With a new administration on its way in and growing concerns about the Fed’s unmitigated money printing initiatives many are starting to wonder if the big stock market party of the Trump years is finally over and where we may go from here. Given that social spending is expected to massively increase along with taxation in the upper income brackets the dynamics that have been driving the market could rapidly be shifting.

In order to shed light on what by all intents and purposes is a complex and controversial topic (since politics is involved) I prefer to start at the end of the story and then work my way backward. It’s a bit like cheating in a book review in that jumping to the ending usually reveals much of the author’s original intent and cuts out most of the fluff and misdirection.

At least that applies to 90% of literature out there. Timeless classics shine in that the journey is more important than the ending, but I digress. Above’s a graph I posted a few months ago which to my knowledge still holds true to this day.

It shows the June 2020 statistics for new retail account opens across several major trading firms. These numbers are completely unprecedented and point toward a massive influx of largely inexperienced retail traders eager to catch their piece of what appeared to be a never ending bull market on steroids.

Of course the COVID-19 lockdowns had a lot to do with this influx as it suddenly created a situation where a huge number of professionals in the U.S. and abroad found themselves working from home with a lot more freedom over how and when to attribute their time.

With retail largely ignoring the bulk of a decade long bull market large institutional trading firms and HFT shops enjoyed almost complete control of the market up until about the spring of 2020. However going forward the dynamics started to shift rapidly as the COVID lockdowns continued and the number of retail participants exploded.

The huge impact of this is somewhat exotic and mostly hidden from view, especially when one’s perspective is limited to merely looking at stock charts. But if you pop open the market’s hood you and dig deeper you quickly realize that something extraordinary is going on.

Gamma Squeeze

I understand that not everyone reading this is an avid options trader and thus probably not versed in the greeks. So I’ll try to explain what’s going on in simple terms. Let’s say you go and buy a call option at your favorite retail broker. This means that someone out in the marketplace has to take the other side of that trade and sell it to you.

In many if not most cases that would be a market maker or institutional trader who now faces a problem. By selling you that option he now is effectively negative gamma (as well as delta) and that’s not a good place to be in a bull market.

So what to do? Buy the stock – that’s what. Which in turn gets him back to a happy place with normal sleeping patterns and out of the reach of your friendly divorce (or bankruptcy) attorney.

Of course a lot of stock being purchased results in that stock going up, which in turn feeds into more retail wanting to catch a piece of that action. Since retail traders love leverage to a fault they usually prefer to trade options, and call options in particular. Many do understand how puts work but in most cases they are not used to trading them (successfully at least).

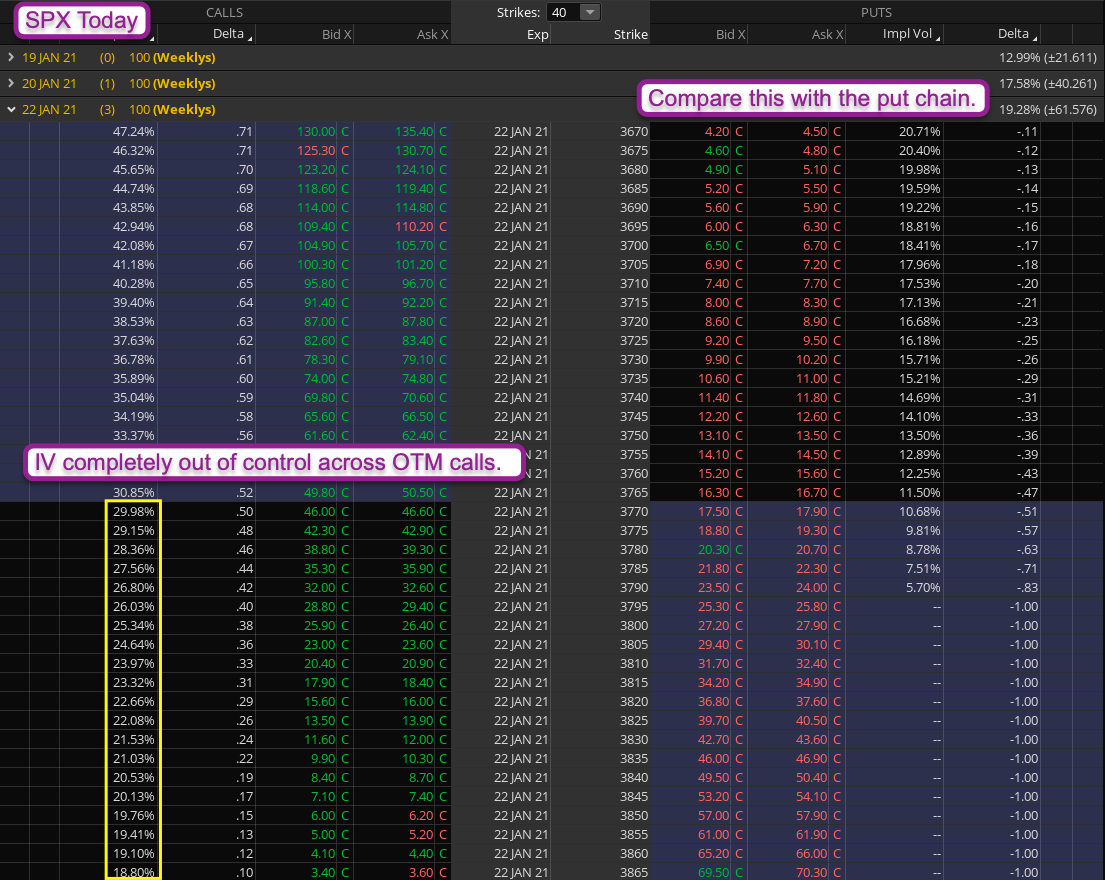

So they buy more calls and that in turn leads to more stock purchases by institutional traders and market makers. With a lot of retail traders bulking up on calls in comparison with puts this over time creates the situation shown below:

What you are looking at is nothing short of a massive gamma squeeze grown out of control. Look at the OTM call side of the SPX option chain I highlighted and then compare it with IV across the put series. See the difference?

Clearly the call side is being priced much higher in comparison and that’s due to an inversion of SKEW – the difference between how OTM calls are priced in comparison with OTM puts.

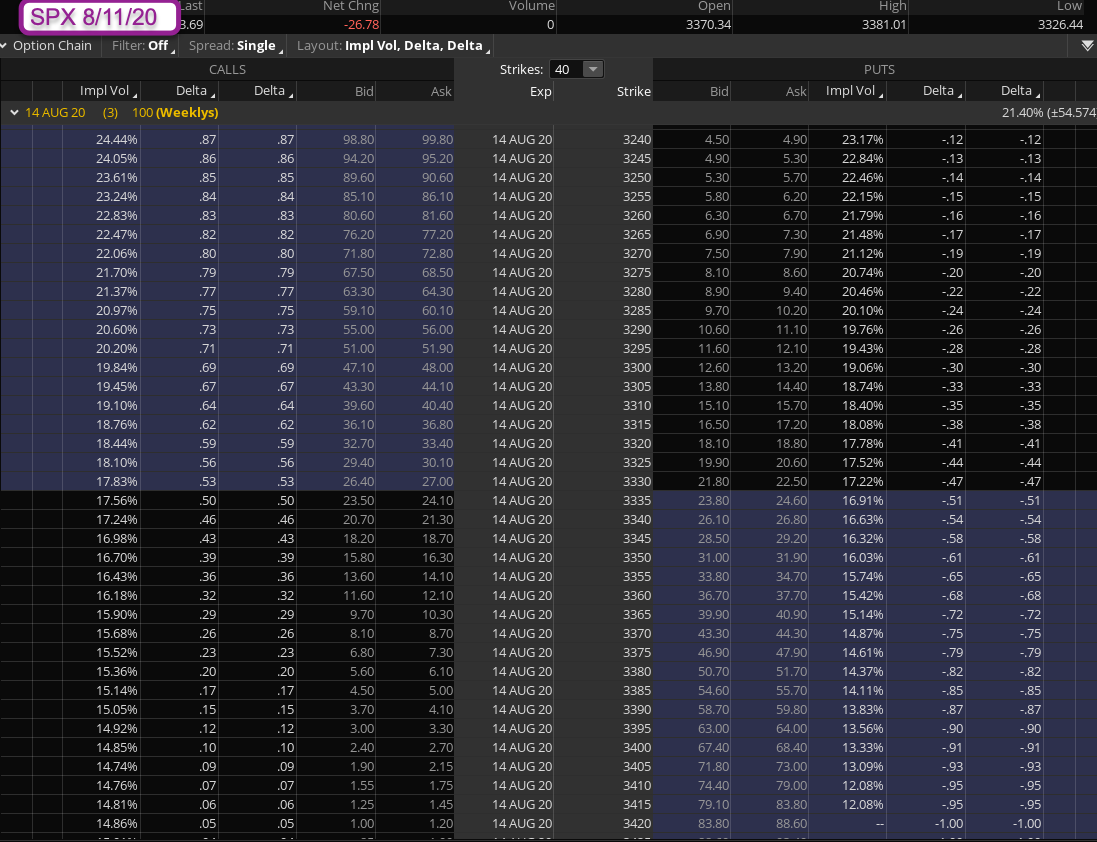

Let me assure you that this is not normal – here’s an example of what’s ‘relatively’ normal. This is an August 2020 screengrab of a similar SPX option chain with 3 days until expiry. Note the difference.

This long term SKEW graph quickly reveals that we’ve been in similar situations before over the past decade and that it’s not a situation that usually remains for very long. With everyone chasing risk and retail falling over itself to ride this late stage bull market into the sunset the big shoe is just waiting to drop sometime in the course of this year.

Just ask yourself this: WHERE are all the good news going to come from going forward? We don’t have Trump anymore tweeting the market higher. Social spending and continued lockdowns will put a damper on the economy, with the exception of big tech of course. Add to that the banking system, which is on threshold of another crisis, in particular over here in Europe.

So what to do about it and how do we not just survive what may come next but prosper?

[MM_Member_Decision membershipId='(2|3)’]The answer is pretty simple actually. The VIX clearly has settled around the 20 mark and shows no signs of being able to drop lower. Where do you think we go from here over the next few weeks, months, years? To the 15 mark? I guess anything is possible but I frankly do not see how.

For me this means I’ll buy IV in all its forms (i.e. ETFs) while selling OTM calls – that’s affordable and safe via OTM credit spreads. And buying OTM put spreads should also be on the menu. Naked puts are a no-no for obvious reasons as they ar way too expensive. I’m not saying don’t ever buy a naked put but don’t back up the truck and see your premiums melt away due to theta burn.

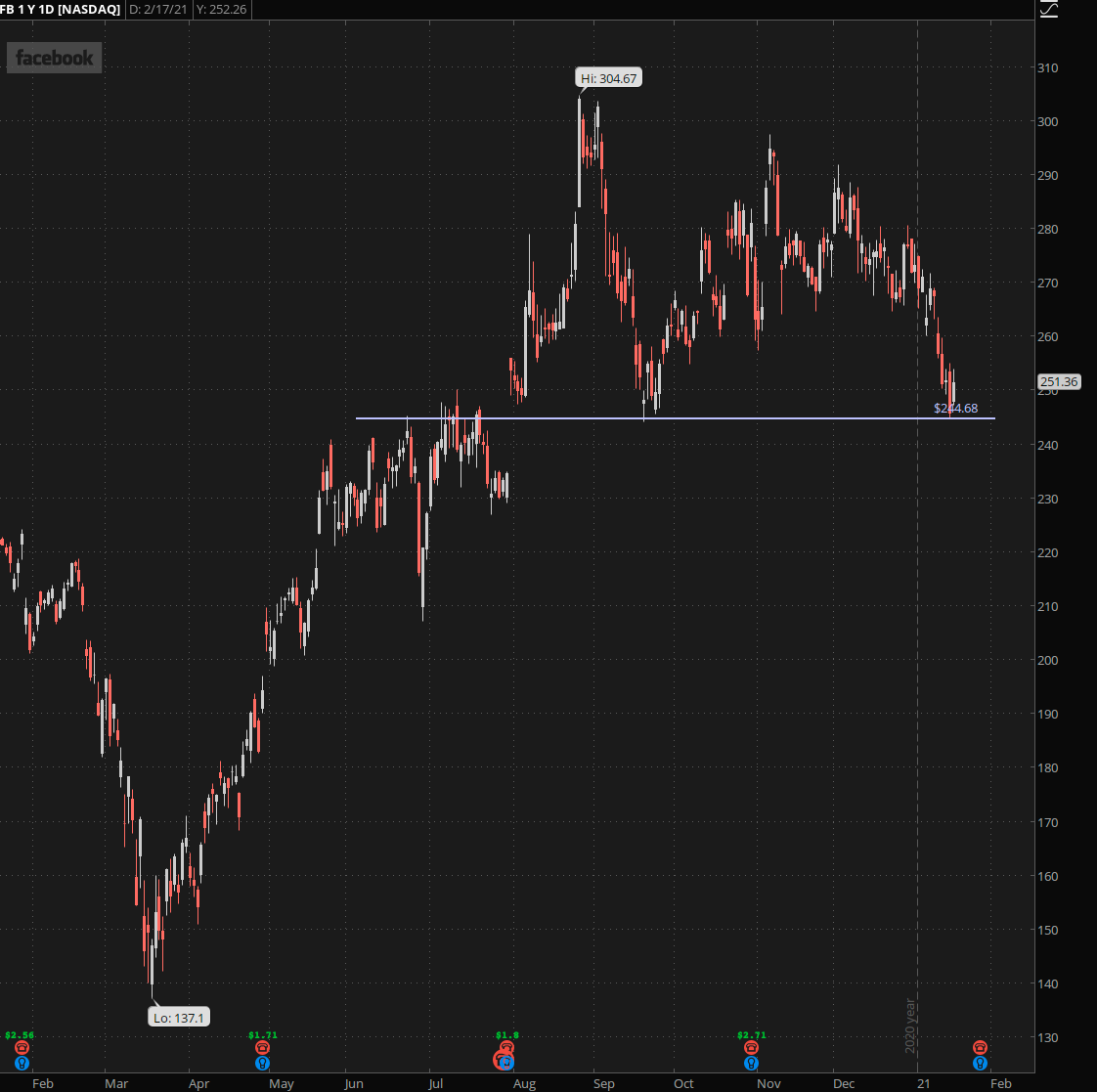

Another rule of mine is to never ever listen to what’s being peddled in the news. FB may be on everyone’s shitlist right now but that doesn’t mean I can’t see a golden buying opportunity if it presents itself. After all I would be proven wrong rather quickly here.

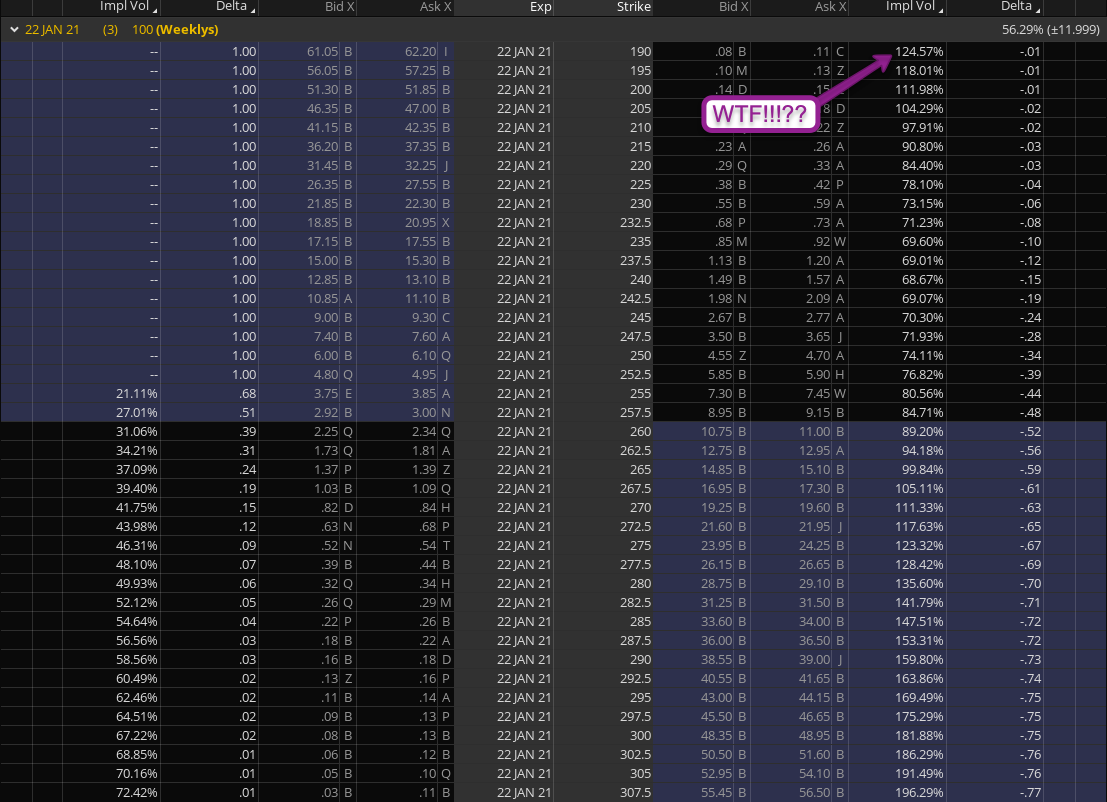

And given the enormous SKEW in FB (puts being priced much higher – which is relatively normal but not to this extent) I also am considering to sell a few OTM put spreads.

Finally I wanted to talk about the Dollar a bit more as there is a lot of concern about unmitigated inflation. Yes, it’s in the dog house right now and if it breaches below the 88 mark it’s probably not gong to stop until 80.

However over the long term we are simply stuck in an ebb/flow cycle that has existed for several administrations now. If you hate Trump for killing the USD then you can say the same for Obama and Bush before him. Actually say what you will about Obama but during his 2nd term the Dollar actually jumped quite a bit.

So the verdict is still out about what to expect under the Biden years. A lot of social spending may lead to inflation but it may also lead to a market crash and that in turn feeds into the USD – gold and BTC be damned.

For now I would recommend a wait and see perspective before you go out and turn all of your savings into Euros or Yuan 😉

Happy trading but keep it frosty.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]