Don’t you hate it when someone you know is proven to be right about something and then keeps on rubbing it in by saying ‘I told ya so’? Well, I hate to be that guy today (actually I don’t) but heck… I TOLD YA SO! What am I droning on about again? Implied volatility of course – what did you think?

So let the record show that I have been warning you about a marked uptick in IV for several weeks now. And after a bit of a warm up period it finally happened over the past few trading sessions.

“But Mole – that’s just a spike. It’ll settle down again in a week or two.”

Yup, that may indeed be the case. But what many do not grasp about volatility and IV in particular is that they come in waves.

In other words, a sudden rise in volatility usually begets more volatility.

VVIX basically measured realized (historical) volatility in implied volatility. It’s an acquired taste just like asparagus but it’s extremely valuable when it comes to plotting swings in market sentiment.

And yes, if you look at early August for example you’ll see a similar spike that then settled down a week or two later.

Which then was followed by an EVEN BIGGER spike (in both the VVIX and the VIX).

Maybe this time is different (cough cough) but just in case I hope you subs paid attention and loaded up on a bit of downside protection going into January and February.

Because remember my favorite IV chart that I’ve been pimping here on countless occasions:

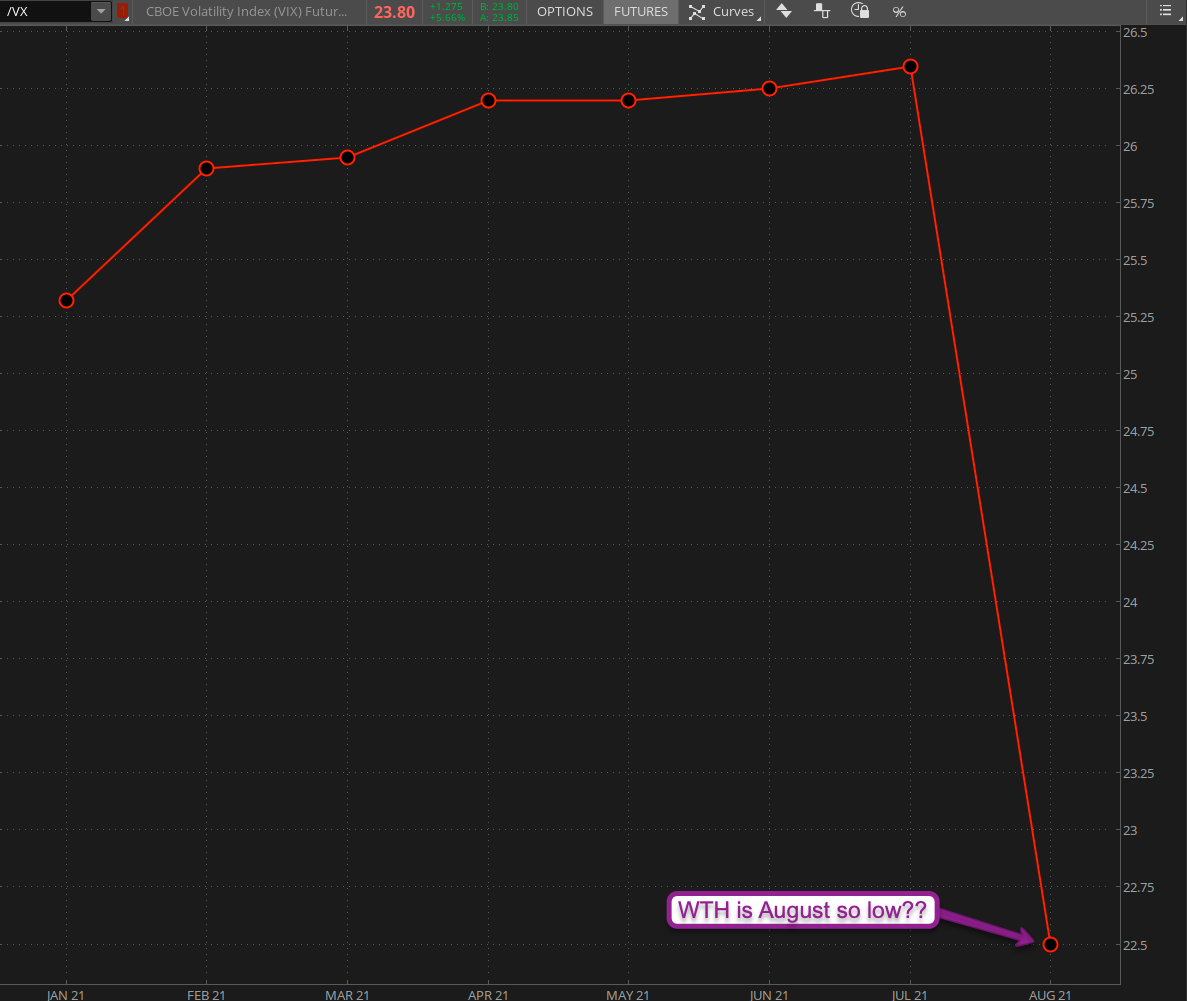

[MM_Member_Decision membershipId='(2|3)’]Yes, of course – the VX product depth chart. Quite a jump across the board.

BTW, why the hell is August so low? Nobody knows… but it’s so far out that nobody cares either.

Compare that with the readings last Monday and 2020 is starting to look like a dry run for 2021. I myself have been eager to kiss this dreaded year goodbye but as the old saying goes:

Be careful what you wish for, you may just get it.

In other words, epidemics, lockdowns, wide-scale looting, political upheaval, a contested election, etc. notwithstanding 2020 has been a brilliant year for equity investors and by extension for us evil speculators.

2021 on the other hand may give us all that plus a crashing stock market. Again, I don’t have a crystal ball. But I know how to read market sentiment and boyo, let me tell you – it’s not looking good right now.

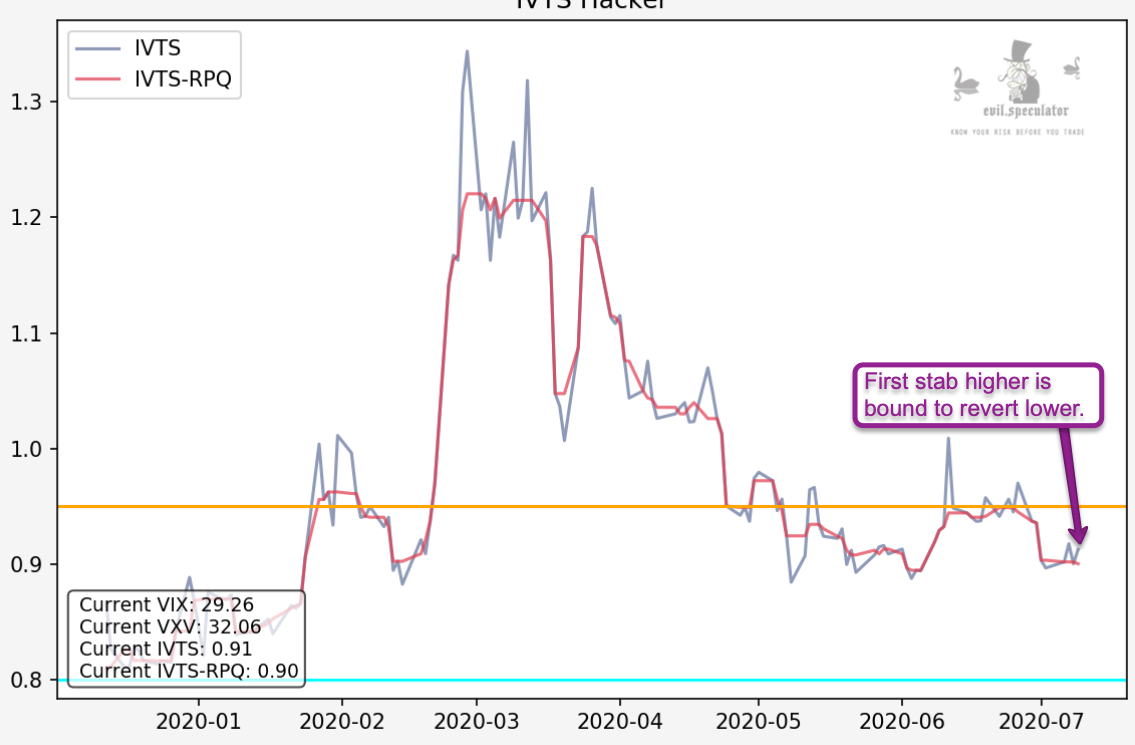

Now that said, my IVTS hacker chart shows a spike that is most likely going to be mean reverted next week. So if you are long vega right now today then it may be a good time to cash out and wait for new instructions.

Especially given that weeks #51 and #52 of December traditionally are super earnings weeks. Which supports a final spike higher in equities and by extension of course a drop in implied volatility.

Happy hunting but keep it frosty.

Mole

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]