Last week turned into a complete and utter roller coaster which traversed not only the entire weekly expected move but did so in both directions. Moves like these usually serve to confuse the average retail participant but they often present unique profit opportunities to savvy option traders. In fact what transpired once again confirms what I have been preaching here over the past year as well as the trading approach I outlined in my RPQ options courses.

So let’s set the stage here. It’s Wednesday afternoon (on my end) and I looked at the Spiders which at that time had been mostly treading water over the previous two and a half sessions. With about two and half more to go I looked at the March 26 expiration and saw the 396 strike already being heavily discounted as the odds of touching that mark appeared remote.

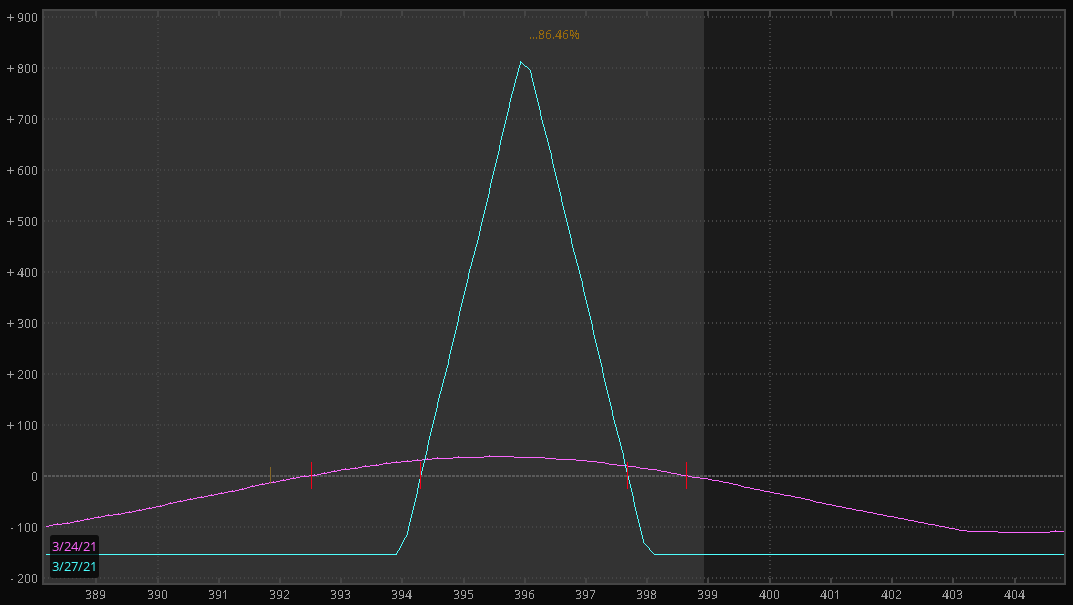

For a bit of background, the 396 strike basically marked the weekly expected move to the upside and understanding the probabilities involved based on my research I decided to take out a 394/396/398 butterfly for a whopping 28c. This is what I posted verbatim over in my RocketChat trading room:

BUY +5 BUTTERFLY SPY 100 (Weeklys) 26 MAR 21 394/396/398 CALL @.28 LMT DEBIT

Filled at .28

Here’s the profit graph posted at the same time. Of course the odds of hitting the center dead on were remote at the time. But a heck of a lot better than what they were on Thursday afternoon when the Spiders kissed not the upper but the LOWER expected move.

At that point I thought to myself: “Well, the upside made more sense at the time, but you can’t win them all.” I completely expected the entire spread to expire worthless. But then Friday came around and late in the session the SPY made a last minute run for the finish line once again confirming the time tested gamma squeeze theory. Here’s my exit order:

SELL -5 BUTTERFLY SPY 100 (Weeklys) 26 MAR 21 394/396/398 CALL @1.65 LMT CREDIT

That campaign ended up being one for the ages and I hope some of you subs tagged along. Better yet, it was executed by the script based on an establishes system, one I have been preaching here on a continuous basis. Only to see most of it being ignored but I’m more than happy with banking coin all on my lonely own, thank you very much 😉

Okay so per the title of this post we’ve got to talk about what I call ‘the wall’ and it’s one we are approaching rapidly. At least as of the time of this writing bonds have continued their downside trajectory and unless we see a decisive breach of the 159 mark I expect this to continue until….

… until the Fed finally steps in and that’s really the entire premise of what follows below. Not one to be missed as I see a huge trading opportunity here with all key players already present and accounted for:

[MM_Member_Decision membershipId='(2|3)’]

So here’s the protagonist of this story, the TNX. It’s been sailing on a cloud due to continued weakness across the entire bond sector (albeit it’s officially tied to the 10-year) and we’ve seen it triple in less than one year.

If you’re selling interest rates then you’ve been doing very well lately. But as you can see things have been a bit laggard as of late and the reason for that is that we are approaching the proverbial wall on the interest rates side of things which stands at around 2%.

Right now we are at 1.65 and that means we’re only a bagel toss away from a threshold at which we may see a massive squeeze in the real estate market and across foreign held holdings. So what is currently a benefit for the financial sector could quickly turn into a curse.

A lot of eyes are glued on that magic threshold and at some point the Fed will have to get off the proverbial pot or take action. I for one count on the latter as I expect Powell at least begin jawboning operation twist if the TNX indeed continues to push higher.

The first thing this would do is to break the back of the current bull market in everything finance. But there’s another side to this coin:

And it is big tech as shown here via my ‘monsters of tech’ synthetic index. Clearly it’s been suffering throughout the past few months and a reversal on the TNX would most likely produce at least an interim jump higher here.

So basically that is my nefarious plan for the week. For now we do nothing – we wait as we have not yet reached that magic 2% threshold. Or perhaps magically bond vigilantes will lose their appetite and that 159 mark on the ZB will be breached without Fed intervention.

Either way this should trigger a significant short squeeze and so we have two calls for action:

- Get busy buying big tech and shorting finance if the TNX approaches the 2.0% mark.

- Do the same if the ZB starts testing the 159 mark.

Which symbols to trader is pretty straightforward, just pick the strongest big tech contenders and the weakest ones over on the finance side. I just wish DB still had more juice to the downside….

Happy trading but keep it frosty.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]