I’m aware that I may be eating my words in the not so distant future but alas: I just took a gander at my market momentum charts and none of them are even close to bearish territory, quite on the contrary. In fact what I’m seeing at the current time is simply the natural process of correcting a market that got a wee bit ahead of itself in late August.

I usually reserve these charts for my intrepid subs but since they are not flagging any immediate action I believe it’s fair to post them in the open. Mind you, these are some of the most accurate LT gauges I have put together over the years and they have treated me (and my paying supporters) very well.

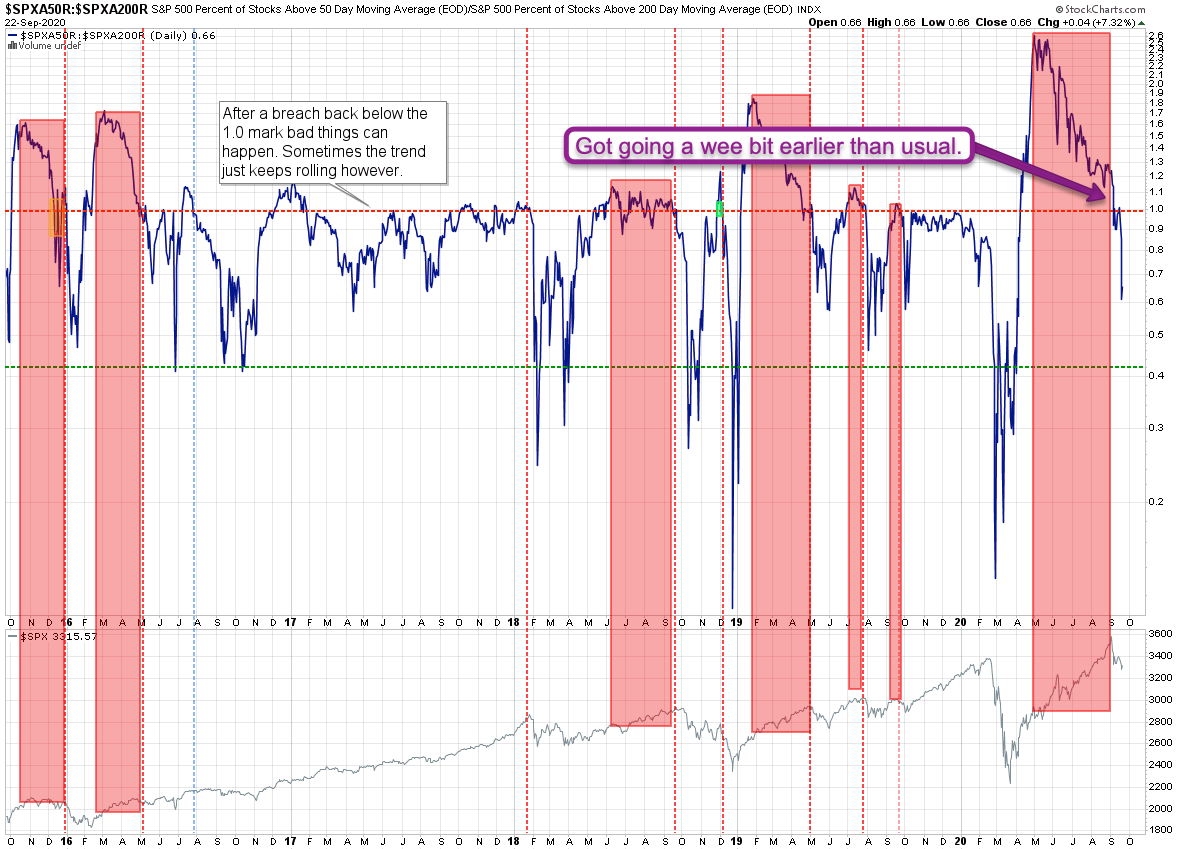

First runner up is market breadth which flagged an impending medium term correction in late August. In comparison with previous signals things got going a wee bit earlier than usual.

The first big take away here is that the magnitude of the correction cannot be predicted. It may be deep or or it may be shallow. The second is that breadth is now in neutral territory and it’s pretty rare that we immediately bounce from here. Usually we correct at least to the 0.4 mark.

So what this indicates to me is that we are most likely not out of the woods just yet. Especially with November coming.

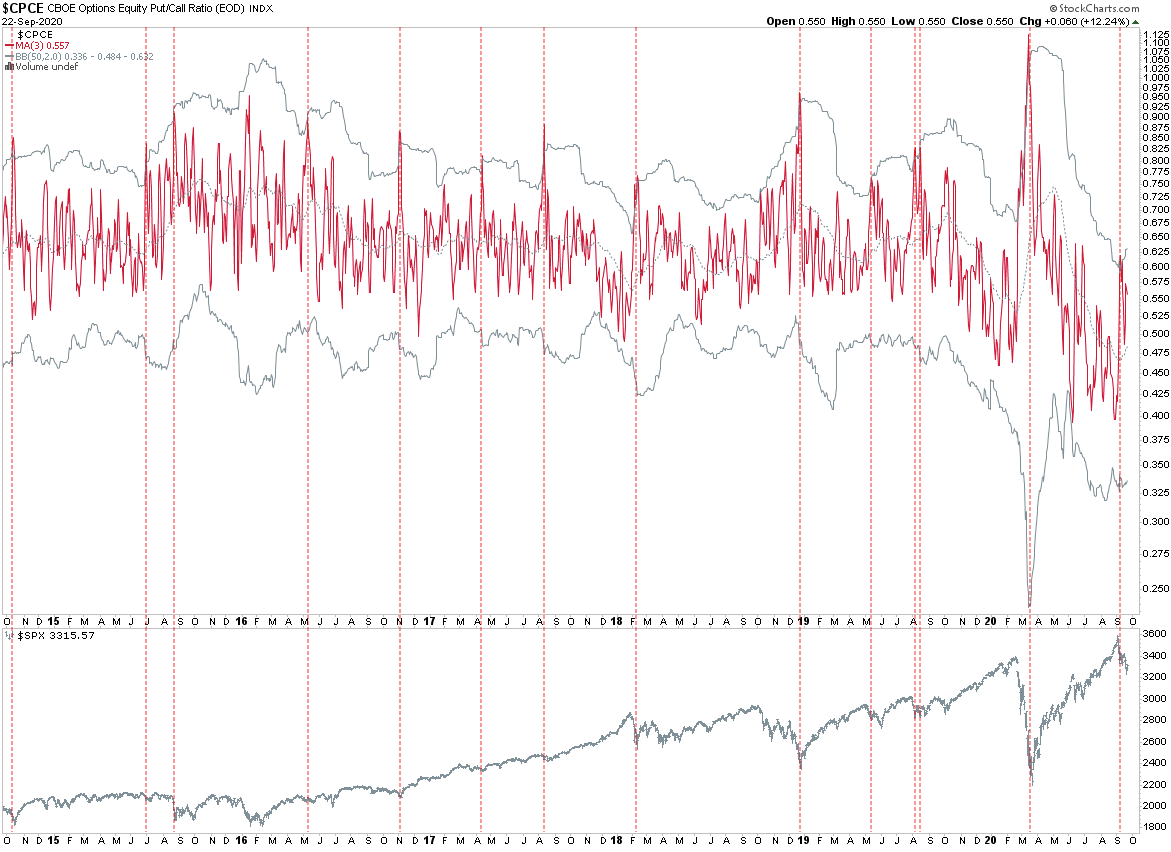

The CPCE chart above usually does a bang job signaling a possible floor post correction. The only problem this time around is that it flagged at the height of the market as if a correction had already taken place. I have not observed P/C behavior like that in the past except during sideways markets.

This may be good news for the bulls in that it suggests that the market sentiment is resembling that we would see after a correction. Which we have been getting of course but after the signal triggered – go figure.

Let’s talk implied volatility. The IV term structure (IVTS) also has done a great job when it comes to flagging market floors. Unfortunately – or perhaps fortunately – the signal has stubbornly remained below the 0.92 mark. Which – per our rather exhaustive statistics is the threshold after which bullish trend and MR systems start to break down.

It’s really strange that the current wipe out has not been able to shift the IVTS at all. If you look back to February of 2020 then you see that a rather tiny correction (ahead of the big one) popped the IVTS all the way into 1.0 – which is deep in bearish territory.

Alright, I hope you are sufficiently warmed up as we’re now going to make sense of it all:

[MM_Member_Decision membershipId='(2|3)’]

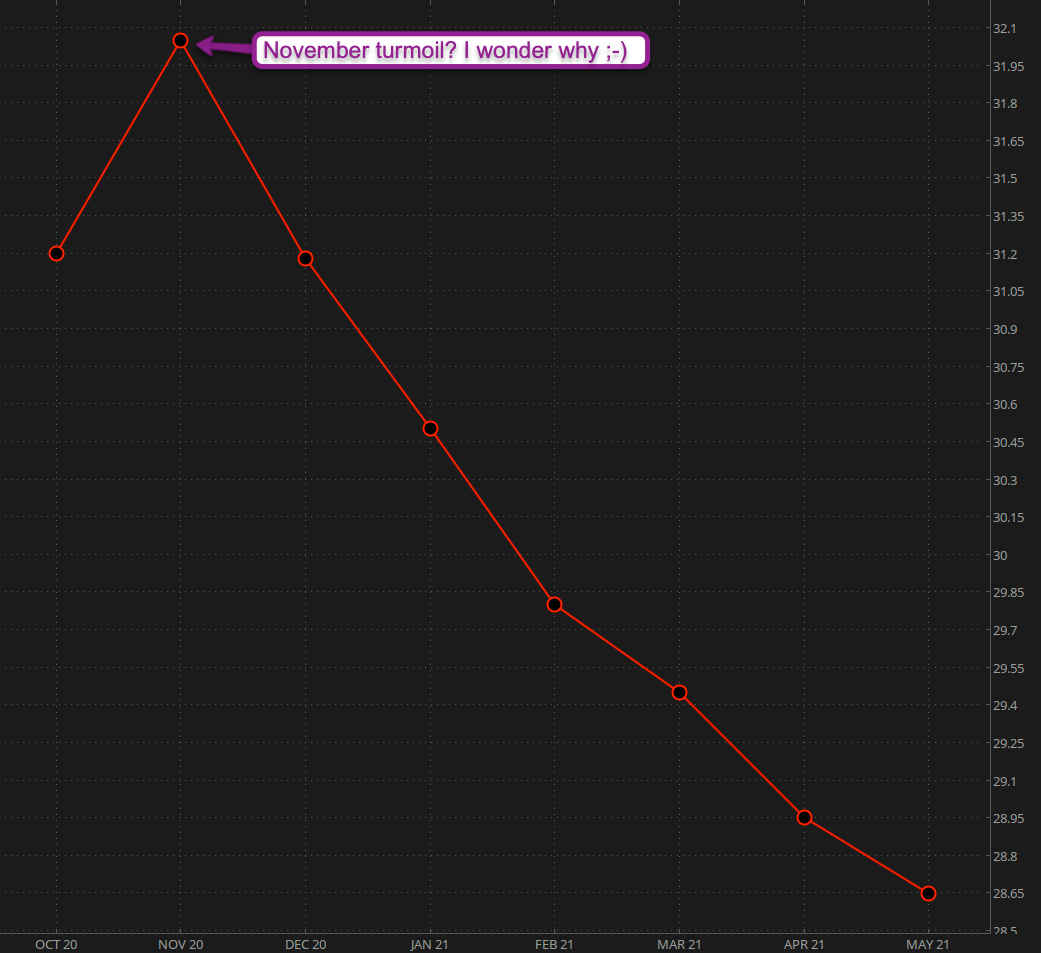

The VX product depth plots the monthly VX futures contracts all the way into mid 2021. It rolls over on a monthly basis which provides us with a pretty fine-grained perspective on investor sentiment.

What do we see? Yes, spot prices are once again in backwardation. But there’s a new pop for the November contract. Why November? Presidential elections? Most likely – as the big date is in 11/3 and most likely most hedges will still be holding November as the roll over is two weeks later.

Note that there’s a pretty steep drop in IV thereafter and I expect this curve to drop even more after the inauguration Of course in the interim anything is possible and you better hold on to your hats.

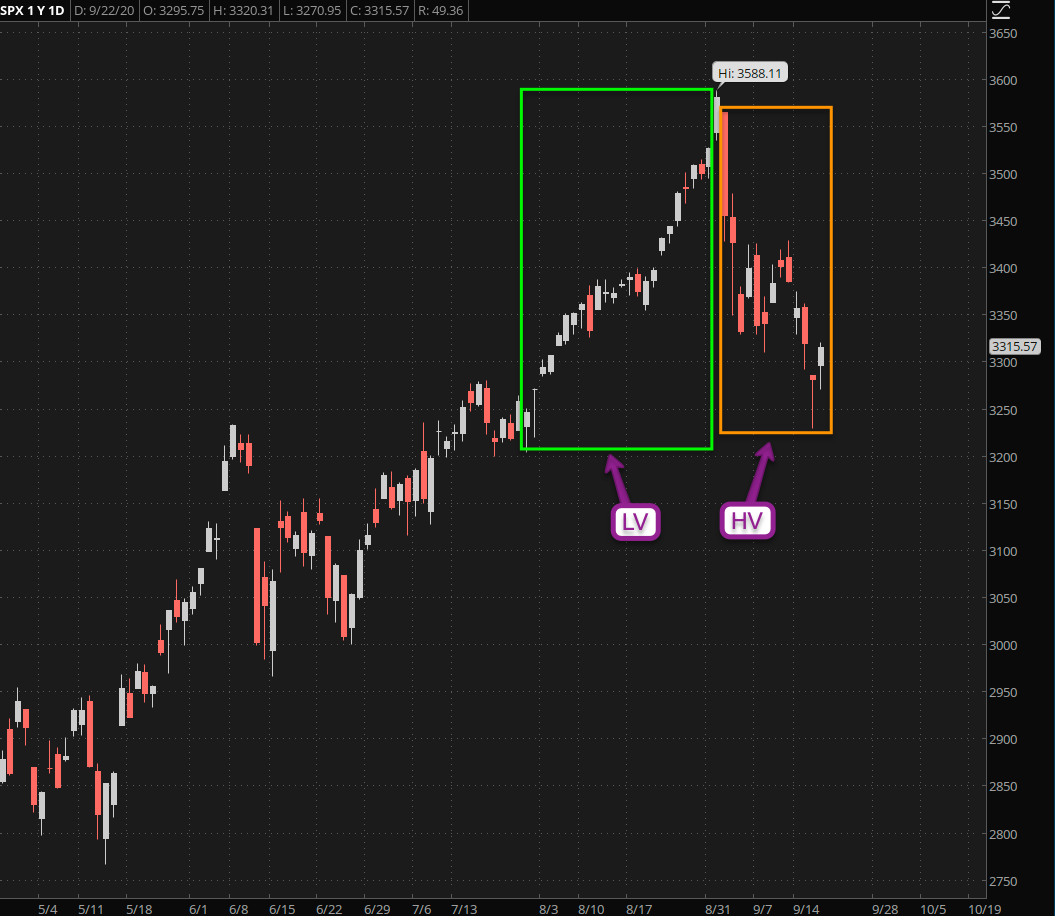

Quite honestly I didn’t know where to exactly stick this chart as it’s not super relevant to the above but I once again wanted to point out how tremendously market conditions have shifted since late August. My all intents and purposes we are now in a HV bearish correction and this must have been one of the quickest transitions I have ever witnessed.

Now I told you guys to watch at big tech for signs of a bounce and I was not wrong. What I’m seeing on my ‘monsters of tech’ composite symbol is a nice v-shape rebound but it is still early days and a lot can happen. Let’s dig deeper:

AAPL dropped through my 108 threshold and then quickly bounced back. Had it closed below another session we would probably see it in single digits now. The current squeeze looks legit but needs to get over 120 to put the bulls back into the driver’s seat.

AMZN appears to be leading the charge and this may be the bullish canary in the coal mine. Should it be able to push past 3200 I believe it’ll give the rest of the gang a much needed boost.

If you recall I recently had to update my ratios for my MOT composite symbol and realized that all the other (AAPL, MSFT, FB, GOOGL) had been lagging AMZN by quite a bit. So where AMZN goes that’s where the rest of the tech sector goes, and where the tech sector goes that’s where the rest of the market goes.

MSFT is looking strong and I like the hammer candle it painted yesterday which suggests attempts to drag it lower which failed. Here the bullish inflection point is 212ish – the previous spike high.

Which brings us to the stragglers. FB has bounced but just because everyone else is doing it and it doesn’t like to make waves, just like Zuckerberg.

GOOGL lagging really surprised me. But this was the one I had to ratio adjust the most the other day and as such it’s not overly surprising.

Google may still own online search but from a trading perspective it is lagging the rest of big dogs. Of course it’s still a 1500 stock, so what the hell am I talking about? 😉

Well my point is that it’s looking vulnerable right now along with FB. So, should AMZN slow down and perhaps roll over in the days/weeks to come then I would look toward FB and GOOGL for possible short candidates.

Happy hunting!

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]