A funny thing happened on the way to the recent Federal Reserve board meeting. U.S. treasury yields fell despite the latest policy meeting minutes showing that it was preparing to taper bond purchases before the end 2021. Apparently after years of dangling the specter of a more hawkish stance market vigilantes are finally prepared to call the Fed’s bluff. As the saying goes: Don’t ever bullshit a bullshitter.

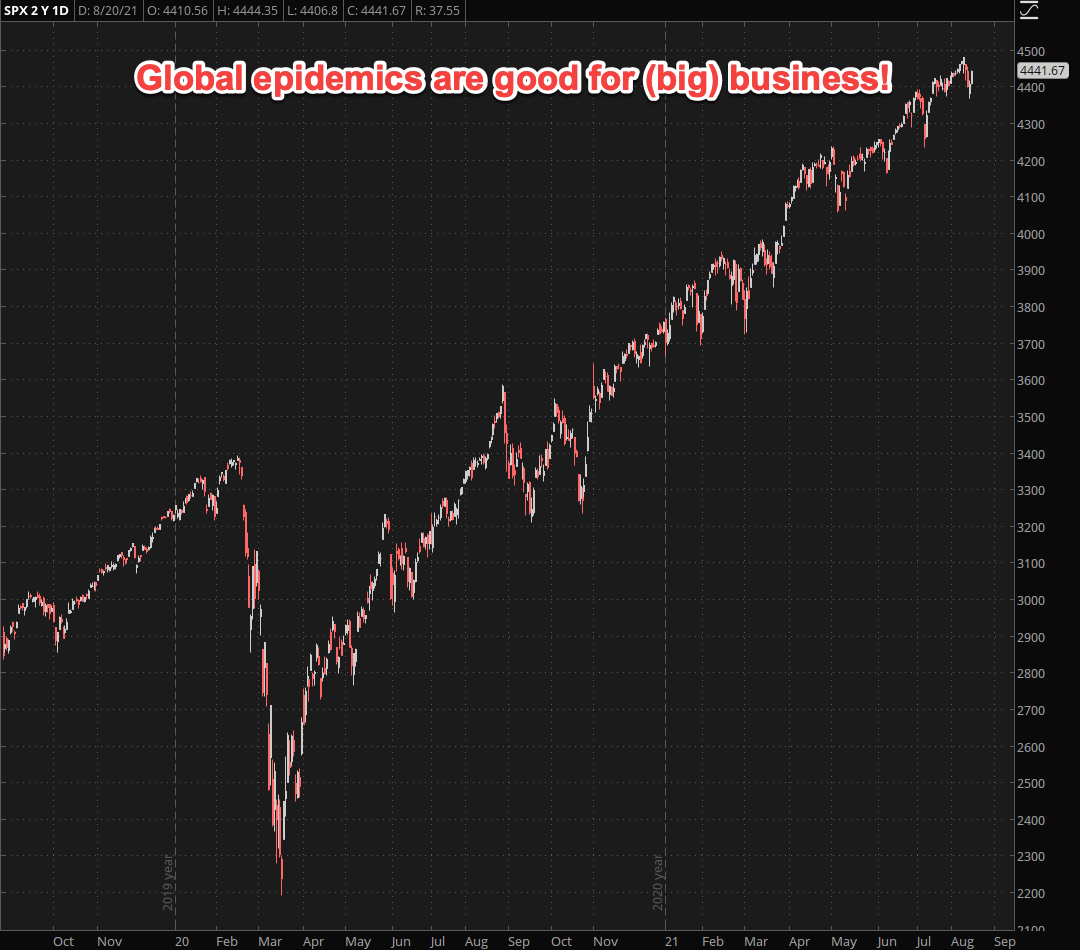

Whether or not you believe that bond purchases by the Fed or, heaven forbid, an actual rate hike would make any dent into this bull market is of course purely academic. The Fed has been pushing on a string for years now and the equity market has long ceased to care. “Don’t fight the Fed” may one day be remembered as the synopsis of the early 21st century by historians.

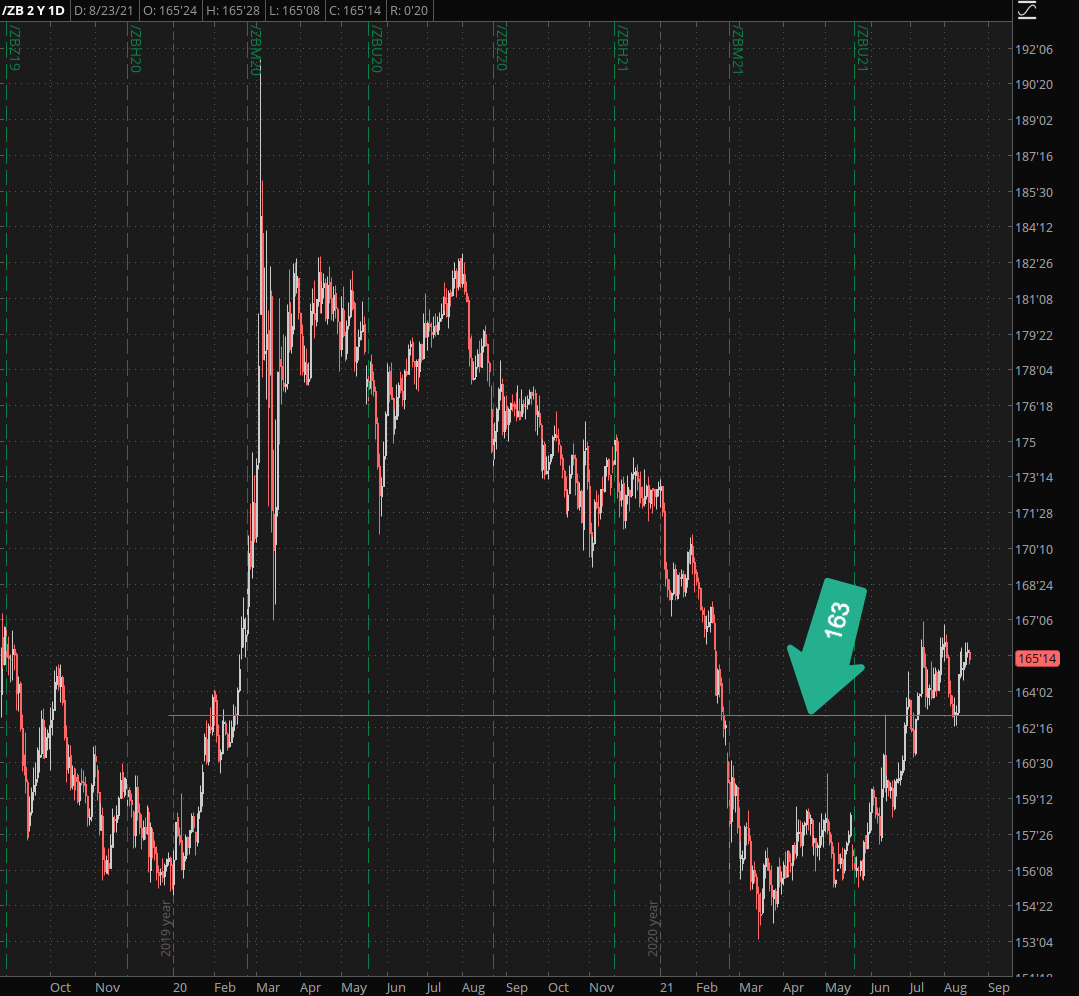

Somebody clearly seems to be getting a bit nervous however, as the 30-year treasury bonds have clearly shifted into a bullish market cycle. Technically speaking we don’t have much to hang our hats on, at least until we breach the 170 mark.

What grabbed my attention was the retest of the 163 mark and I will definitely be long on a breach of 167. Not here in the ZB specifically but most likely over in the TLT where I finally closed out a four month old call ratio backspread on Friday – with 6R+ in profits I may add.

Of course in the big scheme of things any bearish allusions should be met with extreme skepticism. This may be the most hated bull market in financial history but retail is now jumping in with both feet, which may be good for a good old fashioned blow off top. And never let ethics or reason get in the way of turning a buck.

With yields falling over the past few months big tech has had a hell of a time keeping up the pace. MSFT just broke out higher, so this may be changing shortly. Has the long summer of sector rotation finally come to an end? We shall see…

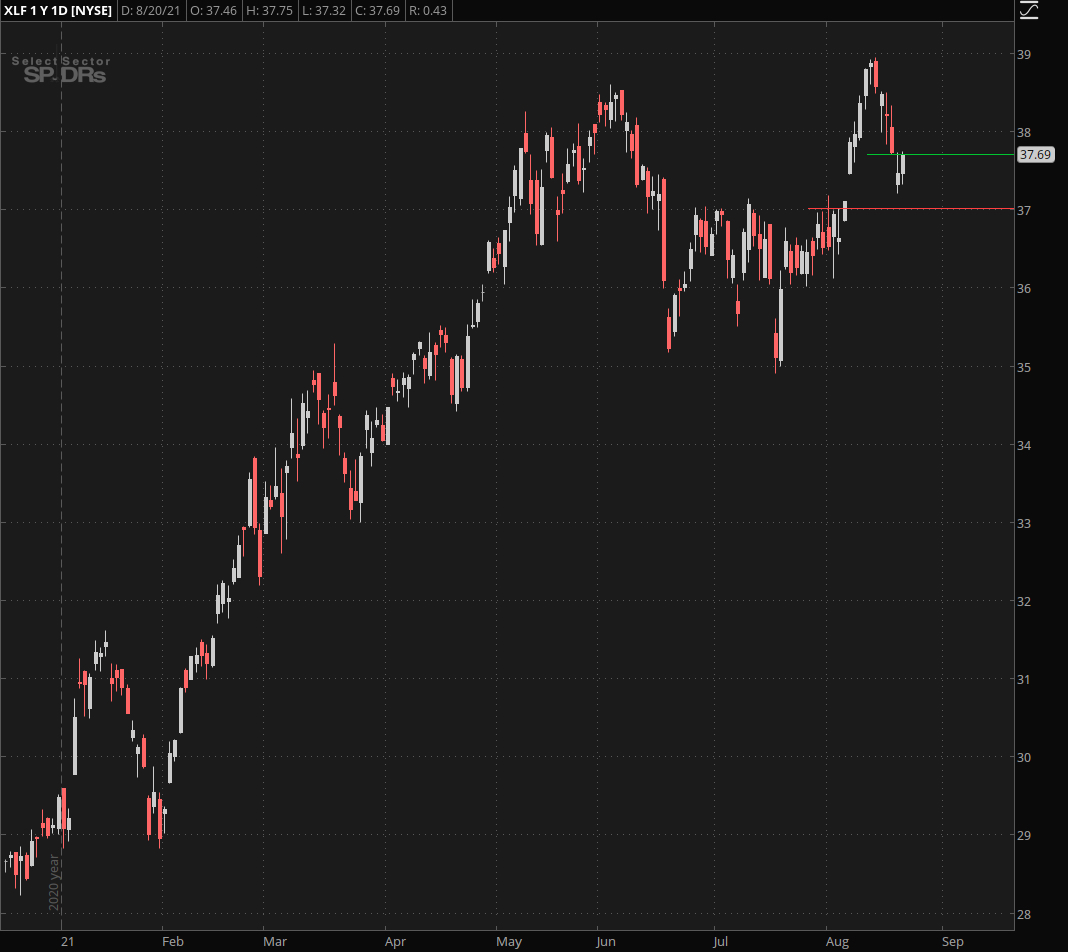

Finance has pulled back over the past week and now seems to be ready to make a run for its recent highs. I’m a buyer here until I’m proven wrong around the 37 mark.

[MM_Member_Decision membershipId='(2|3)’]

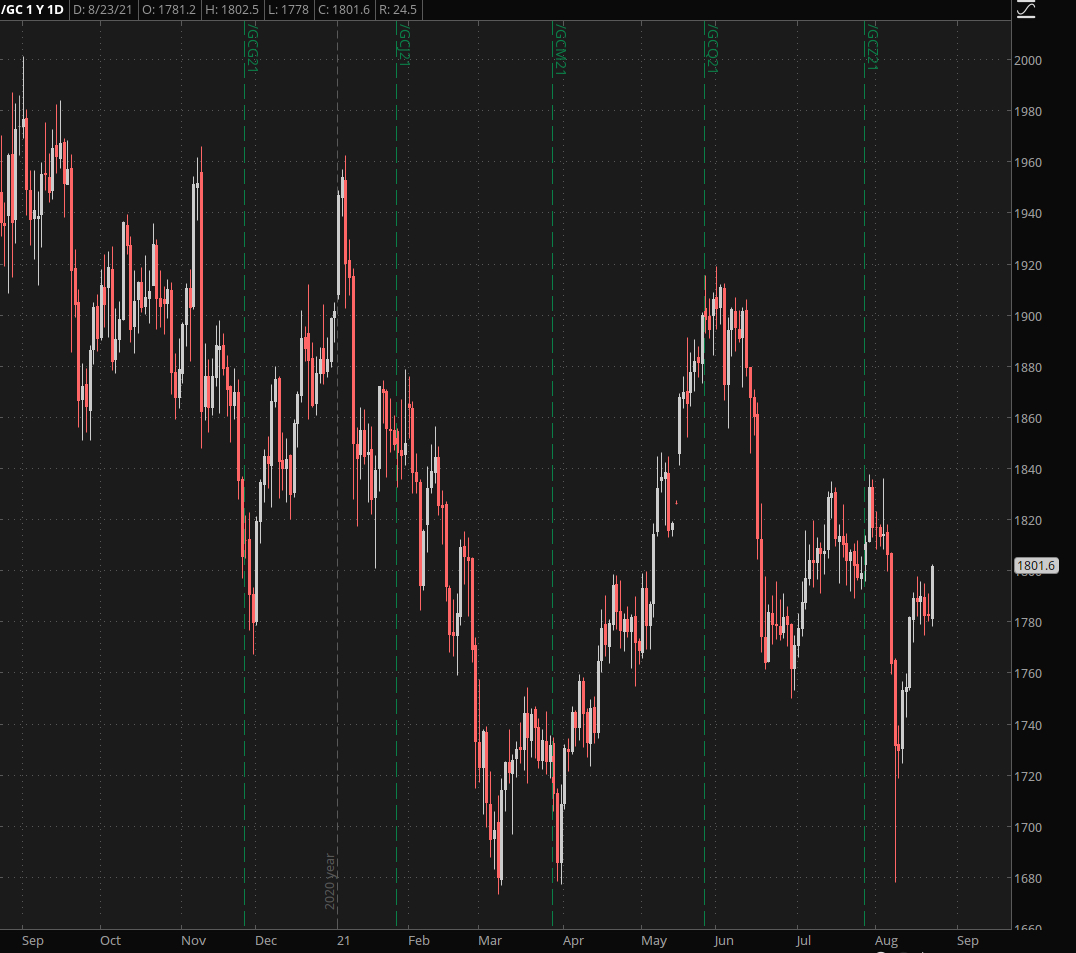

There has been a lot of doom and gloom in precious metals recently but what really has me miffed is that snapback in gold which I completely missed as I was getting ready to my trip to Switzerland.

You can’t catch ’em all but I would very much be a buyer on a retest of 1760 or below. The odds of that are slim at this point but I wanted to throw it your way just in case.

Crude may be trying to follow the trail that gold has been blazing. I’ll watch the open but most likely will be taking out a long position here as well with a stop < the 61.8 mark.

Happy hunting but keep it frosty.

[/MM_Member_Decision]

[MM_Member_Decision membershipId=’!(2|3)’]

Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]

[MM_Member_Decision isMember=’false’]

Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]