is a possibility.

SELL -1 1/-3/1 CUSTOM SPY 100 18 JUN 21/18 JUN 21/18 JUN 21 374/351/342 PUT/PUT/PUT @-6.00 LMT GTC

Here’s what I actually just filled on my end. You can copy/paste this one into your own ThinkOrSwim console in the trade tab.

Happy hunting but keep it frosty.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]