Let me be crystal clear. Opportunities like these only present themselves once or twice in a lifetime. I am dead serious about this. What is going on in the marketplace right now is absolutely unprecedented. However I would bet you good money that 99% of retail traders are completely unaware.

Now that I have your undivided attention let share another little tidbit with you. You are wasting your time looking at and debating price. This is NOT where the action is.

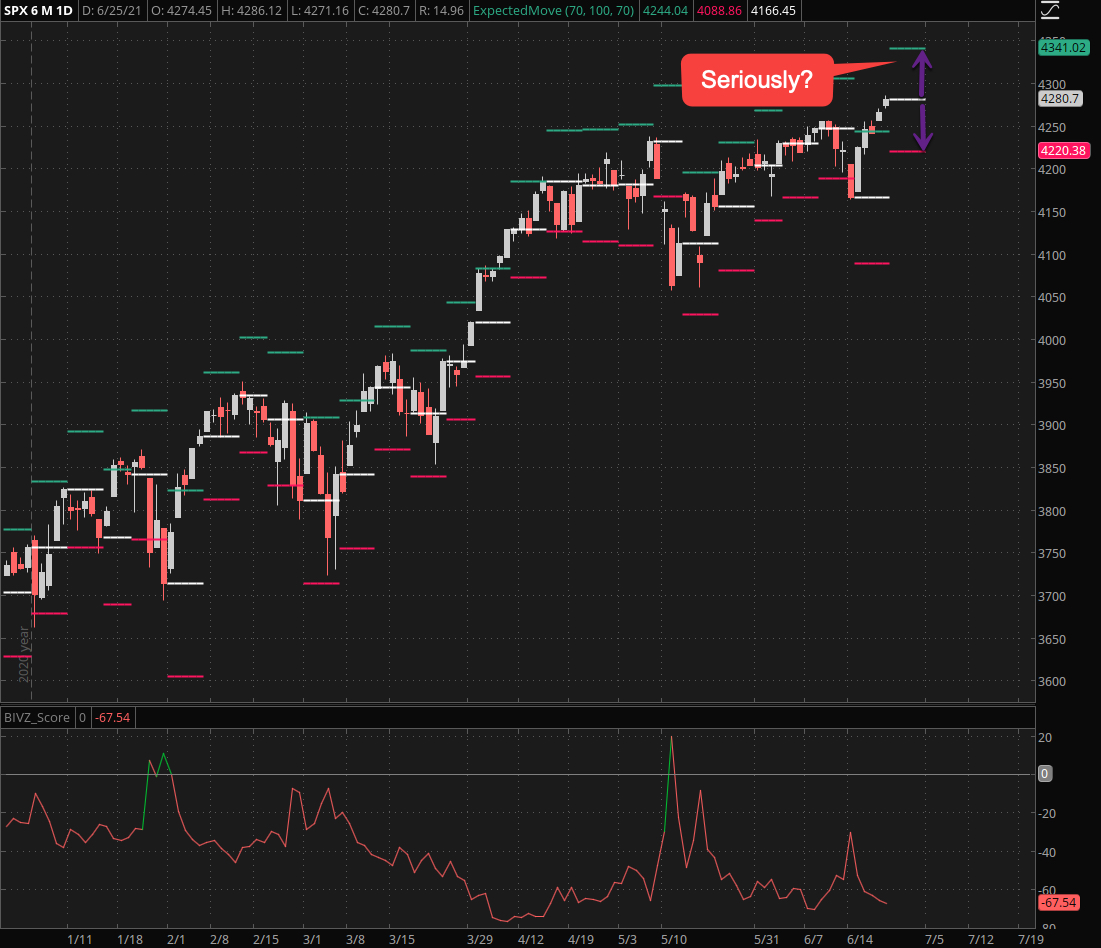

Yes the market is going up. Tell me something I don’t know.

So you could play the long side via stocks or options perhaps. But just look where we’ve been since April and then remind yourself that we are heading straight into the mid-summer rotisserie churn. Paging George Foreman!

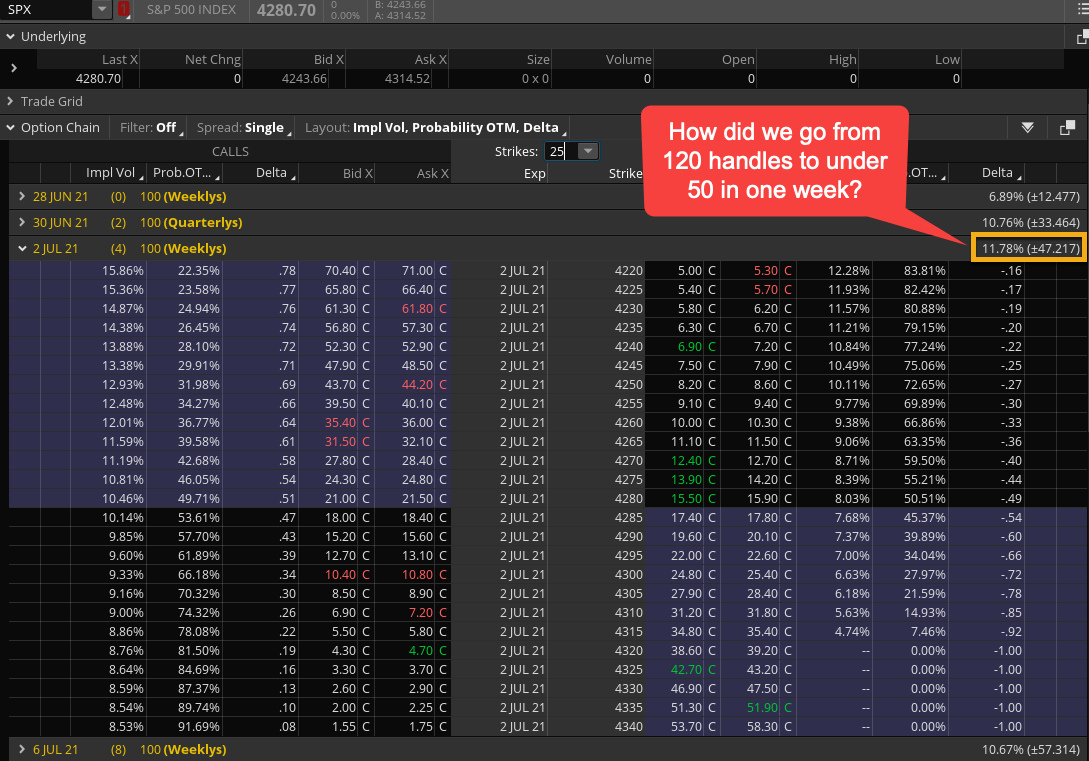

Nah, you’re not looking close enough, so let me give you a hint. Look at that expected move range – it’s a whopping 48 SPX handles.

Now if the next thought in your mind wasn’t ‘WTF’ then you haven’t been paying attention.

Let me illuminate you: Last week’s expected move was roughly 90 handles. And what did we get? 120 handles!

So why in the name of all that’s holy is this week’s EM range set at only 48 handles?

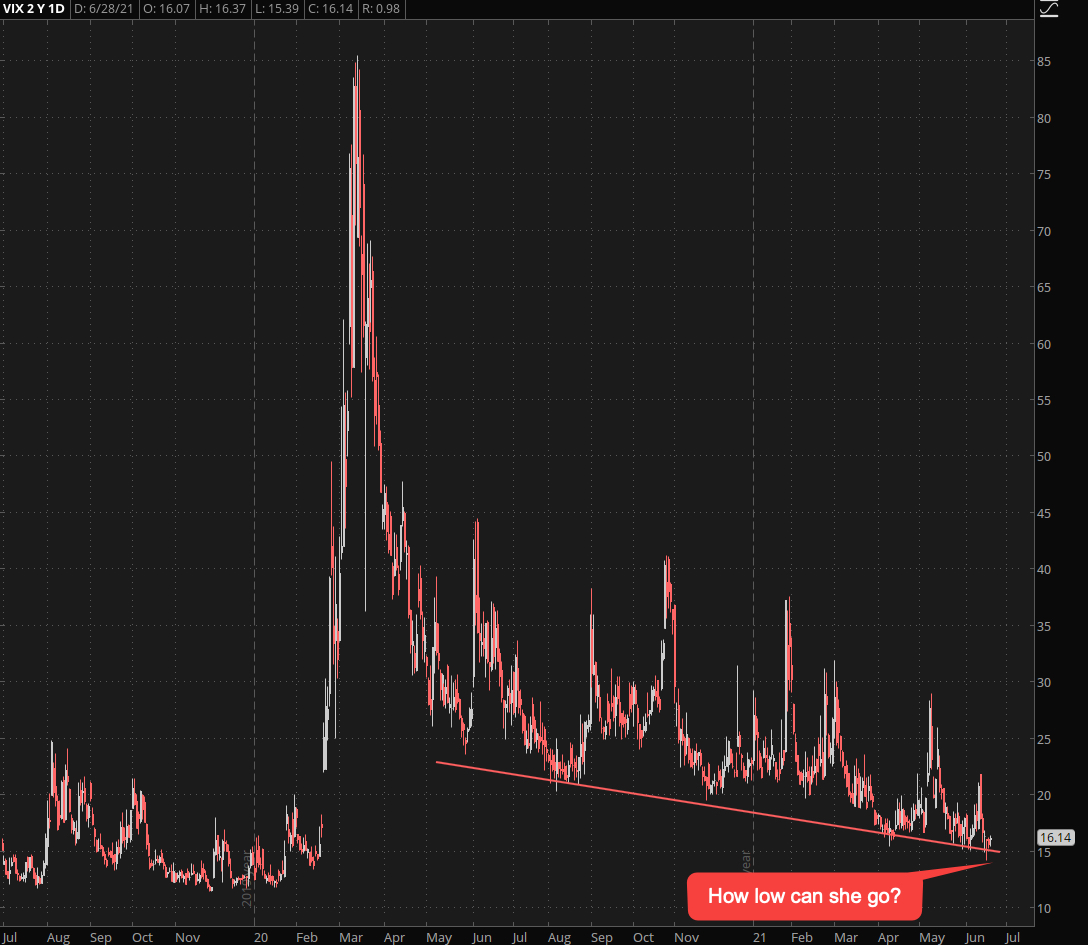

Especially in the face of SKEW scraping all time highs. I’ve been trading for nearly 20 years – 12 of those professionally and let me tell you: I have never ever seen anything even close to this reading.

So here’s take away #1 for this week: Whatever yo you refrain from selling any front month IV.

Why? Because the odds of this 48 point EM range being touched are significant.

And the odds of IV dropping much further pretty low at this stage as we once again are kissing our baseline.

Since I’m not one to miss out on free money here are two simple butterflies I just took out and posted over on the RPQ trading floor. If you hurry up you may still grab them at a decent premium:

BUY +10 BUTTERFLY SPY 100 (Weeklys) 2 JUL 21 424/423/422 PUT @.04 LMT

BUY +10 BUTTERFLY SPY 100 (Weeklys) 2 JUL 21 430/431/432 CALL @.05 LMT

Now that covers the easy stuff. The juiciest opportunity – and the one that’s hiding in plain sight – awaits below the fold:

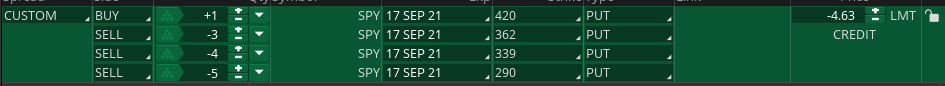

[MM_Member_Decision membershipId='(2|3)’]It’s been a long time since I took out one of these spreads but here it is in all its glory: a SPY put Christmas tree.

The idea here is to take advantage of the record SKEW in how put options are priced by selling far OTM puts against one closer to the money we’re buying at 420. Here’s what you can copy/paste into ThinkOrSwim:

BUY +1 1/-3/-4/-5 CUSTOM SPY 100 17 SEP 21/17 SEP 21/17 SEP 21/17 SEP 21 420/362/339/290 PUT/PUT/PUT/PUT @-4.63 LMT

Warning: This will eat up a lot of your available buying power, so feel free to go smaller by reducing the number of puts you are selling or shifting the short strikes further OTM.

What matters is that you still walk away with a decent credit, which you of course expect to keep.

Just FYI – break/even at expiration for this spread would be around the 335 mark – it depends what credit you receive of course and if you are shifting the strikes further in or out.

The basic idea of course is that this spread will expire worthless on Sept 17th. My campaign management has me out at around the 50% mark, which may be a lot earlier if things start to move fast.

Words To The Wise

Selling premium is a bit scary but keep in mind that large outlier moves are ALREADY being priced in. Which is what makes selling them so juicy.

This is a concept that most retail rats have a hard time wrapping their brains around.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]