Just ask the Fed and the answer should be ‘how many trillion would you need’? Which why it’s a bit puzzling that the old greenback actually seems to be bottoming out right now and may even be getting ready to put the squeeze on all those degenerate Euro fanboyz. As you can imagine the thought of not being taunted by my local ATM anymore fills me with much glee. But in the context of the overall market situation we’ve got a few charts to review. Let’s get to work.

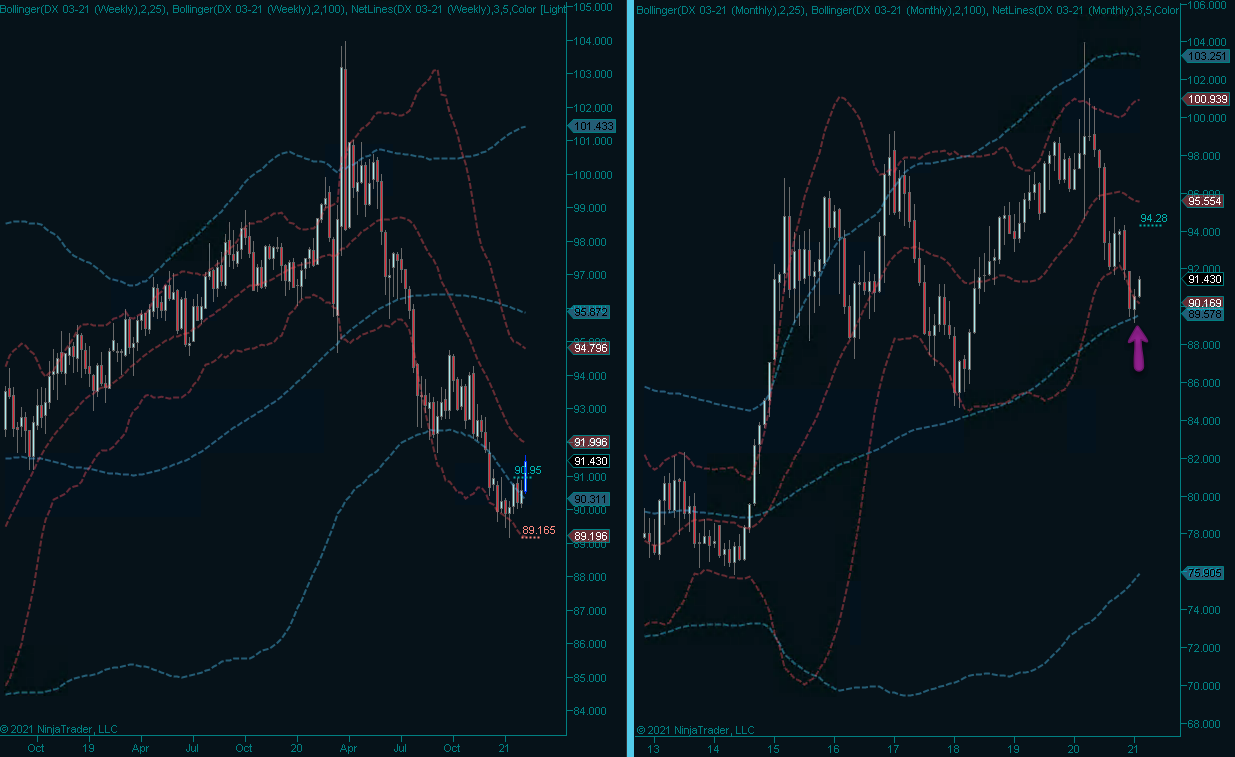

I’ve zoomed all the way out into the weekly and monthly panels to give you all a wider perspective. As you can see the Dollar slapdown over the past year has been brutal and relentless. I have been eying that 100-month SMA with much trepidation and was quite elated when it actually started to provide a bit of support.

We’re far from being out of the woods but this is a good start. What you need to understand about trading currencies is that they move like oil tankers not like speedboats. Meaning that once they get going in a particular direction it’s difficult to turn them around.

But once it happens it can trigger the most gorgeous squeezes (short or long) you can imagine.

Of course a strengthening Dollar suggests that market participants may be getting a wee bit concerned about their own irrational exuberance. The TNX (the 10-year t-note yields) has also been going strong and is currently painting a sideways correction.

Which in itself is a pretty bullish signal after the preceding ramp. If those weekly SMAs (left panel) catch up over the coming month or two and we see a bounce from there then the sky’s the limit!

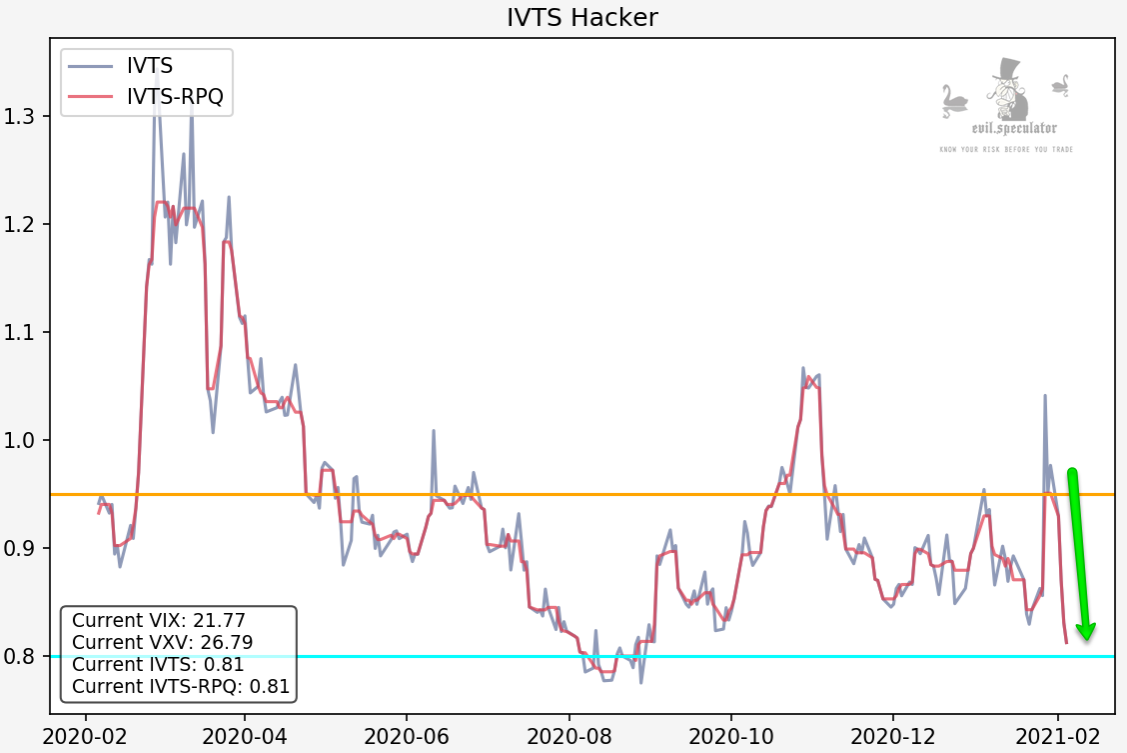

Now I already hinted that a few things aren’t lining up here and the VIX is by far the biggest offender. Meaning it’s not only dropping, it’s falling like an anvil Loony Tunes style.

But Mole, that’s pretty normal to see the VIX drop when the market pushes higher, duh!!

Yup – true that. And you would be right if it was just a 5% or 10% drop or so. But a 42% reduction is outright ridiculous given the amount of upside we’ve seen.

And it’s not just the VIX – the 3-month VIX3M (formerly VXV and that’s what I still call it damn it) has been dropping as well. But not as hard as the VIX and ergo the IVTS has been falling to a reading I have not seen since last summer.

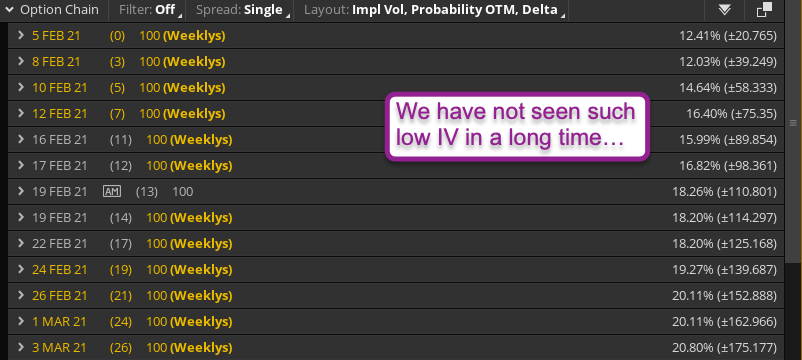

Which of course is reflected in the implied volatility on the SPX and the SPY. And that my dear ladies and leeches, brings me to the good stuff – so perk up and pay attention:

[MM_Member_Decision membershipId='(2|3)’]

Look at that IV-Z Score on the SPX. I did see it in the futures yesterday afternoon and thought it was a fluke. But here we are, it’s now on the daily cash and that means after rejection at the 0 mark we are back in a medium IV regime.

The big question of course is whether or not we will remain there. What is price telling us?

It’s a bit occupied right now with crashing to the upside, sorry. Look at where we are in the context of the weekly expected move. That’ll put a world of gamma squeeze on call sellers who are now scrambling to hedge themselves.

So today should be exceedingly interesting but aside of all that I see a clear and present opportunity here. Or should I say I see a clear and present opportunity once again.

Honestly I can’t remember when I last saw IV that low on the SPX or SPY chain. We are not in ‘go long IV’ territory just yet but I’m willing to dip my toe into a few more speculative positions.

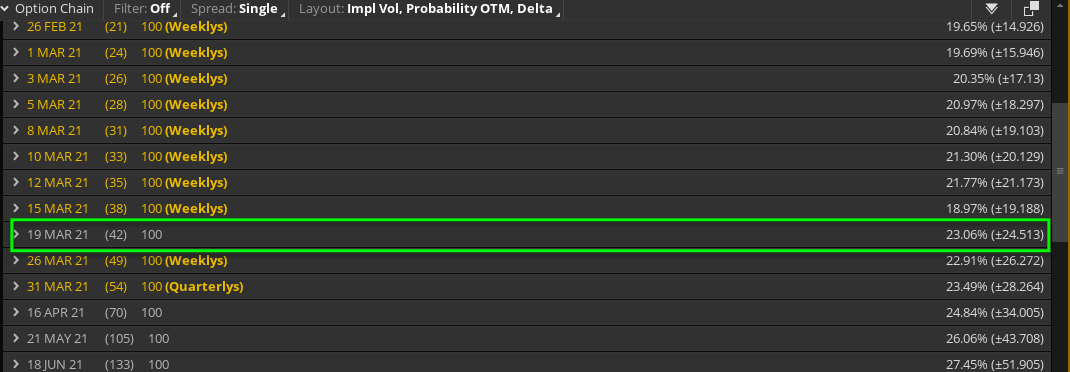

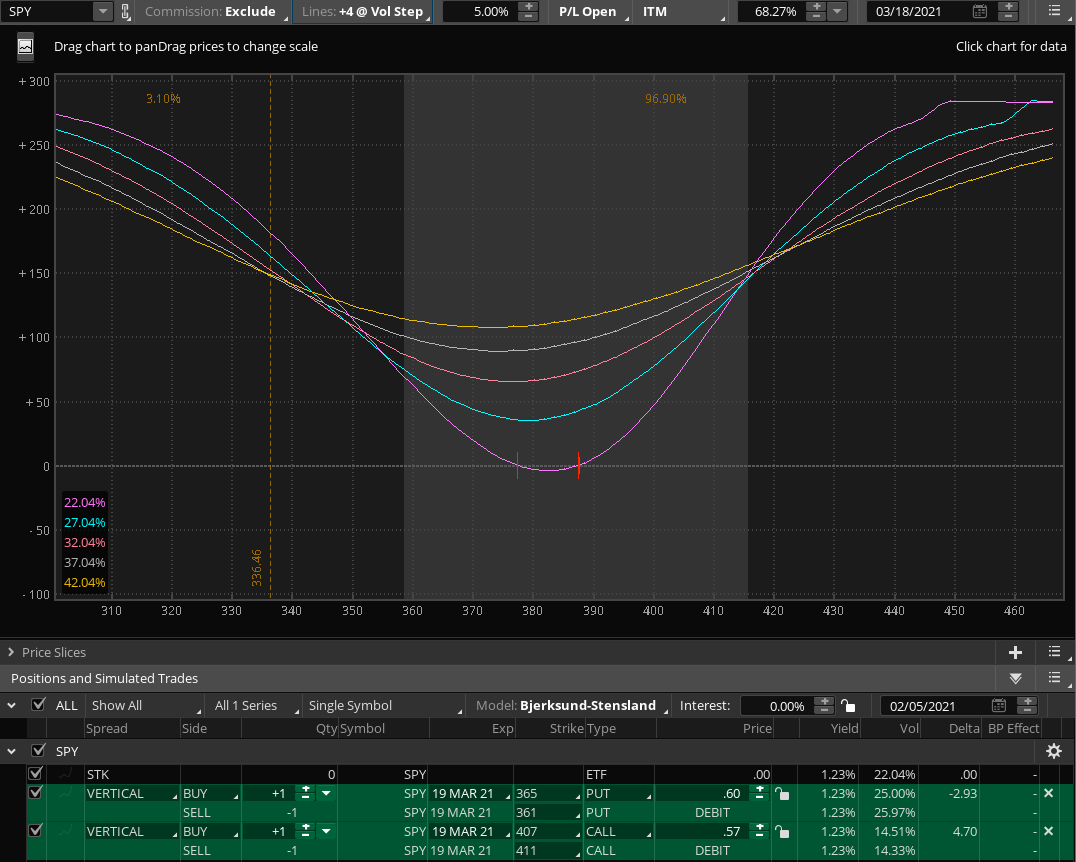

Take a look at the SPY March 19 expiration which shows us an IV of 23% or ~25 handles. Got it? Okay, now follow me to the next slide:

That’s basically my evil plan right here. The IV tells us that there is a 1-std deviation probably that we are going to move 25 handles over the course of the next 42 days.

Well, I have an inkling that we’ll see that much and then some. So per the theme of this post I’m donating roughly one Dollar (okay it’s $1.17 – bite me) on two OTM debit spreads. I’m not going fancy here and I’m giving myself more than enough time.

Should we not see a significant move in the next three weeks or so then I have the option to just sell them back for half the premium or more, depending on IV. But honestly it’s chump change right now due to low IV and with a bit of luck IV will drop even more which should open the door for yet another strategy which I have waiting in the bullpen.

BTW my condolences to all those retards who bought GME at $300 plus and then held it to slightly over $50. There should be laws against this much stupidity.

Even worse are the guys who bought it at $10 and then HODLed it all the way into $500 without taking at least partial profits. That’s just criminally insane in my book and at the time I was tempted to drop a pertinent comment over at r/wallstreetbets.

But we all know that I would have been tarred and feathered and then carried out of the room on a rail, so I didn’t bother to incur the wrath of 8 Million plus fanatics.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]