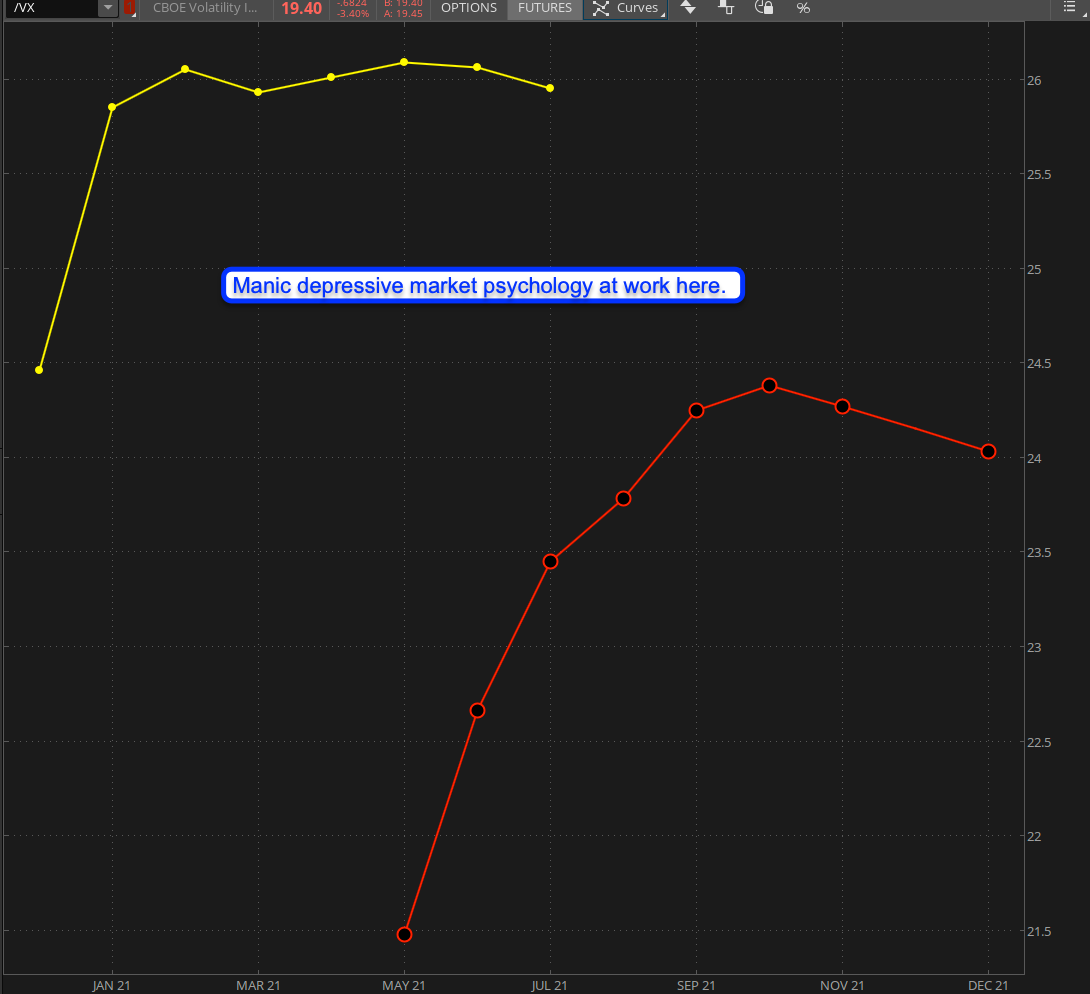

I looked at the VX futures term structure this morning, i.e. the series of VX futures contracts from now into late this year, and something occurred to me. For over six months now I have been plotting various changes in this curve in exhausting detail and the story it’s been telling us has remained largely identical. Big trouble ahead! So how come the market continues to push higher and higher with the SPX officially marking new all time highs as well as reaching the coveted $4,000 mark?

The graph above shows us two curves – a yellow one and a red one. The yellow curve basically represents a window into the past while he red curve shows us what’s going on right now. What immediately stands out is that the market appears to need to book some time with a good shrink as the anticipation of ‘trouble ahead’ appears to have become a constant.

But what we’ve been getting instead is something completely different of course. A very clean series of higher highs and higher lows in fact. The IV Z-Score has dropped into the basement and we may need to bring out some excavation equipment to get it back.

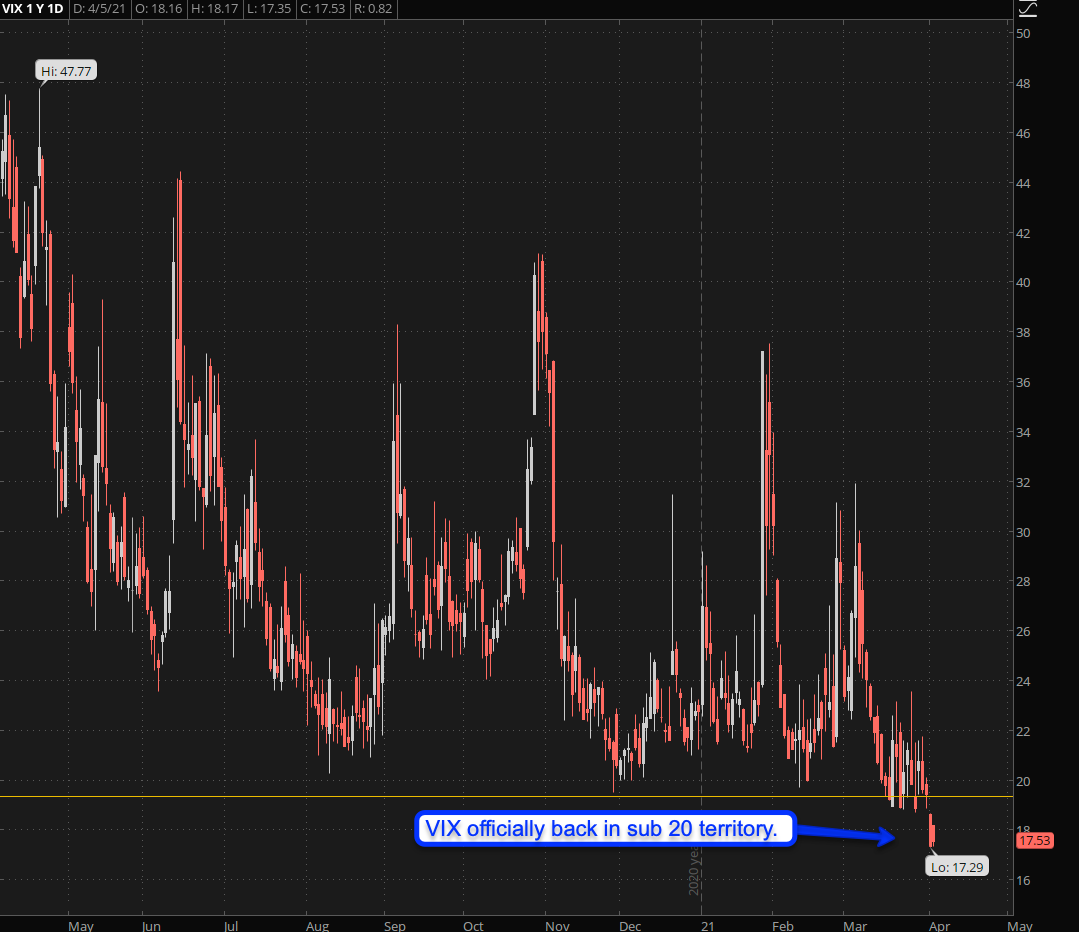

The VIX is now officially back in sub-20 territory which on one hand is very exciting as we may be able to start loading up on some medium to long term hammock spreads.

But not so fast! There are some important developments we need to be cognizant about:

[MM_Member_Decision membershipId='(2|3)’]

The first question I always ask myself when I see a push to new ATHs is ‘what actually is driving all this higher’? The week prior Iw would have pointed at the financials but last week we would have been wrong. It’s clearly not the XLF, which in fact has barely moved over the past three weeks. In fact you could be using the EM range from two weeks ago and you’d be well within the margin of error.

So is it tech? YES, as anticipated we’ve seen quite a bit of sector rotation recently which on the surface makes sense. However I apologize for having to burst that bubble in the next chart:

Bonds have barely moved. To be honest I did anticipate a much stronger response on the ZB but thus far we haven’t gotten one yet. Of course the last player standing in this market is the FED and the current anticipation of a massive put on the bond side is what in my mind is driving quite a bit of irrational exuberance.

Either way, falling/weak bonds are bad for tech as it’s not enjoying rising/high interest rates on one side combined with a historic silicon shortage on the other.

I’m sure you’ve heard about the silicon shortage… why do you think that new Ryzen CPU or GeForce RTX card has been increasing in price? Assuming you can get one that is… I’ve been trying forever to get my hands on one of those juicy DJI HD V2 goggles but they are chronically on backorder until 2055 despite their sky high sticker price of nearly $800 over here in Europe.

What has been pushing up rather aggressively is the Dollar – bless its heart (you know my story). But wait a minute – how does a rising Dollar play into rising equities? Should that not be inversely related? Yes it should and that just one phenomenon among many that has been confusing even the best traders among our ranks.

Cathy Wood over at ARKK is not having a good year for sure – my understanding is that she had heavy exposure in TSLA. Which I have been selling OTM calls in over the past two months – with plenty of entertainment value. I love to see them squirm….

Bottom Line:

So our big nefarious plan is based on the following key take aways:

- The market continues to over estimate forward risk whilst continuing to expect significantly higher risk a few months down the line. Basically we are dealing with an irrational risk friendly market.

- IV meanwhile has dropped back into semi-bullish territory, real bullish turf begins around the 15 mark, but I have an inkling we may just get there.

- SKEW is still sky high on many option contracts out there, just dig around. For example IV is pretty low on the front end side in the SPY while shooting up after about 15 days further out. See the graph below:

We could be taking advantage of that by selling OTM calls puts whilst buying shorter term puts and just let them expire. We could also sell OTM calls on various stocks with chains that offer high SKEW. Or we could buy VXX puts to offset the risk we take in selling OTM SKEW.

What has me the most excited however is that we are in a risk-on environment with FOMO at all high time highs along with equities. VIX is low and that may open the door to some really exciting hammock trades. Because one thing we can be sure of: This is NOT a stand-still sideways type of market phase, so we should expect to see big moves in the near future, either to the up or down side.

And for us that represents a juicy profit making opportunity. Details to follow, so stay tuned. Rome wasn’t built in a day 😉

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]