Over the past decade of Fed fueled monetary extravaganza a ramp and camp formation has become the norm rather than the rare exception. The Monday short squeeze that officially cemented a new S&P milestone above the $4k mark has pushed us to new stratospheric valuations, and it stands in stark contrast to the worldwide economic situation in which we currently find ourselves. Not to mention the one we are heading straight into. Let me assure you that a global silicon shortage affecting chip production across a wide swath of industries is merely the tip of the iceberg. There’s a lot more fun to come.

From a trading perspective one single session (i.e. Monday) has now propelled us to what institutional option traders regard as the line in the sand when it comes to managing their gamma exposure. And it now leaves us in an interesting situation.

A little pop higher and stat-arbs are going to start selling while institutional buyers will have to start buying futures in order to mitigate increasing pressure against the boatload of far OTM calls they enjoy selling to hapless retail shmucks. Yes that’s us – know your place in the pecking order and you may just survive long enough to tell the tale.

The NDX is in a similar spot which strongly suggest that tech is once again leading the chart. Also note how the IV-Z-score has literally cratered over the past week. From an option trading perspective this is very exciting! And yes I’ll tell you why – patience grasshopper.

The Russell is the odd man out as it has barely moved. So there is a bit of trouble in paradise and divergences like these near all time highs always have my undivided attention.

Part of that is related to finance of course which has been lagging behind over the past week. Yup, you’re not going anywhere, pal!

Not until the following chart is starting to make a move. And quite frankly it’s the only one that truly matters right now:

[MM_Member_Decision membershipId='(2|3)’]

If you’re a sub then you guessed it of course. It’s the bond market – shown here as the ZB futures.

As I mentioned to you on Monday. We have falling IV all across the board, but mainly in the S&P 500. The VIX is at pre-COVID levels again while the VX futures are predicting a significant uptick in implied volatility over the coming months.

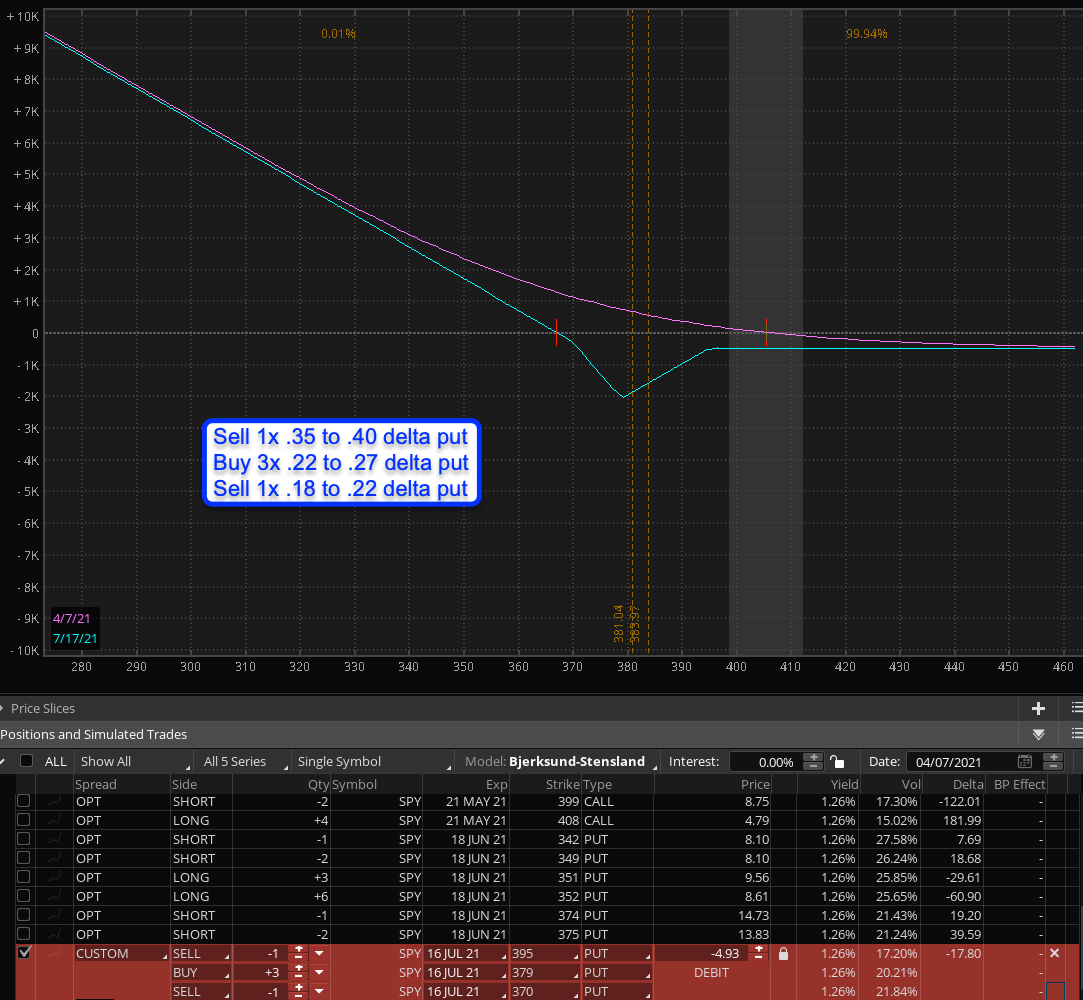

If you’ve followed my options courses then you probably know what that means. In a nutshell: IV is at a discount right now and that means that options are cheap. I am already sitting on a few hammock spreads in the SPY but given where we are I am now going to switch to my genetically engineered CYA put spread:

You usually want to go out at least 90 days and the upper limited is around 120 days, you can push it into 130 if necessary. The delta ranges are explained on the profit graph above.

This is basically a fat butterfly but there’s a lot to it that I cannot cover in one post. A major aspect of this spread is that it mitigates IV SKEW which starts affecting us when implied volatility spikes up on the way down.

So while we us a regular call ratio back spread on the long side, we have to apply a bit more finesse when playing the downside. Which is why we are also selling yet one more put between a delta of .18 and .22. To rebalance we then add one more long put to the center.

I have been testing the CYA spread exhaustively and it promises massive returns and is the only formation that, at least to my knowledge, is superior to a naked put, as it has more staying power and suffers less from theta burn.

You don’t want to hold this into expiration – I would close this one out (in profits or not) 30 days prior to expiration. Which in this case gives us all the way until June 😉

Happy trading but keep it frosty.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]