In my Monday post I promised you a volatile week and judging by the past two sessions the market does not intend to disappoint. If you take what historically is already the most volatile week of the entire year, add a heaping of political brinksmanship, a controversial presidential election process, ongoing riots, burning cities, an impending release of classified information by the DOJ, and a healthy dash of good old fashioned MSM hyperbole, then you’ve got yourself a veritable tinderbox of market volatility just waiting to be unleashed.

I for one love it, for volatility means opportunity to get my grubby little hands on even more ill-gotten gains. This may come across as a bit cynical and uncaring. In my defense I would counter that taking any of the flaming train wreck that 2020 has turned into seriously would submit me to a level of mental and emotional hazard I’m unwilling to embrace into my life.

Of course you didn’t come here for cynical diatribes so let’s get on with a bit of charting goodness. Looking at the SPX I see us going nowhere fast as it already ran up to the upper expected price threshold (upper EPT) bounced back, and is currently pushing higher in the early morning session for no apparent reason at all.

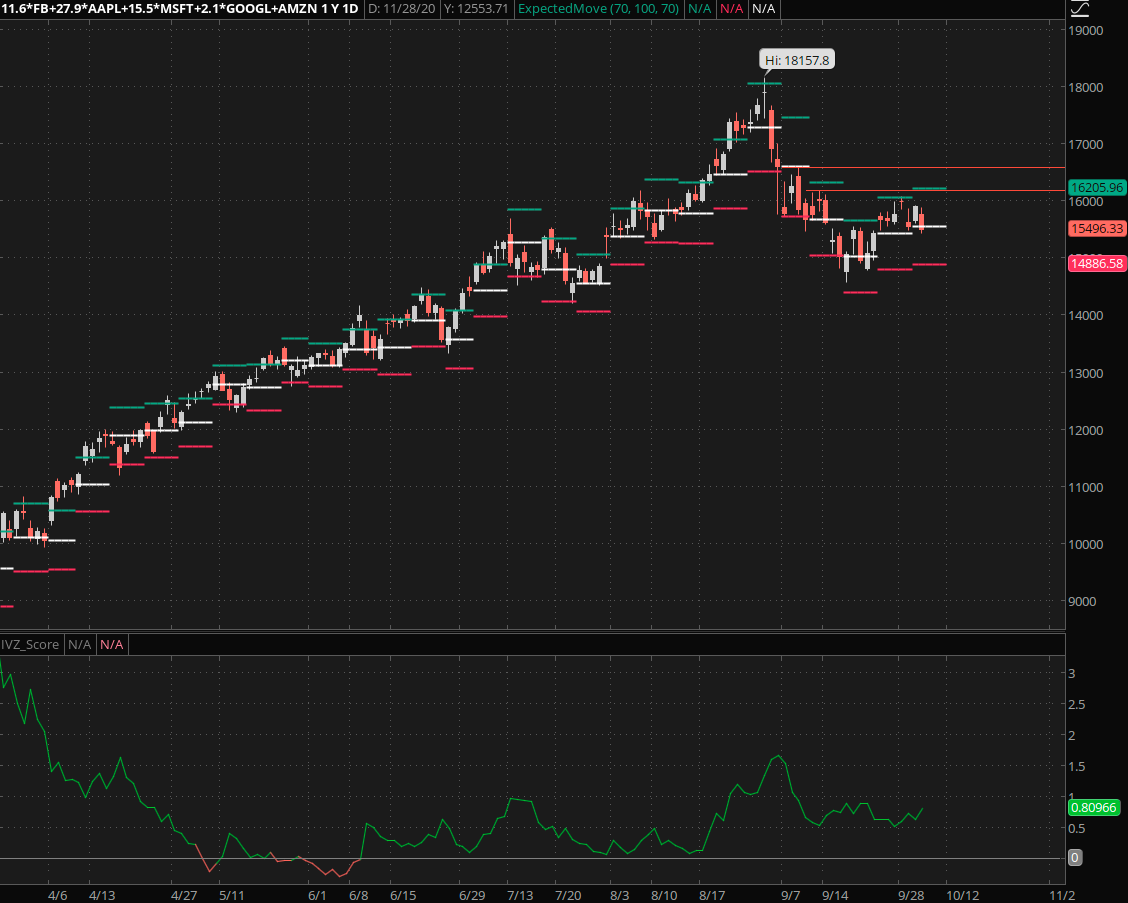

My monsters of tech (MOT) composite has been curiously quiet over the past two weeks and although I don’t consider big tech a prime short candidate I cannot help but wonder what implications this may have on the rest of the market.

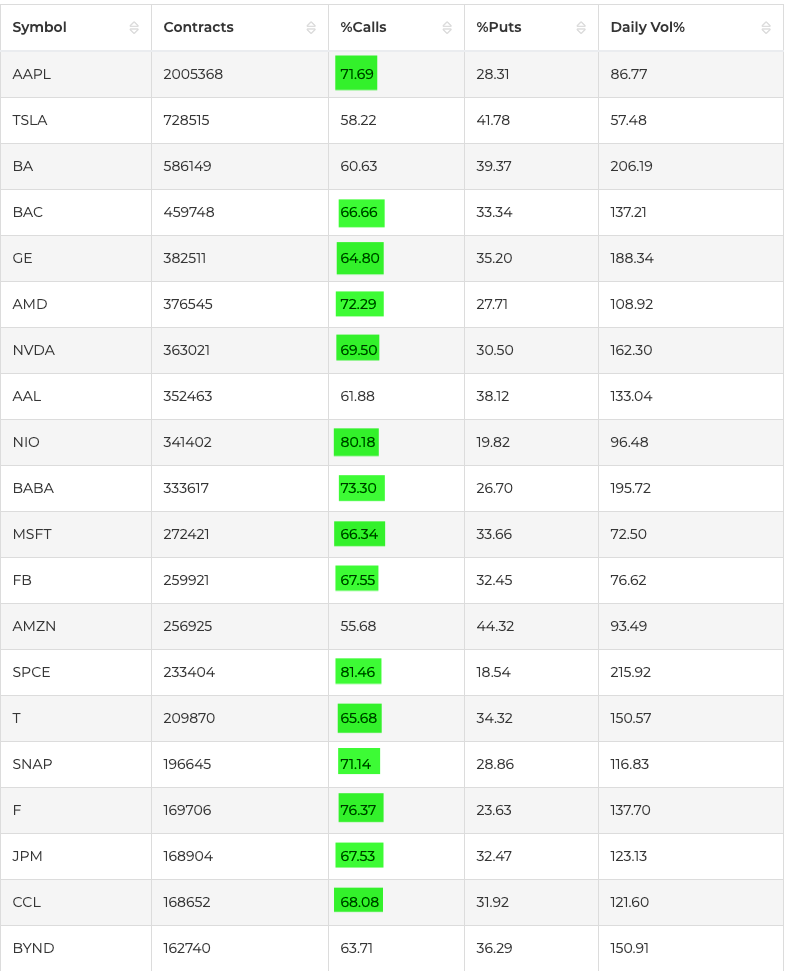

And once again, it’s not for a lack of trying. Every time I check the OCC report I see tech and automotive related symbols push call to put ratios above 2:1. In the table above, which features yesterday’s closing OCC top 20 stats, I have highlighted all symbols that rank above 65% in the call column.

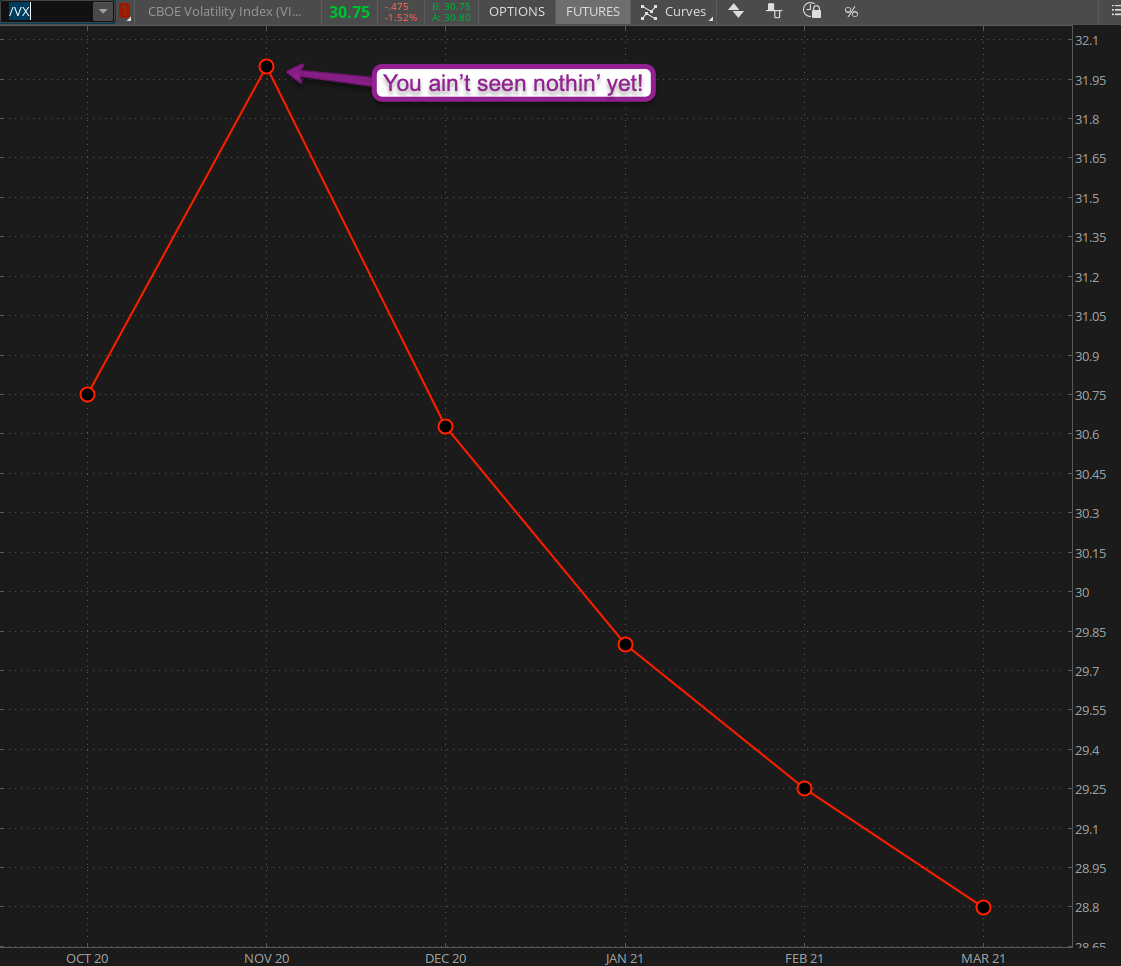

Which stands in stark contrast to what I’m seeing on the IV front:

[MM_Member_Decision membershipId='(2|3)’]

The VIX continues to creep higher after having formed a new baseline near the 25 mark. I mused a few weeks ago that our ‘new normal’ was the 22 range and although one month doesn’t make a season this accumulation right above 25 will play a factor going forward.

Which is good as we need technical context to make it through the remainder of this year. A breach < 25 and then perhaps 22 would be a good sign that we are finally ready to embark on the EOY Santa Rally. Then again, maybe Santa got cable at home and is thinking to himself “fuggit – I’m staying home this year”.

VX futures – I’ve shown this chart on numerous occasions starting at least three months ago, some of you probably remember my ‘shark fin’ post. Well November still shows us that same large spike and understandably so.

Things are going to get crazy in the first week of November. Which will be a great opportunity to introduce an option strategy designed just for that purpose. More on that later. Stay tuned.

Okay here are a few major futures symbols that caught my attention.

Crude is pushing sideways in a 4 handle range and that’s a good thing as I new see distinct bullish/bearish inflection points.

New campaign: I am taking out a long position here with a stop below CL 35.5. Confirmation will be > 41.72.

Gold apparently failed the retest near 1910 and a drop < 1850 spells bad medicine.

New campaign: I’m taking out a short position with an ISL < GC 1955.

Bonds have been a difficult market all year and recently have devolved into a sideways churn that never seemed to end. However we are now seeing movement in the ZB and I’m watching the 173 mark in particular.

It’s a bit early here to grab an entry. On the bullish side I’m waiting for a push > 175. On the bearish side I would like to see a drop lower followed by a failed retest of 173.

Happy hunting but keep it frosty.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]