With the presidential elections drawing near the worrywarts are beginning to hedge their bets, may this be in real life by boarding up your storefront or virtually/financially by protecting your assets from a potential wipeout. In normal times – meaning pre 2020 – investors and speculators would usually look at ways to protect against election day whipsaw. This is what we saw in 2016 for example where conflicting reporting plus misinformation caused equities to push wildly in both directions. However everything I am seeing points toward this time being different.

Not only do fears regarding a market upheaval extend all the way into late January, but it also seems like the game of musical chairs – i.e. sector rotation – is increasingly running out of chairs.

On the surface everything looks pretty quiet but I consider this to be the proverbial ‘quiet before the sh…t storm’. Over the past few weeks we’ve been running in circles within the expected move but closed fairly near to where we left off the week prior.

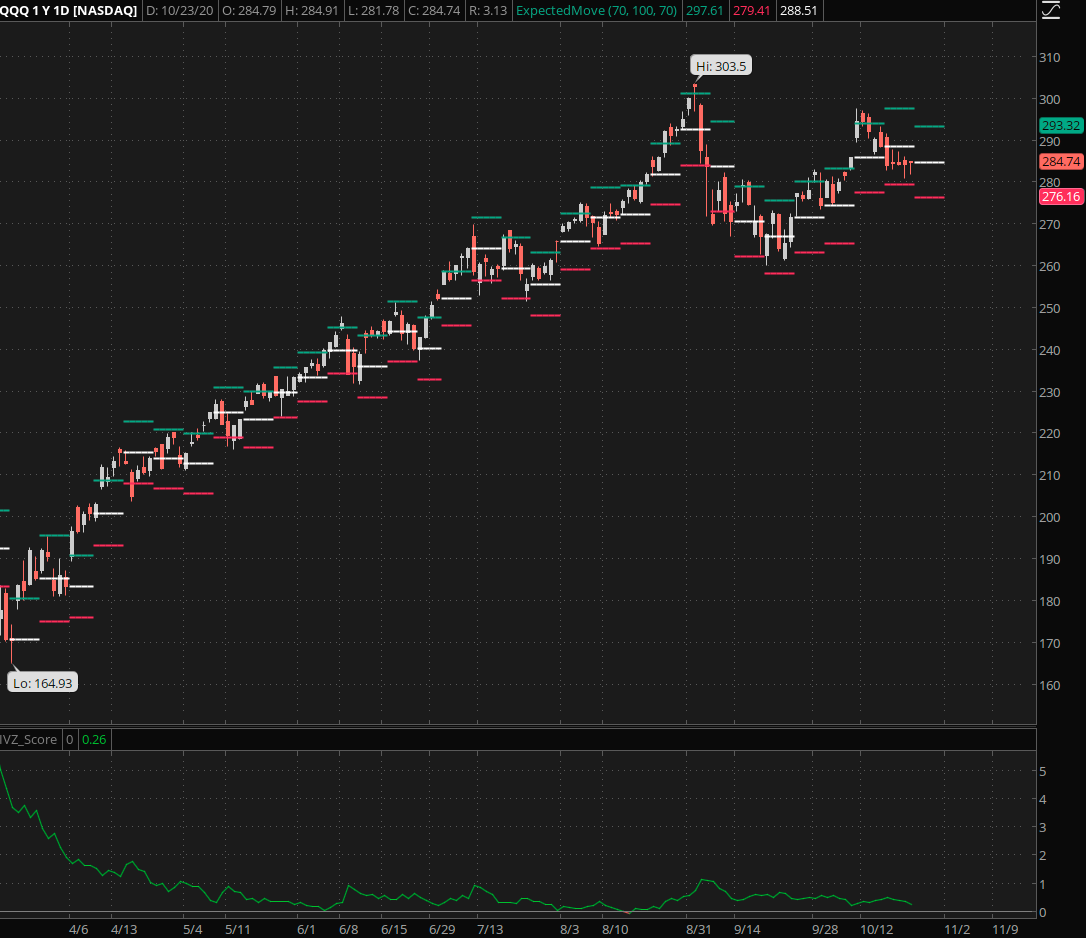

Even the cubes have started to slow down in anticipation of who will be the 46th president of the United States. I am not one to resort to hyperbole but it’s fair to say that the future of big tech in particular will be heavily influenced by who takes the helm on January 20th 2021.

We would expect the VIX to be elevated only days away from a controversial election day but this year a ‘slight elevation’ means we are circling around the 30 mark.

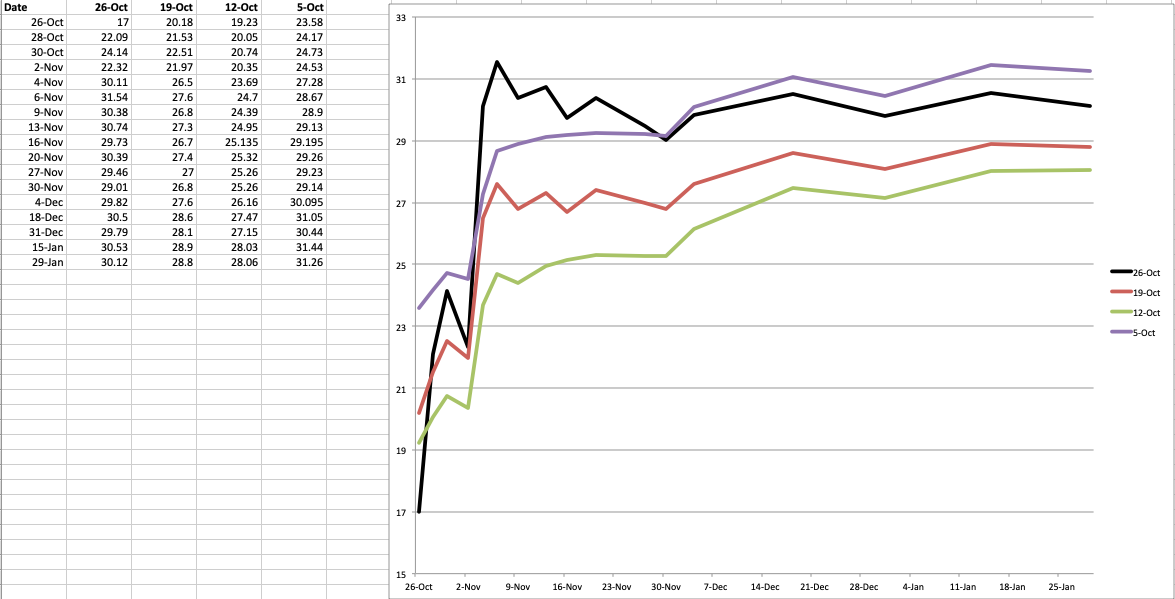

Speaking of which I updated my pre-election SPX option chain spreadsheet – I know a mouth full – and it’s starting to steepen on the front (the near future) whilst dropping a little bit in the back (mid December into late January).

That said, as you can see the back weeks/months have been ranging within 26 and 31 for several weeks now while contango (if you would call it that in this context – it’s usually just used in the futures) has remained consistent.

The VVIX remains highly elevated. Don’t let the the previous swings fool you – may I remind you that we’ve been through 9 month’s worth of a worldwide epidemic which – justified or not – has taken down our global economy?

Meaning, if this reading is the ‘quiet before the storm’ then we better dress for a cold winter in hell.

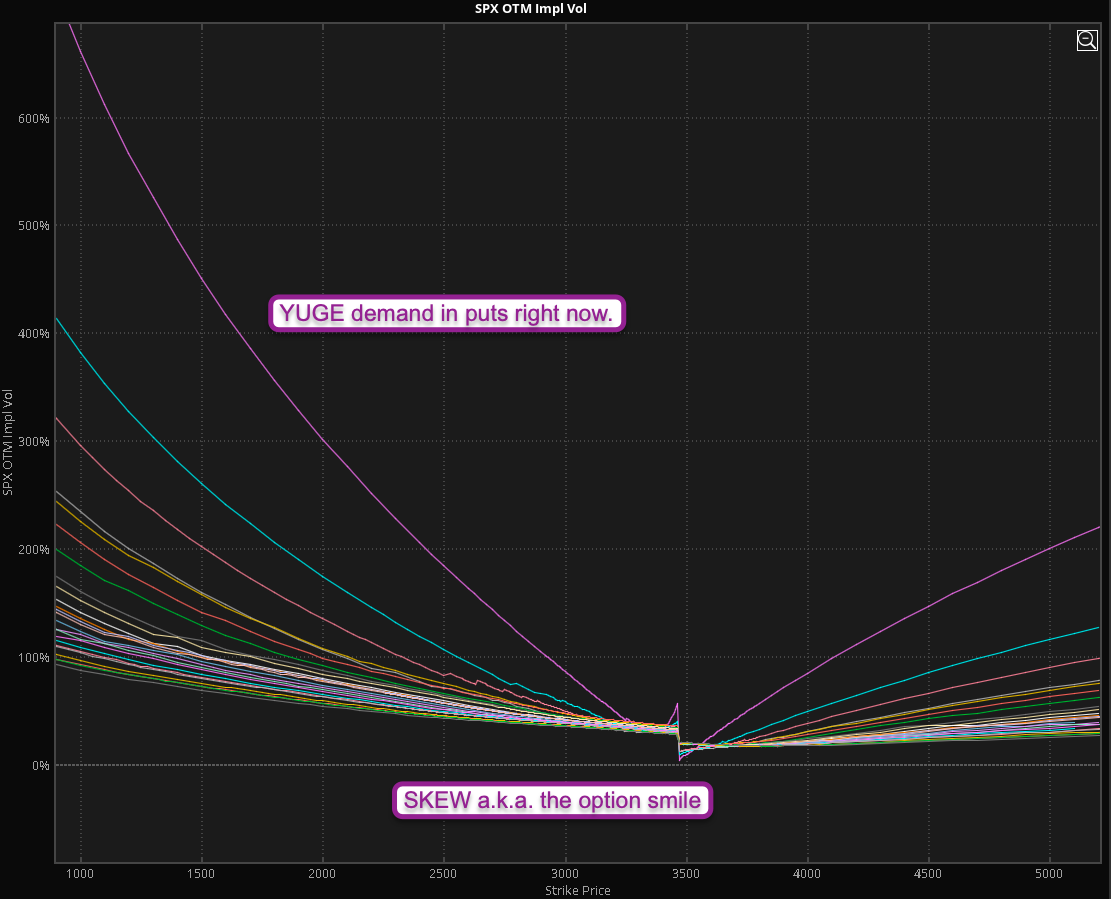

Of course what’s a lot more disconcerting is this:

[MM_Member_Decision membershipId='(2|3)’]SKEW across the SPX option chain, otherwise known as the ‘option smile’. Well it’s grinning rather cynically as put buying activity is off the hook with put premiums far out pricing call premiums at a comparable distance.

I incidentally saw that on TSLA the other day when pricing out an iron condor as you may remember. Risk is NOT evenly distributed and this tells us a LOT about the mind of the average investor or institutional trading firm.

So while we d not see much activity on the price side right now, if you bother to look underneath the hood you’ll find everyone scrambling to get their paws on some downside protection. Whether this is due to the expectation of a Biden or Trump win I’ll leave to you to decide 😉

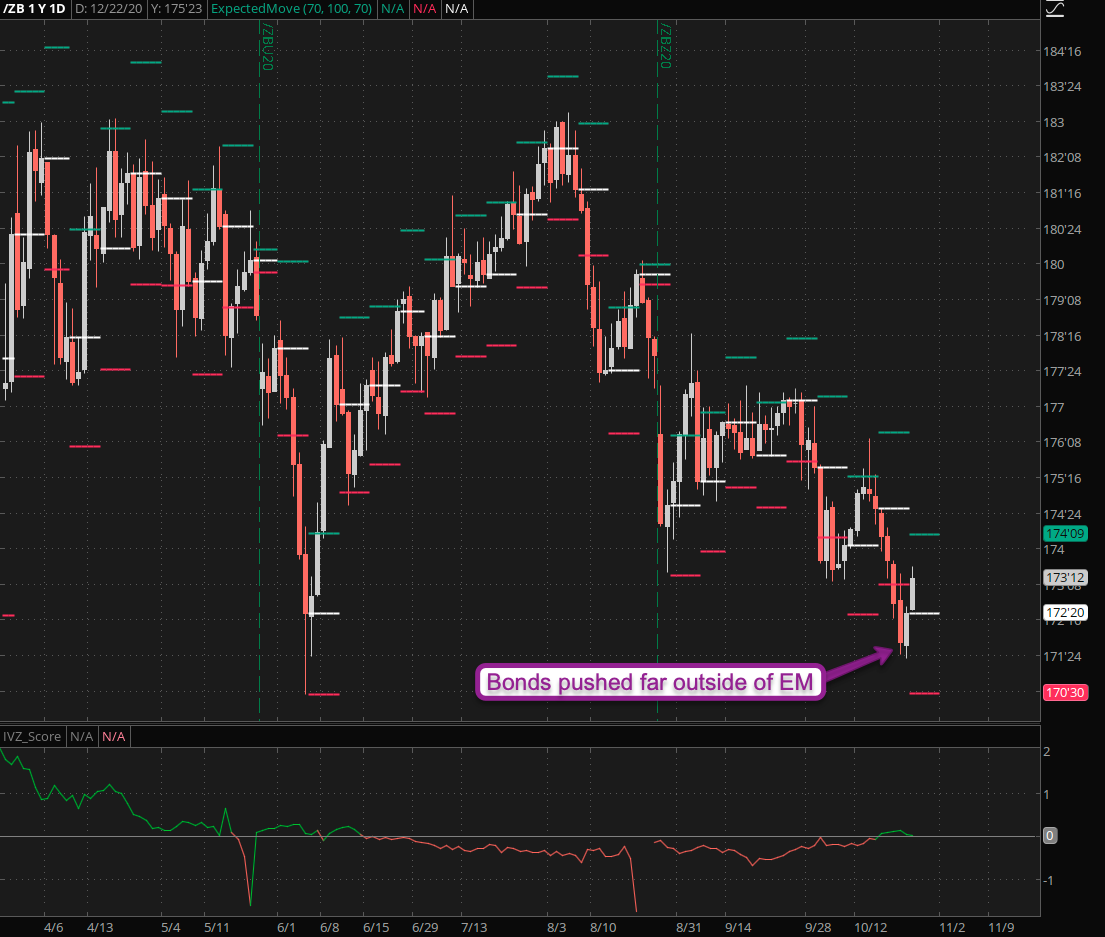

What makes the situation more complex is what I’m seeing in both the bonds (shown above) as well as the Dollar. As in zero interest in either as a possible safe haven from turmoil. In fact the ZB dropped below its weekly expected move and then snapped back a little closing about 0.3 EM ranges below it.

Here’s the Dollar which has been scraping the bottom of the barrel for weeks now. Not sure what exactly it’s waiting for to be honest as neither a Biden or Trump win will spell bullish times for the old greenback.

Bottom line: There’s a reason why institutional investors are bulking up on OTM puts. It’s not something I recommend for retail traders in general but there are exceptions and this is probably one of them. Yes they are currently expensive but only a handful of them could be worth quite a bit should the proverbial excrement hit the fan.

However, that said – my own MO right now is two-fold:

- OTM iron condors (explained the other week and I’ll be releasing a course on that late this year).

- The ‘hammock’ trade – which is a bit more complicated but in essence consists of a call ratio backspread in combo with a ‘fat butterfly’ on the put side. Also something I plan to make a course about as time permits.

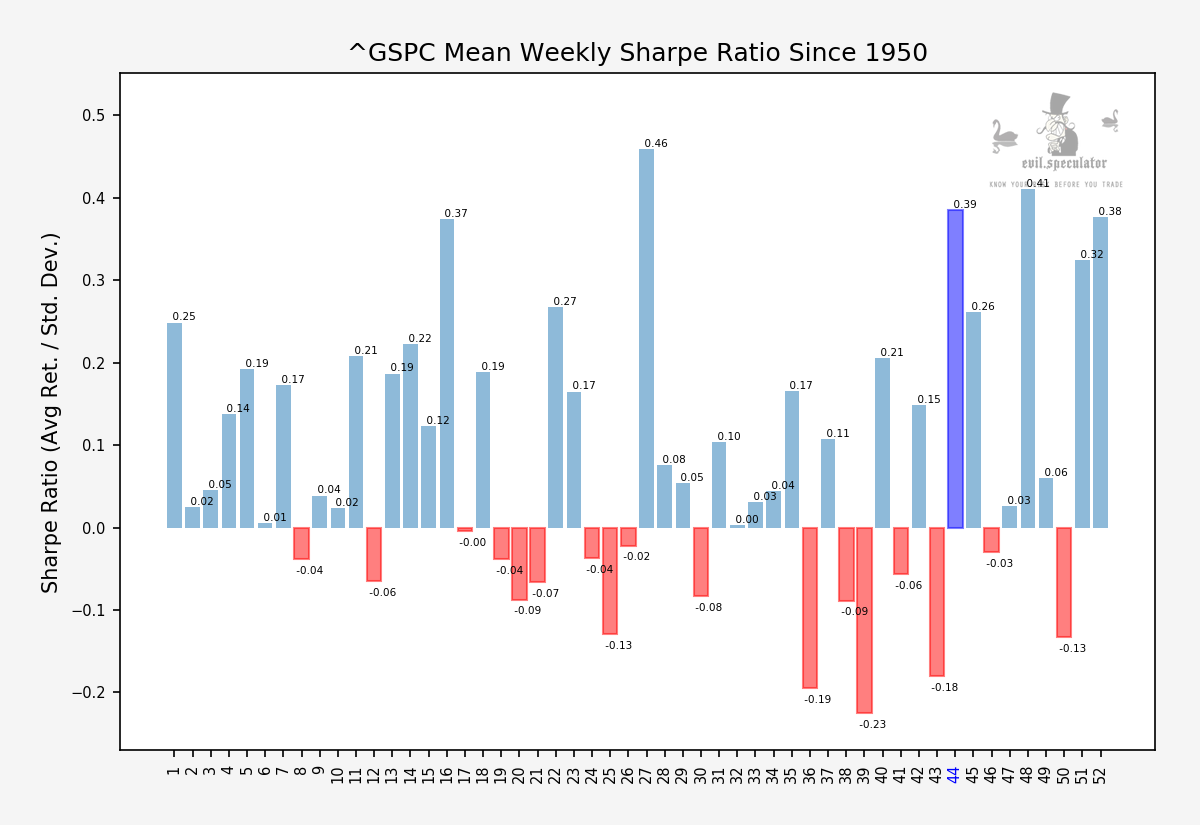

I almost forgot to post the weekly stats – so here we go: Sharpe ratio for this week is expected to be pretty damn good – if it was a normal non-election non-COVID week.

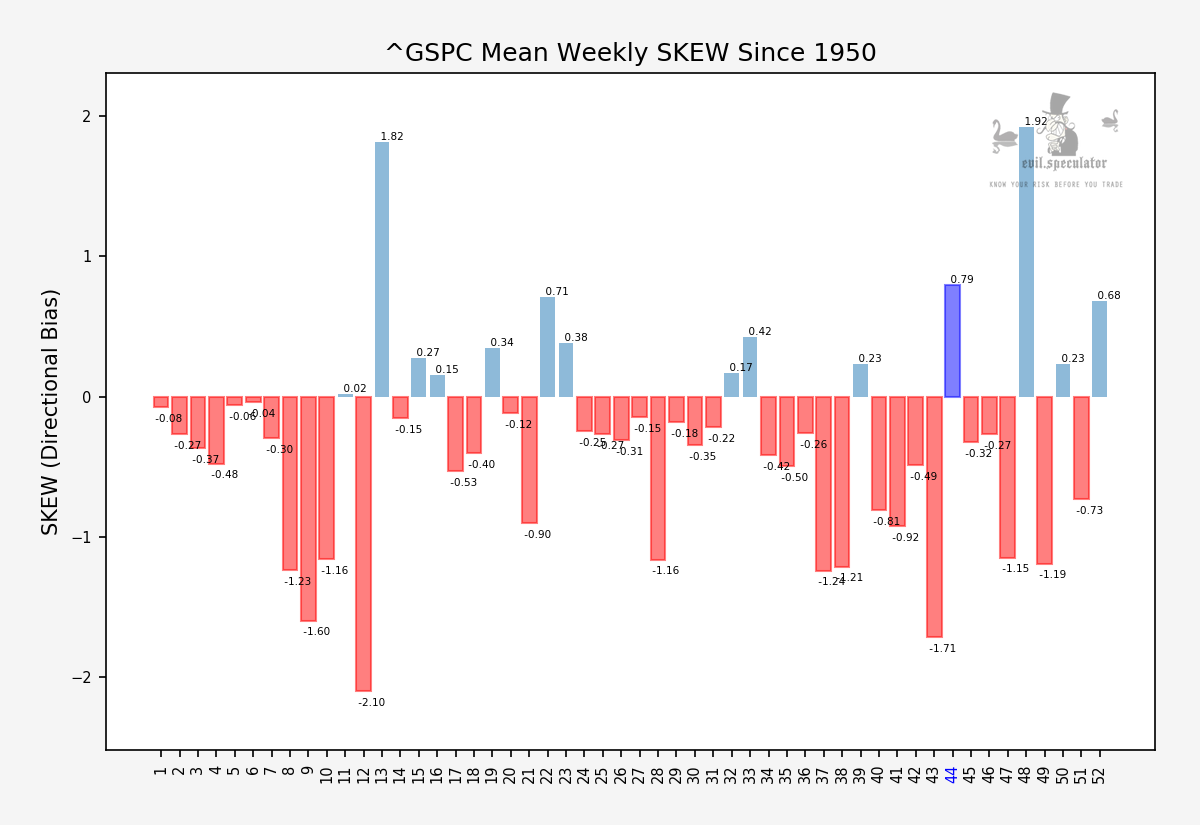

The big issue however is SKEW and if you aren’t firm on the concept let me just show you:

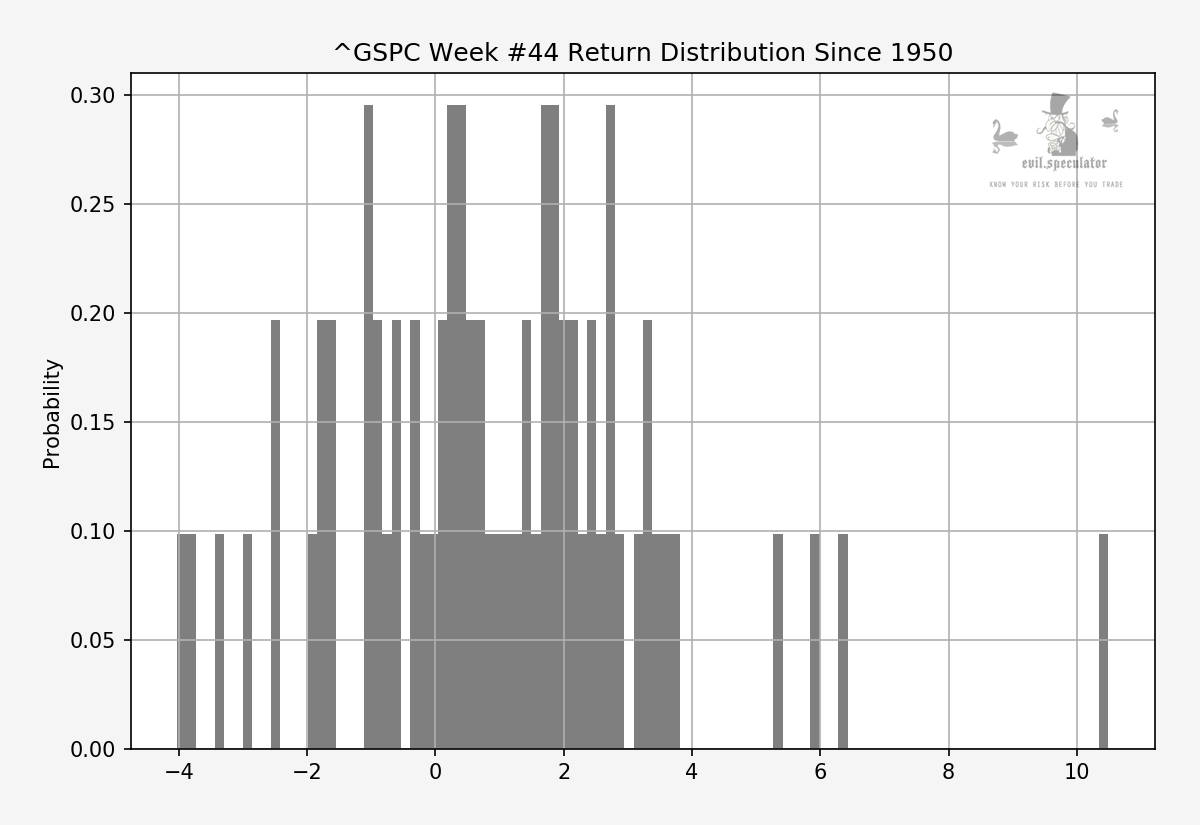

See how there’s a tight accumulation in the negative range – it’s being offset by a bunch of juicy outliers. Which gives us a positive week on average but things are obviously a bit more complicated under the hood.

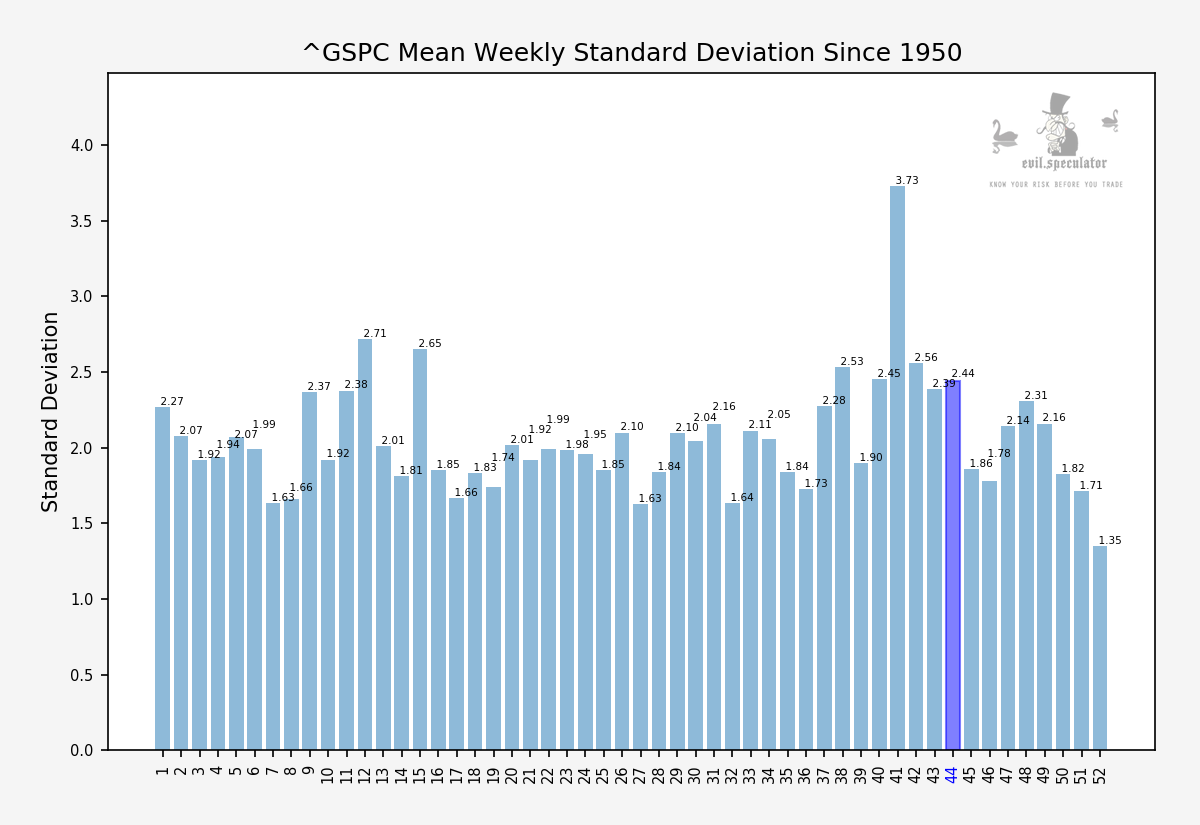

Standard deviation – again under normal circumstances – is slowly dropping off and we are steadily approaching what usually would be the coveted EOY Santa Season. How this will play out in 2020 – I have no bloody clue.

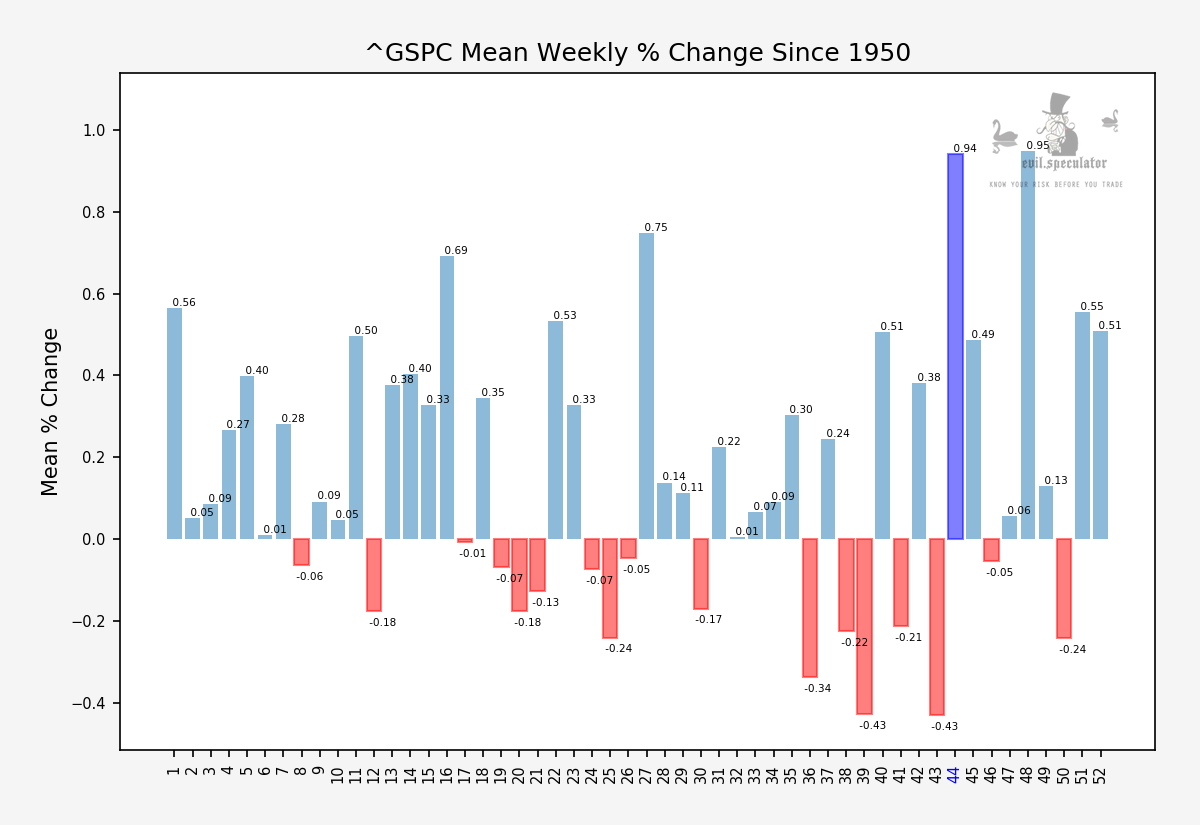

Finally here’s the weekly % change – oooops – that’s quite a range but I think it’s probably mostly due to the big outliers on both the up or downside. So under normal circumstances we would see quite a bit of movement during the week until things settle on Friday.

Bottomline for the stats: Watch your six – expect a lot of gyrations that on the surface make little sense. In the end however I wouldn’t be surprised if we settled near the week’s open again.

Happy hunting but keep it frosty.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]