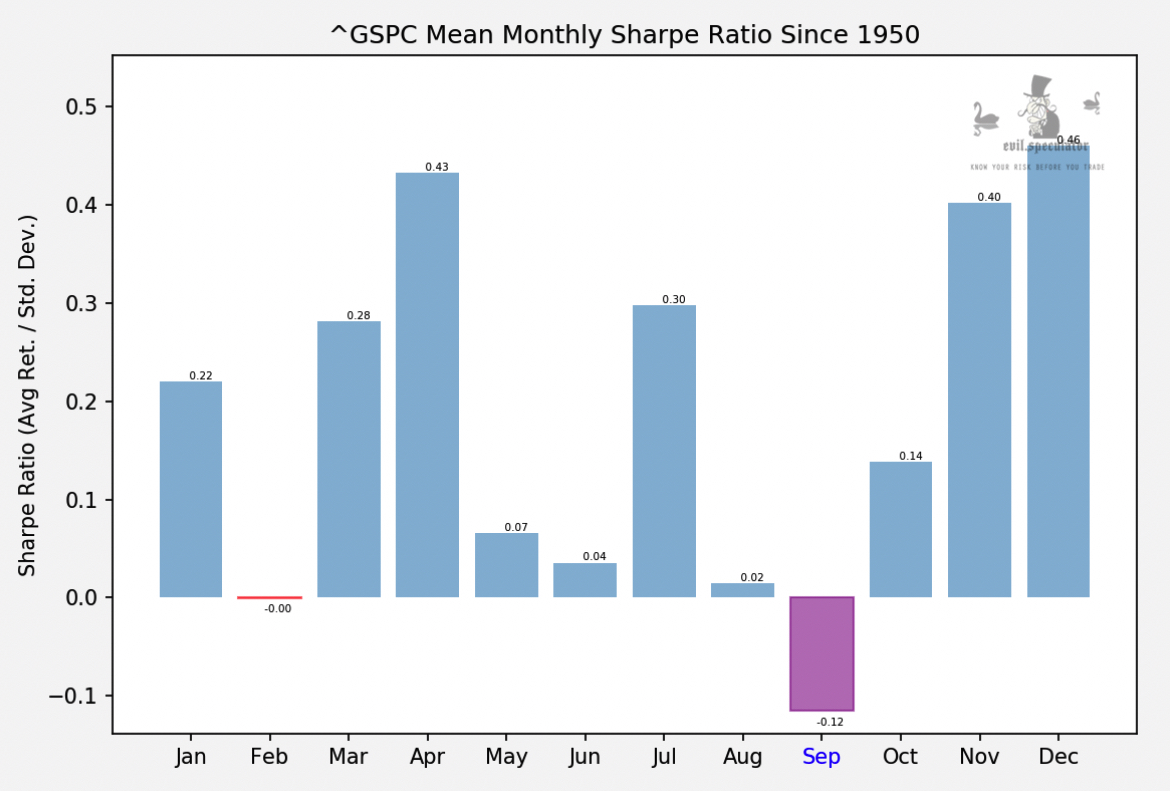

Equities closed September solidly in the red, as was suggested by our monthly statistics that I posted here early in the month. Of course nothing is ever chiseled in stone in the world of trading. But the odds are the odds, and until my crystal ball is back from the shop that’s what we’ll have to content with.

I find it quite compelling that the first negative month since January had to occur in September, especially given this:

As you can see January went against the monthly stats but September more than made up for it. I’ve often mused that September delivers what October promises but I simply could not resist the lure of a good headline 😉

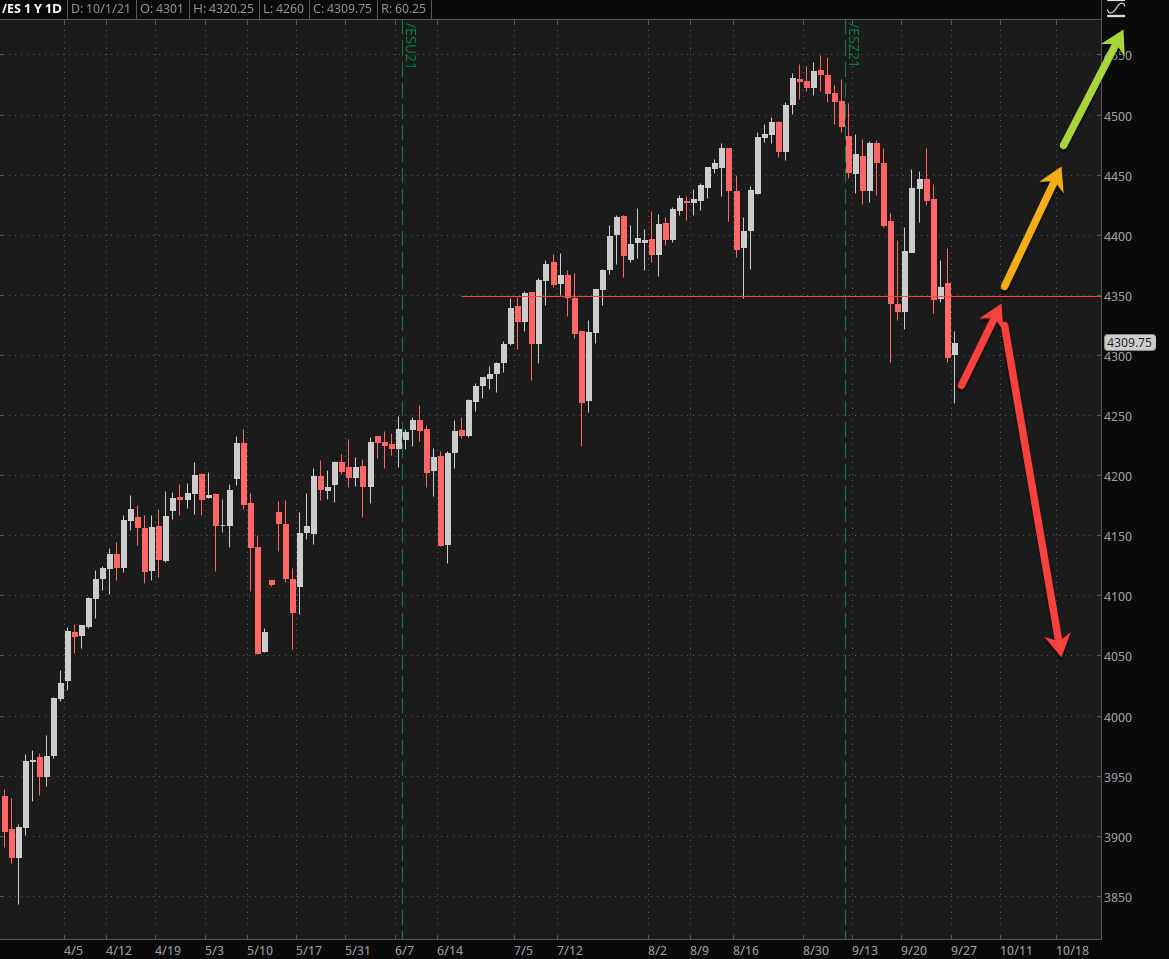

Alright, so let’s talk about what happens next. The futures are recovering a bit after an overnight excursion lower, so the question in everyone’s mind is whether or not we’re going straight down from here.

I personally have my doubts and am currently considering two high probability scenarios and one that’s in the 20 percentile max.

- We pop from here and keep on running higher.

- We pop a bit from here, retest ES 4350 and then fall back toward ES 4050 or perhaps 4000.

- We fall from here and don’t stop until the ES 4000 mark.

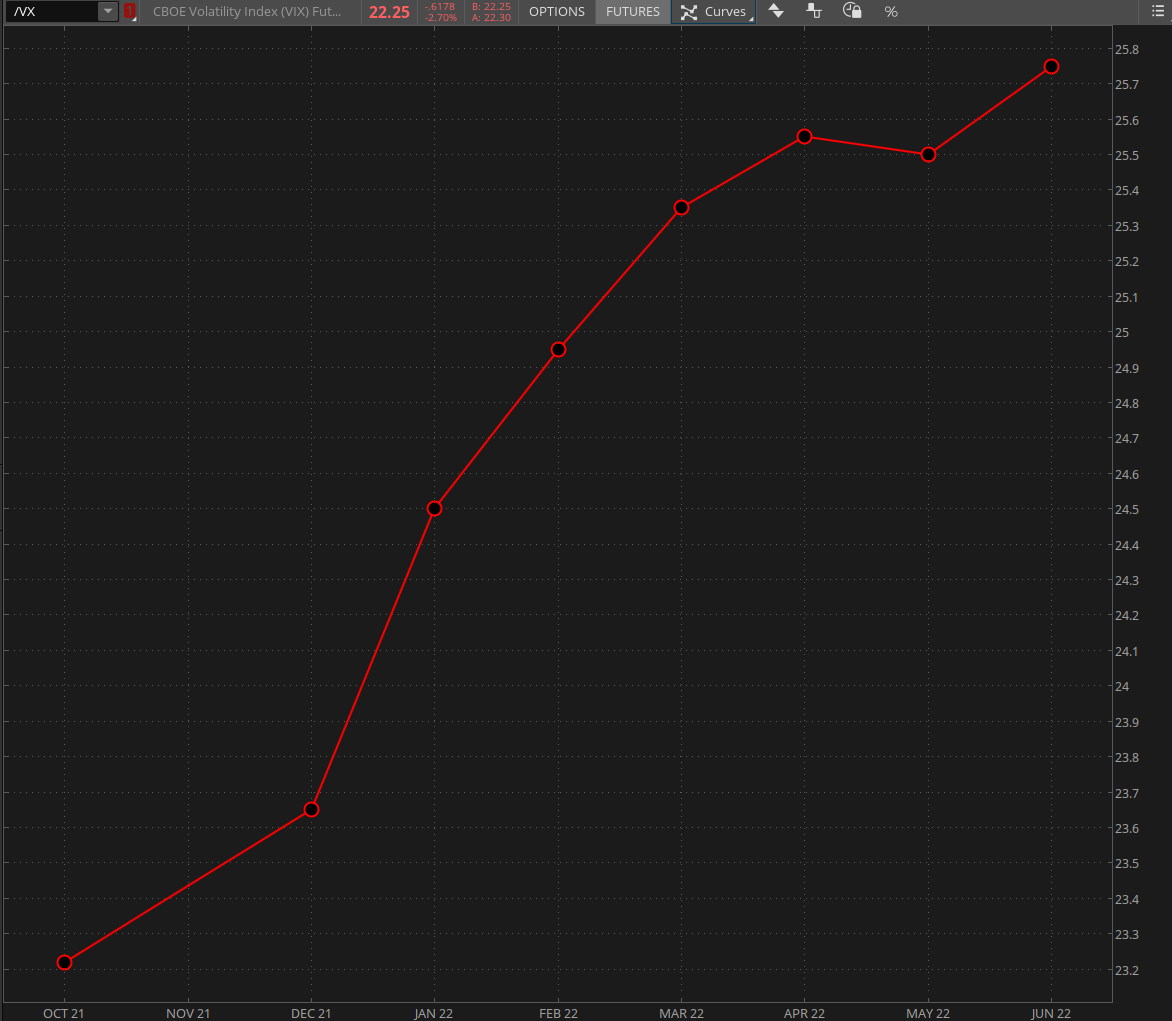

My reason for dismissing scenario 3 as having the lowest probability is mainly what I am seeing in implied volatility right now. The VIX fell all day yesterday plus there is this little monkey:

[MM_Member_Decision membershipId='(2|3)’]

The VX term structure remains in steep contango. That does not exactly scream impending market crash to me.

Also the 10-year treasury notes seem to have bottomed out. If 131 and change marks a floor we’ll see a major bounce in big tech and perhaps a bit of a drop in finance.

This also suggests the following:

- Investors are complacent AF and will be unprepared should the market slip on a banana peel.

- We are heading into a green fall/winter season.

I honestly would prefer scenario 2 as there’s been enough misery for the past two years. But given what I am seeing on the news roll in regards to a laundry list of shortages across the board I have a hard time imagining how this would play out.

Then again, I should remind myself that a bull market climbs the wall of worry and boy oh boy, in living memory had we ever more worries than at this point in time?

Keep an eye on finance should we recover here and breach that inflection point near ES 4350. The sector has largely remained unscathed over the past month and if bonds start dropping again then this is where I would be looking for long positions.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]