With Labor Day behind us we are now officially heading into the most turbulent period of the year. With 2020 being an election year that would apply politically as well as when it comes to participating in the financial markets. At least in the latter department – not a moment too soon. The big summer lull is by far my least favorite season and I’m looking forward to a bit more action and volatility – both realized and implied.

Week #36 started out bucking its seasonal trend. pretending it was going to be business as usual, but then suddenly rolled over and bitch slapped a legion of RobinHood bag holders who spent the weekend applying vaseline to their private parts.

After swinging for the fences the SPX finally recovered slightly below its lower expected move threshold. Coincidence? As always I think not.

Monsters of tech were hit particularly hard with volatility literally exploding overnight. You got to love low participation pre-holiday tape 🙂

So what does the future hold? Well I have good news and bad news for you.

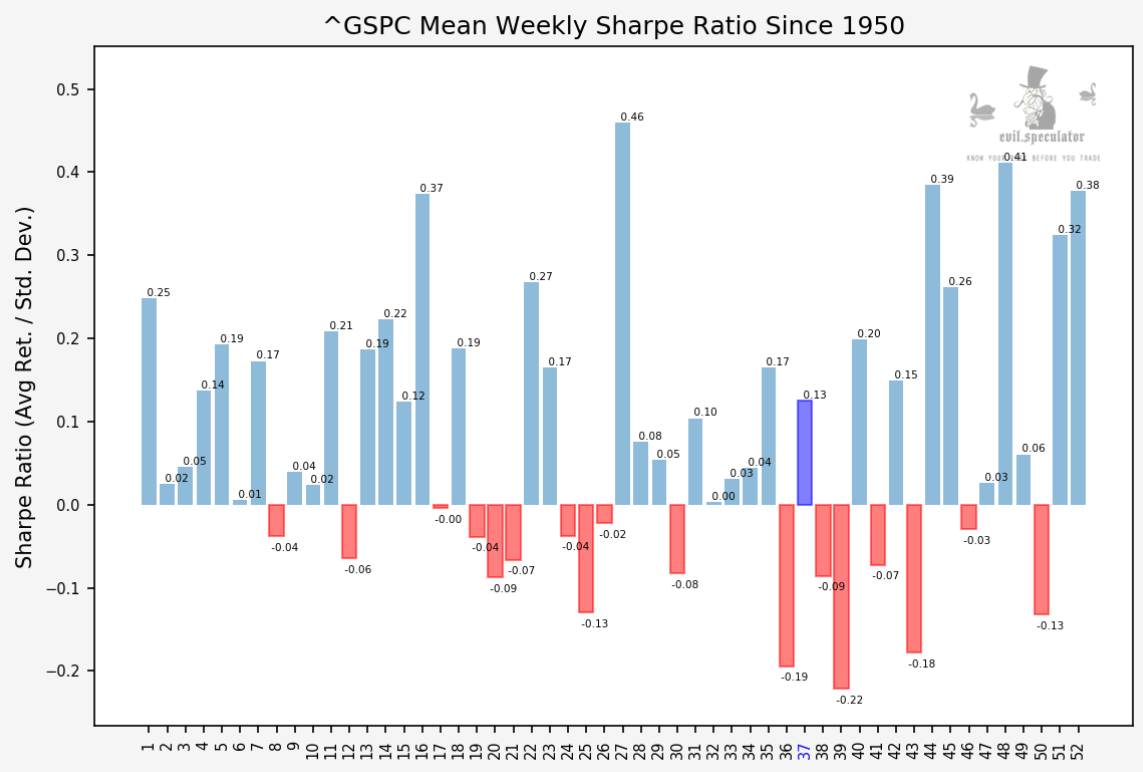

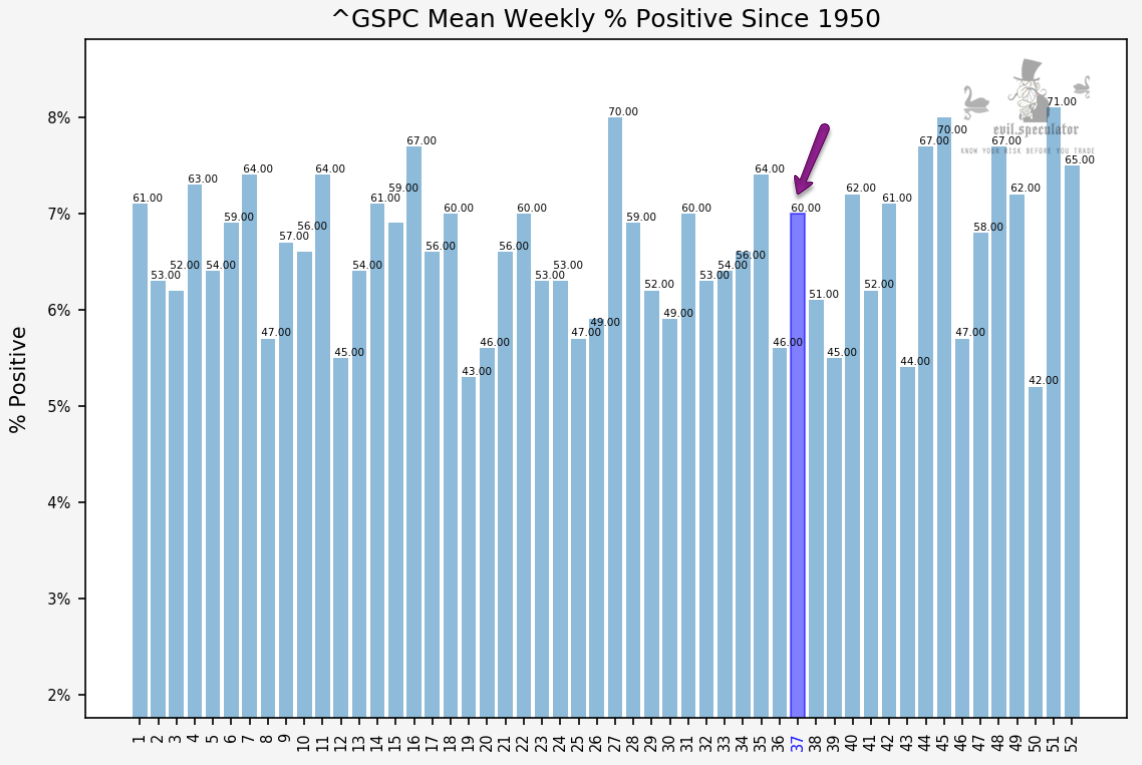

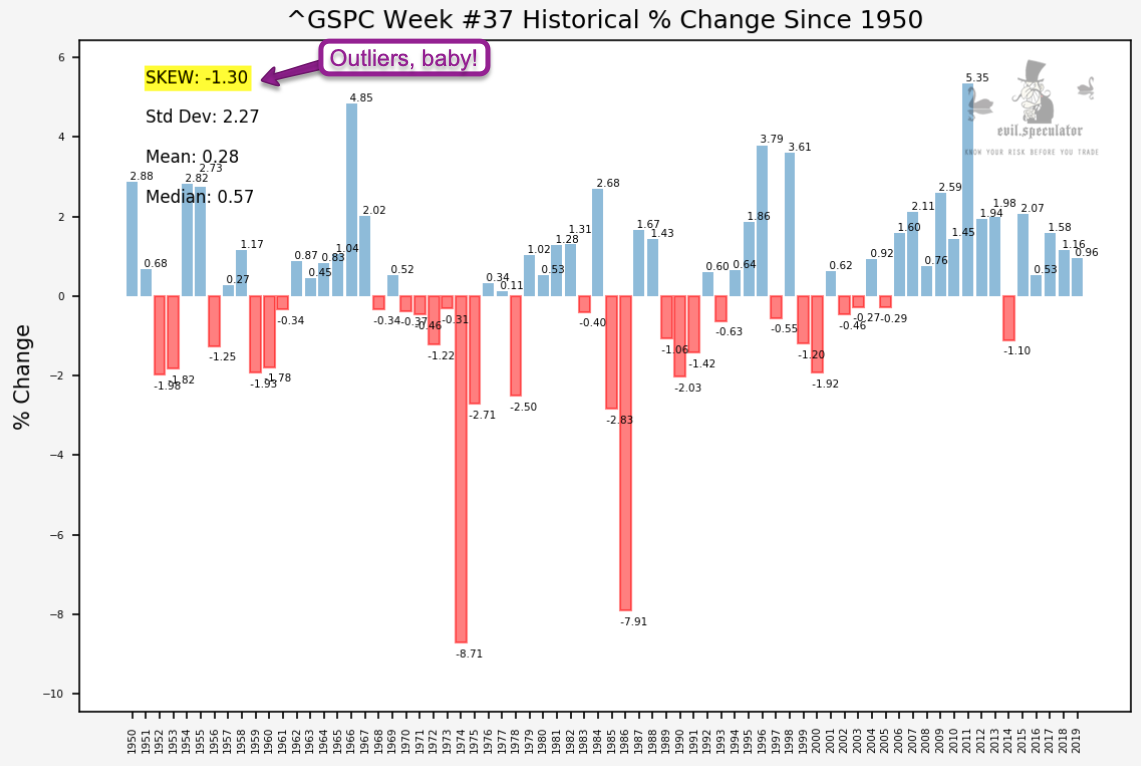

The good news is that week #37 is the most positive of September and statistically we have a 60% probability of ending in the plus. The bad news is that September is a veritable turd historically speaking and you should be prepared for quite a bit of turbulence.

Weekly percent positive stats show us above the median at around 60% which are decent odds at the surface. However if we dig a bit deeper things get more problematic:

[MM_Member_Decision membershipId='(2|3)’]

We are talking outliers, baby!! SKEW is at -1.3 – which is positive on average (the dataset is shifted toward positive closes) but standard deviation ranks pretty high at 2.27.

If that’s all Chinese to you then just look at the historic closes over the past 50 years. On average week #37 closes in the plus but when the wheels come off things tend to get ugly.

That said it’s been pretty quiet since the 2008 financial crisis and various rounds of QE.

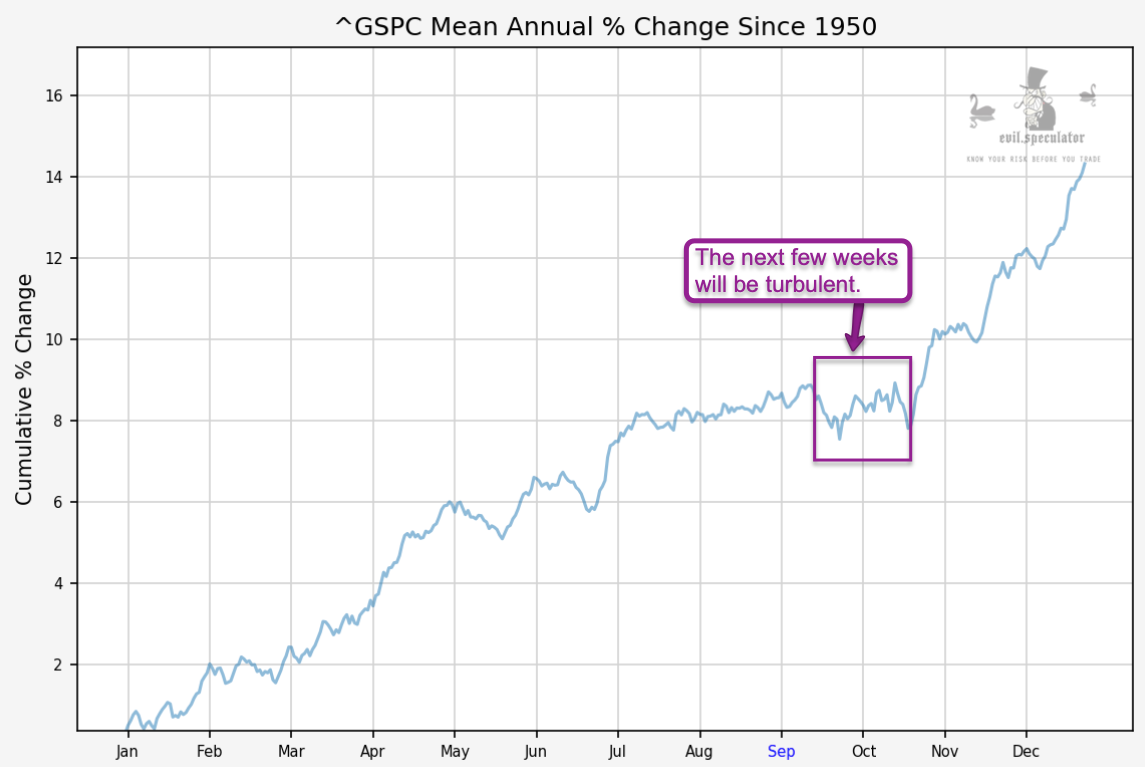

Mean annual percent change plots the average path forward. We are basically on the left edge of that box I drew and things usually get a bit more dicy until the end of October.

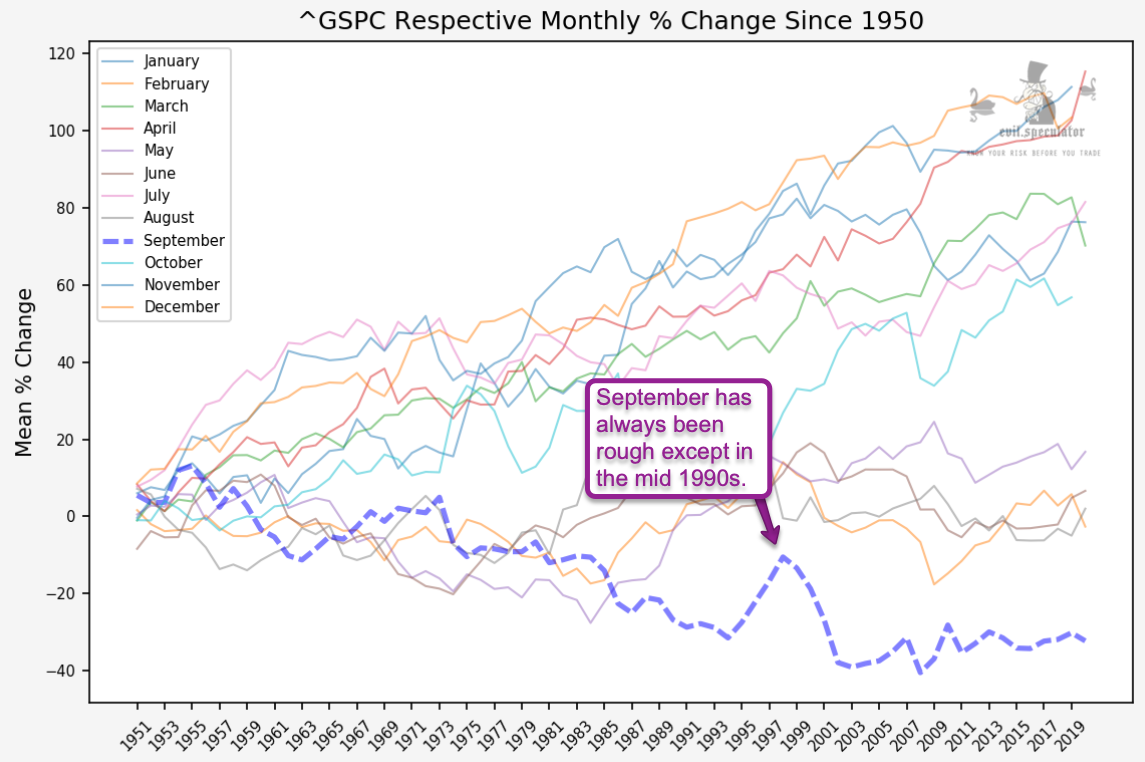

Monthly percent change – I posted this last week but the line wasn’t highlighted yet as it was the 31st. Not a good month for HODLers. If you’re participating keep this in mind and hedge yourself accordingly, if possible.

Unfortunately this sentiment seems to be widely shared as the VIX has held steady near the 35 mark. Which means option premiums are quite a bit more expensive than a week or two ago. Your systems will start behaving differently in such market conditions and some may even break down.

My modus operandi is to widen my stops and lower my exposure. Volatility will help you on the gain side but you also need to protect yourself against whipsaw. If you’re trading options then these are exciting times – make sure you watch our Options 101 and Options 201 courses that will guide you through the basics.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]