I’m a bit of a history buff and beside general curiosity it’s for a very pragmatic reason. Looking back in time teaches you a lot more about human nature and the way the world works than the most erudite of academics or philosophers. The quote ‘never let a good crisis go to waste’ has recently been attributed to Rom Emmanuel but Winston Churchill is claimed of having used it and most likely he himself picked it up somewhere during his long and eventful life.

No matter who coined the phrase it’s exactly that what pops into my head when I look at a longer term chart of the SPX. Would you have ever dreamed of seeing the entire equities market double within the span of one single year? I pride myself of having a pretty vivid imagination but I’d have to be honest and say no.

Big tech has been instrumental in leading the charge higher of course further fueled by a growing silicon/chip shortage. And it’s not just electronics. I enjoy building and flying FPV quadcopters and just this morning one of the mini motor vendors I favor advised me that they were unfortunately forced to raise their prices.

This made me go mmhhh a bit because knowing a little bit about how retail pricing works this suggests that vendors are now reaching the point where cutting corners or reducing profit margins simply won’t cut it anymore. Nevertheless, some vendors are currently unable to satisfy demand.

I previously mentioned that I’m still waiting for those juicy DJI HD goggles to become available again. No luck thus far and every time some vendor gets some in they all get snagged up in a matter of hours.

Expect a similar situation when it comes to food prices. Usually vendors absorb a bit of a hit and first reduce cost (e.g. smaller portions, fewer units, or cheaper components/materials), then they attempt to reduce overhead. Finally vendors run out of rope and recurring clients are notified about impending price rises.

Over the long term this going to put more demand on the USD which is currently back in a short term retracement cycle. It’s now approaching the 91.3 mark which I believe is crucial as a support level or we may find ourselves back near the 90 mark.

At some point however rising prices will provide a floor in the Dollar and that’s when I expect things to get very interesting. In fact I already see several inflection points in play that will change the dynamics all across equities.

[MM_Member_Decision membershipId='(2|3)’]The biggest of which of course is the bond market. The ZB is slowly clawing its way higher and a breach of 157 puts us in the race to reach 159 and beyond. I most definitely want to be long bonds at that point.

Especially given the relatively low IV we are all enjoying right now. Not in the TLT specifically but there is no argument that an August call ratio backspread for a buck twenty is a pretty good deal.

Plan here is to simply buy a few and forget about them. Let the market do the rest.

Speaking of implied volatility: It’s still falling and I wouldn’t be surprised to see us at 15 sometime soon. I do concede that calling a floor on this one prematurely would be a mistake. But per my experience it has fallen sufficiently to warrant looking into long IV exposure in one way shape or form.

Finance is probably one of the sectors I watch with most interest right now (shown here is my monsters of finance composite). Yes it’s ramping hard BUT it’s in fact lagging tech significantly. When things turn south eventually across equities this will be the sector I’ll be looking at for short exposure.

Goldbugs rejoice! Are there any left or is everyone in crypto now? Either way, there finally may be an entry opportunity. I’ll be grabbing some long exposure on a breach of 1753.5 with an ISL < 1720.

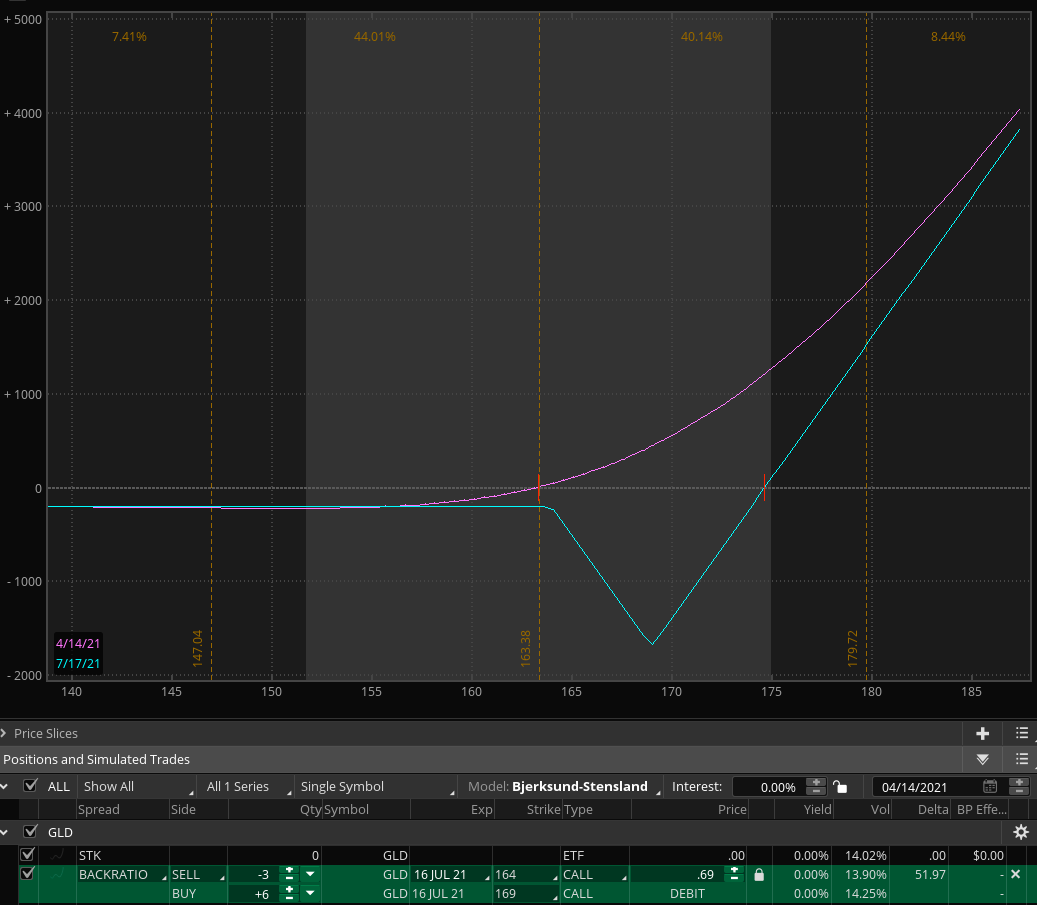

Alternatively a long term call ratio spread in GLD may also be good medicine. I mean 69 cent for a July expiration? Doesn’t get much better than this!

Happy hunting but keep it frosty.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]