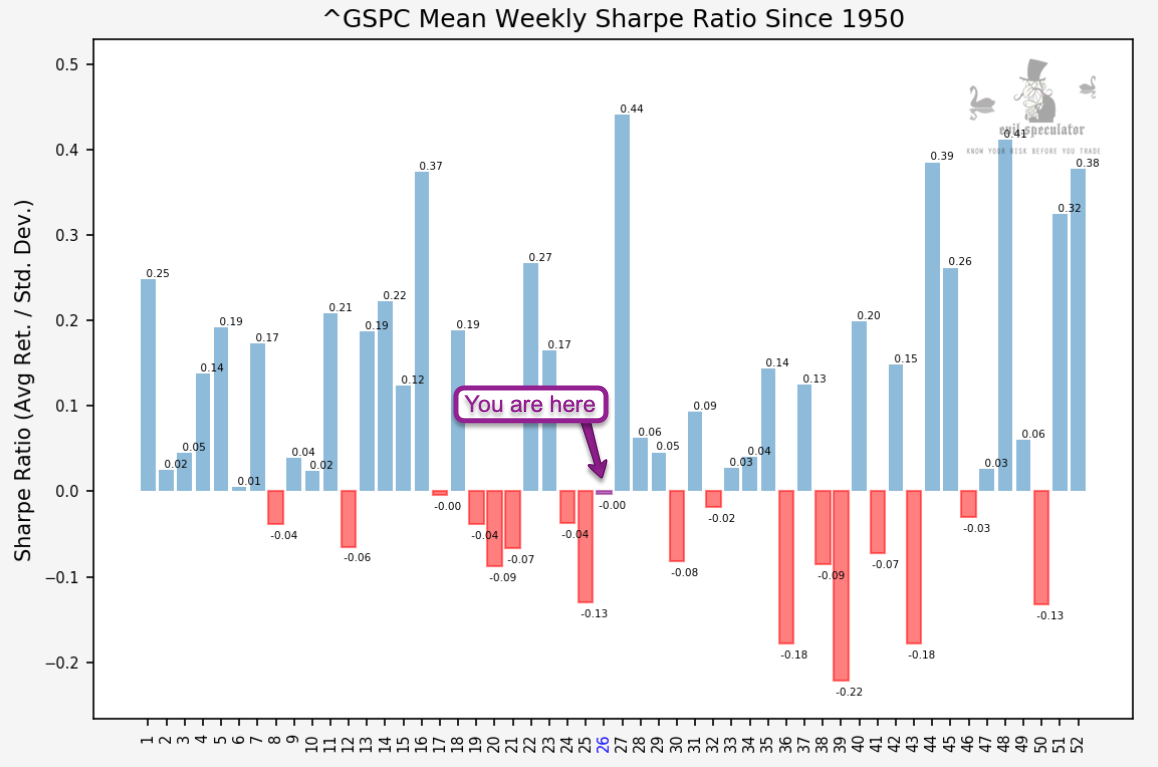

We’ve almost made it through the seasonal summer solstice sell off, which it shall be known as henceforth since it has a nice ring to it. Week #26 puts us right into the middle of the year and true to form it’s a complete coin flip statistically speaking with a net zero Sharpe ratio and a 50% win/loss rate.

The numbers are slightly rounded but effectively week #26 is one of only three weeks of the year that promise not directional bias whatsoever. Again, this doesn’t mean it’s chiseled in stone but know what you’re up against.

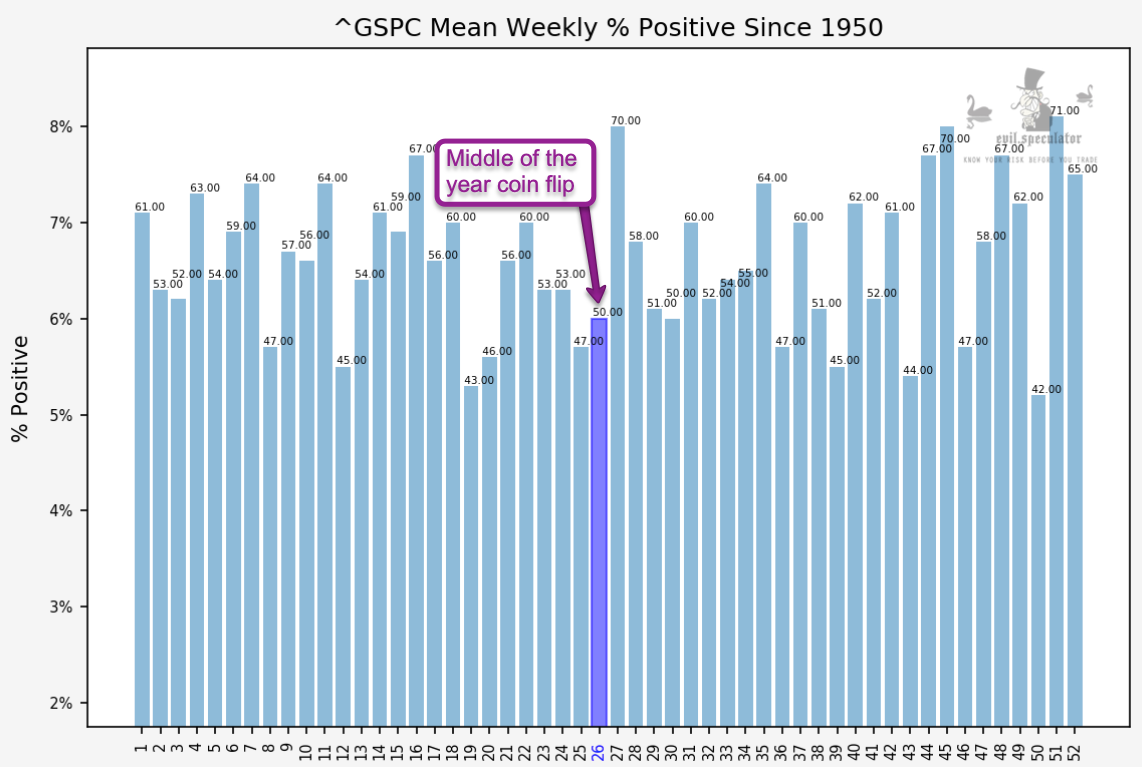

Here’s the weekly percent positive putting us at exactly 50% – one of only two weeks by the way along with week #30. Talking about equilibrium!

Of course this year nothing has gone exactly to plan as waves of volatility continues to reverberate through the market. I don’t expect that to change anytime soon and neither does anyone else judging by the 100 handle expected move (EM) range for the SPX.

If you peek under the hood however it remains clear that the monsters of tech are running the show. If you are looking for weakness or a reversal then this is what you should be monitoring for early hints.

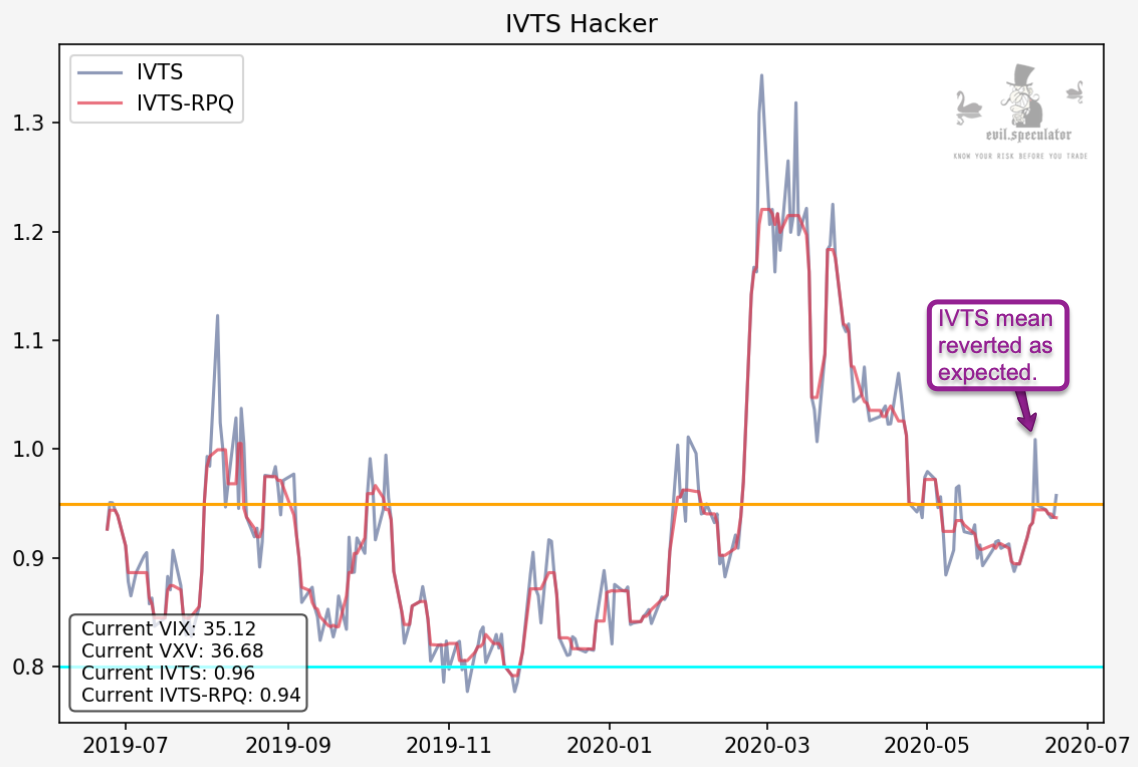

Now if you’re a subscriber here at RPQ then you may have picked up on the large divergence it painted early last week when IV (blue) spiked massively in relation to the control signal (red).

I have been observing these divergences for several months now and find them fairly reliable mean reversion candidates, which is pure gold especially if you are an options trader but also if you trade VX futures, ES futures, or straight up ETFs.

How to use it? Very simple – let me demonstrate:

[MM_Member_Decision membershipId='(2|3)’]

Here’s the VIX on the same day that IVTS divergence occurred. One can sell IV directly by selling VX futures, selling VXX, buying UVXY – or indirectly by buying ES futures, buying Spiders, or buying a call spread in either. The choice is yours.

There also is a way to sell IV along with time decay by trading calendar spreads which is something I am teaching in my recent Options 201 course (in the Academy section). If you have not watched it yet then I suggest you remedy that soon as it’ll give you a huge leg up as an options trader.

Here’s the VVIX on that very day. Huge spikes like that are not always reverted (see March of this year) but in the vast majority they are. It’s not a trading signal per se but I do like to see it jump along with everything else as confirmation.

Okay we have some new entries and possible candidates throughout several vertical, thus in no particular order.

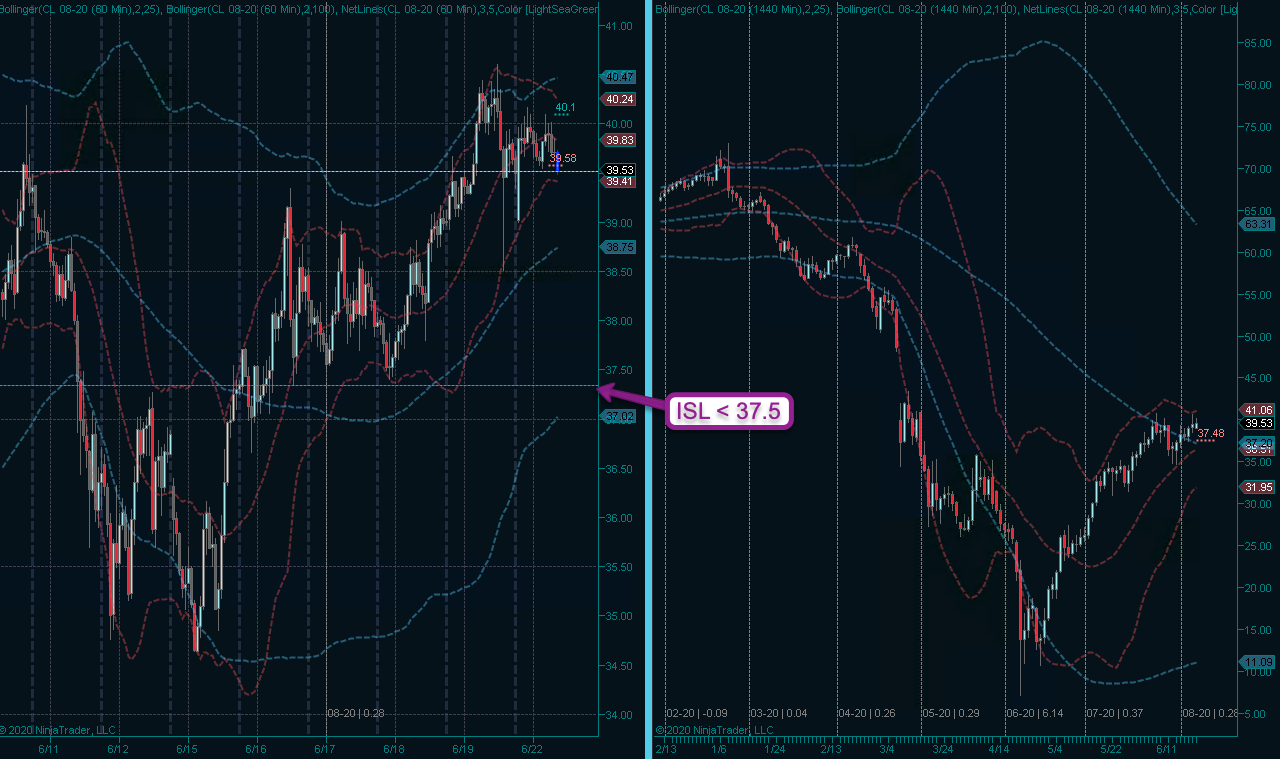

Crude recently rolled over and continues to look bullish. I really like the daily panel here and although I could wait for a push > 40.5 I’m going to grab a small exploratory position now.

So I listened to myself talking about gold the other day and thought ‘what an idiot suffering from hindsight bias’. One should never scratch off a market just because it’s been stuck in a sideways range.

After meditating on this I decided that the proper cure will be a long position given that gold drops closer to GC 1740. This would be a long term campaign that may run for several months – just FYI.

XLF has been a huge disappointment throughout this market rally and we should all take note. Yes sector rotation is a thing but usually only on the way up – if panic sets in everything must go.

I’m not pining for short positions here right now but if it pops a bit higher I may start to accumulate a few long term deep ITM puts (with delta > 0.9).

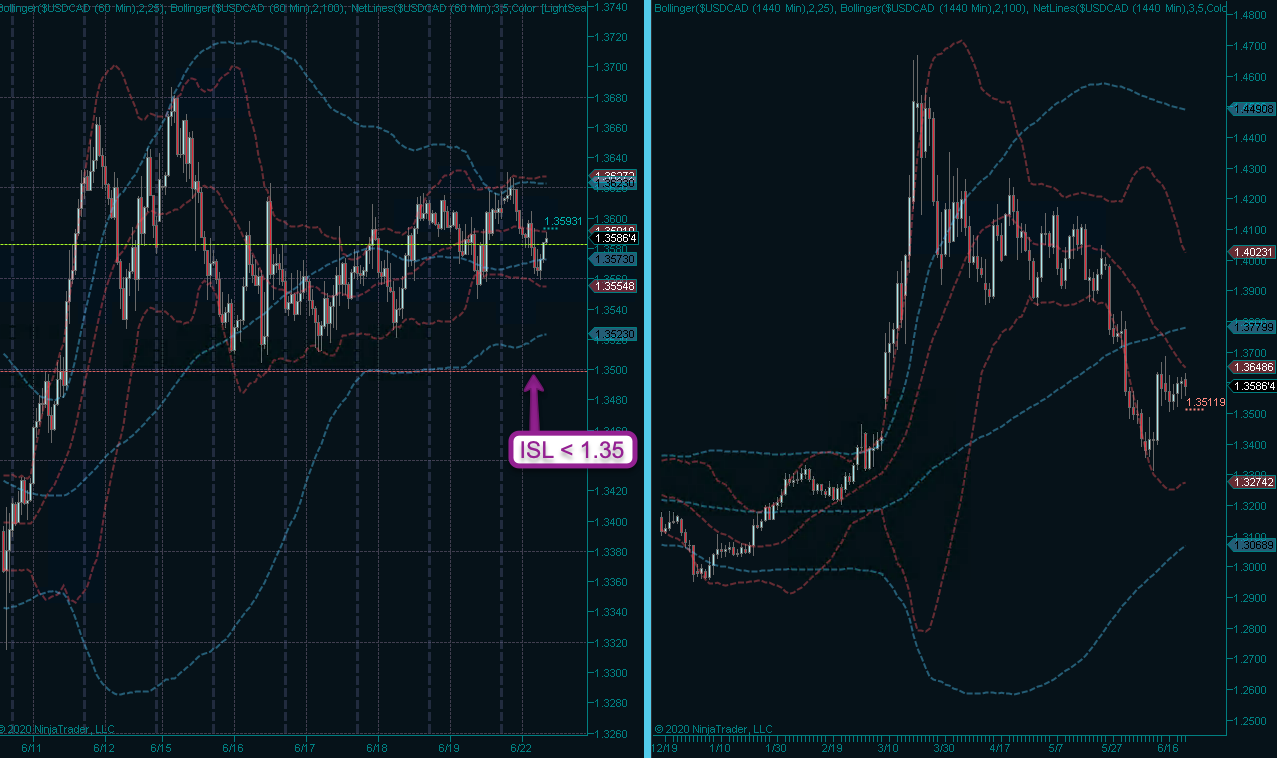

USD/CAD is looking interesting and may get ready to bust outside a month long sideways range. Although I’m already long the Dollar I’m taking out a small position with a stop < 1.35.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]

Before I run some quick campaign updates: DX has not moved much but it’s slowly gyrating in the right direction. Let’s hope it’ll keep it up. ISL remains where it is.

Bonds are heading higher and I’m now trailing at about 1/3R just below 176’04. Humble beginnings but it’s starting to look very positive and my timing may just have been right. Time will tell…