A day or two ago I was cruising around on reddit as I am subscribed to a few hobby related groups as well as some related to crypto currencies. To be honest I haven’t been dabbling much in crypto since early last year but it’s always good to keep one’s ear to the ground, as they say.

As BTC has been forming a base below the 10k mark over the past month or so I saw a lot of optimism and of course some obligatory high-fiving by the usual HODLers. No surprise there, but what definitely stood out to me was the collective level of incredulity regarding the continued strength of the equities market. Which of course continues to rise higher despite a week of non-stop violent riots all over the United States.

Someone even mentioned that he (or she?) had dumped a ton of stocks when it all began and simply couldn’t grasp how markets would continue to stubbornly rise higher with all the smell of ‘civil war’ hanging in the air. It seems once again a retail rat has stumbled over a valuable life lesson, but most likely will quickly dust itself off, hurry along, and then forget all about it.

And that lesson of course is: “Buy when there’s blood in the streets, even if the blood is your own.” Baron Rothschild was spot on and unlike most of us he had the balls to put his money where is mouth was.

Case in point: Even the Dow is now racing higher while most major American cities burn. This is not a cynical statement mind you, it’s simple fact. And therefore all that counts when it comes to trading the financial markets. If you came into this game expecting fairness or justice then boy – are you in the wrong business!

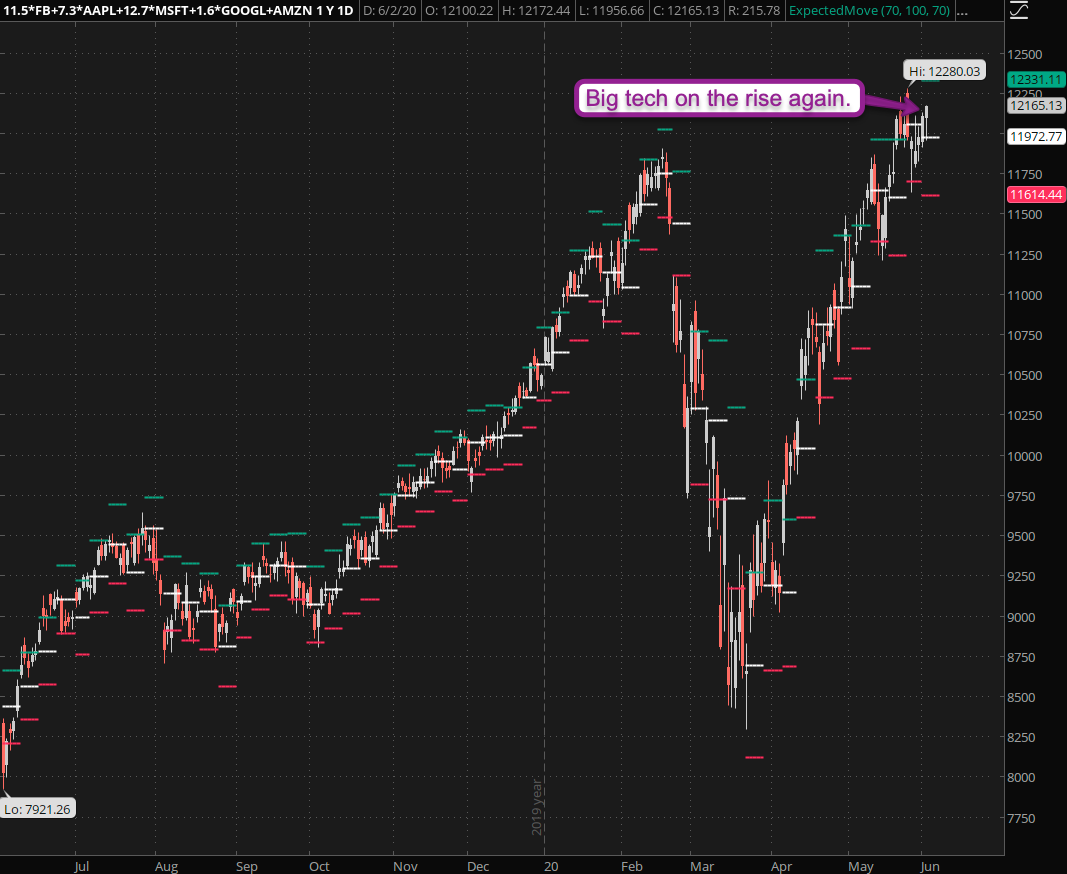

So what’s on the menu? Well big tech of course – here’s my ‘monsters of tech’ composite once again on the way to paint new all time highs. Not sure AAPL is enthralled by all it’s stores being cleaned out and set on fire but with most city centers turning into no-go zones AMZN and social media continues to rock & roll.

[MM_Member_Decision membershipId='(2|3)’]But it’s not just big tech. XLP – consumer staples – is also back en vogue and is now painting what looks like a YUGE inverted H&S pattern. Not a reason to be long here on its own but if volatility continues to drop here while prices continue higher. If you’ve watched our price action course then you should know what that means.

And it’s not just stocks that are on the shopping list – here’s a HYG a popular junk bond ETF which is making a run for its recent spike high near 84. By the way I much prefer HYG over JNK especially when it comes to trading options.

Bonds used to be the hot ticket before COVID-19 epidemic, then reversed backward and have now been in a sideways waiting loop for three months. What does that tell you? Well it tells me that there isn’t much desire right now to park money in risk havens.

The Dollar unfortunately has been in a free fall since the riots began and I expect it to paint a floor once riots subside and a relative level of normalcy returns. What that exactly means in 2020 depends on where you live I guess but it for sure doesn’t involve smoldering Apple stores.

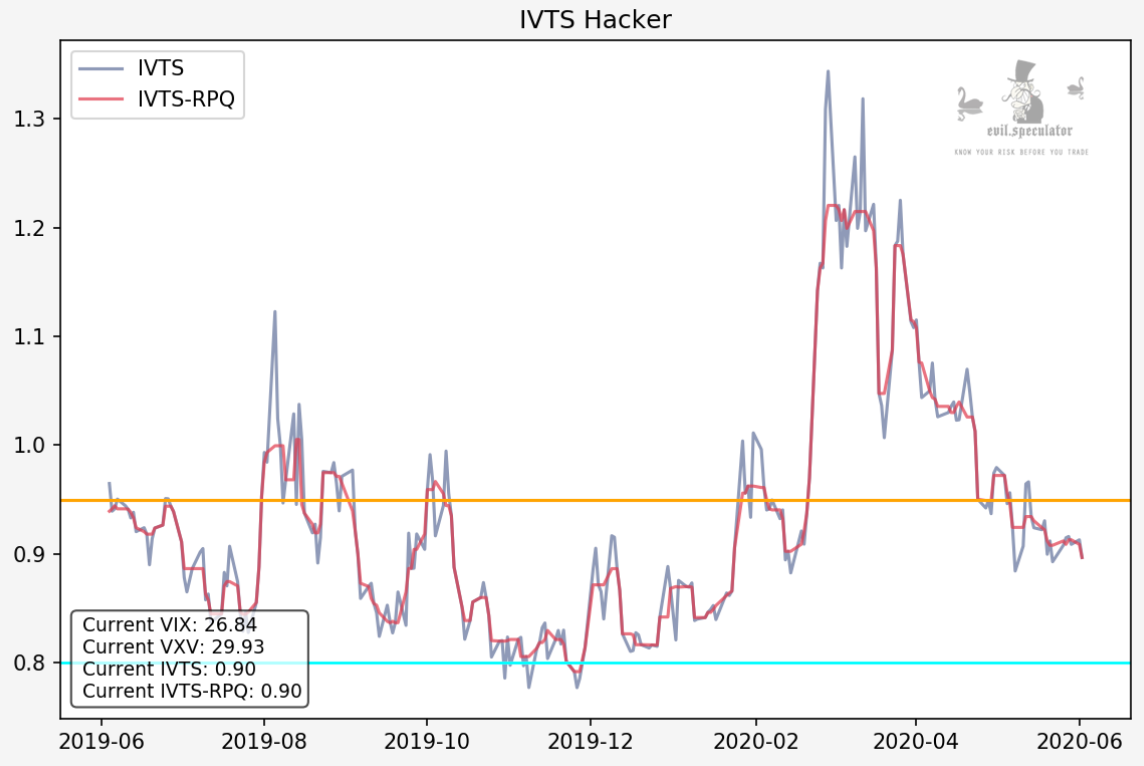

What even surprised me was the VIX. It has not budged whatsoever since the riots began and seems to be getting comfortable near its 25 mark. Again no judgment or cynicism implied – clearly market participants do not consider these riots worth losing much sleep over (unless you live in the affected areas I guess).

The IVTS is of course our go-to gauge when it comes to risk perception and I am happy to report that it has continued to drop into ‘normal’ territory, which is anything below 0.92. That is extremely good news, especially if we remain down here for another week or two.

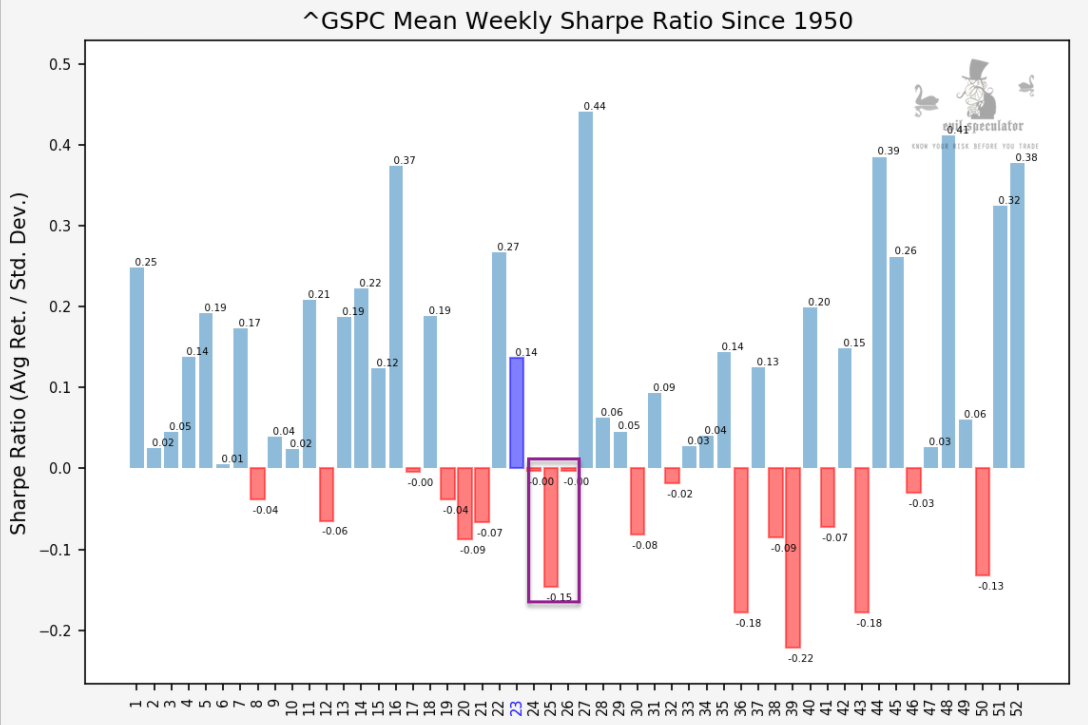

Unfortunately however the next three weeks look a bit iffy statistically speaking. We could be just pushing sideways but especially week #25 (mid June) is historically one of the most bearish of the year. If equities can hold out until July we ought to be in good shape however.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]