This is going to be an awesome day on many fronts – for all of us. My fourth and final Crypto Trading Masterclass is scheduled for later this afternoon at 3:00pm Eastern. Which means I may actually get to sleep more than four hours the first time in weeks, and perhaps even remember my wife’s first name again.

For you crypto aficionados – many of who have been eagerly awaiting the great finale – I promise you that the long wait has not been in vain. I’ve got something very special in store for you guys today. And for all the rest of you who simply despise crypto and especially all those pushy marketing posts as of late this means that the old Mole can finally return back to his old style of programming.

Now I feel a bit guilty about having neglected my old crew for the past two weeks but I’m only a one-man operation (for now) and if I could clone myself I would have whipped up at least three more Mini-Mes and put them to work.

So let’s take care of you guys first because things are heating up on the equities front and low and behold, despite some inactivity over the past week, the subs and I have been getting strategically positioned for several weeks now.

The SPX shows a marked increase in realized volatility, and a formation that looks like a possible exhaustion spike. I don’t want to get my ‘hopes’ up too soon (no, I am not a perma-bear, so take this with a grain of salt), and clearly the way we paint this week will serve for a final assessment.

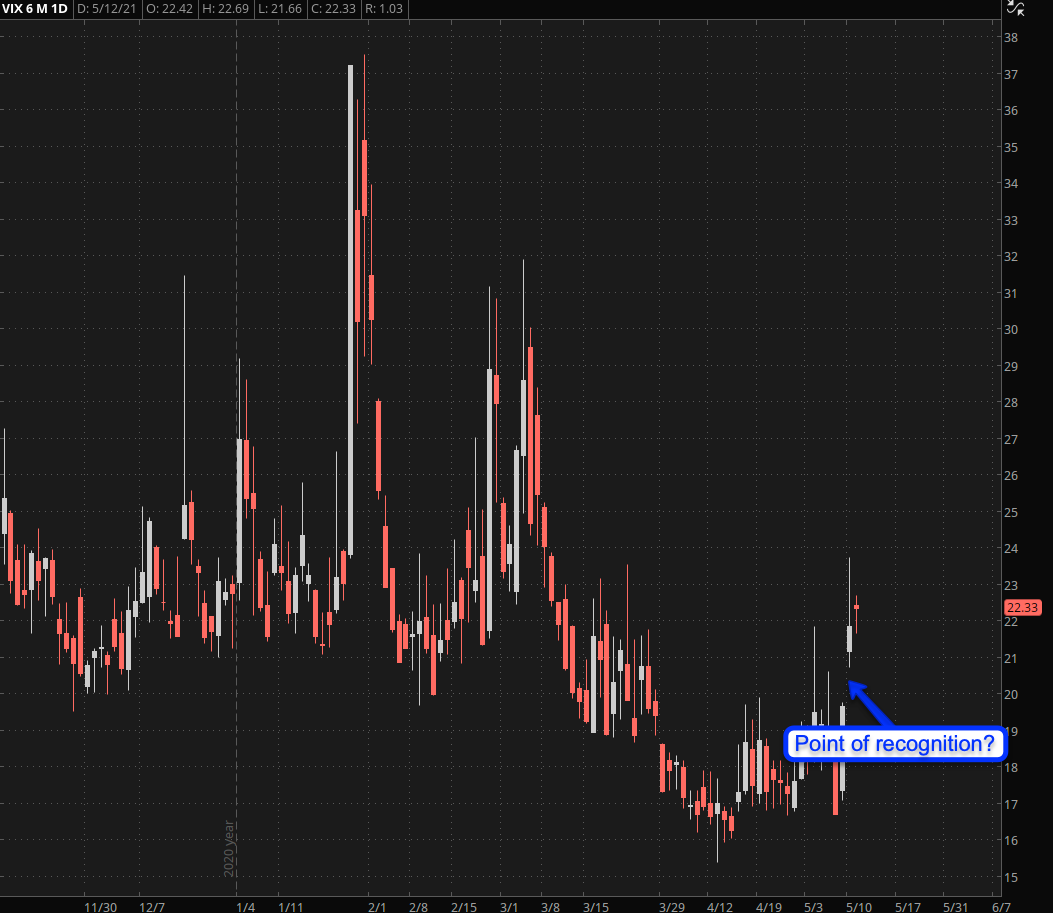

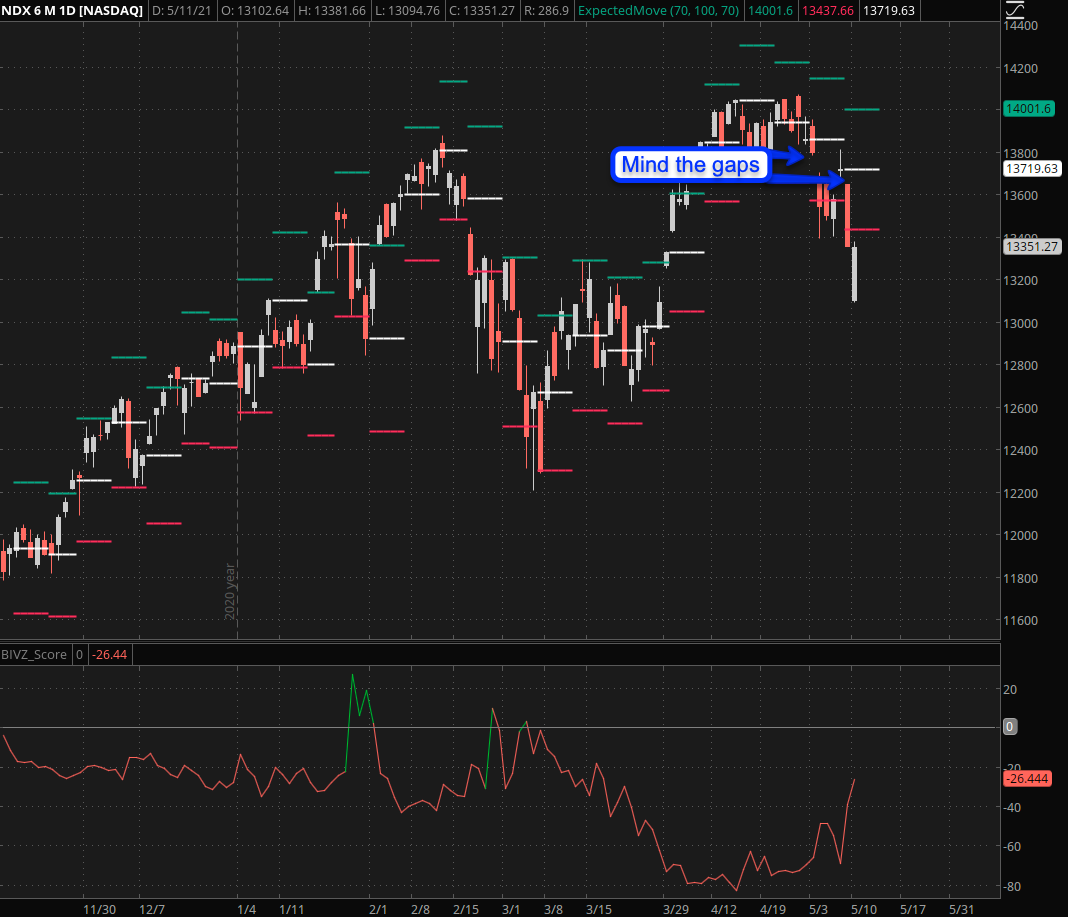

Pay attention to that large opening gap on Tuesday – this is the type of formation I used to refer to as ‘the point of recognition’ back in the days when downside market days weren’t illegal yet.

That point of recognition is particularly pronounced in the VIX, which is starting to look very very ugly and that quick.

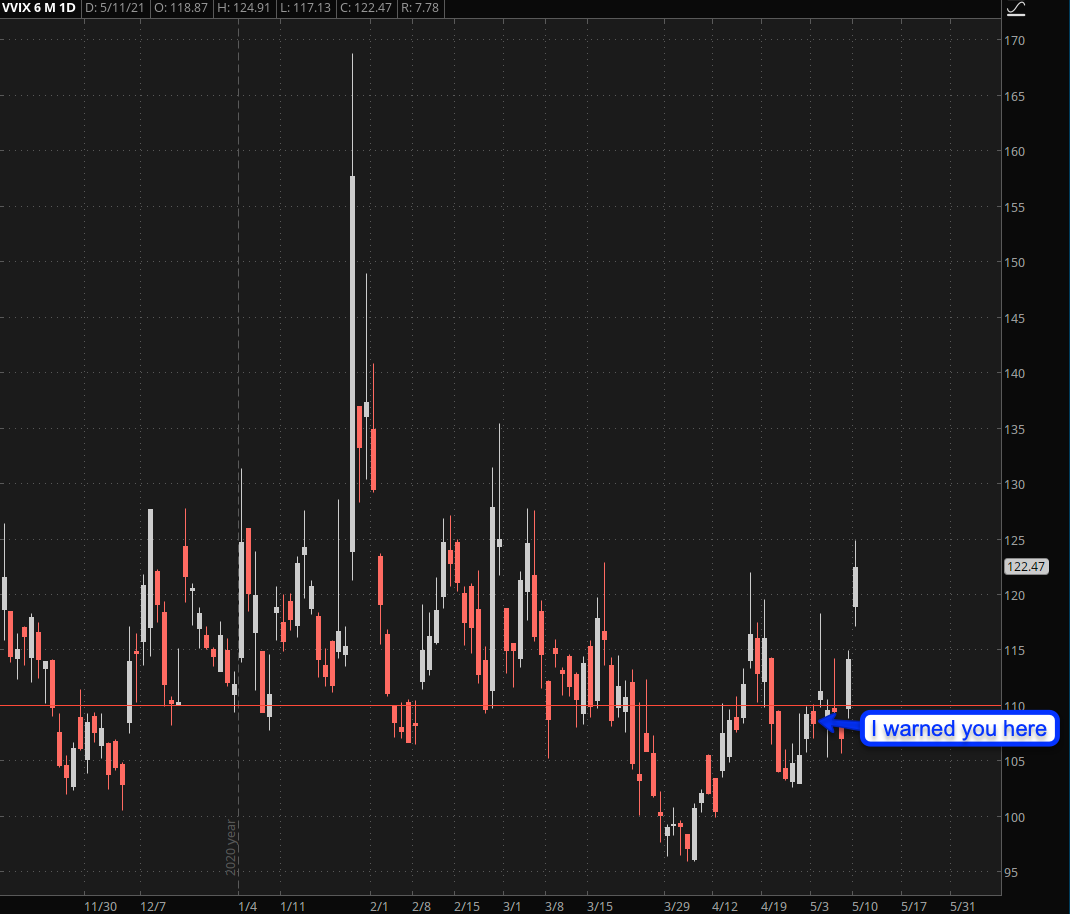

But what’s even worse is the VVIX which is now above our VOMMA zone (remember that post on May 3rd?).

What usually happens after such a large spike higher is either:

- A drop back to the ground within a day or two (90% of the time).

- All hell breaks loose (10% of the time).

So yeah until the FOMC drops its charter the odds for the return of the bear are somewhat slim on a short term basis.

But they just got a LOT better on a medium term basis, and that’s really why I instructed my subs to slowly start accumulating those CYA spreads I have been pimping since February.

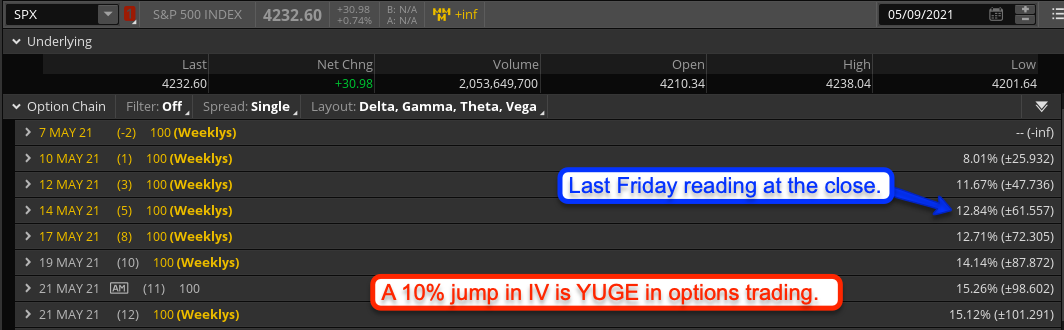

Let’s take a quick stroll down memory lane. Here’s a snapshot of the SPX option chain from last Friday. Take note of the IV reading on that May 14 expiration. It closed the week at 12.84.

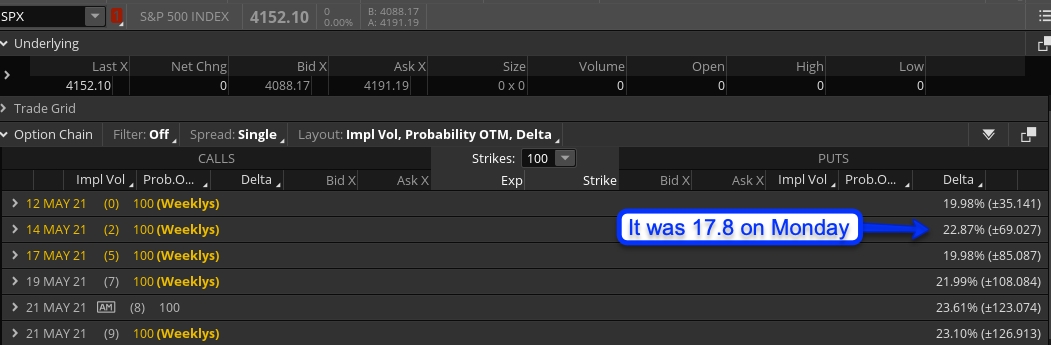

Here’s where we are today. It jumped to 17.8 on Monday and currently stands at 22.87%. That is YUGE!

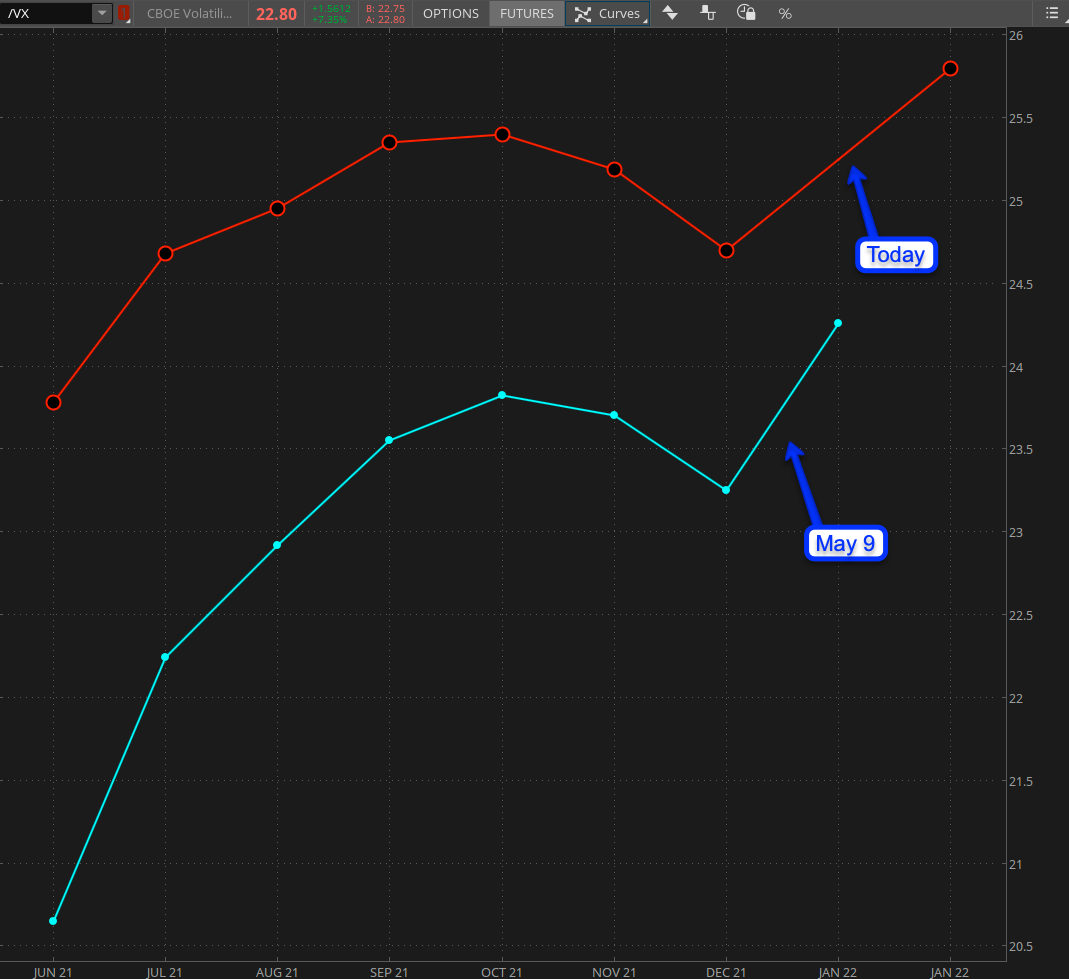

Here’s another perspective on this unfolding train wreck. This is the VX term structure which shows us the implied volatility of several VX futures contracts all the way into the summer and beyond.

Look how those VX futures were priced on May 9th – and compare them all with today. If you are not an option trader you may not really appreciate the full extent of what just happened here. This is a YUGE jump and unless there is an instant turn around we are looking at some very ugly scenarios going into the weekend.

So let’s observe the damage in more detail my looking at the sectors that may provide the best leverage for playing either the up or down side.

[MM_Member_Decision membershipId='(2|3)’]

XLF – finance has been driving the entire marketplace for the past week or so (taking turns with big tech) but even it has now dropped to its lower expected move threshold. This is really where the rubber meets the road as continuation lower would accelerate due to gamma squeeze.

This is the sector we want to be long should a reversal occur.

My monsters of index looks like someone just threw a grenade into the trading floor. UGLY tape there and several opening gaps on the downside. Make no mistake – if this sector as a whole cannot recover back inside its collective EM range it’s curtains on this one.

This is the sector I have already told you for weeks is the one to short.

NDX – same story here – so it’s not just the leading symbols.

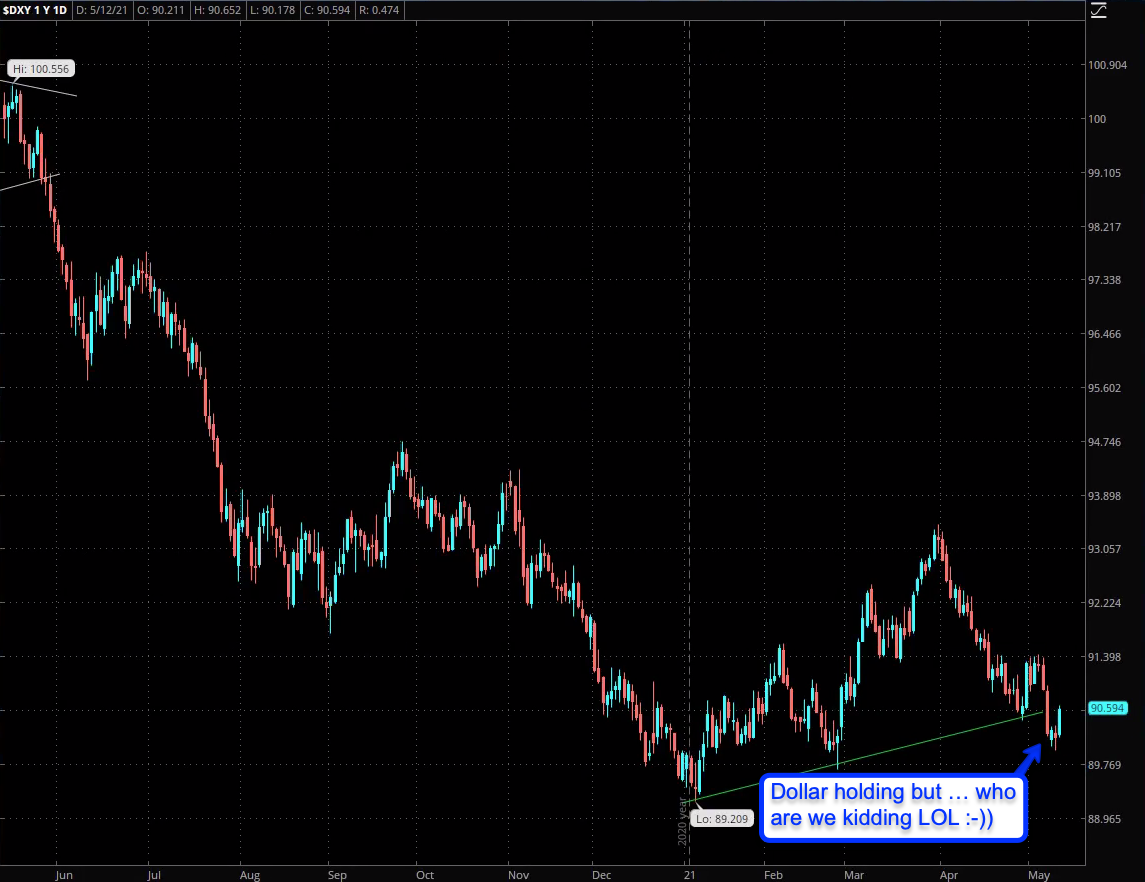

But it gets worse – much worse. With all this going on you would think that there would be some kind of boost in the USD. But no – there’s nary a flick up.

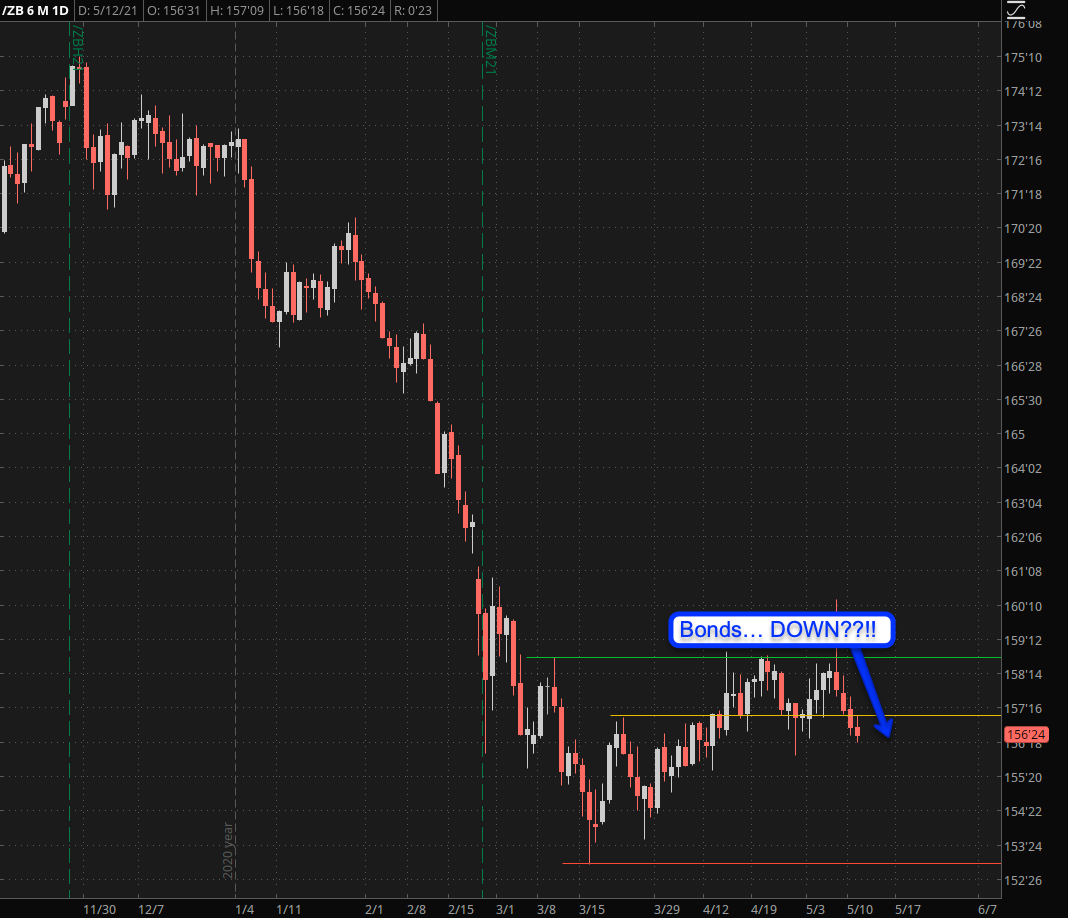

So if money isn’t reversing into cash then where is it going? Bonds? NOPE – the bond market is effectively DEAD right now.

So here’s the million Dollar question: Where is all the cash going right now? Where is it finding shelter?

I haven’t the slightest idea but I have a theory 😉

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]

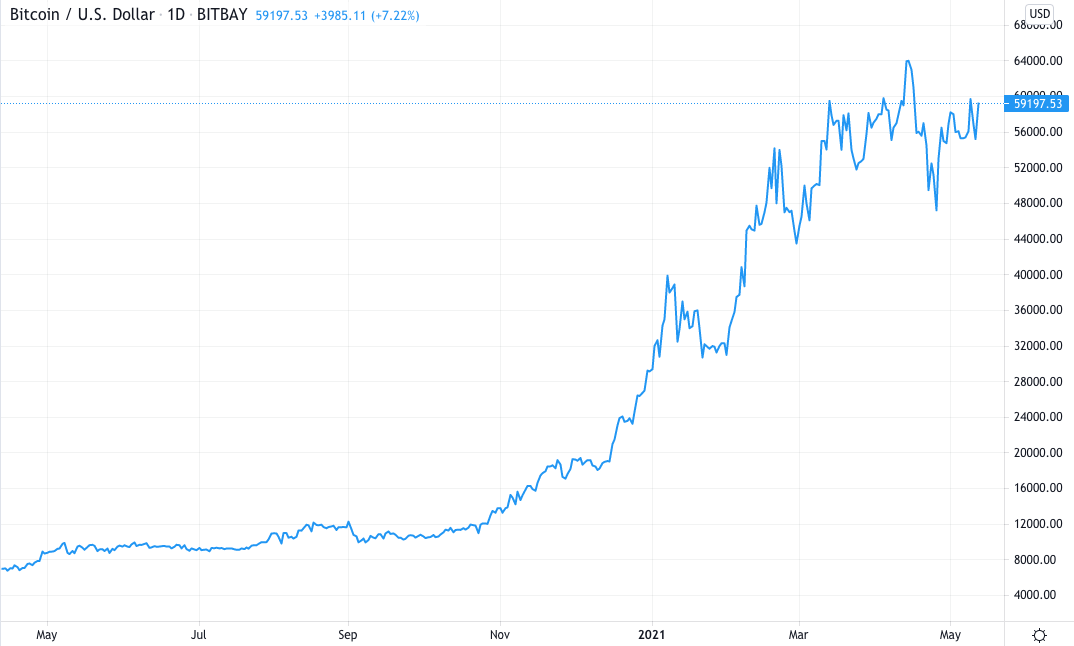

Okay now here’s my final appeal for my crypto crew or anyone considering to trade crypto currencies in the near future.

If you have not already watch my first three Crypto System Trading webinars:

Here is the replay of webinar 1

Here is the replay of webinar 2

Here is the replay of webinar 3

I’m serious, if you never watch another thing from me, watch these videos.

Webinar 4 (la grande finale) is scheduled for today 3:00pm Eastern, that is 12:00pm in L.A., 7:00pm in London, and 8:00pm in Madrid or Berlin:

See you on the other side.