I received a few emails asking about my posting schedule this week, and clearly it was from people who had not seen the heads up I posted last Sunday. So, just to ease everyone’s mind and to stave off further inquiries here’s the elevator version of what’s going on: I had eye surgery yesterday (acquired strabismus) which prevented me from putting up a post. Everything appears to have gone well, meaning I can still see with my left eye but my face looks like as if I just went three rounds with Lennox Lewis. And that’s pretty much how I feel as well, meaning I’m still a bit out of it.

For anyone who cares – otherwise feel free to skip down to the first chart: This was supposed to be a 45 minutes outpatient procedure performed with only local anesthesia. Nevertheless I happen to be quite sensitive to medication and a minute after they injected me with some tranquilizer I was out like a light.

The last thing I remember pre-op is the nurse warning me the local anesthesia around my eyes would sting a bit, and me telling her not to worry but that I wanted a lollypop afterwards. Next thing I am waking up with a bandage on my eye – about four hours later. Apparently I missed all the fun and obviously I’m not too broken up about it. I guess if I was a drug addict my dealer would have to drive a lease to keep up appearances.

The jury is still out on whether or not the procedure actually was a success. The eye muscle was cut in two places (as it separates into two strands to move the eyeball) and as it’s swollen with internal stitches the final alignment will not be apparent until a few weeks from now. I choose to be positive however and if I have to go back under the knife then that’s what I’m going to do.

One interesting tidbit I wanted to share and it’s something I actually learned way back when I was experimenting with stereoscopic 3D in a different life: Some kids are born with really horrendous strabismus and in the first few years they attempt to correct the condition with special glasses that force both eyes into the proper direction.

When that fails it means you’ll have surgery BUT it comes with a caveat. Turns out that stereoscopic 3D vision is actually something our brain has to learn at an early age, within the first two years of your life. If you don’t acquire that ability and then later have your eyes corrected you will see a proper image but your brain will never be able to see depth as most of us take for granted.

Really fascinating and it shows how plastic the human brain is at an early age. Maybe future generations will be moving artificial limbs via implants they received when they were toddlers. Scary but I’m sure some mad scientists in some secret government labs are already working on stuff like that.

Alright, on to some fun and games. And boy oh boy are things getting interesting. An ambiguous Fed has left the market sort of guessing as what’s ahead and true to form the bias appears to continue to the upside.

We haven’t seen the VIX this low since the pre-COVID-19 days and this opens up exciting opportunities for any self respecting options trader.

This is what I’m talking about – note how IV across the chain has dropped significantly with next Wednesday scraping ground near the 15 mark.

But all is not well in paradise as I see very pronounced divergences across various asset classes:

[MM_Member_Decision membershipId='(2|3)’]

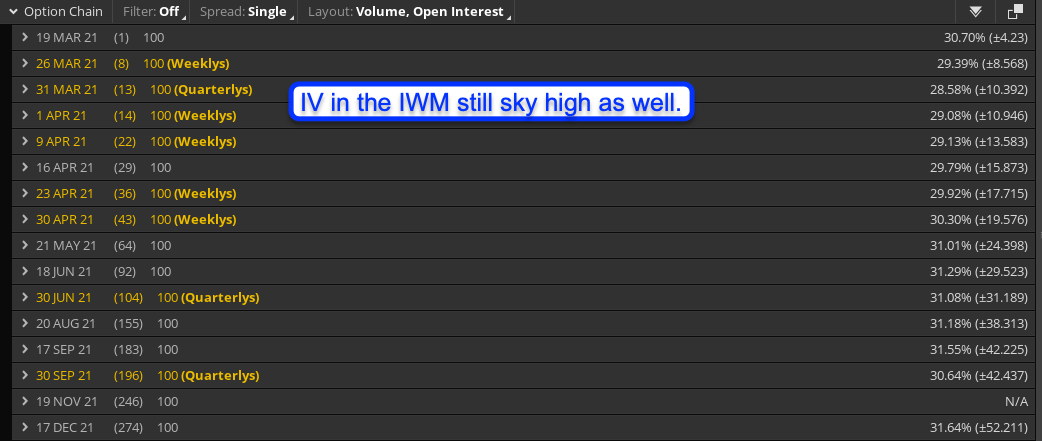

Compare the IV ranges in the SPY with that of the IWM…

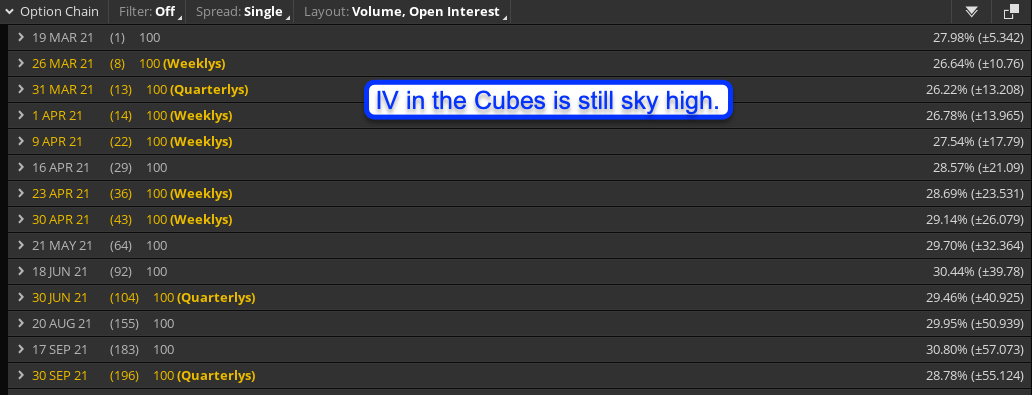

… or that in the Cubes. Quite a difference and you may wonder why. The shorthand answer is the composition of the respective indices with the Cubes and the IWM being more dominated by big tech than the SPY where finance (XLF) is a major component.

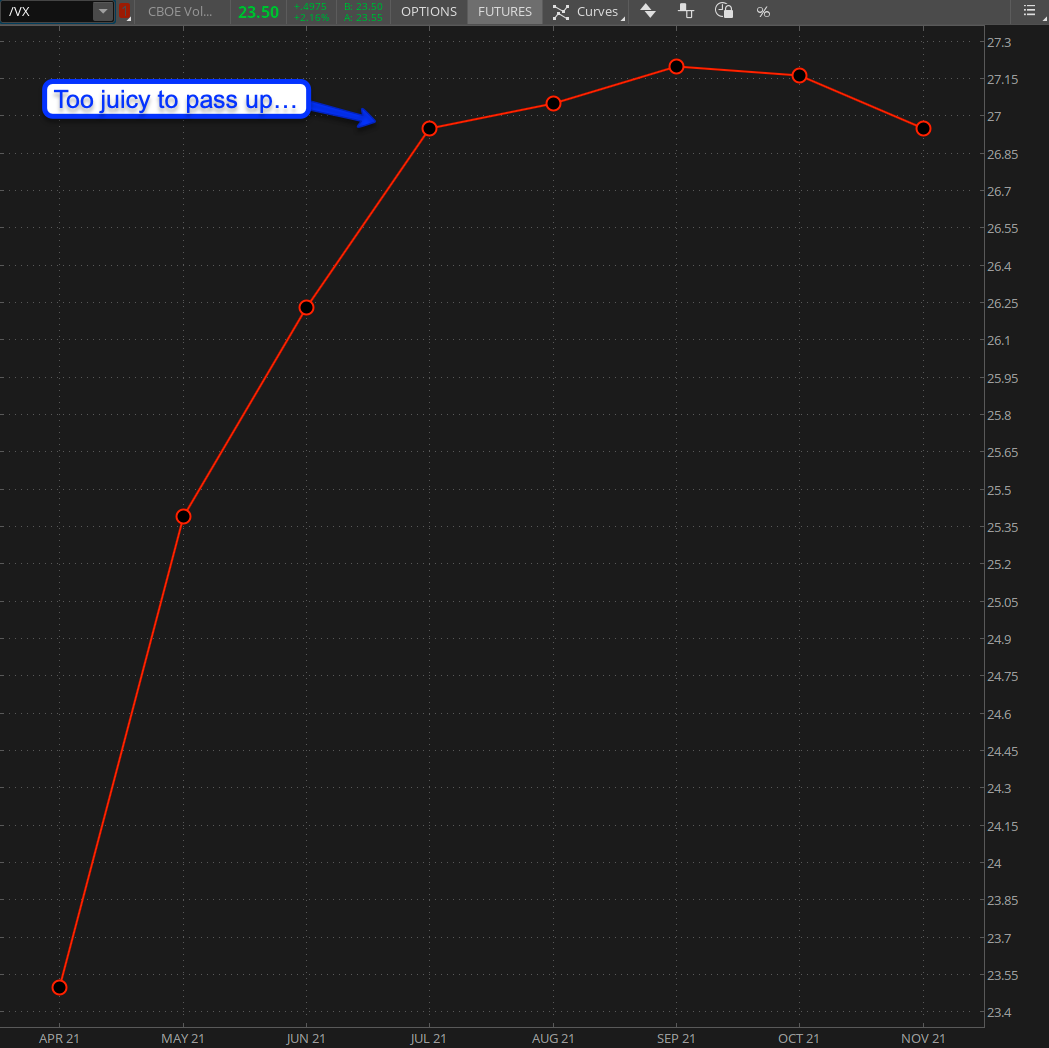

And then there’s still this. How could I possibly pass up a juicy opportunity to benefit from an impending IV explosion?

Now I know what you’re thinking. Sure, Mole – you’re being a bit too biased toward the downside. Obviously bonds continue to fall but it doesn’t seem to affect the equities market.

Well then explain to me why the May 19 contract is pricing in a VIX move all the way into 25. How do I know? Look closer.

MUCH CLOSER!

You don’t see it? Well I did draw a square around it but the reason for me doing so was that this effectively represents the ATM price for the May VIX futures contract. Note how the put and the call are similarly priced, which is a dead give away on top of the VX futures curve I posted above.

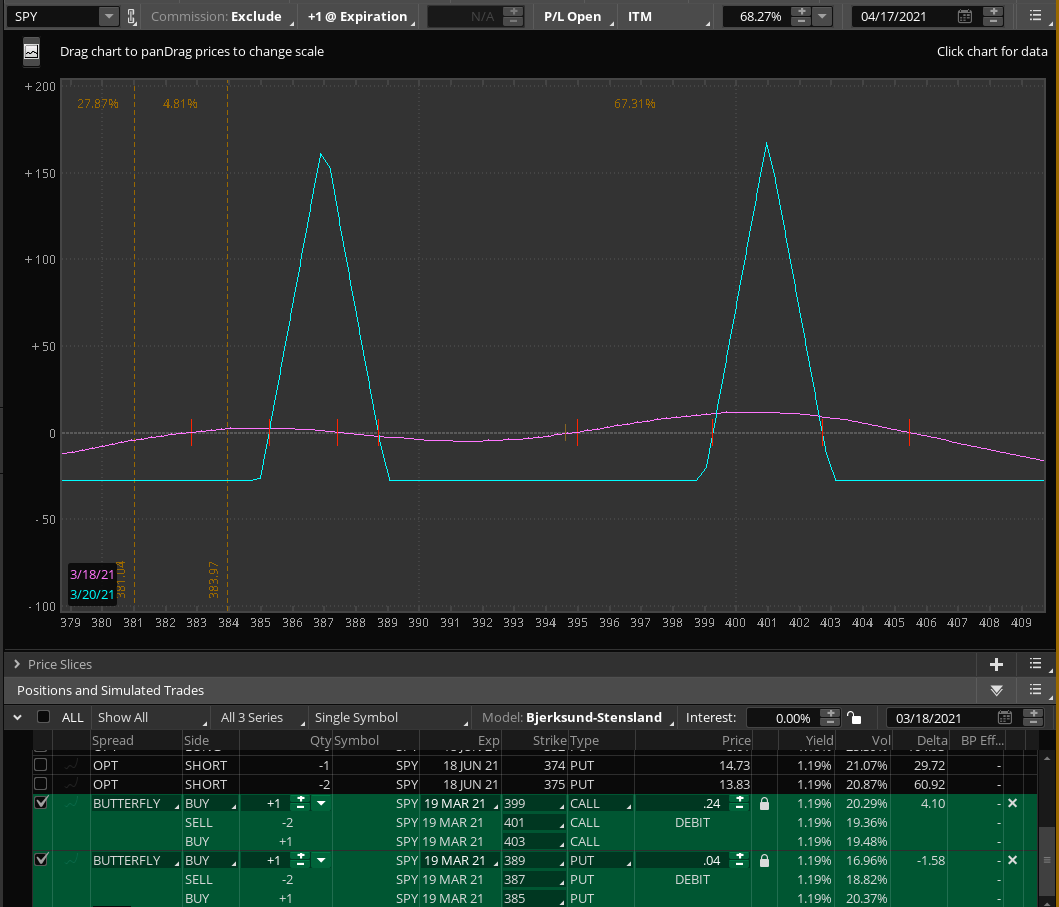

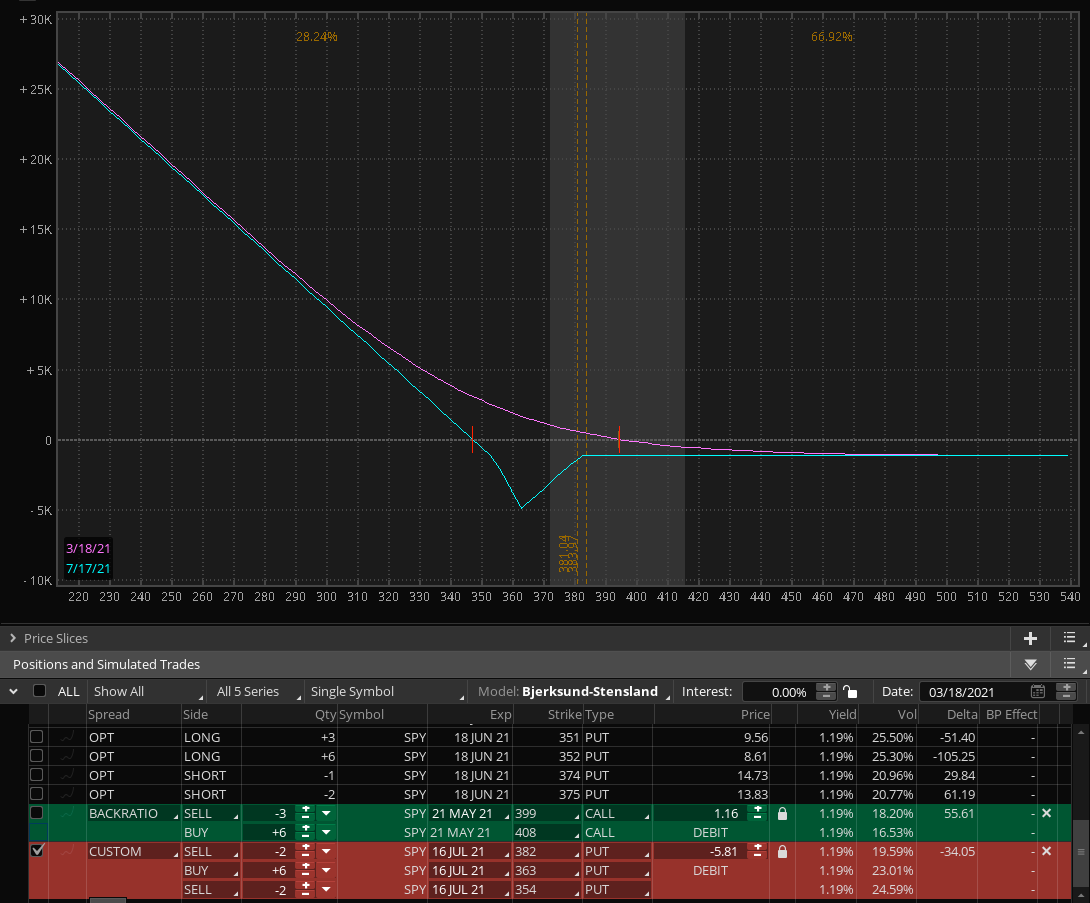

So what am I going to do about this? Well on a short term basis I’m going to take on a batman spread as we have barely moved this week and the odds of the SPY touching one of its expected price thresholds (EPTs) in the next two sessions is pretty damn high.

Not guaranteed of course but IMNSHO much higher than what’s being priced in right now. BTW, I got filled right away at the open, so I recommend you put in a lower bid.

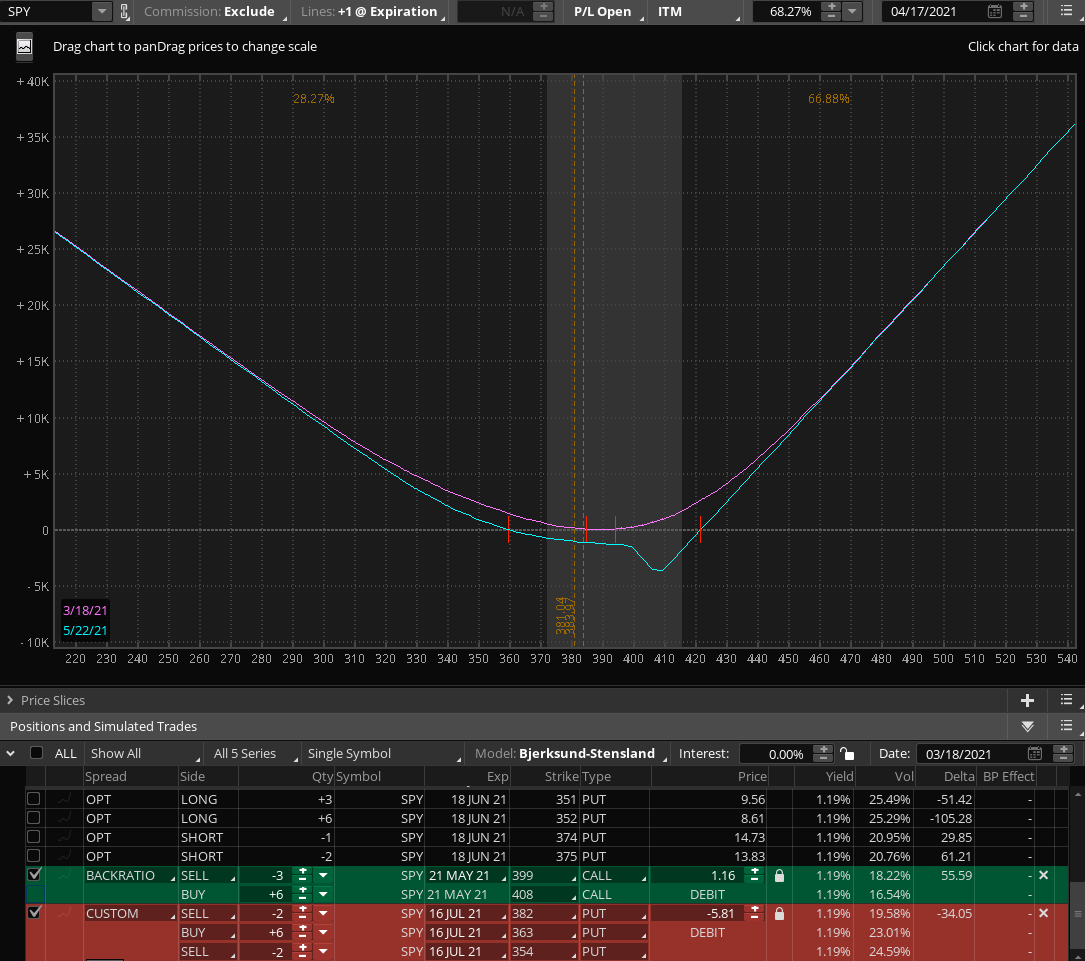

Long term I present another hammock trade which I have already discussed in detail over the past few weeks.

Or if you’re bearish stick with only the bearish side which is a bit pricey but one single position would produce MASSIVE gains if the equities market actually does what the VX futures continue to predict.

Happy hunting but keep it frosty.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]