Here’s a little tidbit you won’t ever see mentioned on CNBC. The longer markets remain range bound the more gamma risk continues to build up. Which is something you ought to be very worried about, even if you are not an options trader per se.

And I know what you’re thinking: Gamma risk? Heck, I don’t even know what that means, plus I recycle and eat mostly vegan, so I’m doing my part.

Well, if you’ve ever traded options then you’ve probably heard about a thing called ‘open interest’ which effectively tells us the total number of option contracts that are currently being held in the open market.

In a trending market that open interest (o.i.) has a natural tendency to get dissipated across a wider price range.

But what happens in range bound market is that all that trading activity begins to cluster and concentrate. Which increasingly builds up gamma risk as market makers are forced to provide liquidity centered around a relatively small price range.

So what does any non suicidal market maker do? That’s right – they hedge themselves and they do this either by buying stock or – better yet – by buying up SPX or ES futures.

Because once that range is finally cracked all hell breaks loose in the form of counter party risk and they don’t want to be the ones left holding the bag.

Big impending moves usually produce ever increasing option SKEW. So what is SKEW again and why should we care?

I wrote a post on SKEW a few years ago so point your browser there if you’re curious about the basic concept. Here’s a more recent one I strongly recommend.

The CBOE SKEW index above however is a little different as it shows us the delta between premiums of far OTM calls and far OTM puts.

As you can see it’s going complete gangbusters recently but let me tell you – you ain’t seen nothing’ yet!

Here’s the LT panel which goes back all the way to 2012, so almost a decade. Clear trend to the upside here.

What usually happens at those extremes is an explosion in price action – either to the up or downside. This clears out all of that open interest and gamma risk normalizes again.

But we are not there yet and in fact – the SKEW that has accumulated may be the biggest opportunity we will see in a long long time.

So how do we take advantage? Simple – burn that premium!

Which has been a profitable play over the past few weeks as IV crush has done some real magic if you were short premium.

But how is it done? Let me show you…

[MM_Member_Decision membershipId='(2|3)’]Where has AMZN gone in recent weeks? Exactly nowhere – that’s where. In the meantime it’s burning premium.

Same story over here in AAPL – a lo of hoopla but it’s remained range bound.

Would I trade those two, probably not but what I would trade – and have been trading – are the Spiders:

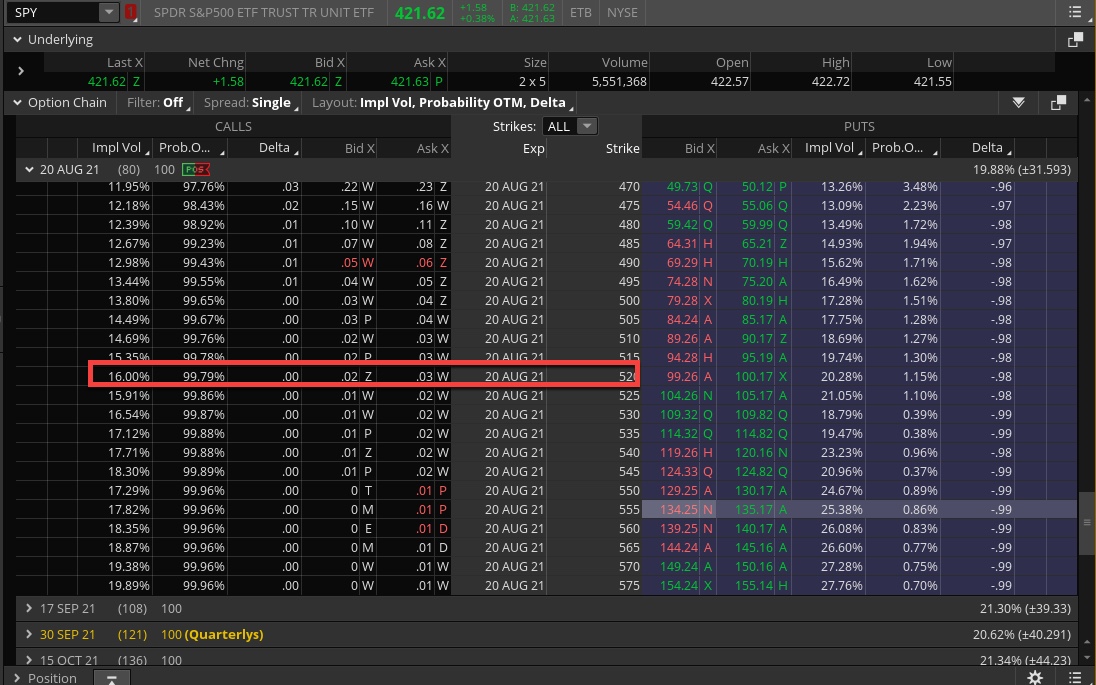

So let’s go about 100 handles out in the Aug 20 SPY contract. I’ve circled the 520 call which currently goes for free… IV is about 16%.

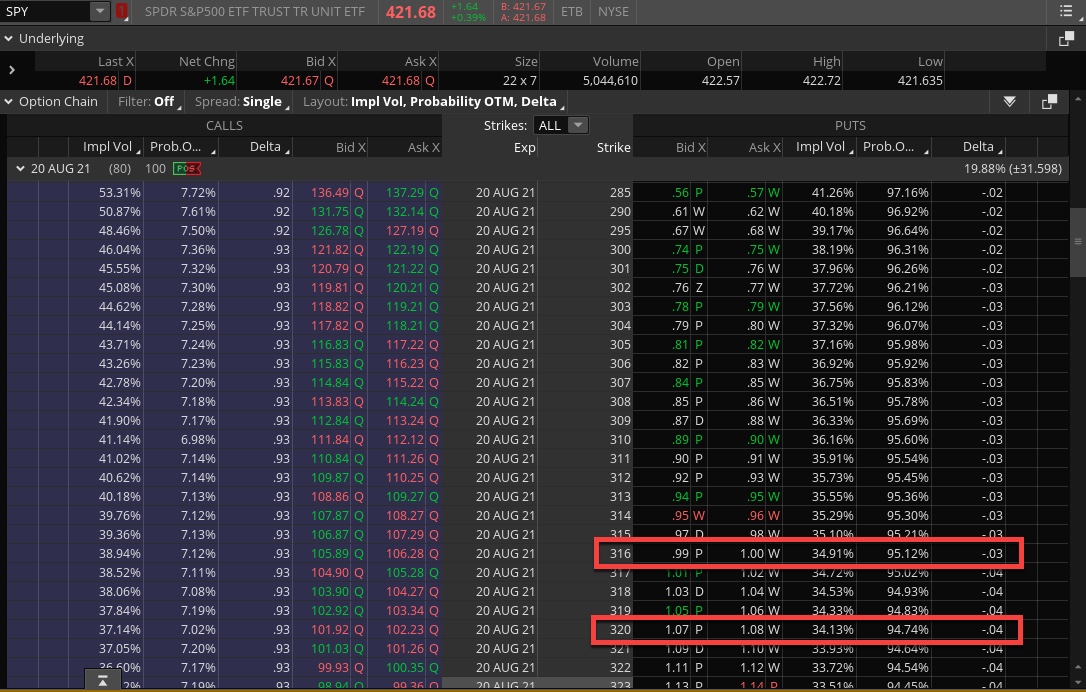

Now let’s do the same on the put side. The 320 put is currently selling for over $1 and if you want to earn a clean buck then you could go and sell a 316 put.

Now once again I know what you’re thinking. Could we see a $100 move in the Spiders ($1000 in the SPX) by August?

Yes absolutely we could. But what most people are not getting is this: It’s already priced in!!!!

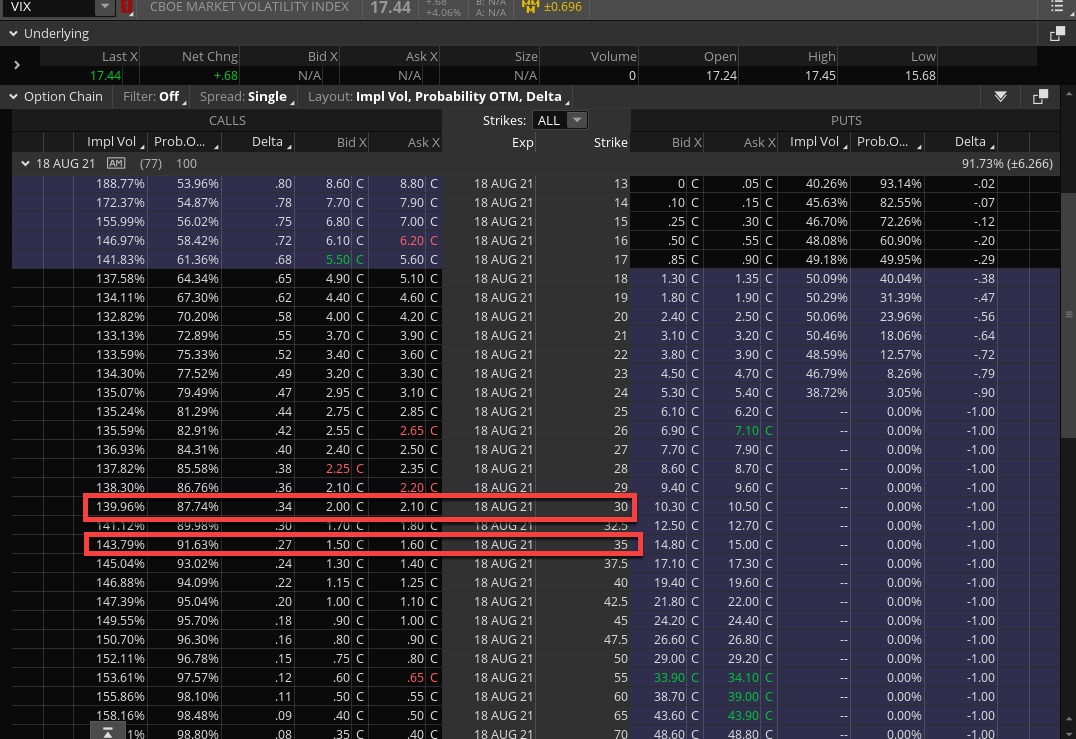

And remember that the VIX is still scraping its YTD lows right now.

Which leads me to this little hedge. The 30 calls ain’t ‘cheap’ but believe me – in a crash situation they would get juiced up like crazy. So I’ll grab a few of those suckers which lets me sleep night.

You know – because I’m completely crazy 😉

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]

Public Service Announcement

Summer is at our door steps and I have decided to take a well deserved vacation starting tomorrow. Where I’m heading? That’s a closely guarded secret but let me give you a little hint – it’s NOT the beach.

I am scheduled to return on the 13th of June. Until then I won’t be looking at the market and I for sure won’t be checking my emails more than once every other day. So don’t bother writing me unless it’s an absolute emergency.

See you on the other side.