Bond futures are in free fall and we are quickly approaching a situation where the floor may give way underneath whatever has been holding up the stock market over the past month. Of course you wouldn’t be a regular on Evil Speculator if you did not recall the many times we have peeked over the proverbial abyss only for the Fed to step in and stomp all over the bears. Lucy has had some fun over the past 12 years and clearly it’ll take a bit of finesse to gauge direction and play the swings.

BTW, I wasn’t exaggerating when I said that the bonds are reaching terminal velocity. Just the other day I pointed at the spike low at 158 and suggested that a floor needed to be painted here or all hell would break loose.

While the 30-year bonds are popular among retail traders it’s the ZN that institutional traders are mainly focused on. And you don’t need to be an expert analyst to figure out that the bond market has transitioned from a HV sideways churn to a HV corrective phase.

Accordingly the 10-year yields are exploding higher with opening gaps that exceed the range of last year’s trading range. I think the trend here is fairly clear and continuing to print fiat and buy up any debt instruments that aren’t nailed down seems to have the same effect as pushing on a string.

There is a lot of talk about YCC at the moment referring to ‘yield curve control’ and as I hinted it’s very much possible that the Fed is going to try to pull another rabbit out of its hat. The Wednesday FOMV report obviously disappointed on that front but I’ve seen this game played before, meaning the Fed plays hawkish, the bears start salivating, and shortly after a surprise announcement pulls the rug underneath of everyone’s short positions.

With bonds falling like an ACME anvil and yields exploding higher. For some mysterious reason (yes I’m being cheeky of course) the XLF is not following higher and if you’re a sub then you probably know why. Sorry I can’t give it all away 😉

Now let’s take a look at our list of entry candidates in an attempt to from the gyrations over the following days and weeks:

[MM_Member_Decision membershipId='(2|3)’]And you probably guessed it – tech has been on my chopping block for the past few weeks now and it increasingly appears that we’ll see a major correction here.

Google is right back at its island support level near the 2k mark.

AMZN has failed my first hurdle and is now kissing the second with nothing but air underneath.

AAPL is painting a pretty juicy looking H&S pattern.

And FB is still bucking the trend but since it hasn’t gone anywhere since last summer it’s not exactly the paragon of strength.

Now there are probably two questions in your mind right now:

- Is this is it? Are we going down?

- If so how do I benefit?

Well, sorry to break your bubble but you are asking the wrong questions.

Regarding 1) the right time to get positioned toward the downside was a week or two ago when I recommended medium term hammock spreads and OTM spreads which were still available at a discount. Further I also showed you a few very nicely priced OTM calls that I had been selling. That ship has long sailed.

Regarding 2) the proper approach here is to anticipate the opposite of what everyone else is expecting, which is a push higher. Now let me be clear – I do not think that the odds of that are much higher but a coin flip, maybe even less. But it’s the only possible course of action right now unless you want to waste money on bloated premium due to exploding IV.

So instead I do what nobody in their right mind would do, look for cheap bets to the upside:

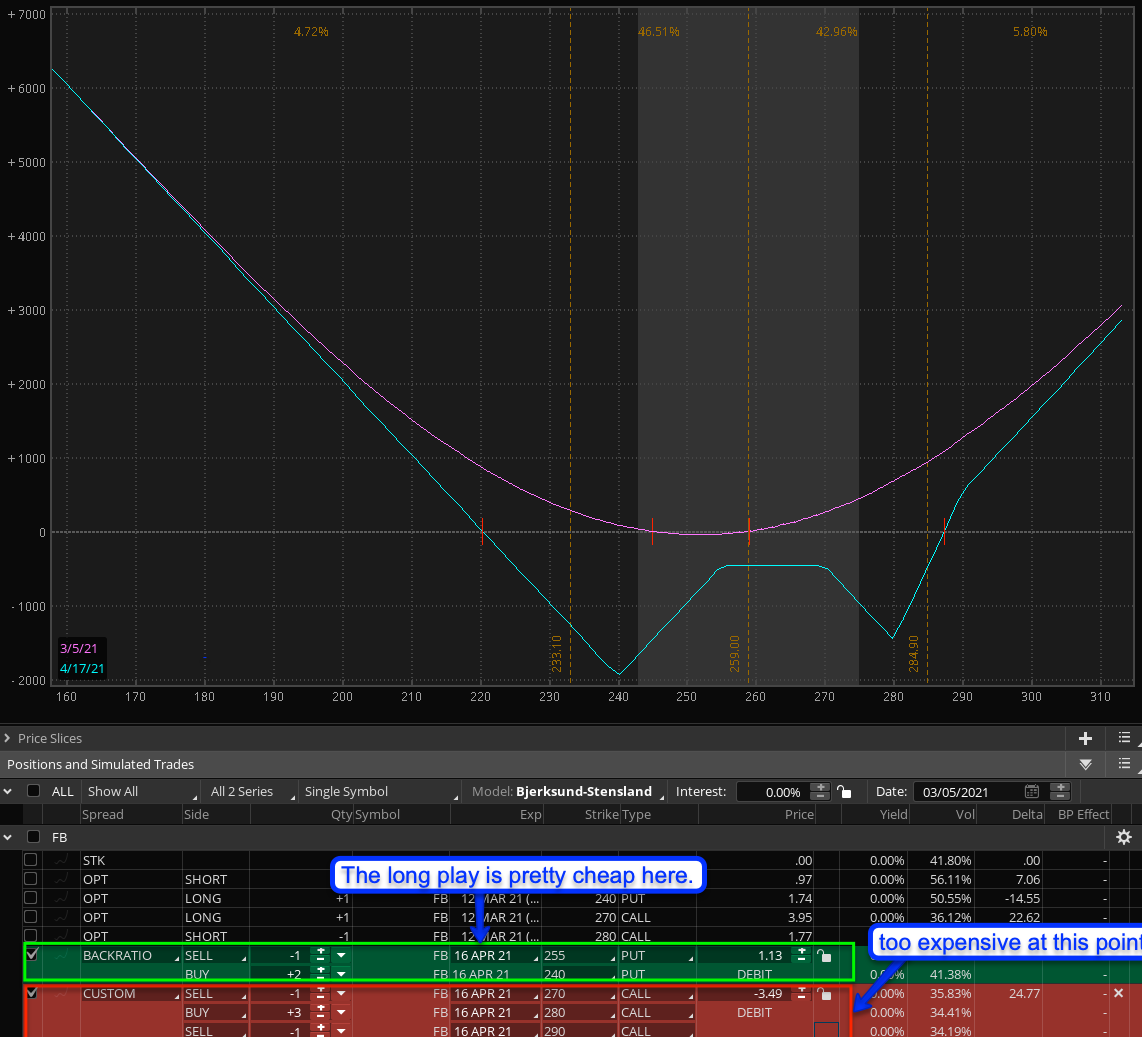

In the risk analyzer above you see a typical hammock spread (actually two spreads) consisting of a fat put butterfly and a call ratio backspread. The former is way too expensive right now and as I mentioned the right time to place this was at least a week ago when IV was still tolerable.

The call ratio backspread however is actually quite affordable given the profit potential and the time that’s left. So EVEN IF we drop from here, unless we take the express elevator into Hades, we may easily jump right back up to shake out some weak hands.

Or we turn today or Monday, nobody knows. The one thing I’ve learned over the years however is that nothing in the financial markets moves in a straight line. And paying a little over a buck for the potential for this crap shoot is worth the expense.

If you want to put together a similar call ratio backspread on other symbols follow these delta guidelines:

- SELL X 1 .40 to .49 delta call

- BUY X 2 .23 to .35 delta call

Have fun but keep it frosty.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]