One single overarching characteristic that separates seasoned traders from all of the noobs and spectators is that they have grown to be a lot less reactive to market events. This applies equally to large and sudden moves to the up- or downside. The market has a knack for pressing our collective buttons but once you’ve been around the block a few times you start to see a pattern and like a seasoned poker player you begin to recognize a few tell-tale signs that monkey business may be afoot.

As in all things in life one often exchanges one set of problems for another. With more experience there is a risk of becoming too complacent or to cynical when signs of trouble arise.

I always make an extra effort to emotionally detach myself from my own book as well as my prior analysis/commentary in order to not fall into this trap.

Looking at last week’s price action I could not help but feel a bit skeptical about the acceleration we started to see since Tuesday all across various verticals (i.e. finance, tech, and even bonds).

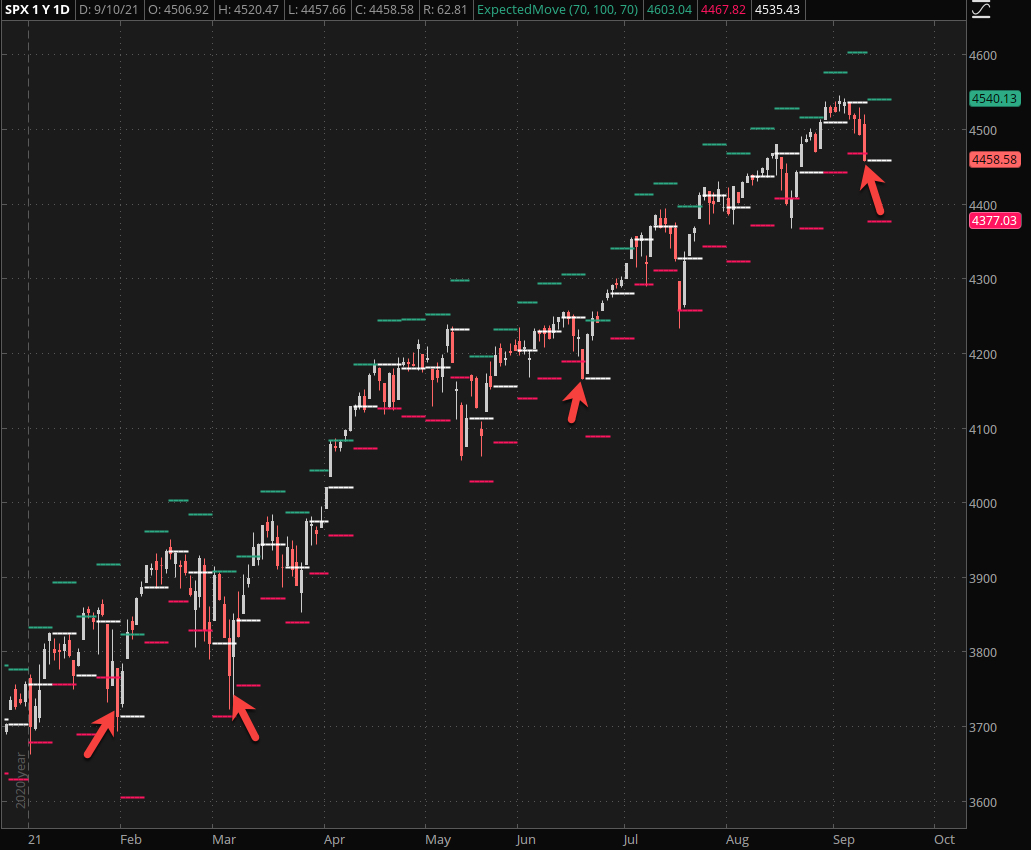

What stood out distinctively however was the fact that we closed the week far outside the lower expected move threshold. The chart above shows us only the auto-calculated thresholds and the real one (based on the prior Friday’s closing ATM straddle) was actually a few handles higher.

Big tech had been lingering listlessly for well over a week and the current drop through the tentative support line I have drawn does not come at a huge shock.

Finance has been in the doldrums for over a month now and if one were to look for short victims this is the sector I would be looking at.

That said – before considering any bearish endeavors let’s take pause for a moment and dig a bit deeper.

[MM_Member_Decision membershipId='(2|3)’]

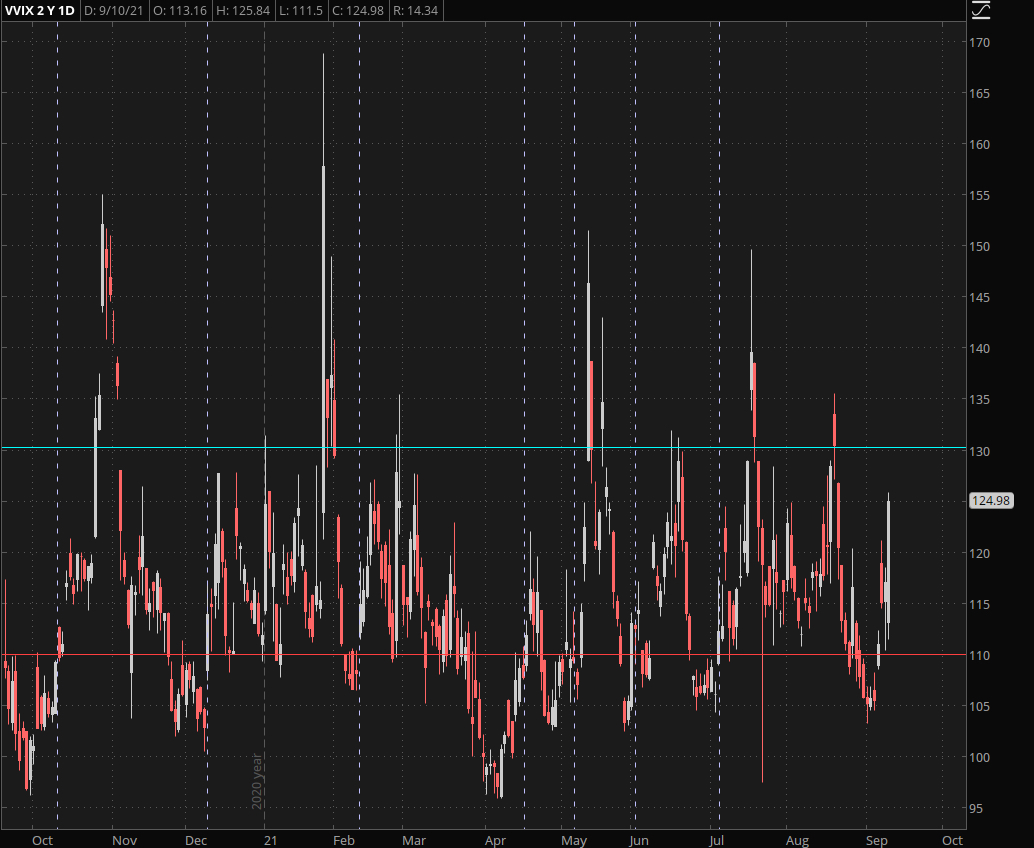

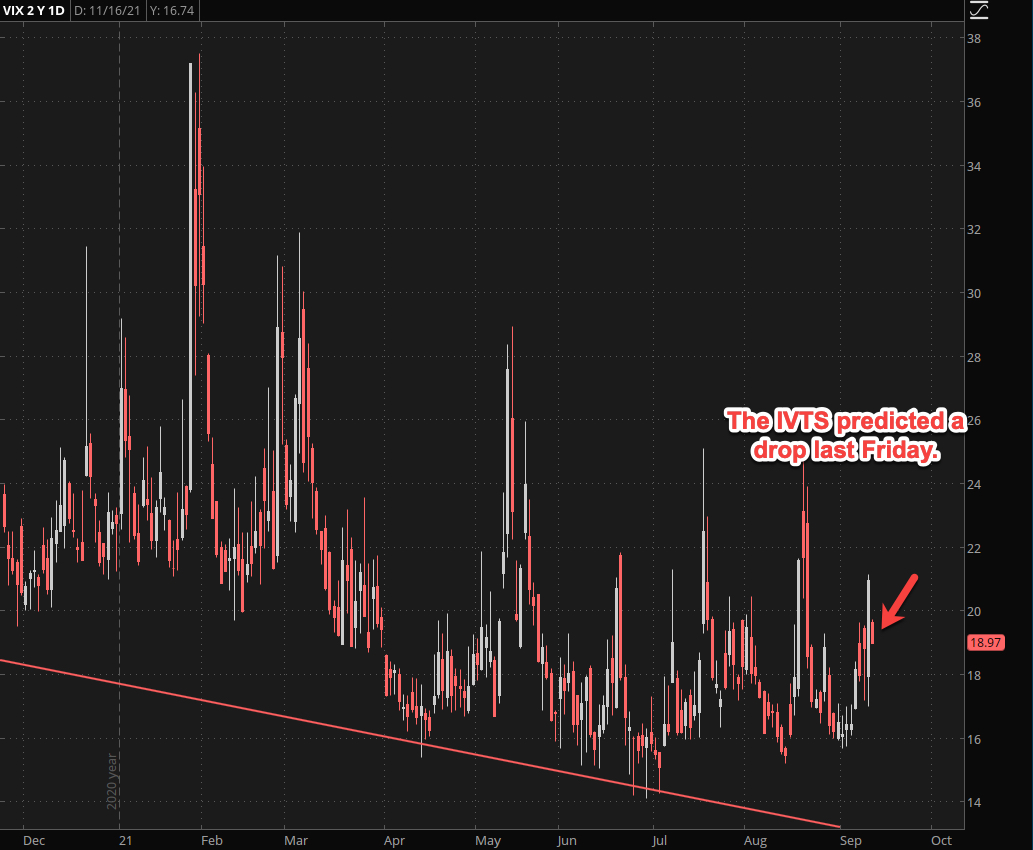

Let’s start with the VIX: It’s been warning us about a possible carpet pull for a while now but the summer lull kept a lid on things until last Tuesday.

Given the mid August spike it was clear to me that we would see a bit of follow up RV as implied volatility does propagate in waves and usually does not just quiet down. Plus October is looming 😉

The VVIX pushed above the vomma threshold at 110 on Tuesday as well. This used to be a very reliable harbinger of trouble ahead but in the past few months it’s been largely ignored due to various machinations by the Fed (IMO).

The current spike higher may find a bit of follow up early this week but unless we’re ready to head into a DEEP correction I think the market is signaling that it’s ready for a bounce.

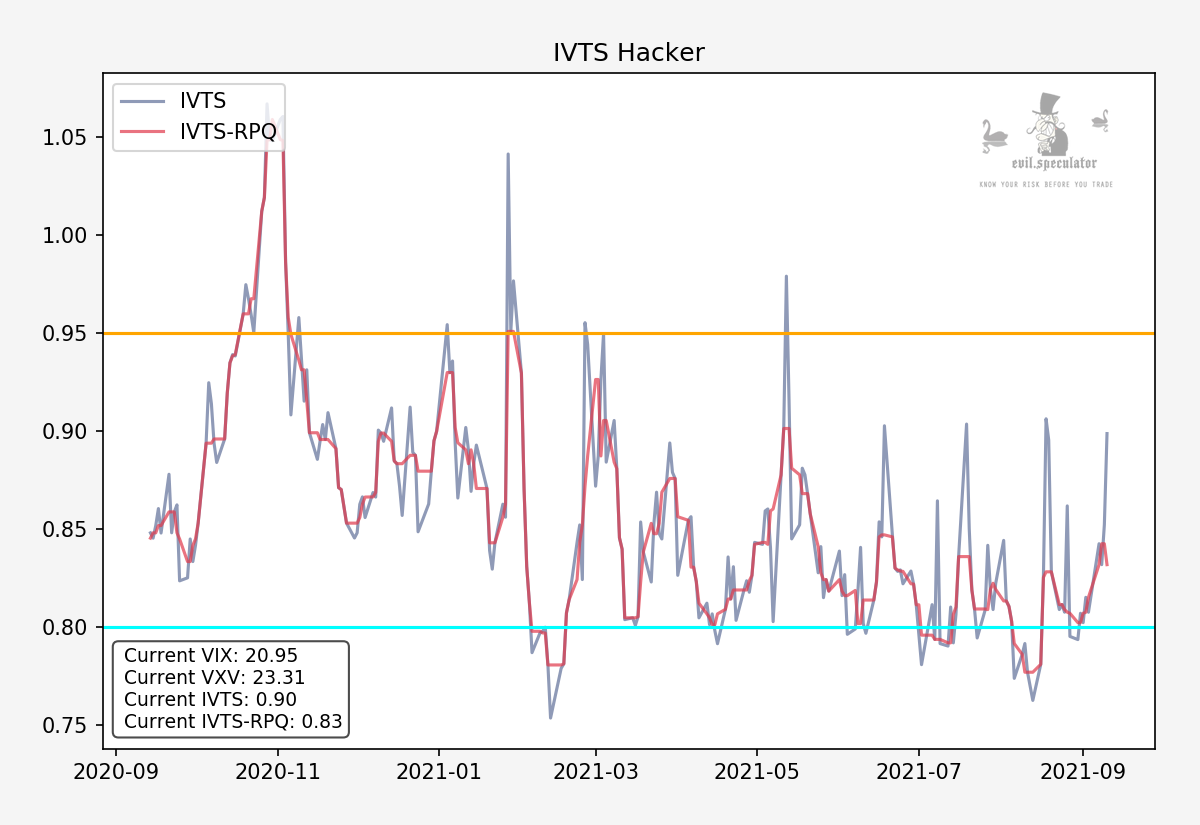

This is also confirmed by the IVTS – the Friday closing signal was FAR above its control line, which convinced me to keep holding an 23/26 vertical spread in the VXX which at that time had reached max loss.

I’m happy to report a significant drop in the VXX this morning – fingers crossed it holds until Friday.

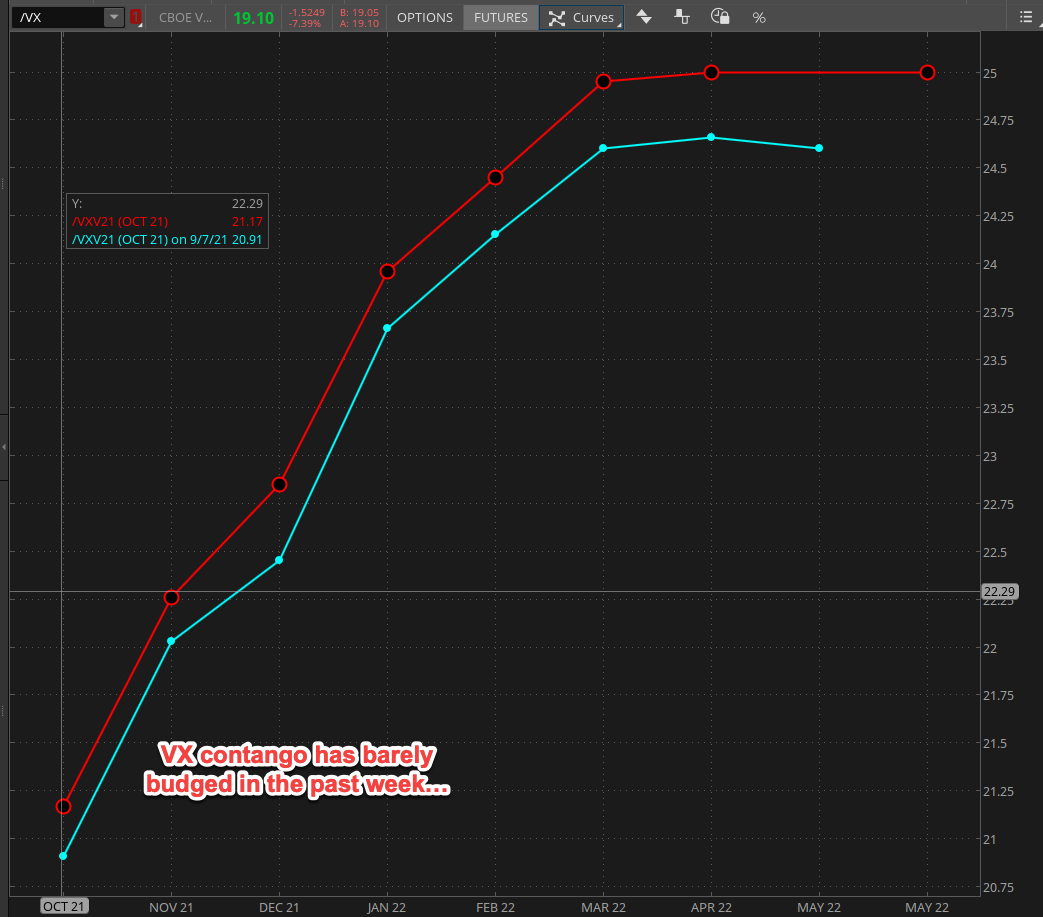

VX product depth is the big whopper however and I deem it to be the most important chart to be shared this morning. The cyan line is a reading from a week ago and the red one is the current one.

What really really surprises me is that contango has remained practically identical all the way into next spring.

If the market would anticipate serious trouble around the corner we would see this curve flatten and potentially even shift into backwardation (meaning the front month would trade at a premium at all others).

Given that we see no signs of that happening there are two possibilities to content with at this point in time:

- The current correction is b.s. and we’ll bounce back by mid-week.

- The market is SERIOUSLY underestimating the current wipeout potential. Which in my estimation is not insignificant.

I am currently operating on assumption 1) but will reduce my position sizing and various trading activity this week to a point where I won’t lose much sleep if scenario 2) ends up slapping us sideways.

Happy hunting but keep it frosty.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]