Every year here at the beginning of August the entire country of Spain enters into a one month long hibernation period. Although major retailers and stores are open most of the small ones close up shop and head out to the old ‘pueblo’ or their 2nd properties near a beach to spend quality time with the family. Good luck trying to get a hold of a doctor, dentist, attorney, plumber, what have you – everyone’s MIA until the end of the month.

When I moved here back in 2012 shutting down an entire nation for a month seemed like an alien concept to me, especially after becoming fairly ‘americanized’ having lived 20 years over in California. Quite frankly I still have a hard time wrapping my mind around that much leisure time and especially the fact that everyone schedules it during the very same month.

Best one can do is to be prepared, for example getting a check up at the dentist ahead of time as Murphy’s Law has proven itself on numerous occasions, at least during my life. For some reason cavities or chipped teeth always seem to occur during the holidays, and I somehow think I’m not the big exception.

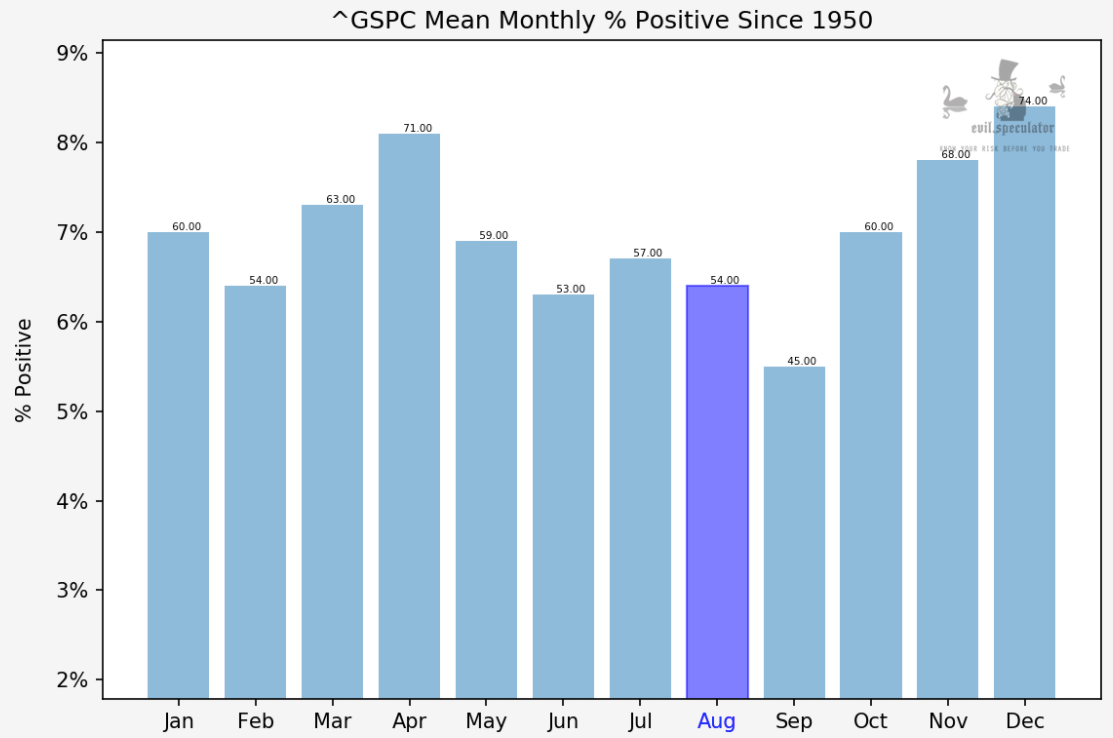

Speaking of hibernation, the statistics for the month of August rival that of February – another month I frankly don’t care much about. While February is just miserable and cold August over here its inverted cousin: hot and miserable.

Percent positive is tantamount to a coin flip at 54% – no big surprise there. Give me September any time – at least it’s got some downside bias.

What’s really interesting is the trading range, which as a whole is elevated and the 3rd largest of the entire year. Not by much but given that it’s a completely flat month August does seem to gyrate quite a bit.

Now let me show you why this is actually good news if you’re an options trader:

[MM_Member_Decision membershipId='(2|3)’]

This chart basically averages out all the years of the past 50 years into one graph. It’s almost perfectly horizontal during August but that’s not necessarily bad news as selling theta in August can be very profitable with limited assumed risk.

This is a game Tony and I have been playing for quite a while now over in our RPQ chat based trading floor. More details on that to follow soon.

And here you see August in comparison with all the other months over the past 50 years. So basically had you only bought at the beginning of each August and then sold at the end of the month you’d be broke by now due to massive inflation.

On a weekly basis the Sharpe ratio is pointing down and it’s slightly up for the next few weeks except for the last one which is a wipe-out.

And finally SPX percent positive for this week at 52% – it gets a bit better over the rest of the month except of course in the final one.

Bottom Line

If you are a directional or systemic trader you probably are better off just going on vacation or finding yourself a new hobby to spend your time on. However if you are an options trader then August can be manna from heaven as you’ve got a wider range but the expectation is that we’ll be closing inside the expected move most of the time.

[/MM_Member_Decision]

[MM_Member_Decision membershipId=’!(2|3)’]

Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]

[MM_Member_Decision isMember=’false’]

Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]