I’m pretty ecstatic this morning! And although the prospect of a looming EOY holiday week may play some part, the main reason for my emotional exuberance is that I’m putting the finishing touches on a project that combined has taken me nearly 2 years to bring to fruition. It’s been a monster effort that launched in early 2018 has cost me literally 5000+ man-hours of hard work to get to this point.

Whether or not it will pay off in the end remains to be seen – only the future will tell. But if nothing else a major positive aspect moving forward is that I will once again have a lot more time to purely devote to trading, technical analysis, and market research. Which means more posts, more charts, more campaigns, more politically incorrect humor, and happy subscribers! 😉

Alright let’s dive right in – here we are at the cusp of the last trading ‘week’ of the year. It’s not really a full week though as the NYSE only opens for half a session tomorrow and is closed on Wednesday.

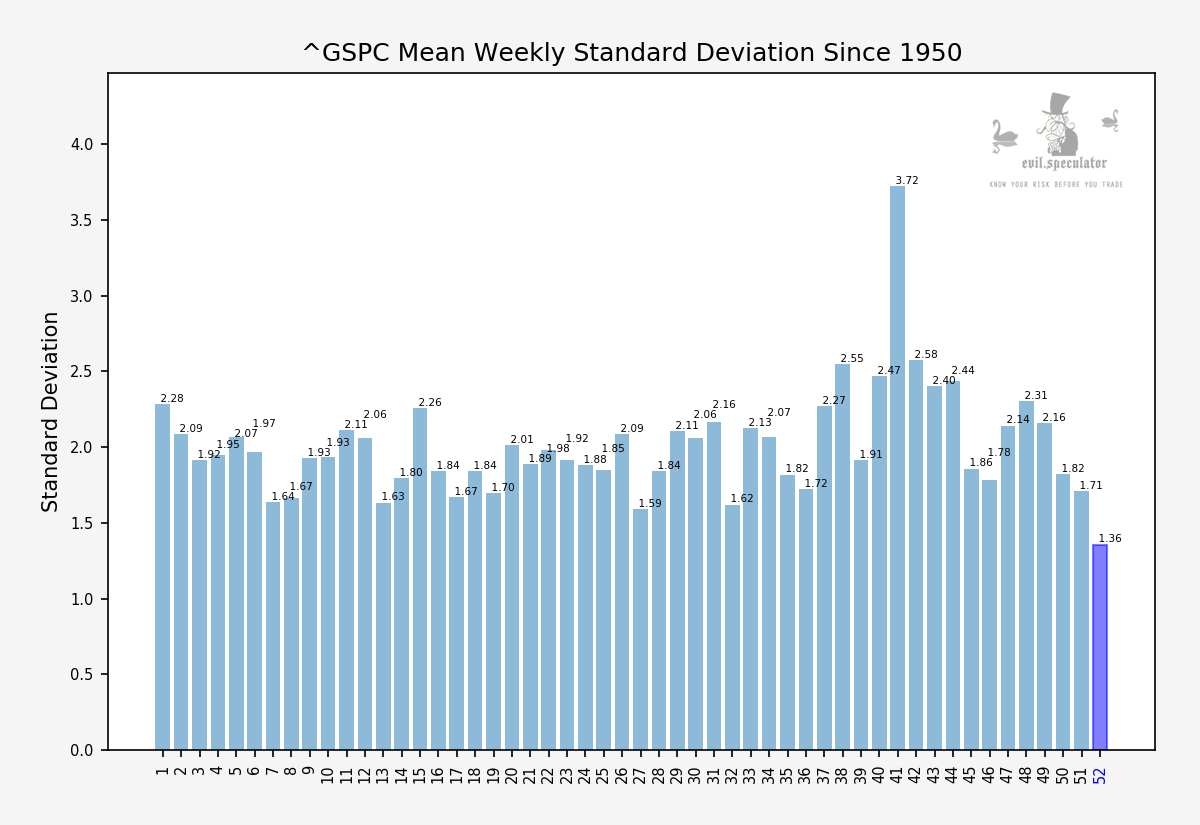

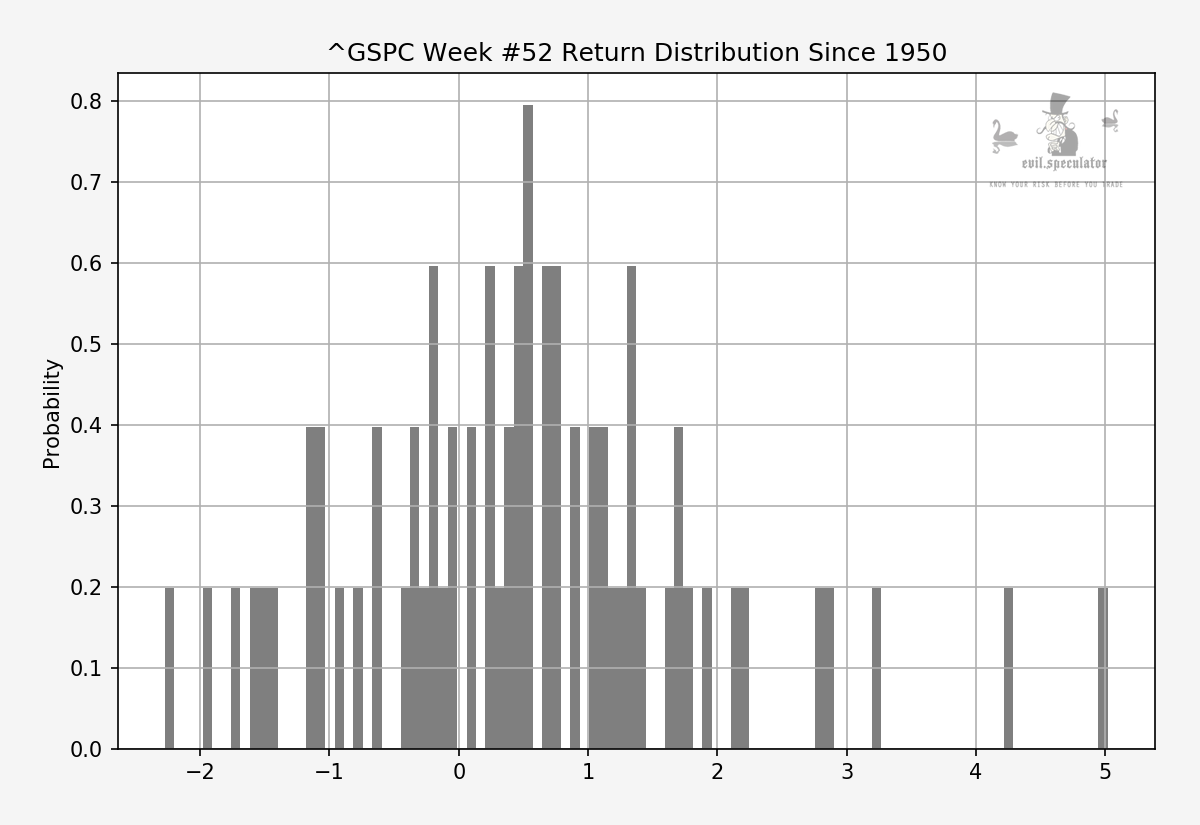

Thursday and Friday are officially open but as you can see on the standard deviation chart above we usually don’t see a lot of movement during the holidays.

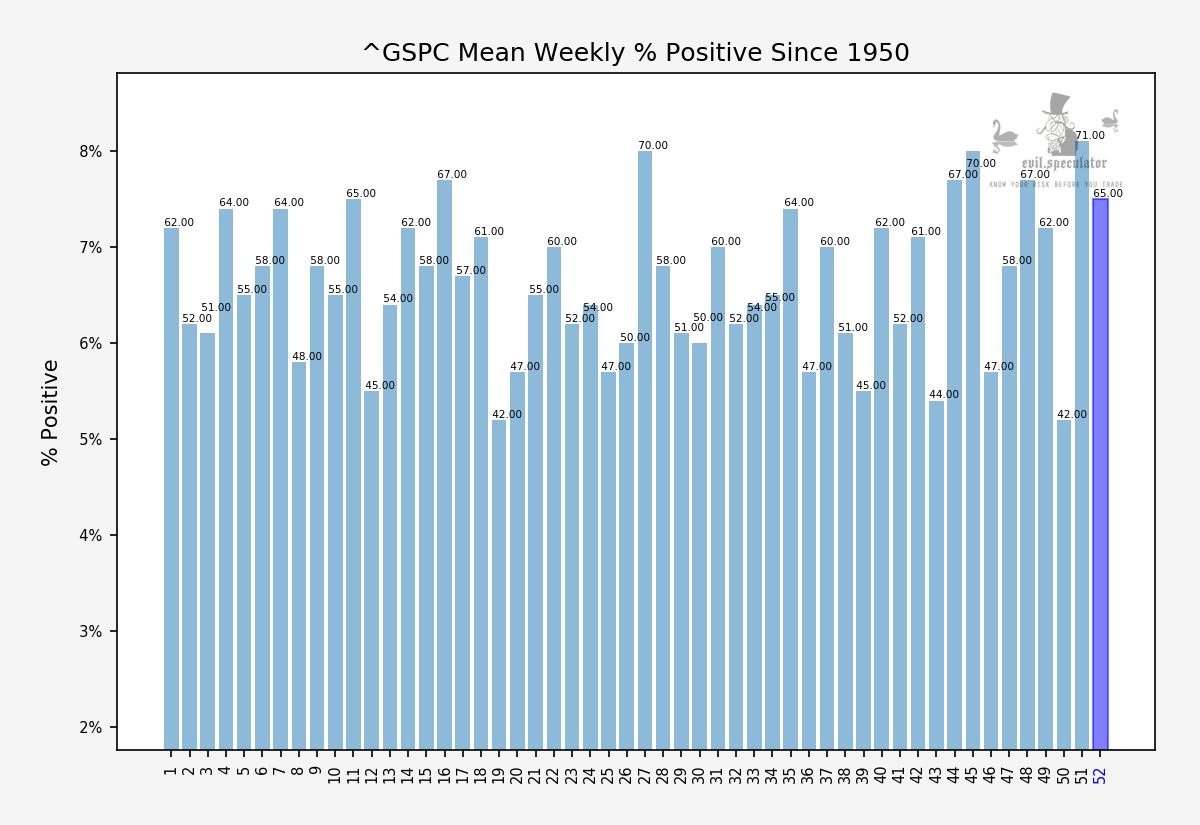

The upshot is that the odds are well in favor of a bullish close in the little session time we do get this week – since 1950 the SPX has closed in the plus 65% of the time in week #52.

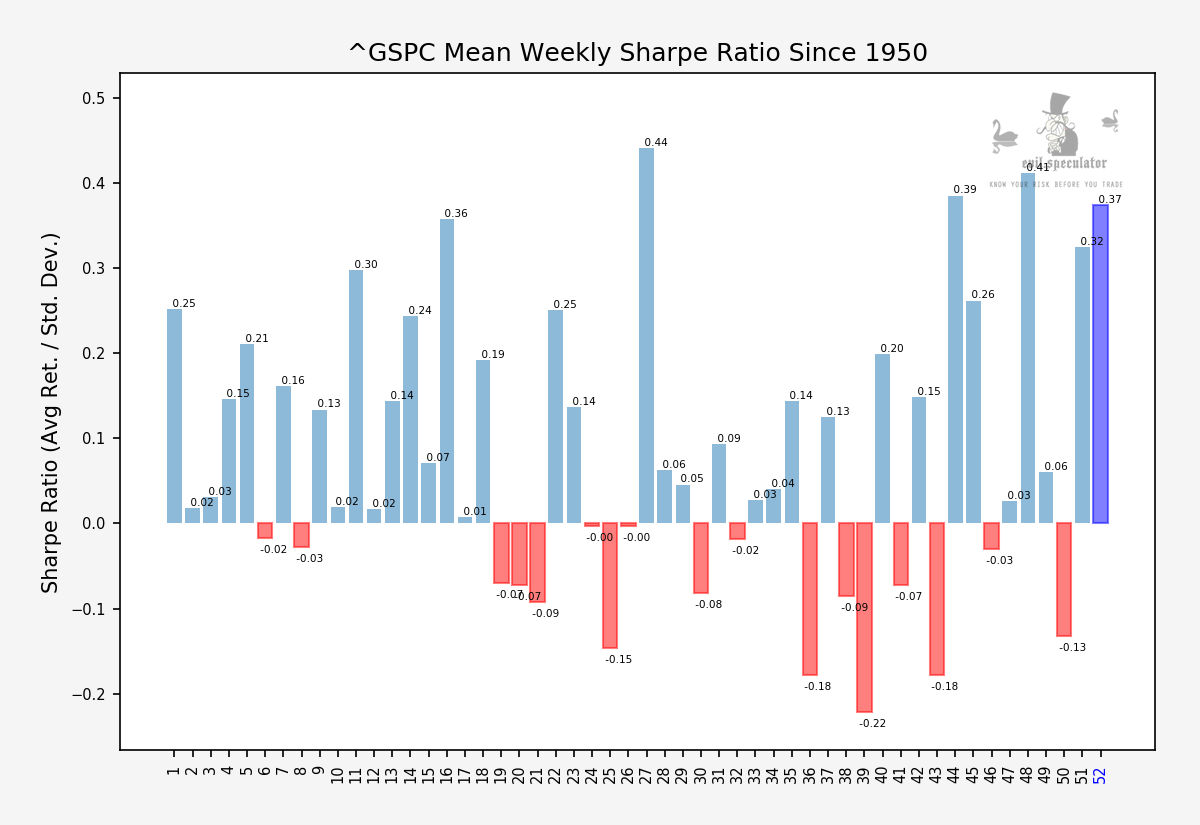

Which is why a Sharpe ratio of 0.37 isn’t overly surprising – what is that it’s the fourth most bullish week of the year, despite it being a very short one. But who really would be complaining about that?

Wouldn’t it be nice to show up for work 3 days per week and pull a little profit each time? One can dream…

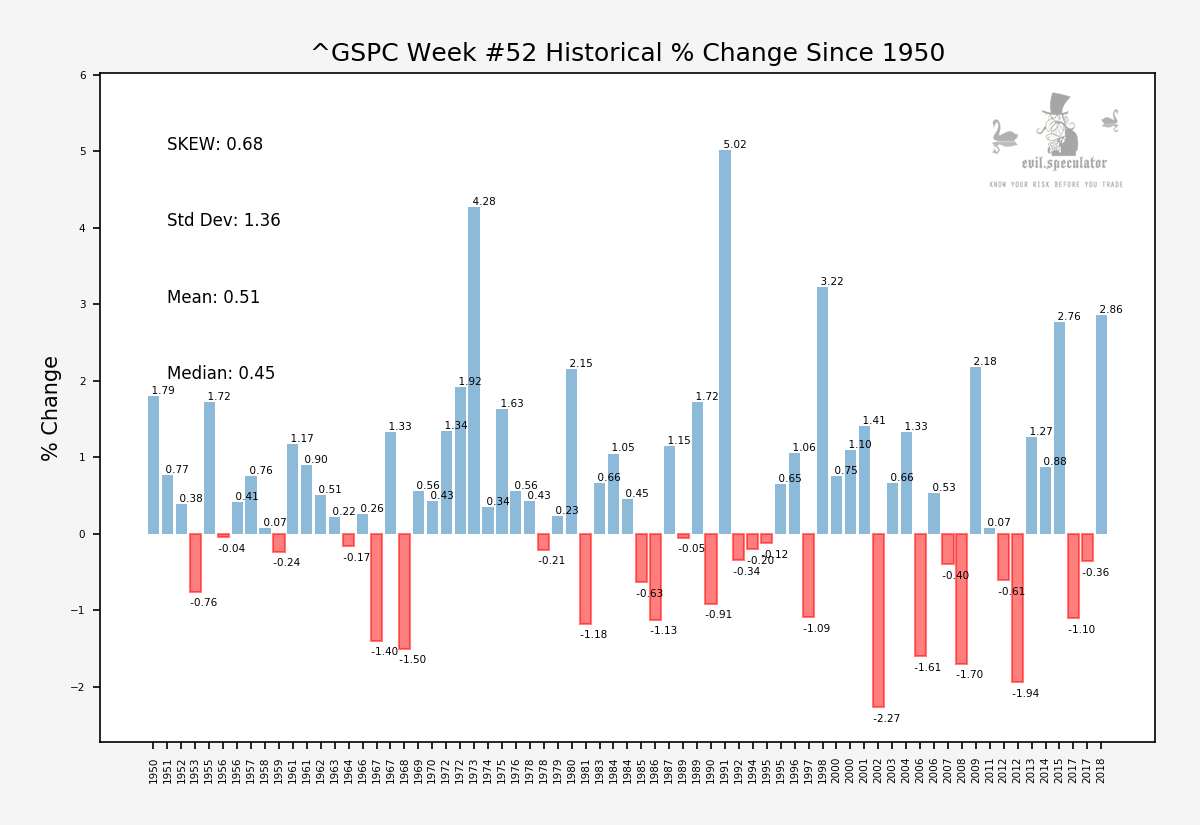

Here’s a bit more context for you statistics nerds. It’s worth noting that the incidences of negative weeks seem to be increasing since the 1980s. There was a period of consecutive positive closes until the dotcom bubble burst in 2000 and since then it’s been about a 2:1 alternation.

If you paid attention to the previous chart then you may have noticed that the mean was actually larger than the median, which gives week #52 a positive SKEW. This does not necessarily speak to the center of the distribution but its shape in that it is long tailed on the plus side.

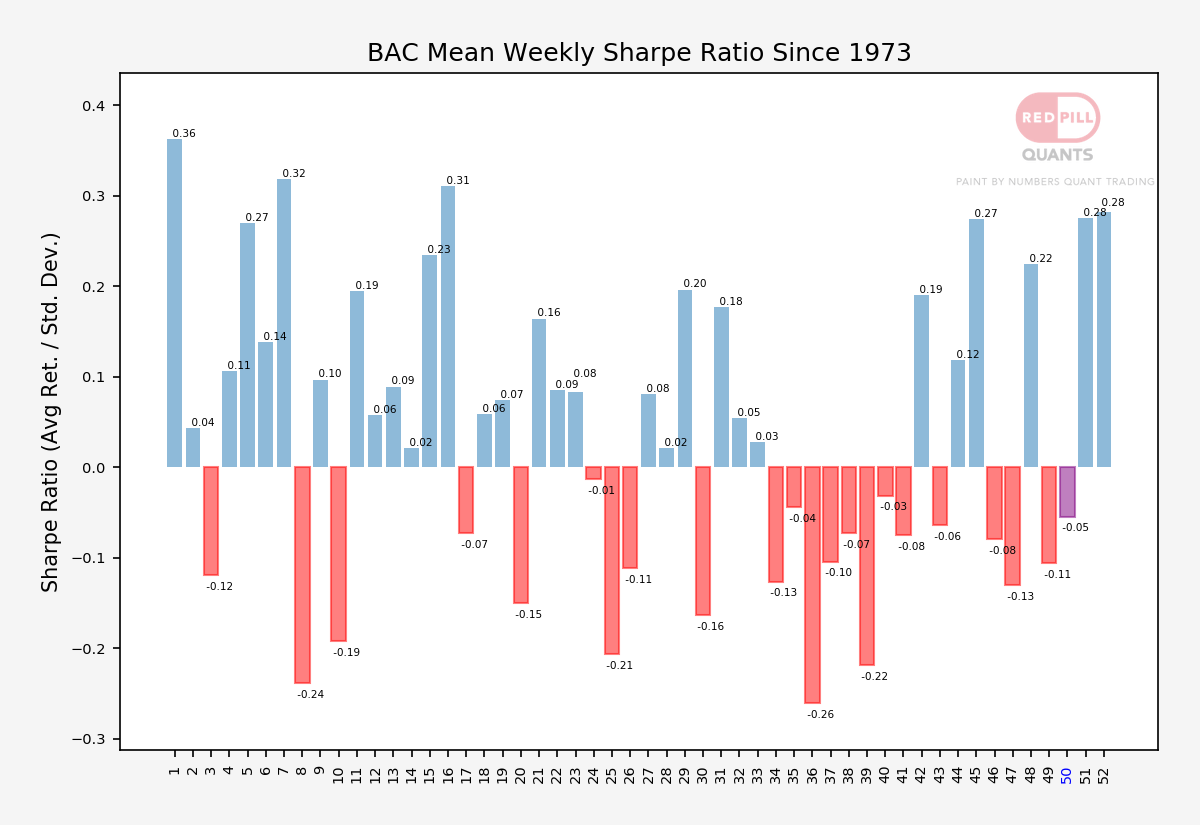

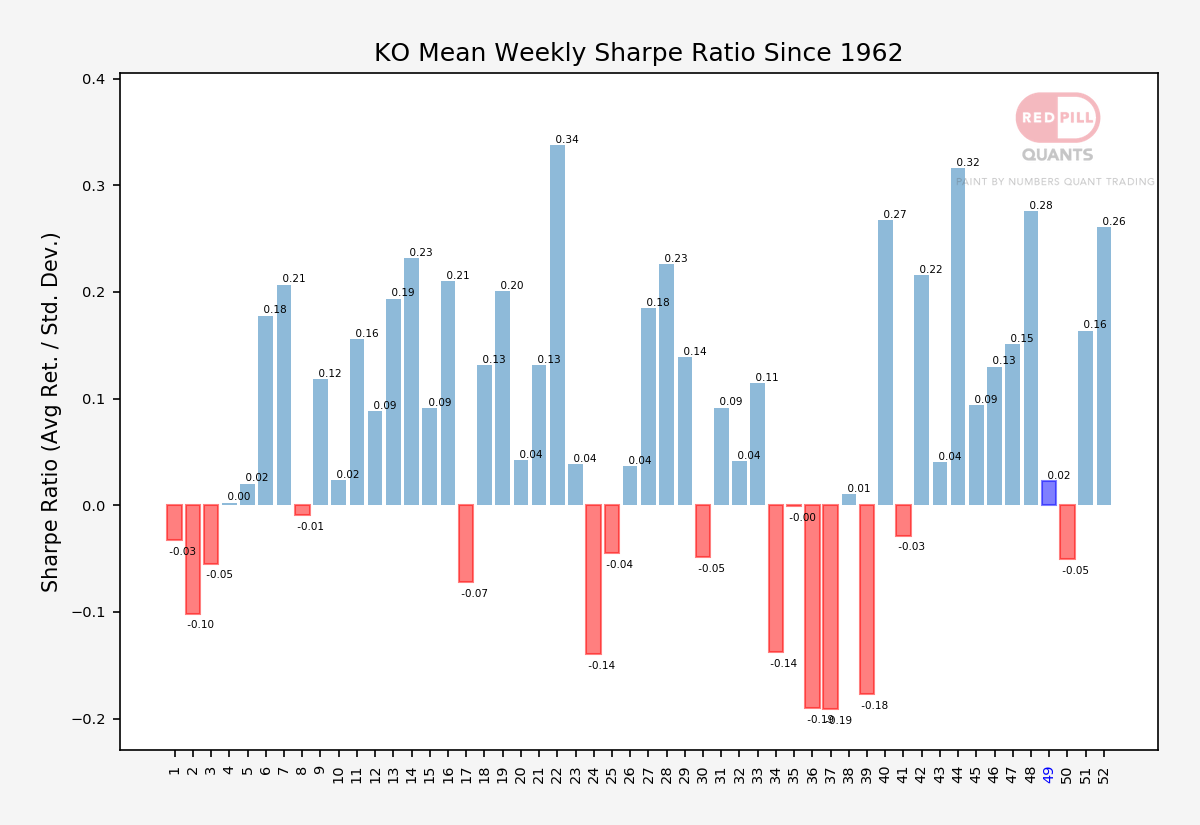

Now for my intrepid subs I’ve got a bit of special IV intel I’ve been digging up. Plus of course we have our top and bottom performing stock victims for week #51:

[MM_Member_Decision membershipId='(2|3)’]What you are looking at above is a chart of the SPX showing each week’s expected range based on implied volatility at the Friday close the preceding week.

Bear in mind that the calculated one differs a bit from the EM you will see in the option chain that expires this Friday. When in doubt I go with that one but it’s harder to pull that through an indicator plus usually both line up. This week is a bit special of course as we have less trading sessions to play with.

Anyway, my general point here is that the SPX has been nailing the expected range for weeks on end now, which is testament to the gamma squeeze that has unfolded since early October.

What’s Gamma Again?

As a quick reminder, an option’s gamma is a measure of the rate of change of its delta, many call it the ugly stepchild of option greeks.

When the market bubbles up like this gamma risk becomes a really serious issue for short term option sellers, in that even a moderate move lower could potentially wipe them out as gamma would explode higher.

Think about it – would you really want to sell something that’s very cheap at the moment but take on the possibility of you having to buy it back for several multiples of what you got paid?

Here’s the crux of the matter – the SPX on top of a VIX/VXG20 ratio. The latter symbol in the ratio is the February VX contract, which currently trades around 16.5. Yes, you heard that right, it’s trading about 4 hands higher than the VIX.

Admittedly this has been going on for a while and on average the VX usually trades at a premium. However when the ratio starts to move up despite price pushing higher we know that a gamma squeeze may be at hand and that we ought to proceed cautiously.

Basically short term option sellers are having a harder time being profitable and once this rally, which partially accounts for this leg of the rally. Once this market runs out of oxygen we could fall hard and that very quickly.

Top 10 performing stocks for week #52

Bottom 7 performing stocks for week #52

[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]