I just finished an RPQ video on what the crypto market is up to (upvote and subscribe!) and shifting my attention over to stocks I can’t help but notice that there increasingly appear to be some similarities. Interesting times make for interesting market correlations I suppose.

After having fallen precipitously since the Sunday open the ES is now retesting previous support around 4350.

As I’m typing this there are only 10 minutes to go until the open but given fair value of about -11 handles that puts us around 4365 on the SPX at the ring of the bell.

Now if you compare that with BTC right now you most likely will agree that we are looking at a similar formation. Except that crypto is about six times as volatile as stocks of course. If you want to learn more about what the future may hold on the crypto end of things make sure you check out my video.

Now back on the equities front the VIX is most likely going to leave a mark this morning. A jump from 21 (already considered low level risk range) to now 26 is massive and it’s going to pump premiums significantly.

So the nagging question in everyone’s head this morning of course is this: Are we looking at a deeper correction here? Or is this nothing but yet another BTFD opportunity?

I’m glad you asked, for answers meet me below the fold:

[MM_Member_Decision membershipId='(2|3)’]

When things are moving fast on the short term end I often step back and consider the overall context. That may be a LT price chart as I have done so repeatedly over the past few weeks, or I may just want to remind myself of seasonal statistics.

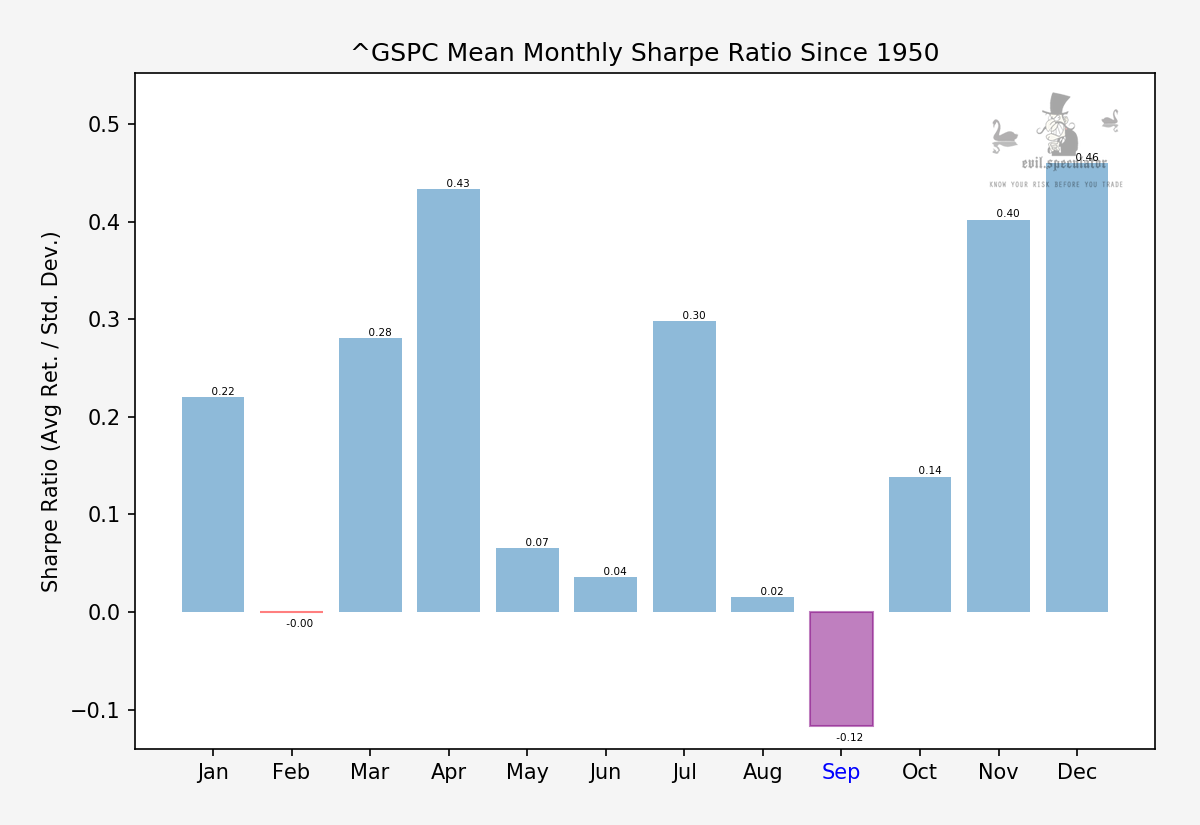

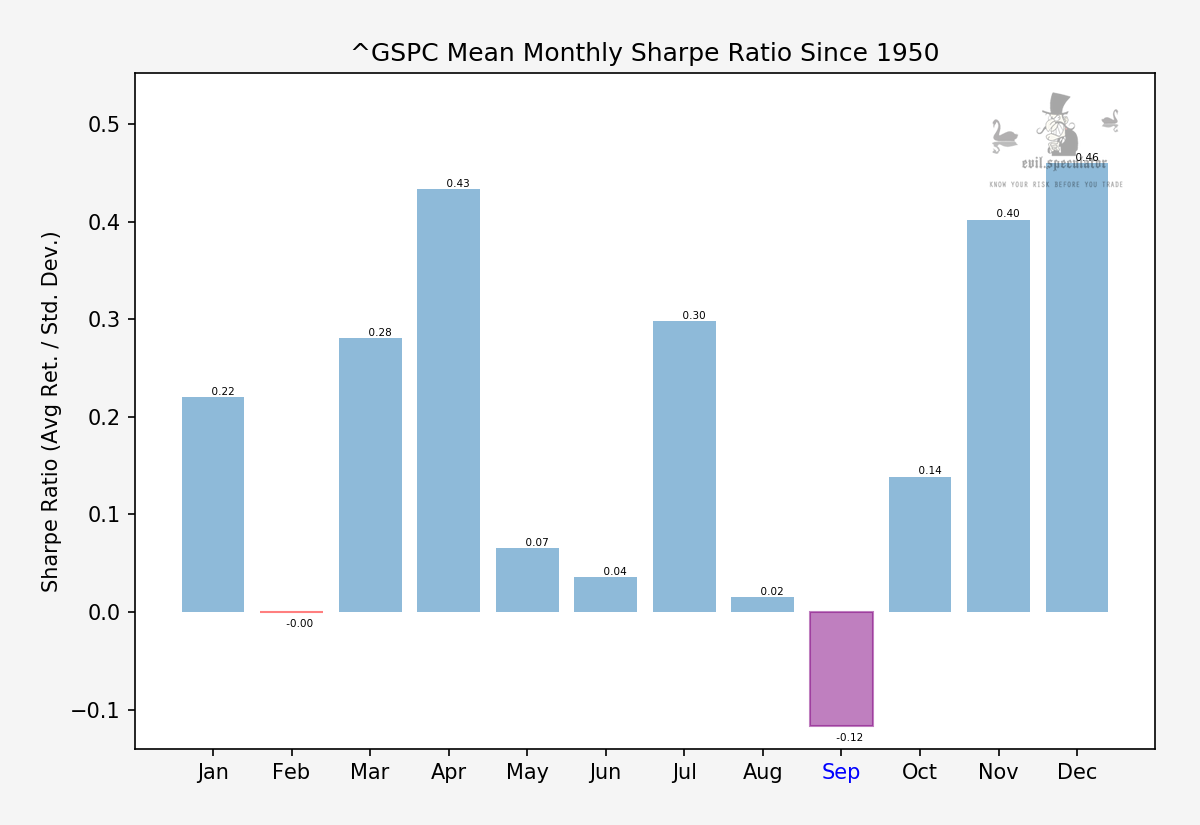

Thus far it seems September has lived up to its reputation, in that it often delivers what October promises.

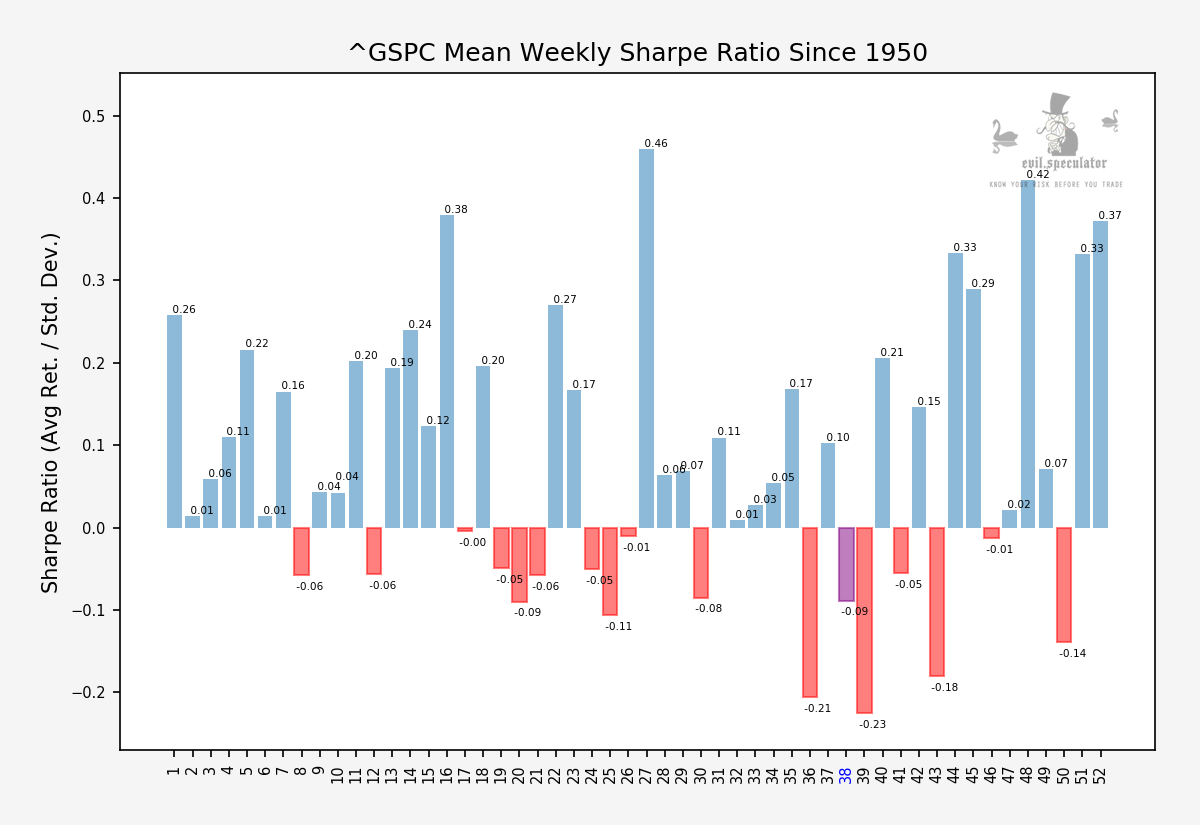

Let’s not forget that we still have two more trading weeks ahead of us in September and both at least historically speaking aren’t looking very promising. In fact week #39 is leading the ugly rat pack at -0.23% on average.

So the setup for more downside here seems to be in sync with what we are currently seeing in the live market.

Although I believe that we probably see a snapback here either today or tomorrow the odds of a positive month are only 44%, so keep that in mind before you engage in large long positions unless you are prepared to hold them all the way into November or December.

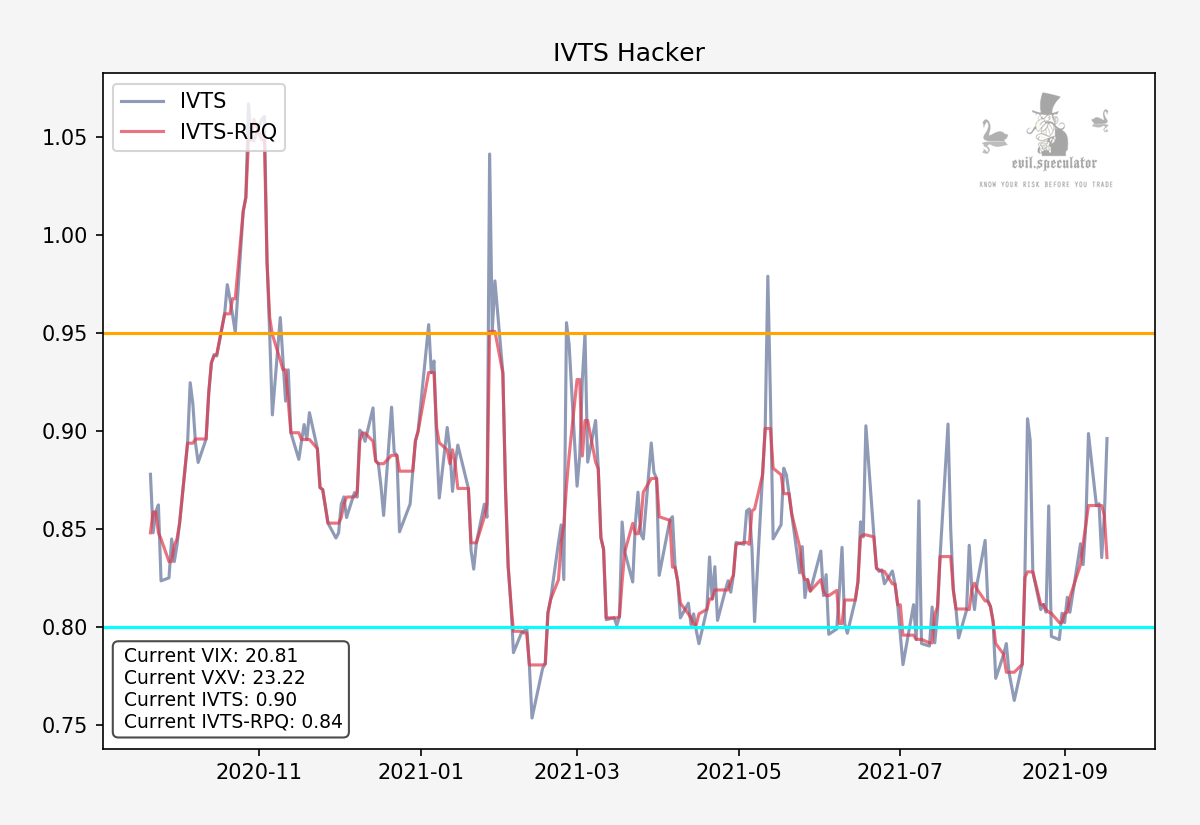

On the options front I may be tempted to sell an ITM VXX spread given that we most likely are going to see a large spike on the IVTS. However before making that commitment I need to see price level off a bit after the open.

No reason to rush matters and I always take a wait and see attitude after a large Monday gap down.

Happy trading but keep it frosty.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]