With the S&P 500 mostly treating water this week the big question in my mind was what the heck is driving the Russell to advance higher as if being juiced by a double dose of Martin Armstrong’s Tour de France special. Time to lift up the market’s skirt and dive in for a closer inspection.

As you can see the IWM has been a very naughty boy lately, continuously disappointing option sellers handicapping risk on a similar anticipated weekly range and getting their members slammed three times in a row now. As Albert was fond of saying: “The definition of insanity is doing the same thing over and over again, but expecting different results.”

Thus far the IWM has remained range bound thus far but with three more full sessions to go it’s easy the potential for another IV wipeout is pretty high.

With big tech, the main driving force of the overall marketplace, stuck in the pitstop right now the question thus remains? Who is doing the running? Well, the big shuffle seems to be scattered all over the place. Here’s TSLA for example – not exactly known to be a slow mover but that Tuesday candle is simply ridiculous, and it’s not even earnings week.

Some of it also doesn’t make too much sense. I mean why a human resources management company is considered the bee’s knees right now? Well, a possible COVID vaccine of course but I fear the great party may be followed by a huge hangover in not too short of a time.

Ditto when it comes to cruise liners. How many of you are eager to be packed onto a floating tomb with thousands of other people right now? While possibly still forced to wear a mask? Oh yeah, sign me up! (sarc: not really)

NVDA makes a lot more sense as many workers will remains stuck at home but it’s not really doing this much. So is there any credible justification for the Russell’s big move higher?

No there really isn’t. But we don’t really care as we are not tasked with making sense out of this whole train wreck of a year. What matters of us is banking coin and on that end I aim to be helpful. So let me show you to take advantage of this apparent disconnect between perception and reality:

[MM_Member_Decision membershipId='(2|3)’]

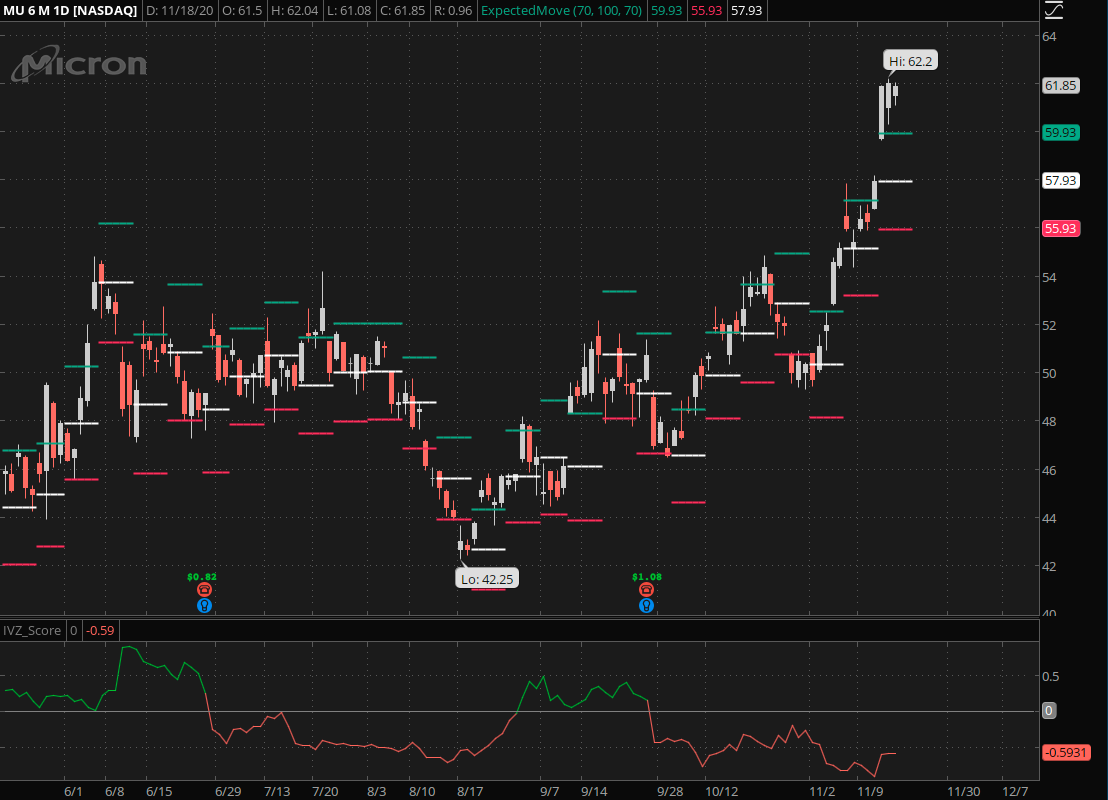

The semiconductor market seems to be pretty not right now but I don’t really care about that as it can change on a dime tomorrow. What I care about is opportunity and that we have right in front of us, IF you care to look in the right places.

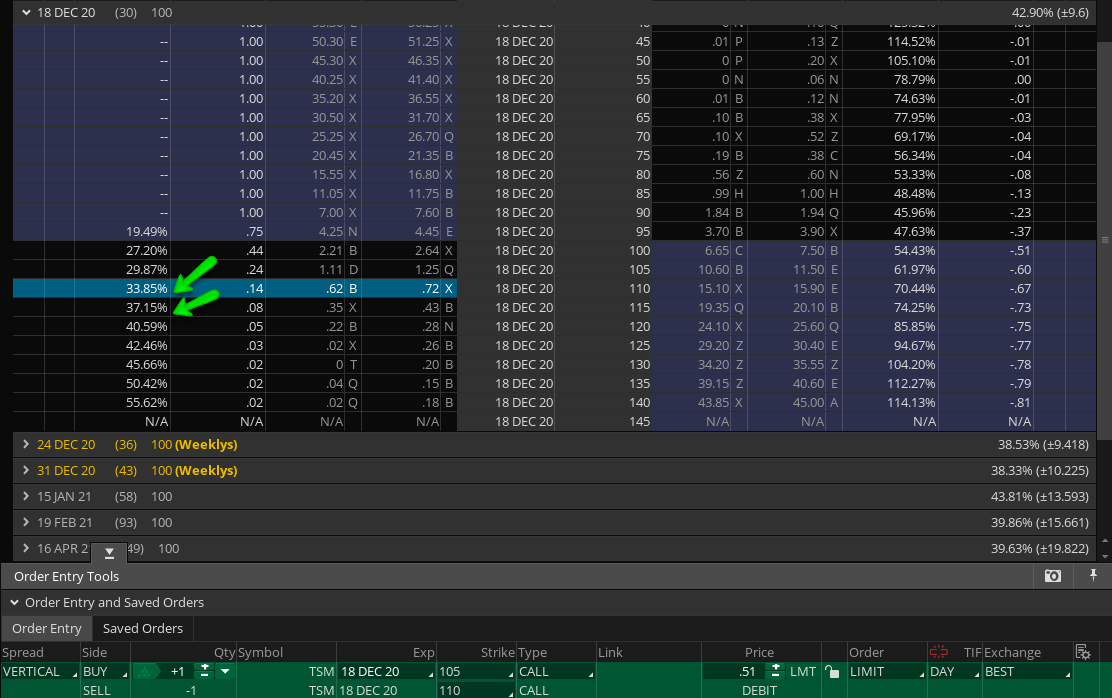

No, not the chart. The option chain and implied volatility in particular. What I’m referring to in particular is the slight SKEW between near the money calls which is rather significant. See how the 115 call has quite a bit higher IV than the 110 call?

You may think this to be academic and you would be wrong. This is actually quite rare (which I will prove to you soon). But what’s important is that it has an effect of allowing us overpriced calls against cheaper calls. Ergo: cheap long spreads.

Of course that is assuming you believe that TSM is going to keep running higher into December 18th.

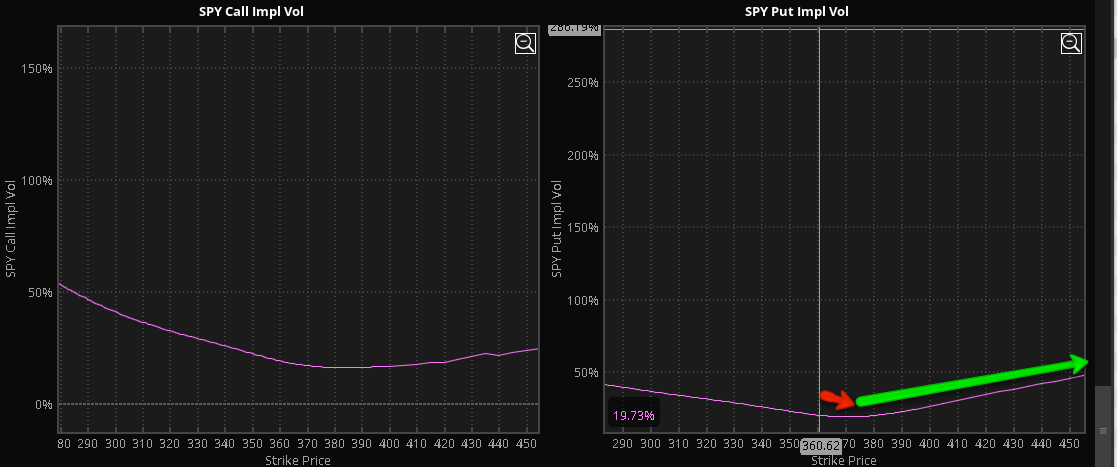

Now as I said, you may be thinking that this is normal and I told you that it isn’t, especially in the first 10 strikes on the call side. How do I know? Just look at the SPY which accounts for about 15 Million contracts traded every single day.

Note how a comparable spread (we have a lot more strikes here and I went for a similar delta differential) is a lot more expensive? It’s hard to compare spreads on different products of course but what stands out is that the IV keeps dropping the further you go out. Thus you are selling cheaper calls against more expensive calls.

You may ALSO be thinking ‘But Mole – isn’t the option smile a normal phenomenon?’ Yes and no actually.

YES – across the bulk of the chain that is true.

NO – it’s usually not true in the immediate range that most mortals are trading.

As a demonstration I have aligned the curser ATM on the call side which clearly shows this phenomenon.

Now here are a few more goodies. MU is pumping like crazy. Let’s see if we can score a cheap golden ticket.

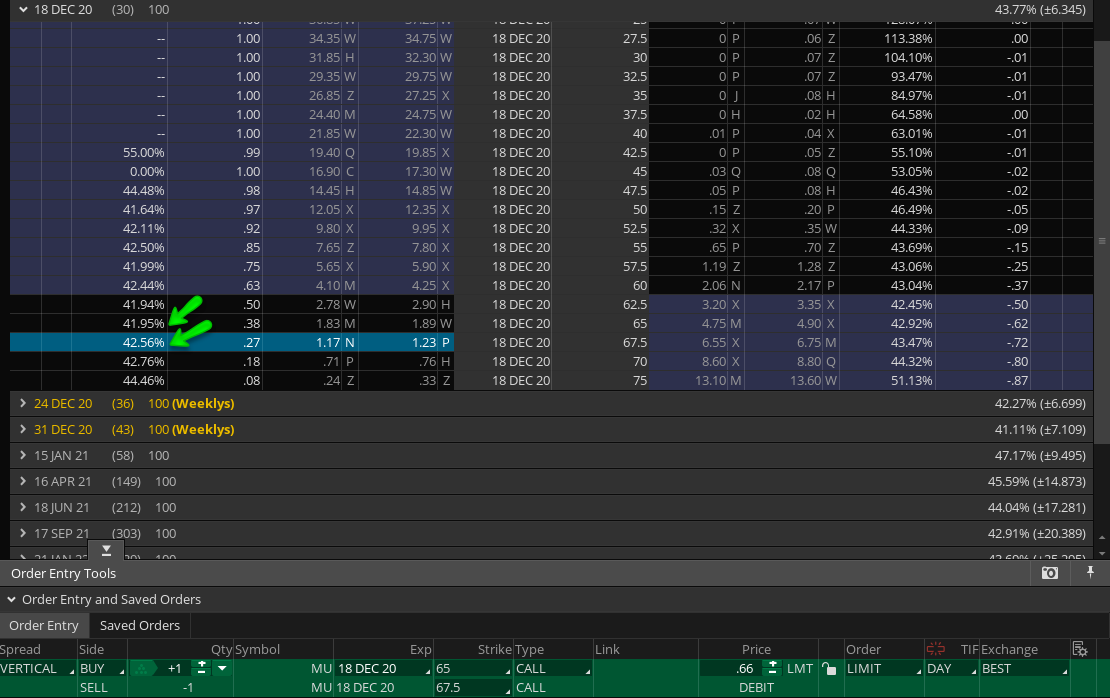

And indeed we once again are seeing significant SKEW in the immediate vicinity of the call series. Pricing out $2.5 call spread will cost us a lousy 66 cents. That of course only offers us 26% odds of making a penny or more but the potential payoff is significant.

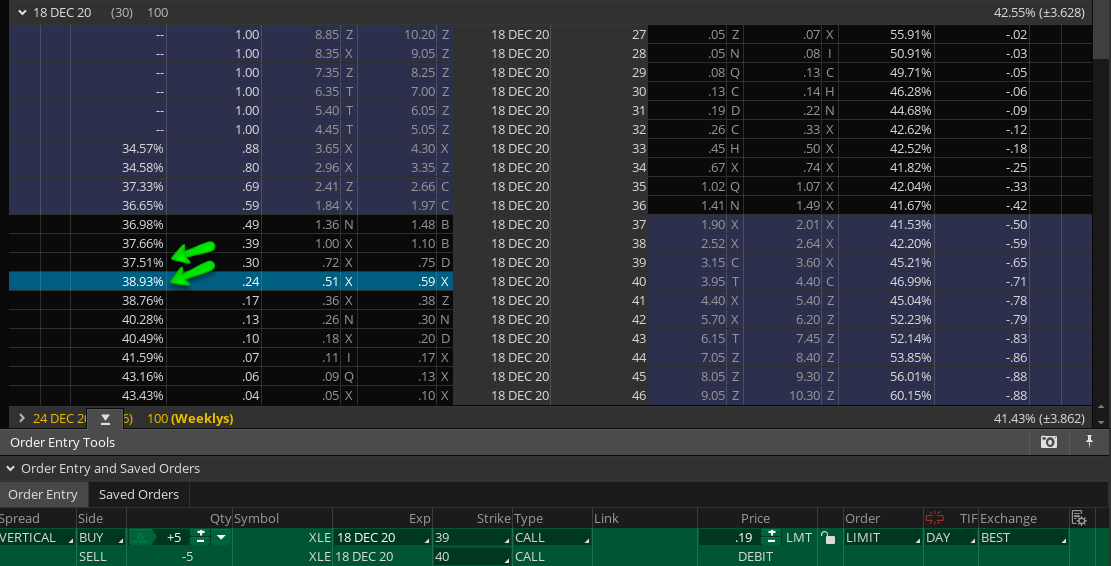

Similar formation on XLE – the financial sector of all things. Gauge me with a spoon!

I hate myself for going long here but I just can’t say no to such a SKEW differential and paying 19 cents for possibly making a Dollar is worth a bit of pocket change.

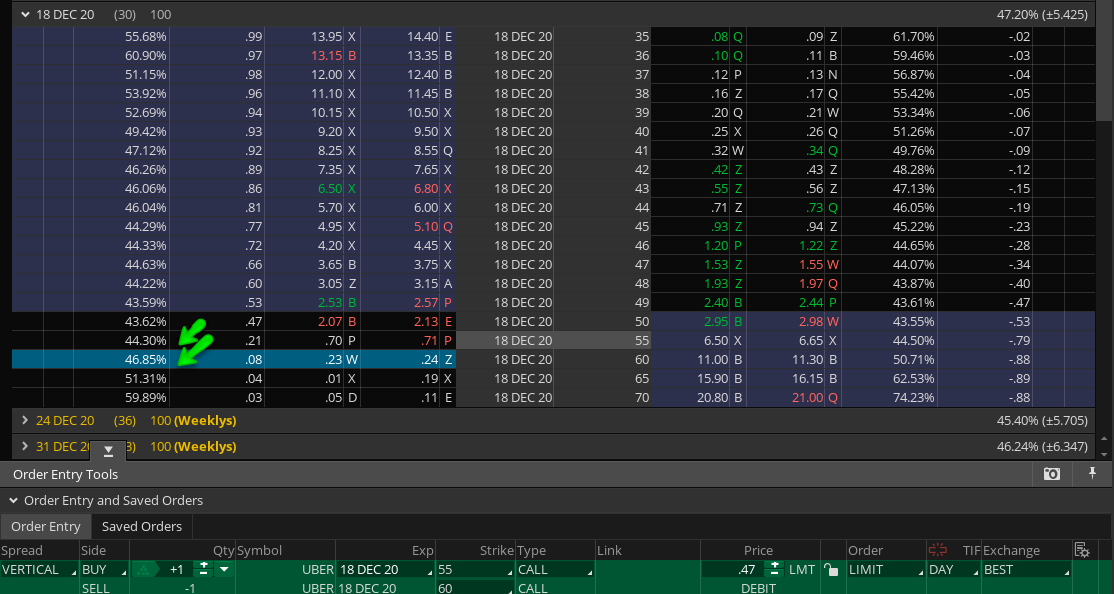

One more for the road: UBER – not yet outside its current EM but clearly on a collision course with its weekly expected move threshold 😉

And yes, as you may have suspected – juicy SKEW is present and I’m going to pick up a handful of call spreads here as well.

Hope you learned something interesting today! Happy hunting but keep it frosty!

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]