Navigating this week is going to take some finesse as the market is giving us more conflicting signals than a teenage girl on her first date. First up the main key to survival and – better yet – prospering in high volatility market environments is to not attempting to find order where there is chaos, to not fill in a gaping chasm of confusion with your own personal opinion. If you have the mental discipline to do that then – congrats, you’re already way ahead of over 90% of all market participants.

As I love to be a tease let me first show you where we’re at and what the inconsistencies are, and then help you sort it all out and make it work for you (assuming you’re a sub that is – sorry pal, I don’t work for free).

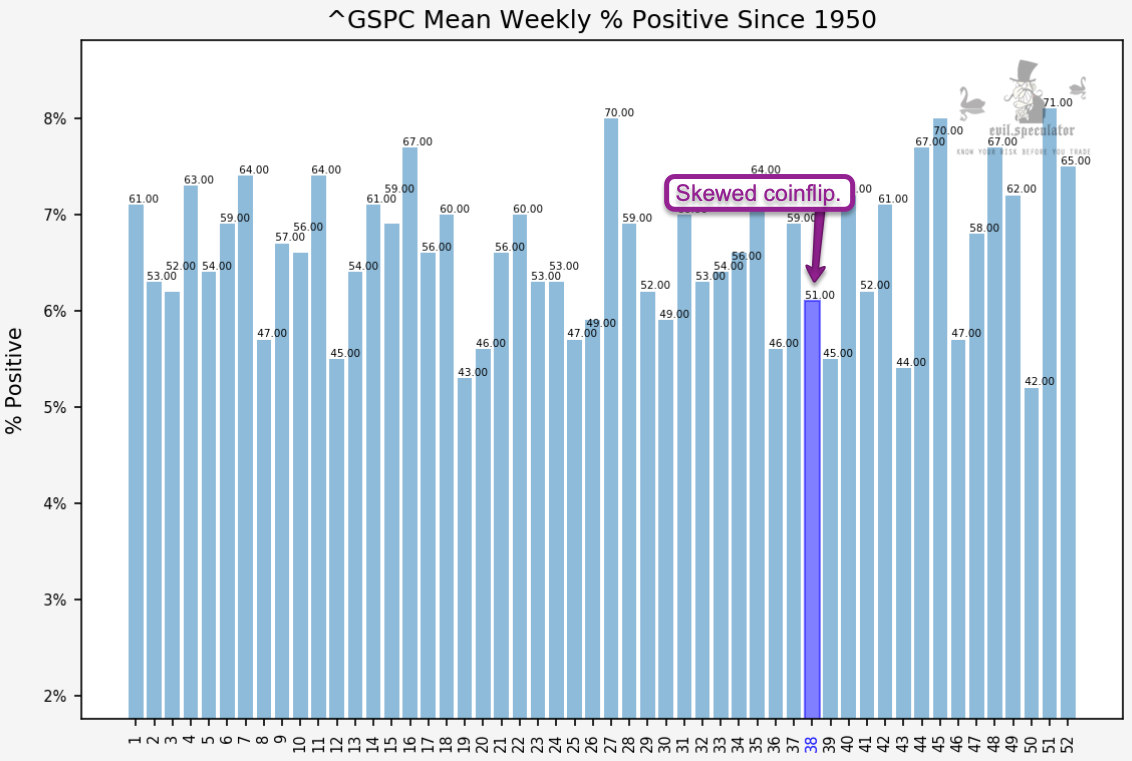

On the surface we are dealing with a coin flip week in that the historical odds have us at 51% on the weekly % positive.

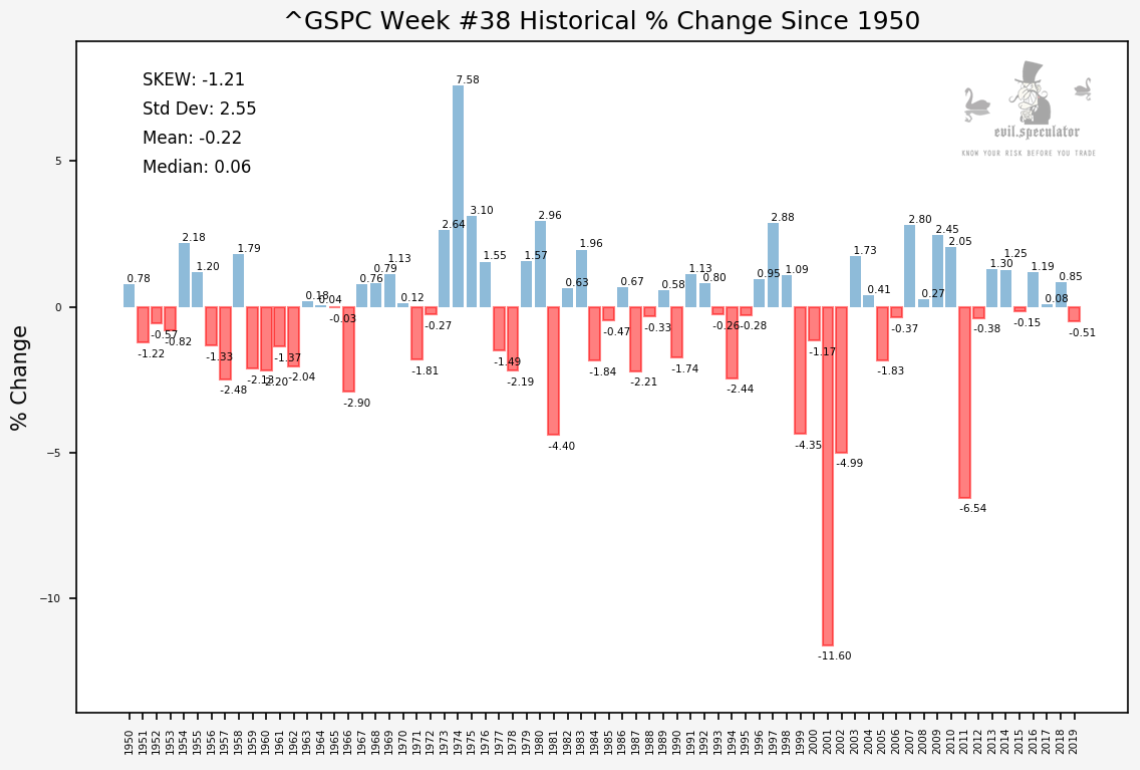

That however does not tell us much about the actual distribution of winners and losers, does it now? And it’s not looking good at all. I could explain the stats above but all you really need to do is to look at the negative outliers and compare them to all the winning weeks which aren’t even in the same weight class.

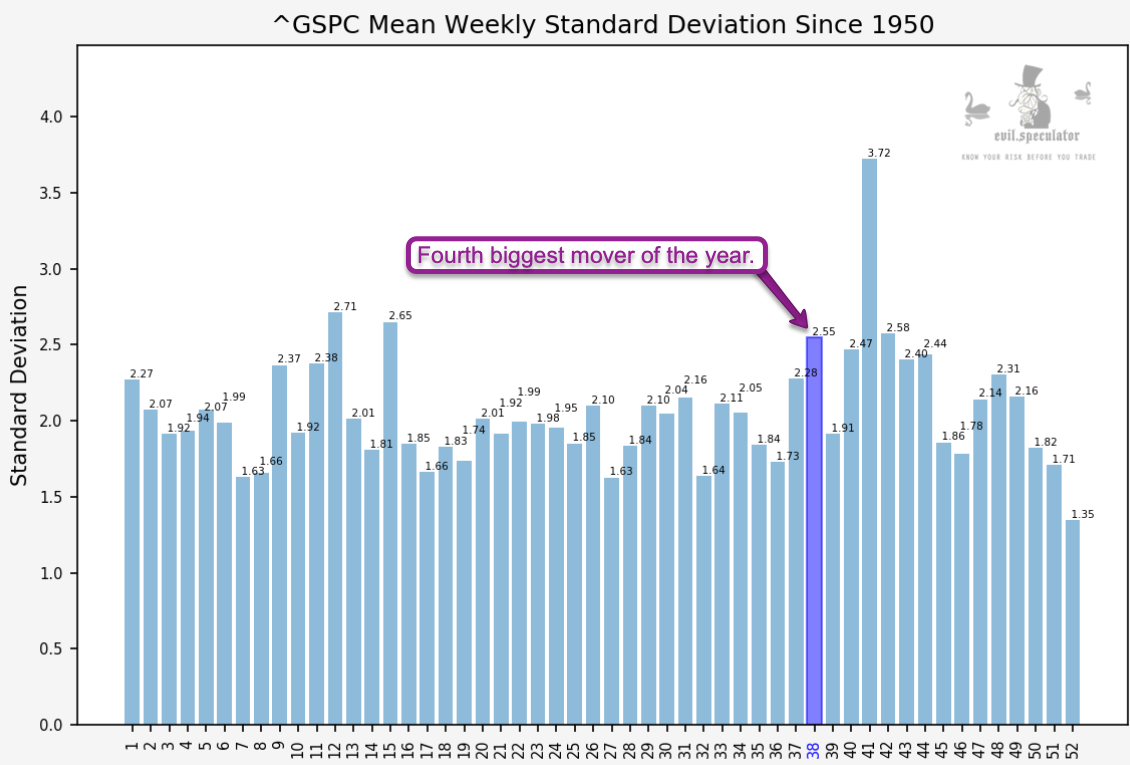

To add insult to injury we also are heading straight into the fourth biggest moving week of the year. And per the previous stats the big movers favor the bears.

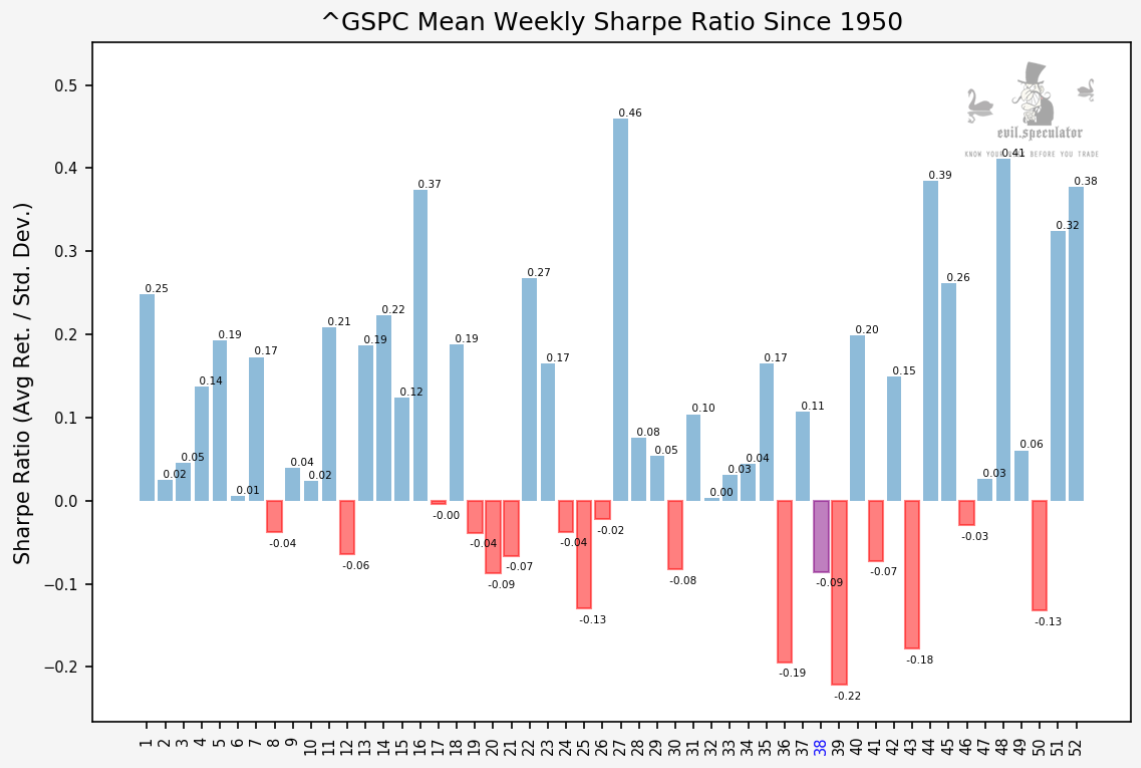

Not surprisingly this all adds up to a negative Sharpe ratio of -.09 for week #38, which isn’t horrible but let’s not forget that’s averaged out. The take away message for us here is that if the market slides in week #38 it tends to swing for the fences.

But as always, and in particular in the year 2020, there’s a lot more to this story. Here’s how we take advantage:

[MM_Member_Decision membershipId='(2|3)’]

Expected move on the SPX has been expanding but has started to contract and stands at around 88 handles for the next five sessions. That is not surprising given that, despite all the drama, EM once again was well observed.

To me this does NOT point toward market participants operating in panic mode.

Similar picture on the cubes – EM was breached but then closed back inside the weekly expected move. For this week IV in the QQQ predicts a little under 11 handles up or down. Note that unlike on the SPX the IVZ-Score remains elevated. We’ll revisit that in a minute.

First back to the SPX but plotted against the VIX. Do you notice anything?

That’s right, IV appears to be dropping ALONG with the market now, a phenomenon I explained in detail in last Friday’s post.

That’s not necessarily a bullish sign I may add but at minimum it’s not a BEARISH sign. Recall my intro – let’s not fill in the informational void with our own wishful thinking or our current book.

Clearly what has been hit the most is big tech – that’s been well established. Looks pretty bearish doesn’t it?

So why does put/call activity on the most active issues continue to favor the call side? Frankly I don’t know but there are 2 possibilities:

- Call buyers are wrong and are going to get royally reamed.

- Call buyers are right and we are about to punch higher, with big tech benefitting the most.

Statistically speaking however we are in a crappy week, so seasonal odds are playing against us. Which for me means buying IV is not necessarily a bad idea, especially given that the VIX is holding steady right now offering us cheaper premiums.

If call buyers are right I may lose a little, but if they are wrong then I’ll probably make bank as vega is going to explode higher.

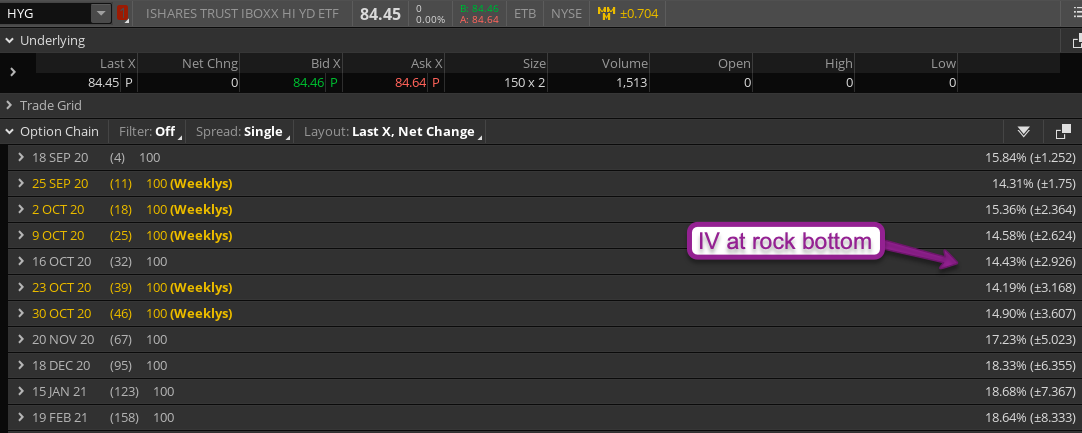

Another interesting chart I was able to dig up is HYG – a.k.a. high yield corporate crap bonds with more junk in the trunk.

How come the EM range, along with IV and its IVZ-Score continues to contract, given what’s going on in equities? If we are really heading into an economic calamity, shouldn’t crappy high yields bonds be stomped on?

Honestly I don’t have an answer to that but as I am an option trader let me show you something that absolutely stumped me. IV on HYG is currently at rock bottom in the teens all the way through 2021.

What’s going on there is anyone’s guess but what I do know is that I’ll be picking up a ton of hammock spreads (a nefarious creation of mine) while the getting is good.

I’ve posted about the hammock spread in the past – basically it’s a call ratio spread combined with a slightly altered triple body butterfly on the put side. Once I’m done with my Options 301 class I plan on doing one on the hammock spread as well.

[/MM_Member_Decision]

[MM_Member_Decision membershipId=’!(2|3)’]

Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]

[MM_Member_Decision isMember=’false’]

Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]