The retail option bubble continues higher with institutional traders watching on in utter awe as to the outright insanity that is taken place in front of their eyes. And of course are taking full advantage per the old aphorism that a fool and his money are soon parted. This is going to be extensive as I’m literally going to bombard you with charts and graphs today. So grab yourself a cup of Java or whatever non-GMO organic sustainable cruel-free tasteless concoction that tickles your fancy, strap yourself in, and get ready for a wild ride.

Let’s set the stage by talking about the big elephant in the room that stomped all over Wall Street and broke all the China last week: Gamestop. Unless you’ve lived under a rock then you probably are already aware but the gist of the story is that a bunch of retail rats were unhappy about short-seller Citron Research announcing a livestream video that would lay out the “5 reasons GameStop [buyers] are the suckers at this poker game” and why GameStop stock would go “back to $20 fast.”

What happened next of course was a retail driven short squeeze of biblical proportions that propelled Gamestop from $20 to over $75 and, just to add insult to Citron’s injury, was accompanied by a collective social media hazing by an unruly crew of Reddit members.

I know what you’re thinking. Serves them right for playing the old ‘analyst slap down’ game, which essentially is a semi-legal way of short selling a stock prior to publicizing negative news about it. Well, yes and no. No love lost for Citron and its ilk here but don’t think that this is going to turn into some kind of happy ending. Let me show you why:

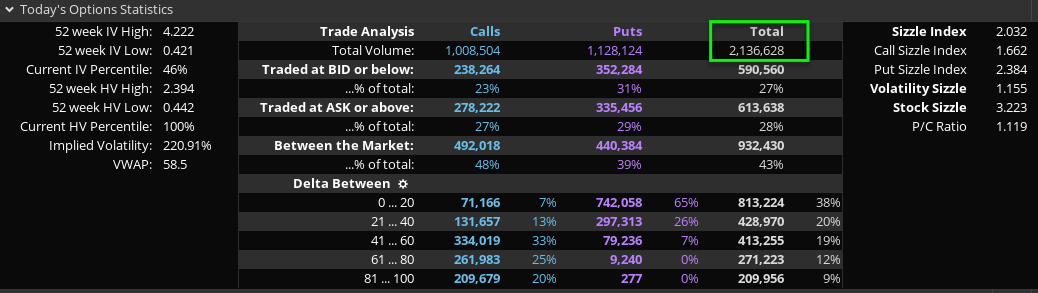

First up let’s look up the statistics for last Friday. We’re talking over 2 Million option contracts traded which is more than double of what is normal for GME. But that’s not all.

Look closer.

No closer. Much closer!

See the columns ‘traded at BID or below’ and ‘traded at ASK or above’? Look at those numbers! This effectively means that from 2.1 Million contracts traded 1.1 Million were market orders!

Now look at the implied volatility in GME across all the chains – that is simply massive and nothing short of a market maker’s wet dream in Aruba.

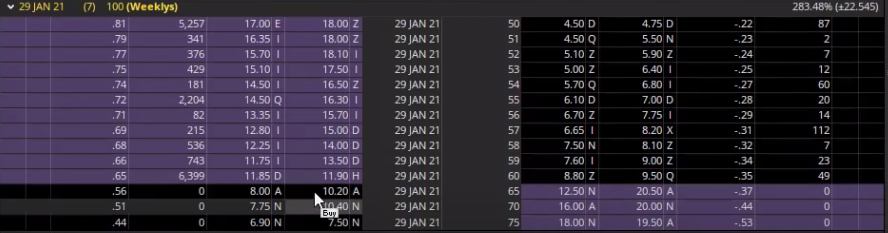

Here are last week’s spreads which are so wide that you could drive a German Tiger panzer through it with plenty of room to spare. And if you really think this is normal then you’re two fries short of a happy meal.

Okay Mole, settle down. Most likely Gamestop is a one-off and thus the exception to the rule.

WRONG!

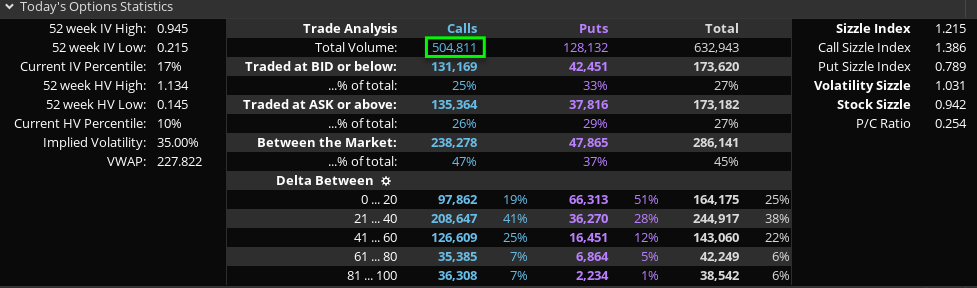

Take a wild guess what these stats are for. No, not TSLA – it’s f…ing MSFT.

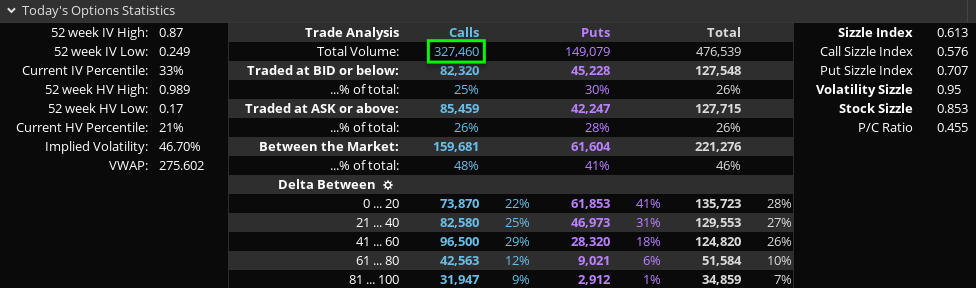

Here’s FB. Put/call ratio of 2:1 albeit with little participation.

Please forgive me for getting a wee bit giddy over here. But if you think what I’ve shown you above is bad enough, then you’re wrong again.

It gets worse…

[MM_Member_Decision membershipId='(2|3)’]

Earnings are coming up this week for MSFT with retail snarfing up naked IV inflated calls at a ratio of 4:1 – on market orders. After a big run to the upside.

What could possibly go wrong?

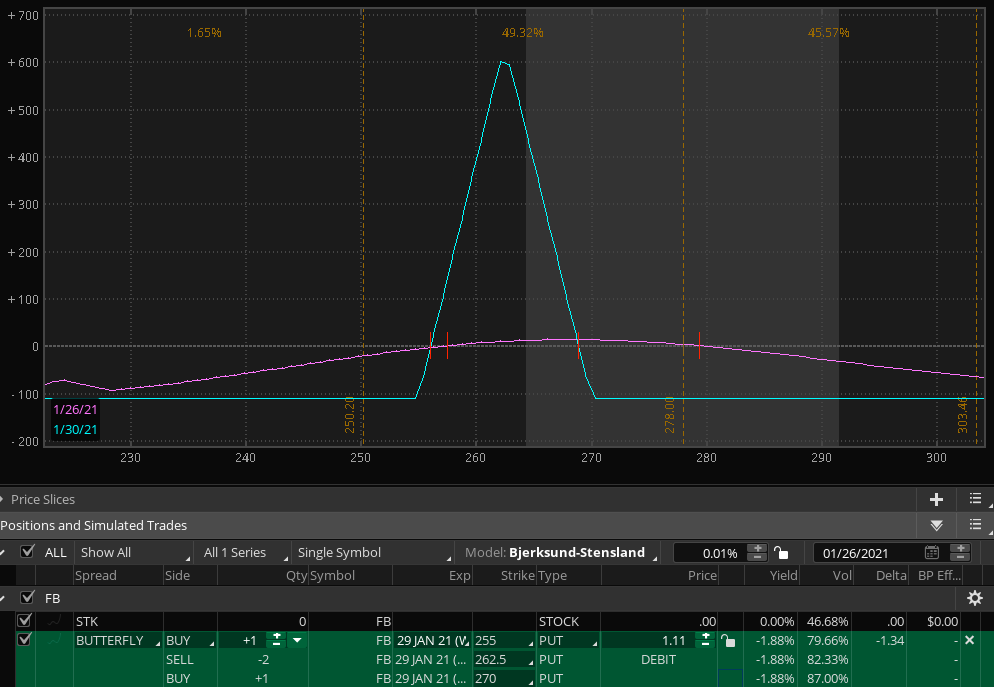

Ditto for FB – as you recall we played this run like a fiddle last week. But that was last week and the put/call ratio here is 2:1. As it’s heading into resistance.

Now, could both surprise to the upside? Absolutely and if I play short positions here (and I probably will) it’ll be a simple iron condor as shown above. A vertical or calendar spread (buying the front month / selling the back month) would have been a good opportunity a week ago but due to SKEW there’s not enough IV juice to be worth the squeeze.

Now speaking of inflated tech stocks – take a peek at the NDX which is scraping new ATHs on a daily basis. So beyond tech what’s driving this?

It’s certainly not TSLA which has turned into a terrible bore since it’s acceptance in the S&P 500.

It’s not finance either – quite to the contrary. And when finance doesn’t back up an explosive rally to the upside one better take notice.

Remember the old expression? “Give me a lever long enough and I can move the world.”

That lever, my intrepid subs, is big tech’s over representation in the S&P 500 and the Nasdaq. Pushing that handful of stocks and getting retail on board on the run higher is tantamount to putting your fat fingers on the scale.

What most retail participants are about to learn – the hard way – is that this leverage can quickly flip the other way. When it matters the most in fact. And although this insanity may be sustained for a few more weeks the Grim Retail Reeper is compiling a long list whilst sharpening his scythe.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]