All the civic chaos and social brinksmanship notwithstanding U.S. equities have brazenly continued to march higher and higher since the activation of the riot brigade. Much to the chagrin of a legion of political arsonists who would love nothing more than to see our entire nation go up in flames.

Now if you find yourself shaking your head with incredulity watching the news coverage, or trying to make rhyme or reason out of the unfolding chaos then I suggest you direct your attention to much more important matters, e.g. protecting your loved ones, your property, your financial assets, and keeping them all out of harms’ way.

To lend a quote from the Dark Knight: “Some men just want to watch the world burn.”

It’s official. Riots are good for the stock market and I am already looking forward to implementing the ‘riot trend trading system’ Tony and I have in development. Yes, I’m obviously being facetious but it will take boat loads of black humor to get us through this summer and I don’t even want to know what the fall election season has in store for us.

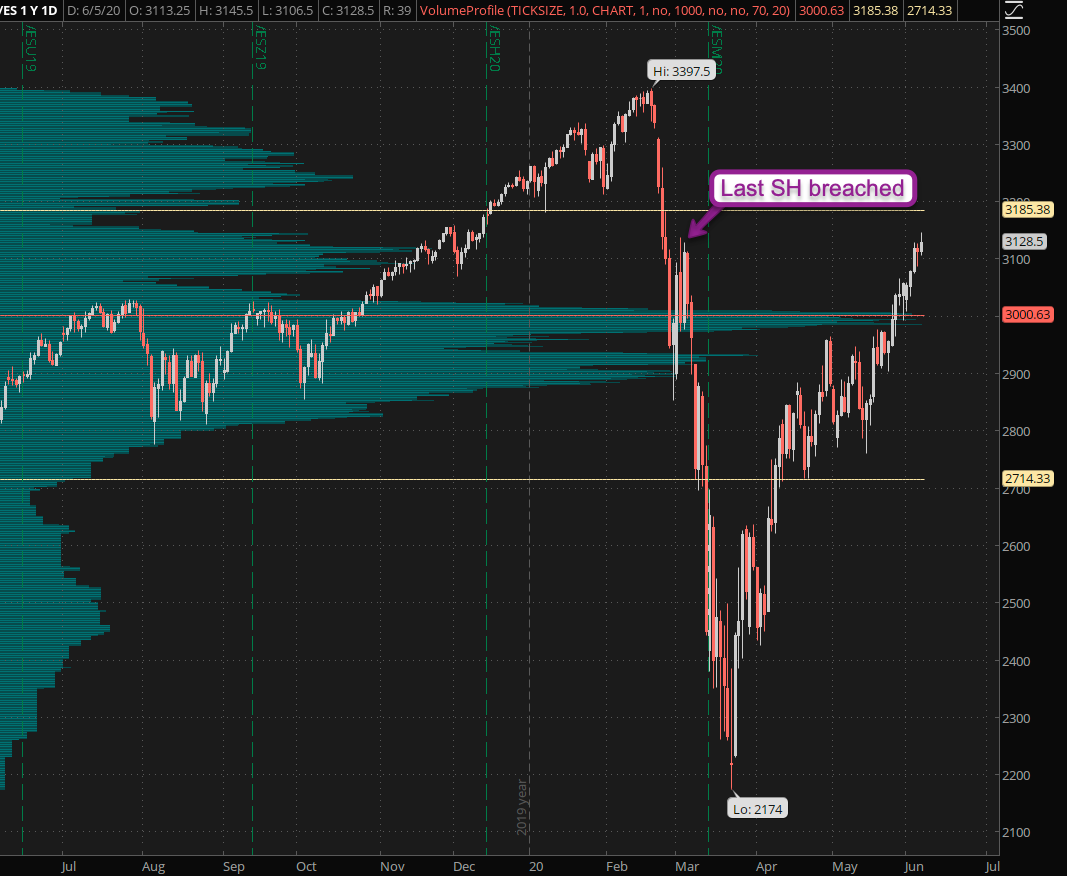

Anyway, equities = up and after breaching the last major spike high (SH) painted in February the S&P 500 is now embarking on the final stretch separating it from its all times highs.

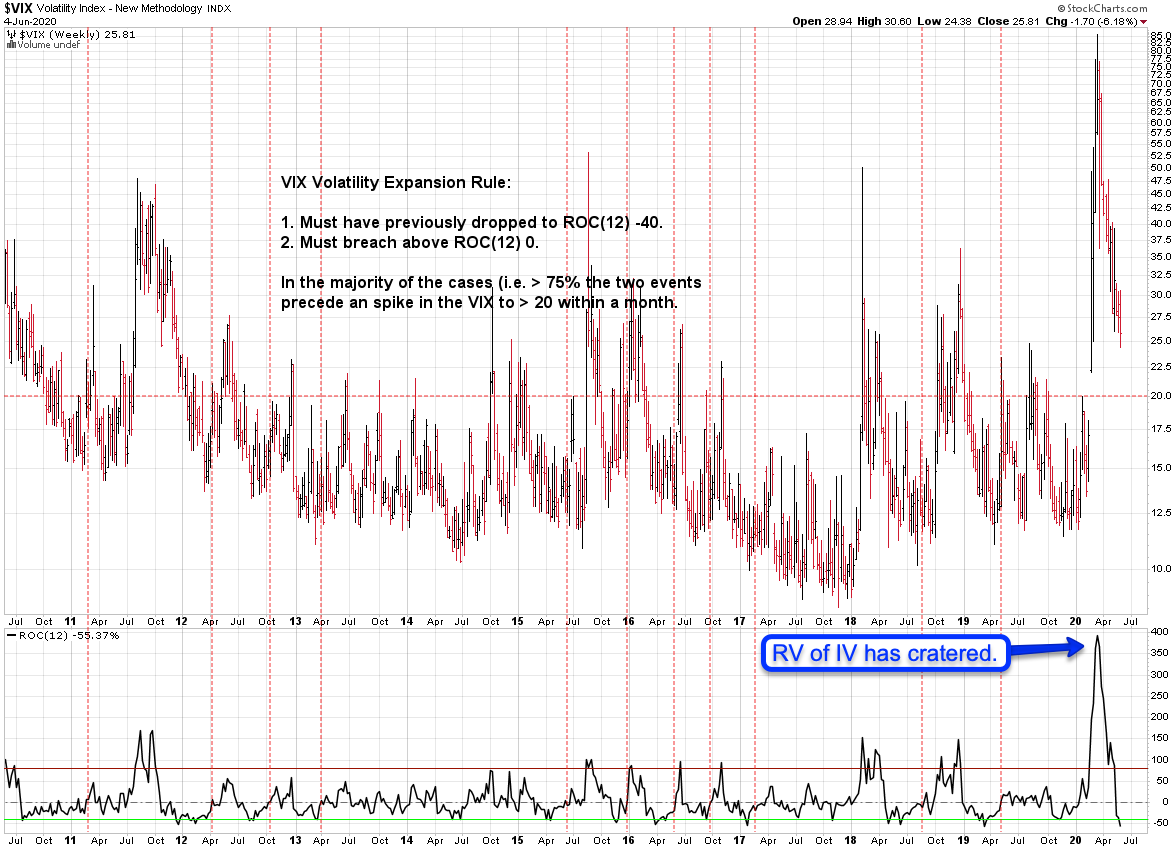

As you know I follow implied volatility closely on a daily basis which includes the VIX as a general representative of market sentiment. Rash movements in the VIX are usually followed by mean reversion, which the VIX Buy/Sell signals are based on.

Interestingly however we have not seen a single one throughout the past three month despite a precipitous drop in implied volatility. Per the rules a close below the 2.0 BB would be necessary followed by a close back inside and then one a bit higher for final confirmation.

Instead the VIX has carefully skirted around extreme drops which would have most likely kicked the bots into mean reversion mode.

The VIX’ rate of change panel (basically realized vol of implied vol) has completely cratered.

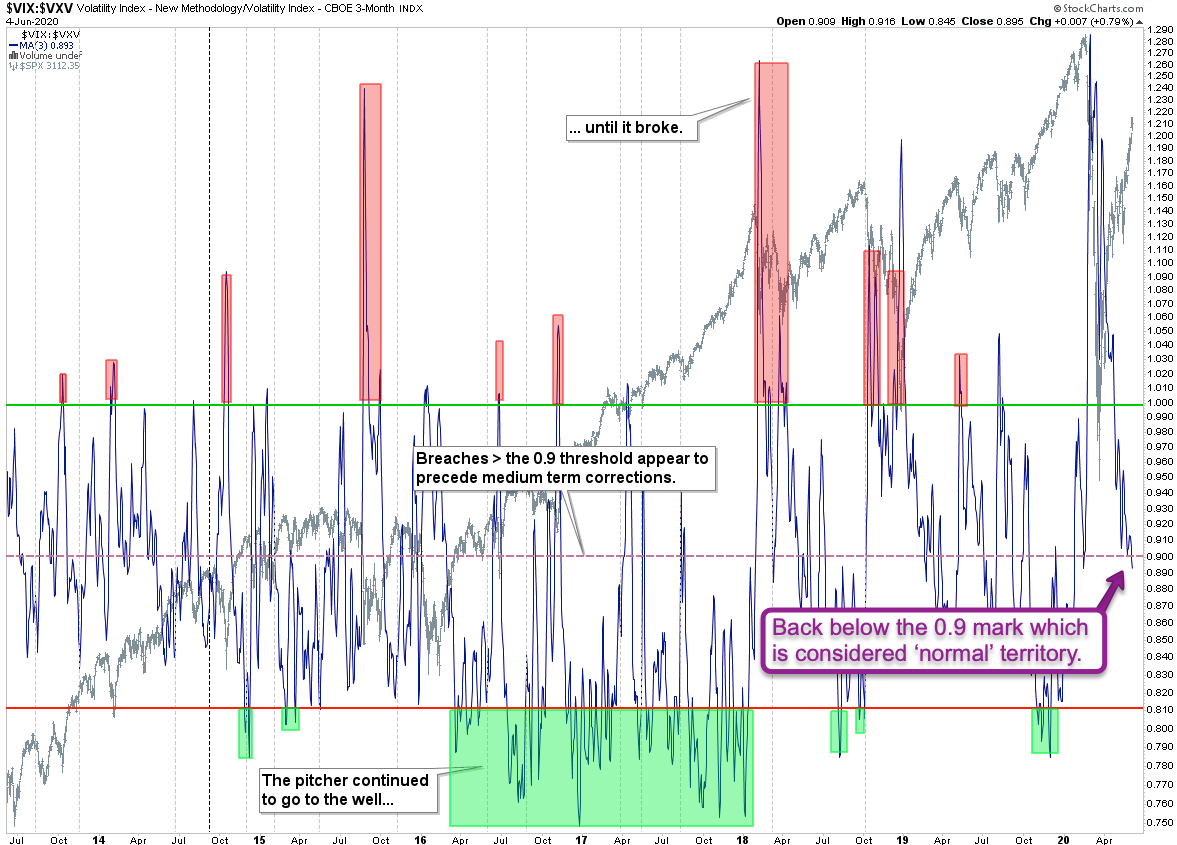

The implied volatility term structure (IVTS) has descended back below the 0.9 mark which both Tony and I consider ‘normal territory’. By that we mean a market environment in which most bullish trend trading and mean reversion trading strategies succeed.

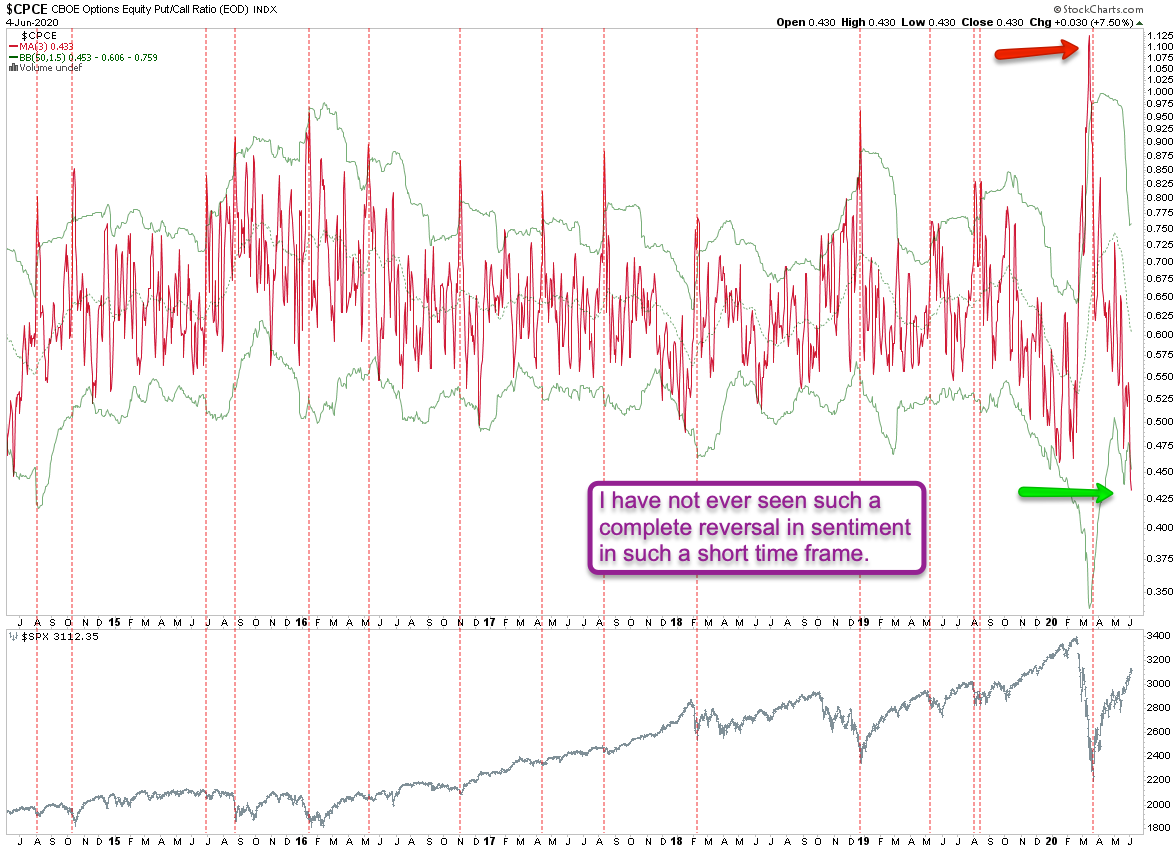

All of this has had a very demoralizing effect on any remaining bears, as evidenced by my next chart:

[MM_Member_Decision membershipId='(2|3)’]The CBOE options equity put/call ratio (CPCE) has experienced what must be one of the if not THE biggest reversal in sentiment I have ever seen, especially given the relatively short time frame of three months.

Of course you may be wondering whether or not this isn’t a harbinger of bearish things to come. Plausible theory – difficult to predict as always. Best we can do is to look at a collection of market momentum measures and then assess our probabilities.

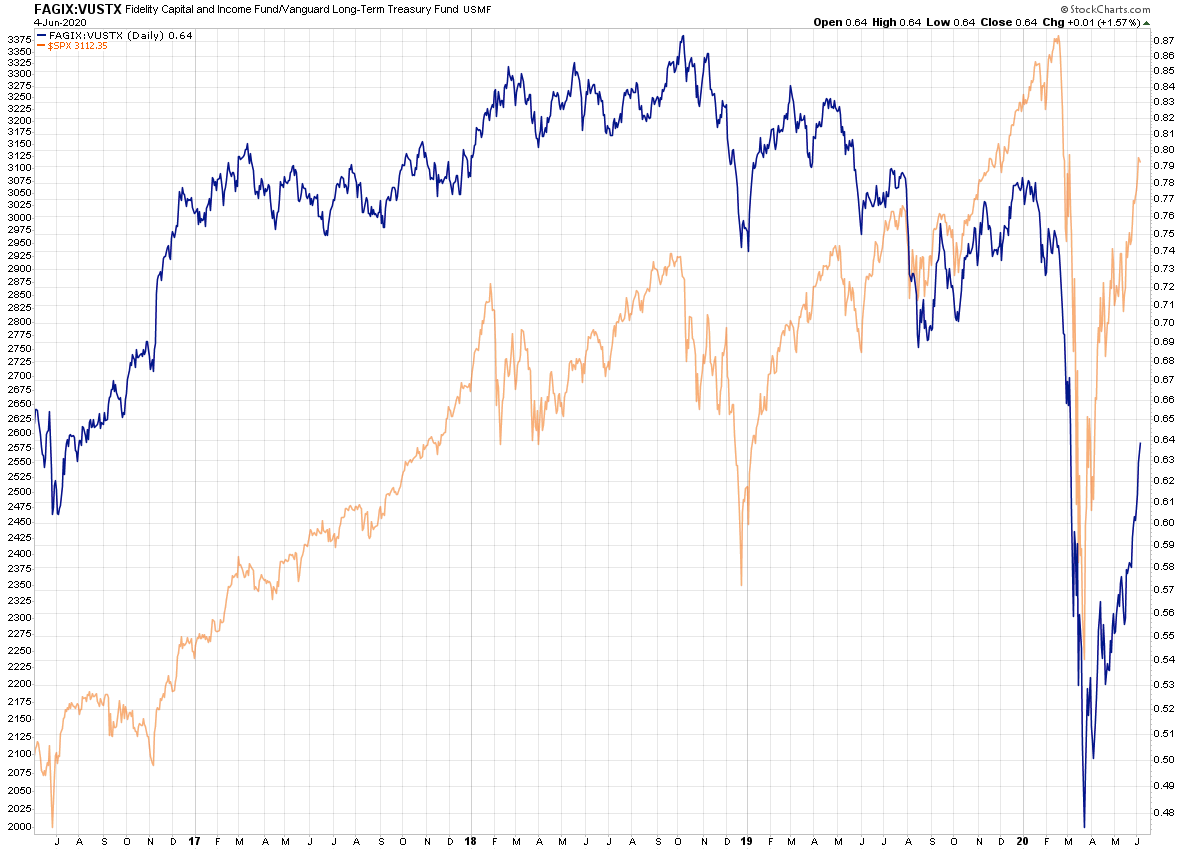

Bonds have been teetering sideways over the past few months but junk based funds like the FAGIX income fund seems to be doing quite well mirroring equities. Shown above a ratio between the FAGIX and the VUSTX which is a long term treasury fund for comparison.

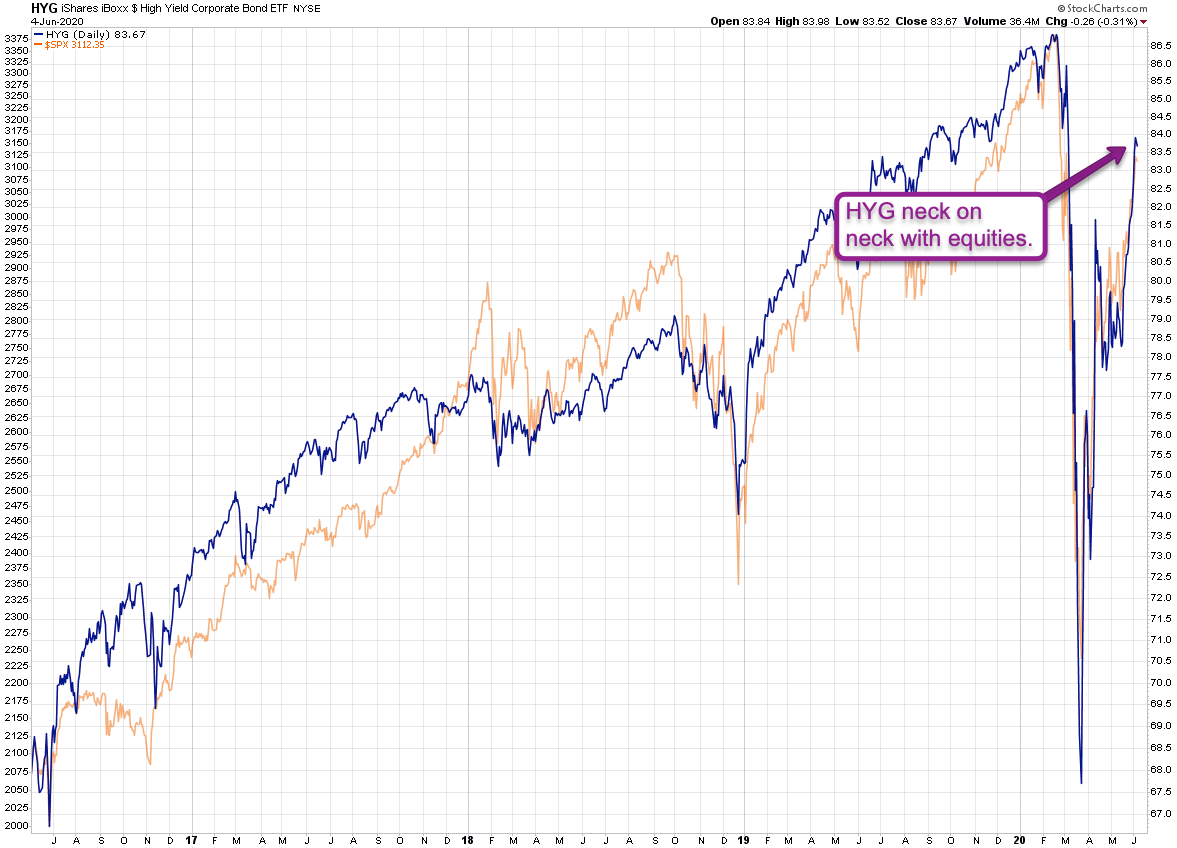

Here’s the HYG which by all extends and purposes is running neck on neck with the SPX. So it’s not just equities that are in vogue right now, despite all the media madness and urban conflict it seems that investors are piling into junk bonds.

What does that tell you about how the top 10% of society views the future of our republic? I leave you to ponder this question over the weekend, but don’t hurt yourself thinking about it too much. See you on Monday.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]