The durable goods report for February came out this morning and thinking linearly – as usual – mainstream analysts expected positive growth to follow that of the previous 9 months. Unfortunately reality stomped on that little phantasy as it turned out to be a tumble instead of small gain which had to be the general consensus (LOL). Strangely it appears that locking down half of the economy and putting large swaths of people out of business will come at a price sooner or later.

Somebody must have been in the know, at least judging by yesterday’s session which was decidedly bearish. This stands in stark contrast to the E-Mini futures which have barely flinched this morning. As the saying goes: buy the rumor and sell the news.

Also let’s remind ourselves that one swallow does not a summer make. Meaning a bit of downside after a bear trap and new all time highs is not at all unusual and actually healthy, especially if it does not affect IV across the board. More about that later.

When looking at various sectors the financials are what grabbed my immediate interest. The past week has given us nothing but red candles and I was trying to figure out whether or not this could be an early harbinger of trouble to come.

Maybe but up to this point financials seem to remain in sync with the TNX, which means that we not yet have reached the point where higher interests start to affect banks and other financial institutions in a negative way.

The drop in interest rates however puts an interesting bond trade on our radar:

[MM_Member_Decision membershipId='(2|3)’]

The ZB and the ZN are once again attempting to paint a floor but have yet to break their current pattern of lower highs and lower highs. Until that happens we continue to be in a medium term down cycle and should treat it as such.h.

However a breach of ZB 158’26 could trigger a short squeeze of biblical proportions, so keep an eye out for that. I would usually just grab an I/O spread, a few OTM spreads, or a cheap call ratio backspread. But good option contracts are far and few in between when it comes to bonds so I may just grab myself some ZB exposure instead.

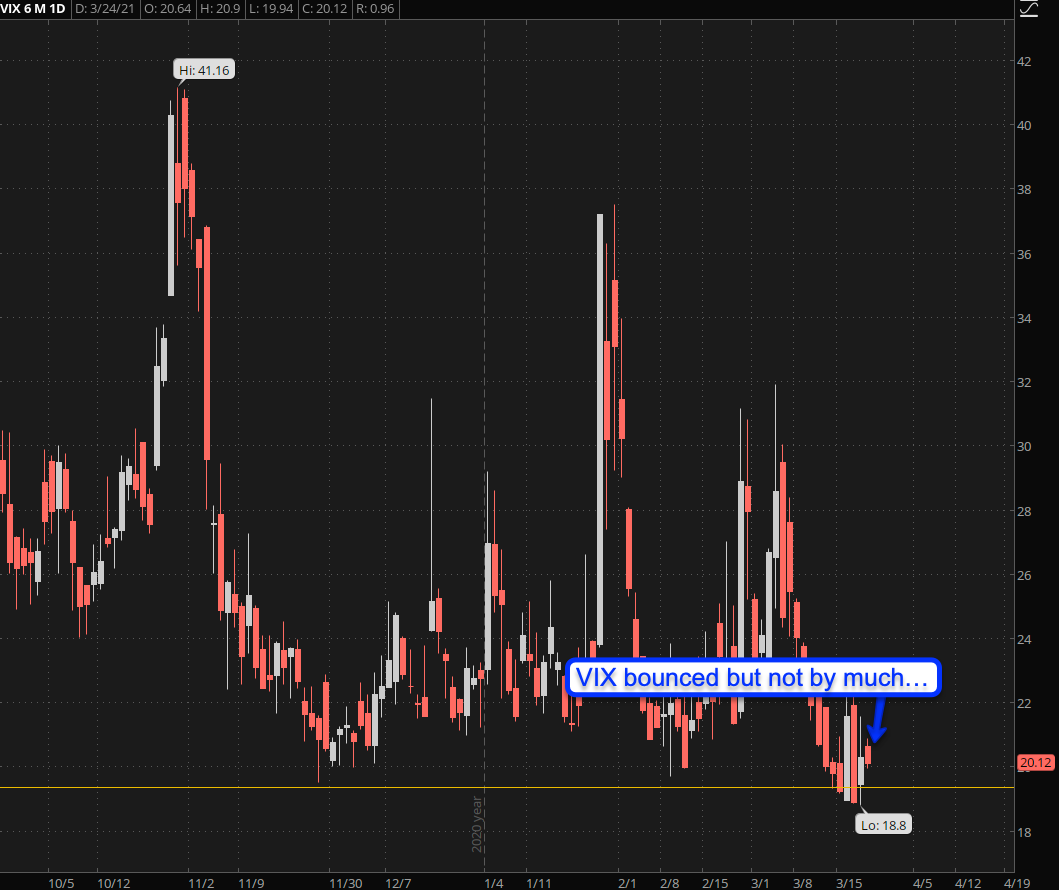

I mentioned IV previously and by extension that is the VIX. As you can see we have a tiny bounce here but it’s minuscule and does not reflect any sense of concern whatsoever at the current time. Which as you recall stands in contrast to what we are seeing on the VX term structure going out a few months.

Tough call here to make in terms of direction. BUT the take away is that IV remains to be low and we can use that to our advantage when it comes to our option strategies, e.g. being long vega to a reasonable extend. If the VIX closes below the 18 mark however we may be heading into a new IV regime and that could mean a drop to 15 or lower.

I’ll be keeping my eyes peeled on that front.

The Dollar seems to have painted a little double bottom and the UUP appears to be ready to bust higher and burn the shorts to a crisp. Would love to see that and I may actually grab a bit of exposure here. UUP is liquid enough on the options front although the spreads are often unreasonable. So you’ll have to wrestle a bit to get a good fill.

Happy trading but keep it frosty.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]