Well that didn’t take very long. Much to the collective chagrin of the perma-bears (i.e. the majority of retail traders) this effervescent equities market seems to always have another trick up its sleeve. In actuality it’s the same old trick over and over again, but per the time tested maxim: if it ain’t broken don’t fix it.

Once again the weekly expected move threshold was instantly defended, which was to be expected but more about that a bit later.

First let’s talk about how the game is currently being played and how it has been played for the past six months minimum.

And the answer to that is: Sector rotation.

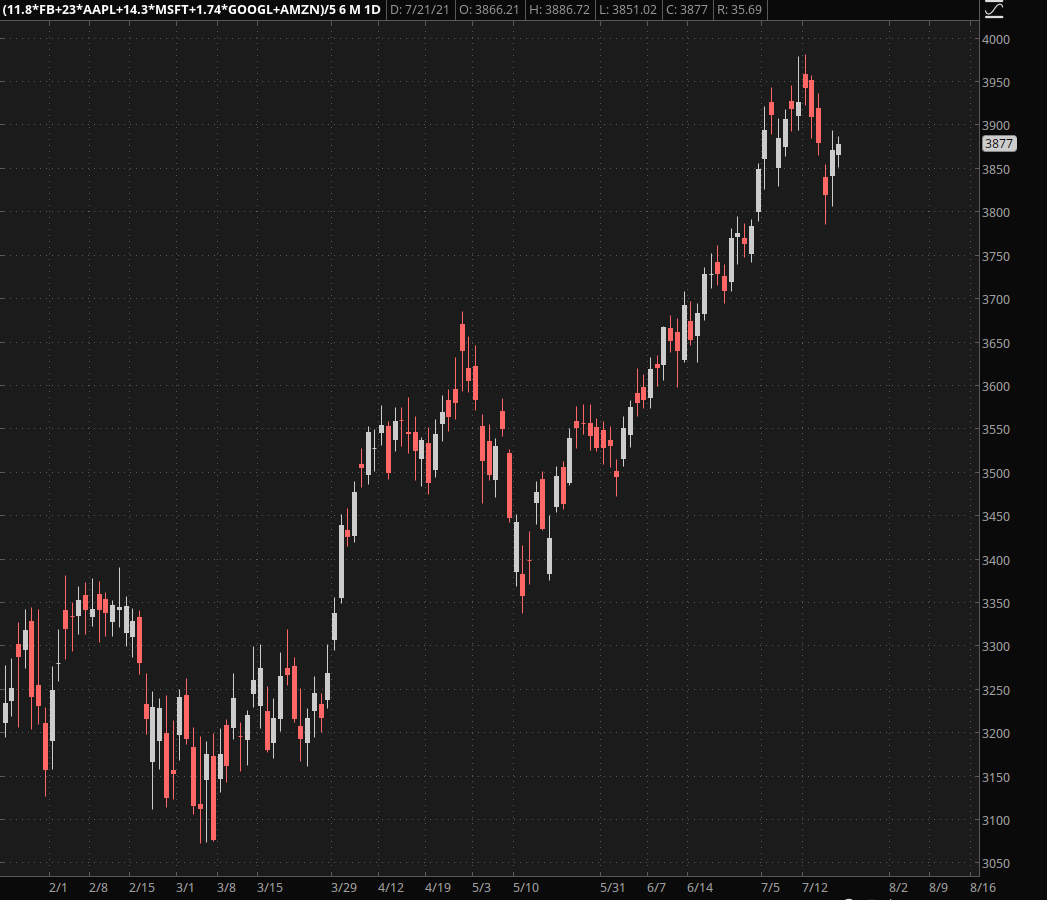

Remember not too long ago when big tech was cruising a wave of buying pressure all the way into new ATHs and beyond?

Well that has come to a halt and the baton has now been handed back to…

You guessed it – finance of course, as shown here via the XLF. Despite being in the proverbial dumpster for the most of the summer thus far it suddenly started to outrun the tech sector.

But why and how?

Meet me below the fold for the answer and valuable tips on how to recognize bear traps like these from a mile away:

[MM_Member_Decision membershipId='(2|3)’]

And of course it’s the bonds, which suddenly took a u-turn after spiking higher. I’m not sure we are going to see a thorough retracement and retest of the previous support zone, but IF we get it then it’ll be one of the juiciest entry opportunities of the summer.

More precisely I would be going long tech (due to falling interest rates) and short finance (once again due to falling interest rates).

See, successful market megalomania does not involve rocket science. Oh well, sometimes it does but I digress.

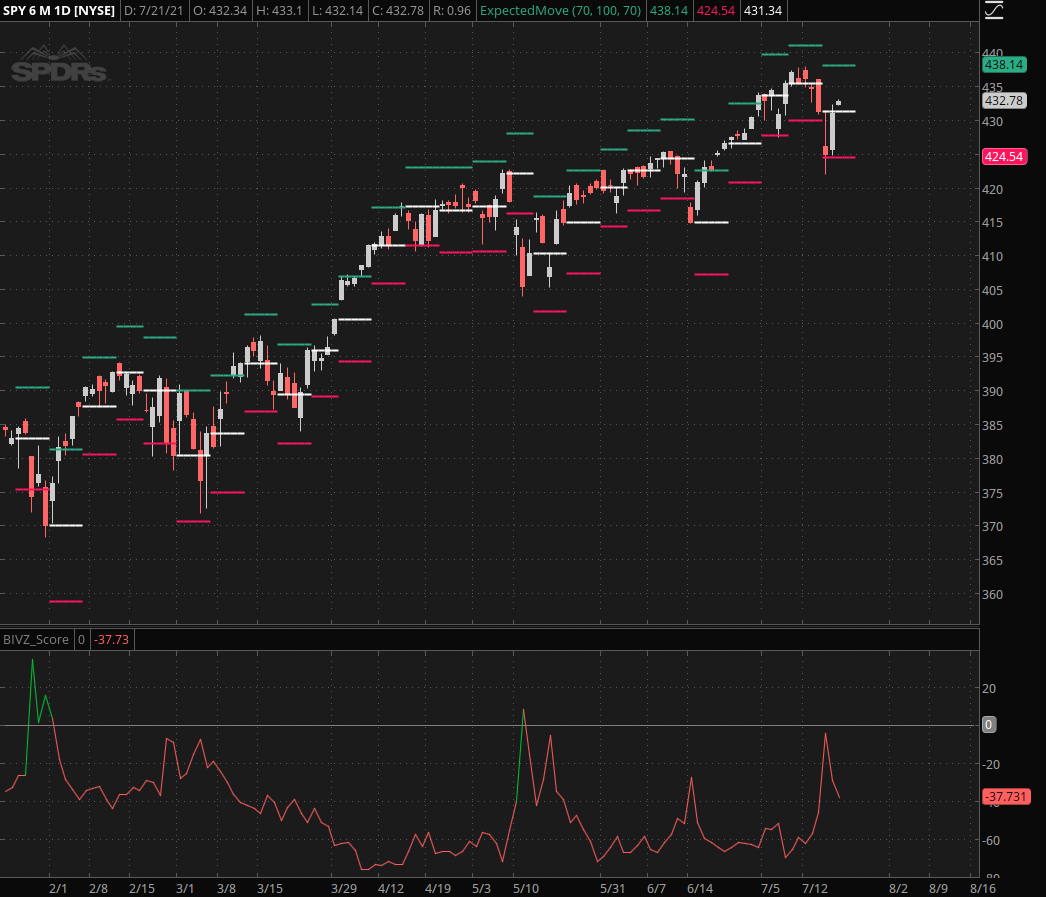

So let’s talk about more interesting matters, specifically how to avoid bear traps like the one that was dangled in front of retail on Monday evening.

That spike looks bearish AF – doesn’t it? And in retrospect it’s quite obvious that it would retrace at least for a day or two. But how do we know?

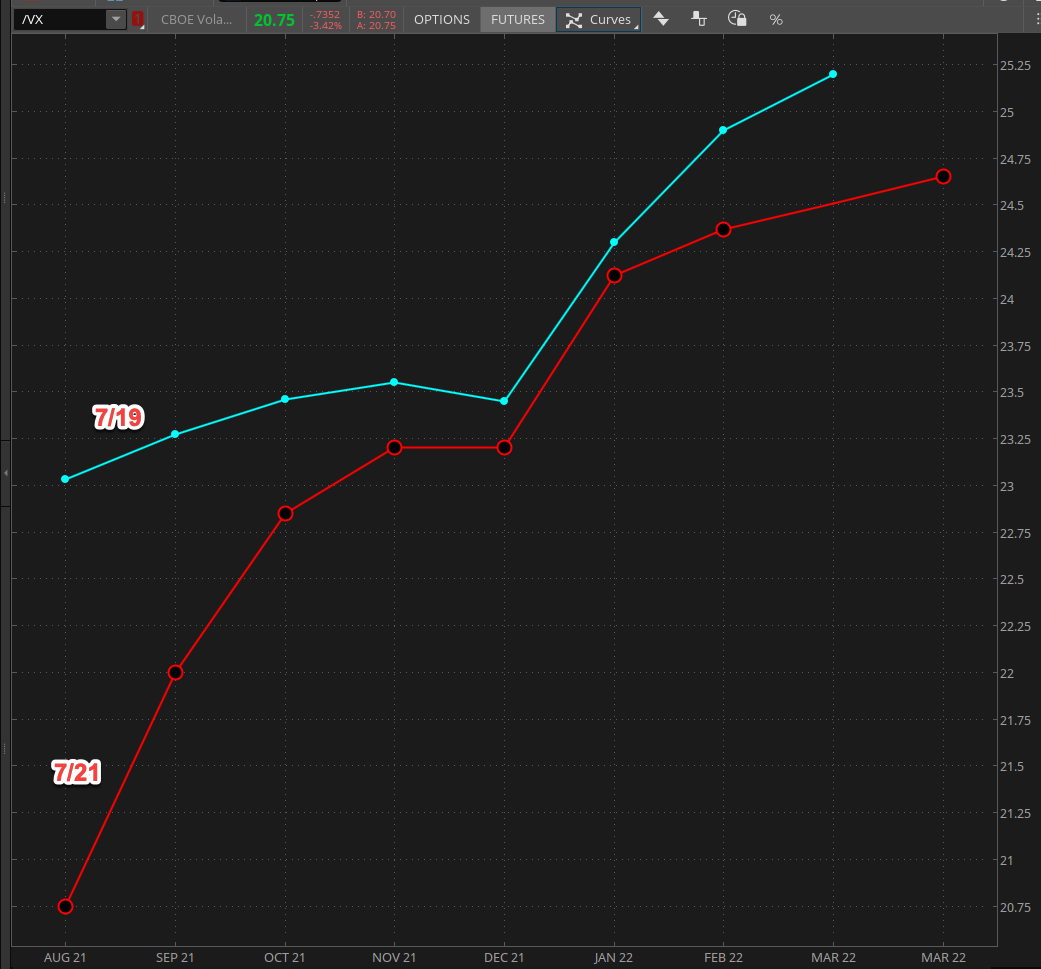

For one – the VX futures product depth gave it away. Yes there was a distinct jump on the near side but the rear barely budged.

Great opportunity for selling front month VX, VXX, or UVXY. Which I have distilled to a science these days and I may even consider offering it as a signal service.

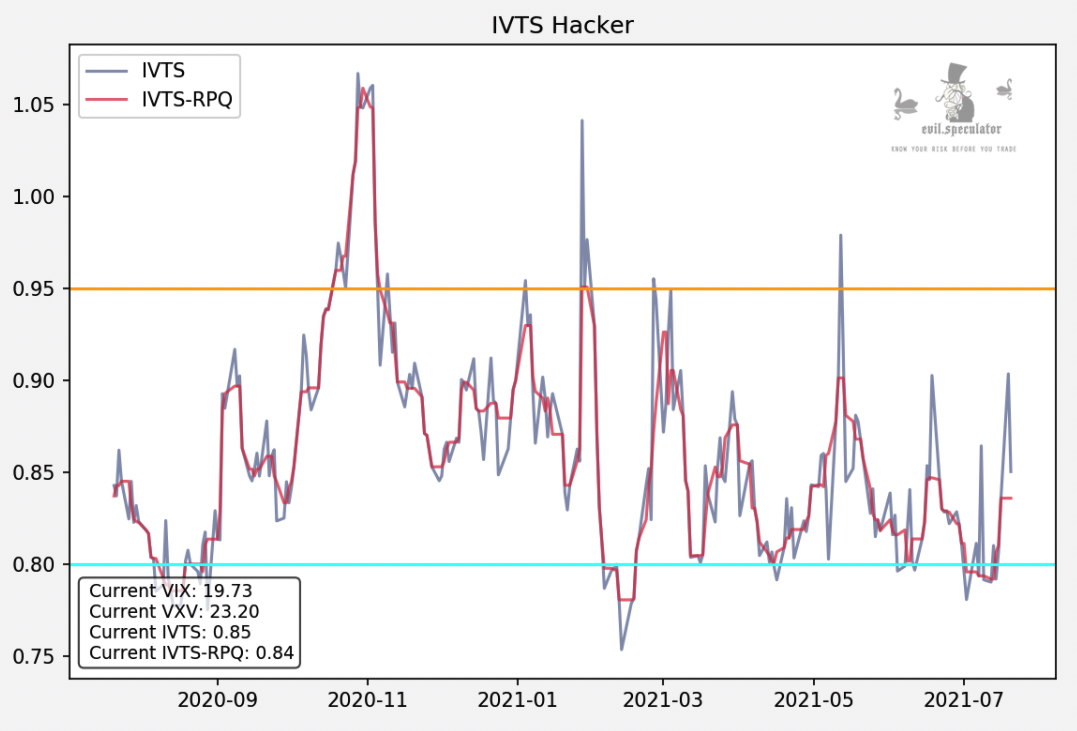

Somewhat related is the IVTS hacker which all of you subs have access to. I strongly recommend you look at times when the IVTS pushes far ahead of its control signal (the IVTS-RPQ – could not think of a better name).

As you can see we’ve got some kick ass mean reversion happening here – and it actually works on both sides. Of course the long side is where all the candy is, so focus on that.

Finally, the EUR/USD – much to my chagrin this time – seems to be forming a new base. I expected a reversal a week ago already and it has not happened yet.

But if you read the price action then it’s pretty clear that it’s starting to range (see those overlapping candles) and that realized volatility has left the building. A bounce in the near term future is most likely on the horizon.

That’s all for today – happy hunting but keep it frosty.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]