For 2021 won’t be a year for the faint of heart. If you’re happy that 2020 is squarely in your rear mirror, then keep in mind that despite all the political and social chaos you may have endured we at least enjoyed a roaring stock market. When was the last time you witnessed a whopping 42% rally in the SPX – or any other sector – in the course of only 9 months? Okay, except for BTC perhaps 😉

But that’s all behind us now. The best way to summarize where we are heading next is this exotic graph of the Spiders which depicts what’s commonly called the ‘options smile’.

It’s a great way of expressing the implied volatility of each series across the entire option chain as it tells you in one simple graph the amount of downside risk ‘the market’ perceives to be present for each particular expiration (one line per).

And even if you’re not a seasoned options trader is easy to see that put strikes shown on the left side of the chart are currently ‘risked’ and thus priced with a substantial premium in comparison to call strikes on the right side of the chart.

Let’s put things a bit more into historical context. Here’s SKEW shown as a line graph and how it progressed over time. After all the current reading could be considered normal to the untrained observer.

Clearly it is not – in fact it is right up there in the market’s stratosphere.

And yes, you are right in thinking that the perception of risk does not necessitate a market crash or at least a meaningful market correction. That said, when you start seeing an increase in warning signals across several verticals then it’s time to pay attention.

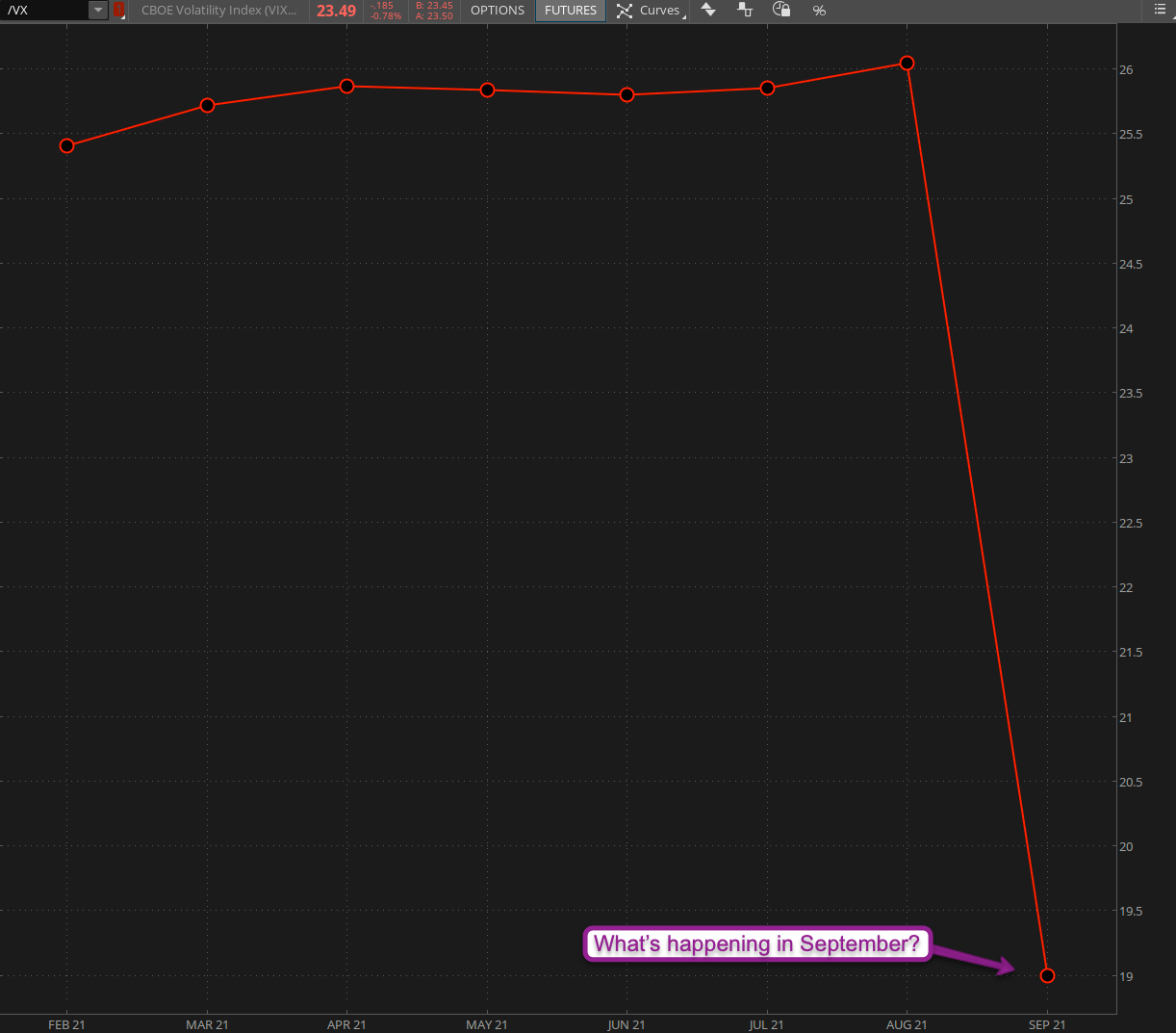

Another one I have continued to highlight are the VX futures which remain consistently elevated all the way into summer. And no, I have not yet figured out why September seems to be ‘all in the clear’.

Again, you may be thinking: “Mole, what are you smoking? The VIX has been treading water for the past three months.”

You would be half right – for one I don’t smoke, but I have studied implied volatility extensively and let me ask you this: Here we have a VIX painting ‘lows’ at around 23 after a 42% rally within 9 months. Does this seem normal to you?

Also let’s not forget that realized volatility within the VIX has consistently remained above the 100 mark (yes that’s high) all through that face ripping rally and our current 6-month median sits at around 115.

Just like face diapers it appears that fear of the future and volatility has become part of the ‘new normal’.

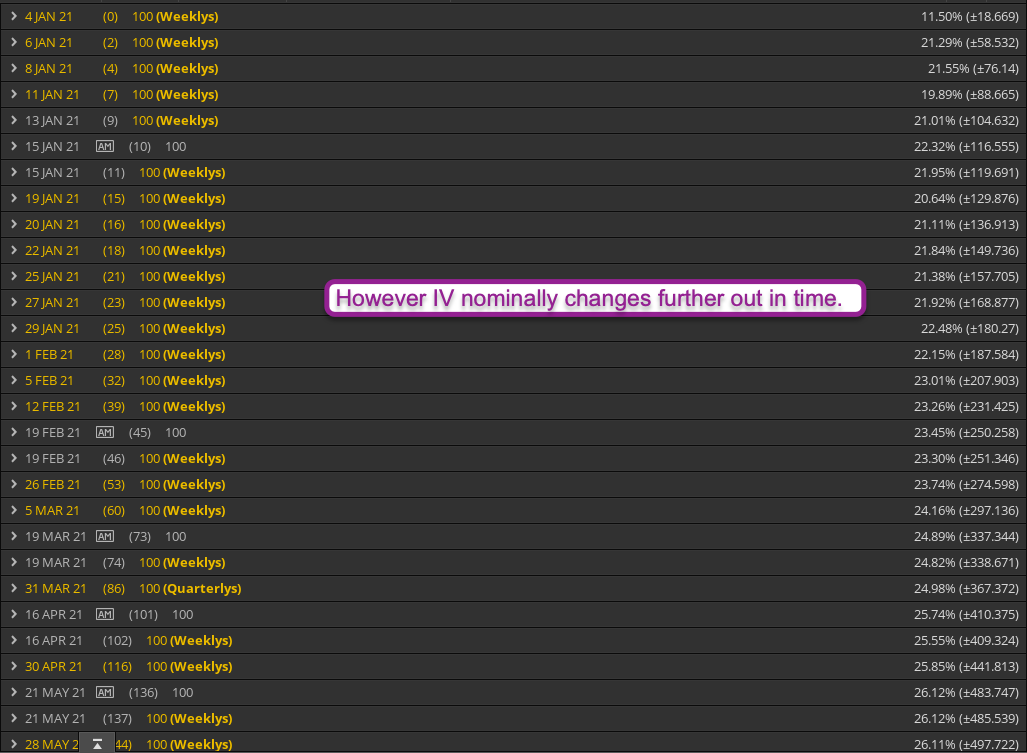

Consider this SPX options chain in the context of the VX futures product depth chart (the 2nd chart from the top). Despite massive price mismatching between OTM put and call options near term implied volatility barely moves as we push further out in time.

What all this combined tells me is this as we push into the first trading session of 2021:

- We are trading near all time highs.

- Downside protection is commanding a massive premium.

- IV remains elevated not just in the short term but all the way into the summer.

- The VIX remains elevated but is low in the context of the past year.

All this spells massive opportunity to me. The iron is hot and now it’s time to wield it.

Let me show you the HOW and the WHERE:

[MM_Member_Decision membershipId='(2|3)’]As to the HOW: Look no further than the options construct I call ‘the hammock’ which I have shared with you subs on several occasions before the holidays [1][2][3]. Again, I plan to produce a special options series on this strategy but for now just follow the instructions as provided.

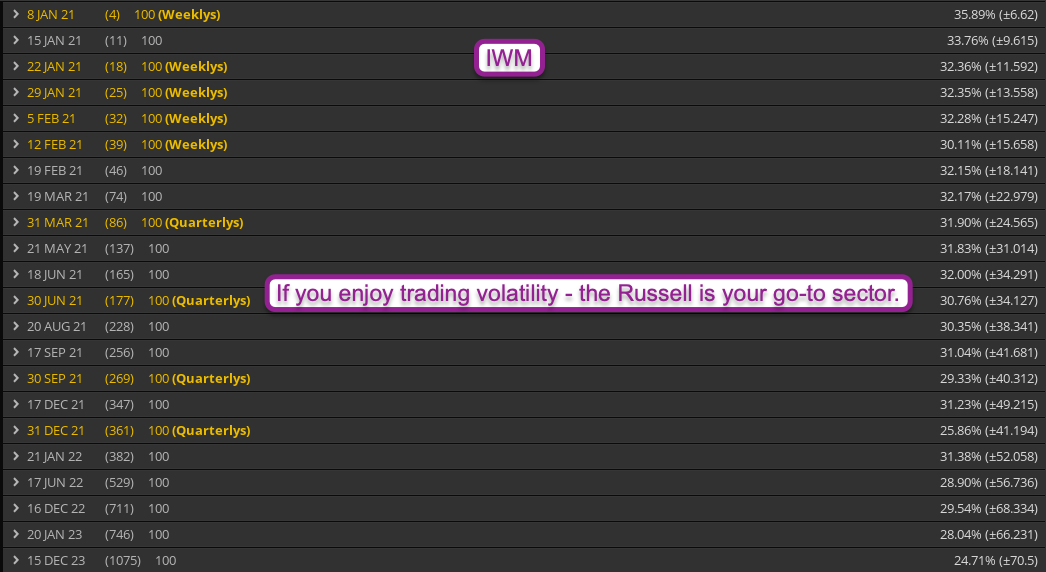

As to the WHERE. If you think IV is elevated in the SPX or the Spiders take a peek at the Russell or the IWM. Boy oh boy – that’s some juicy volatility ready for the harvesting. I am thinking a March hammock or at least some OTM put spreads, again in the March or April contracts.

In addition to that you may also consider an ATM call ratio backspread in the VIX. I could be proven horribly wrong – after all there are never any guarantees – but the odds of a drop < VIX 20 is probably remote given all the evidence presented above.

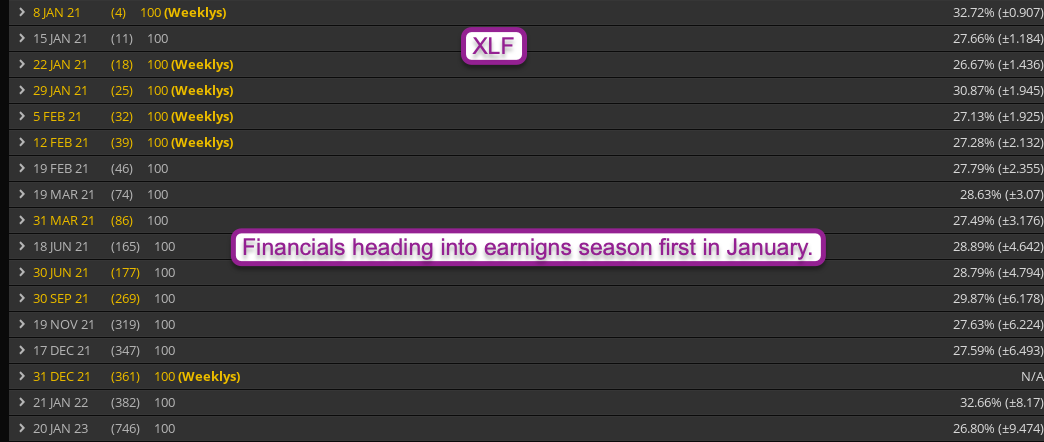

Let’s also not forget about the financials which are equally elevated plus they are first to head into earnings season this January. Once again a hammock spread or both cheap OTM call and put spreads may be good medicine.

Just to add a bit of fuel to the fire here. Recall my post on the IV Z-Score from last year? If not please go here for refresher.

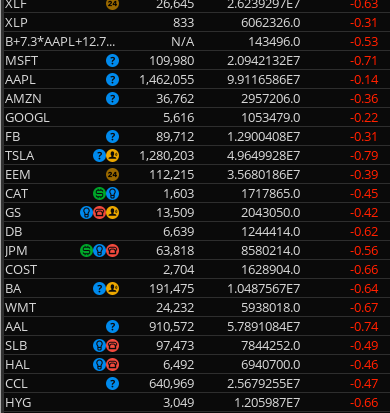

Well, here’s a snapshot of a section of my daily watchlist and as you can see there isn’t a single one that’s even near the 1.0 mark. Recall again that a range of -1 to +1 is considered normal – as within 1 standard deviation. So yes admittedly nothing extreme to write home about.

BUT to see them ALL scraping the bottom of the 1.0 std. deviation barrel is worth considering. I maintain that IV across all verticals – despite massive SKEW – is low and has the potential to explode higher in the near term future.

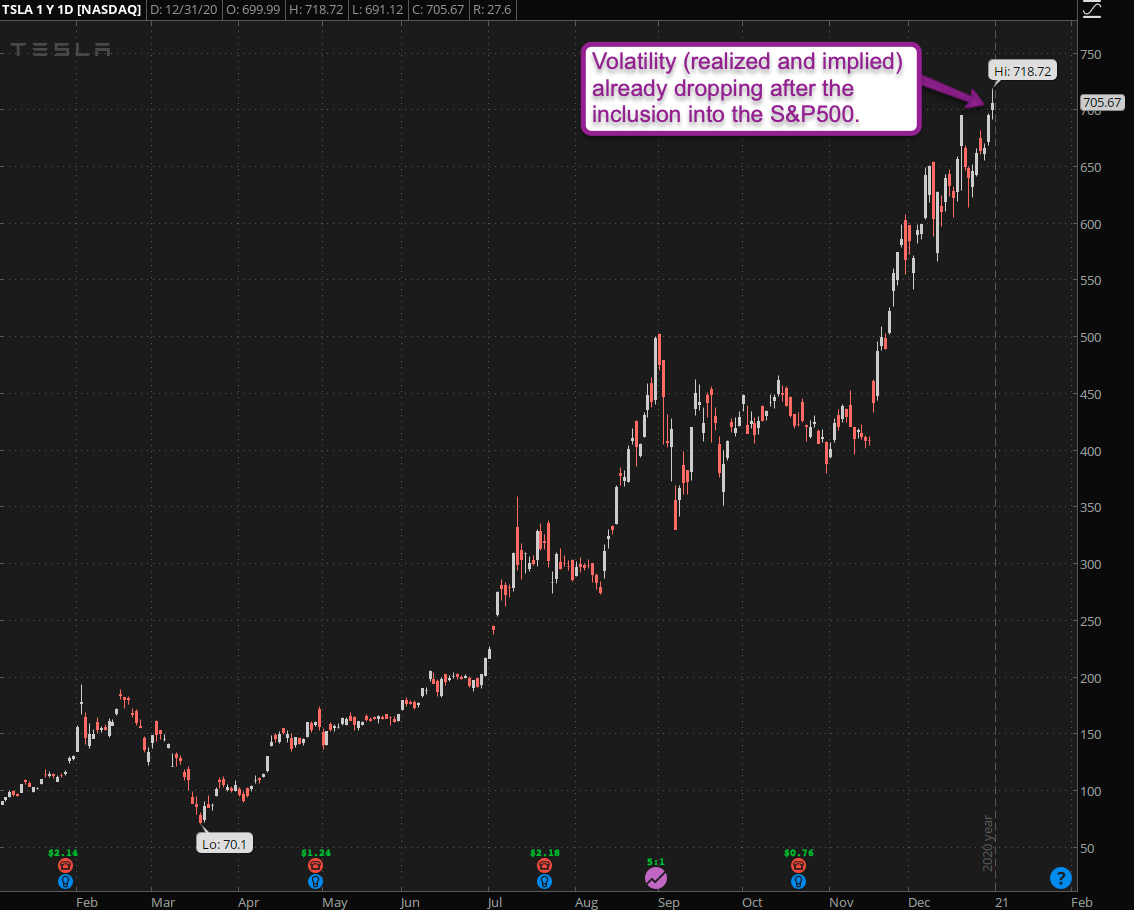

Two more charts for the road. One is TSLA – which I would not short if you would pay me to do it to be honest. But if you love to hate Elon Musk and enjoy trading TSLA then keep in mind that it’s now part of the S&P 500.

And that means you’re already hearing a massive sucking sound as a ton of realized (and implied) volatility is dropping in this issue. The days of 10% rallies or drops in TSLA are most likely gone for good.

That’s a good thing if you want to start it in the context of EM but a bad one if you have enjoyed selling OTM puts to opinion mongers and Elon Musk detractors.

Last but not least: the ‘monsters of tech’. No we have not see big moves here in the past few months but that doesn’t mean it’s ready to roll over and die. COVID-X isn’t going anywhere and neither are a whole cadre of politicians all too happy to not let this crisis go to waste.

Hate or love big tech – unless we see a political 180º turn we are most likely going to see several more waves of lock downs. And that effectively means the destruction of a big section of the middle class and thus more polarization of capital. It has to go somewhere and it continues to go into big tech.

Why? Because there’s nobody else left standing. Admittedly that is a point of contention for most and a lucky (un)intended consequence for the few. You can guess on which side I stand personally, but as a trader I can’t afford to let my opinions or political ideology stand in the way of financial prosperity.

Because if I have learned anything from 2020 then it’s that we are not living in the “Leave It To Beaver’ America you may have grown up in. We are now seeing tectonic shifts at a rapid pace and the final outcome (still) is anyone’s guess.

Take Care Of No. Uno

It’s a ‘brave new world’ now and despite all pleads for fairness and government oversight there seems to be very little of that to be out there at the moment. So your No. 1 mission for 2021 and beyond – should you choose to accept it – is to not get sucked into depression and to do your very best to take care of yourself and your loved ones.

Let the ancient teachings of stoicism guide you. Which tell us that is futile to worry about things we have absolutely zero control over. Instead do your very best to be well positioned and take advantage as opportunity knocks. Which it does in spades especially during trying times.

[/MM_Member_Decision]

[MM_Member_Decision membershipId=’!(2|3)’]

Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]

[MM_Member_Decision isMember=’false’]

Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]