Whether you like it or not, most would agree that the German language has a good number of very cool words which are not only difficult to translate into other languages but also hold special meaning. Schadenfreude is a popular one that even English speakers seem to have widely adopted over the years. Blitzkrieg is one that is associated with Germany’s WW2 ambitions which speaks to the country’s ability to exert ruthless efficiency which however ended in total disaster.

One word that you probably have never heard about is ‘Endspurt’, which loosely translates to ‘final sprint’ in English. However as many German words ‘Endspurt’ has a connotation that subtly conveys more information, and in this case it’s that you are heading toward the finish line after a long run and are therefore giving it your very best. Or at least whatever you may have left after all those miles.

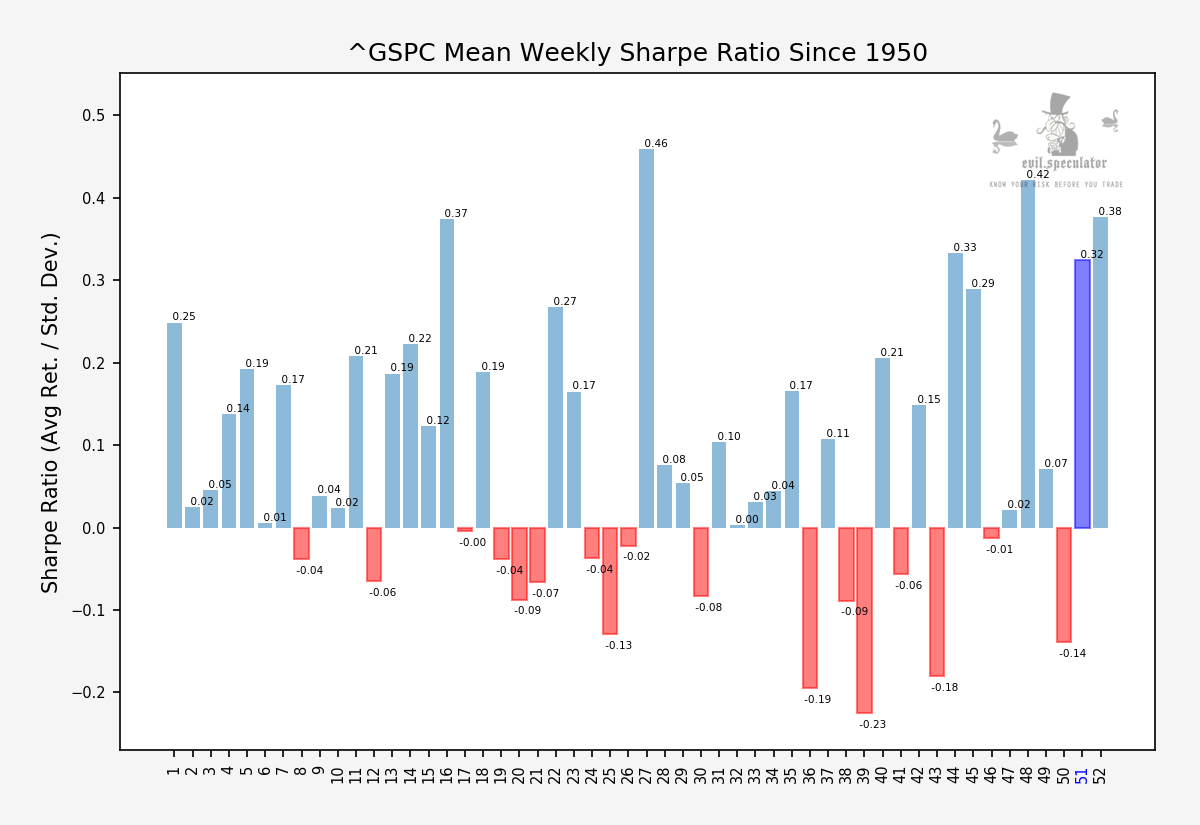

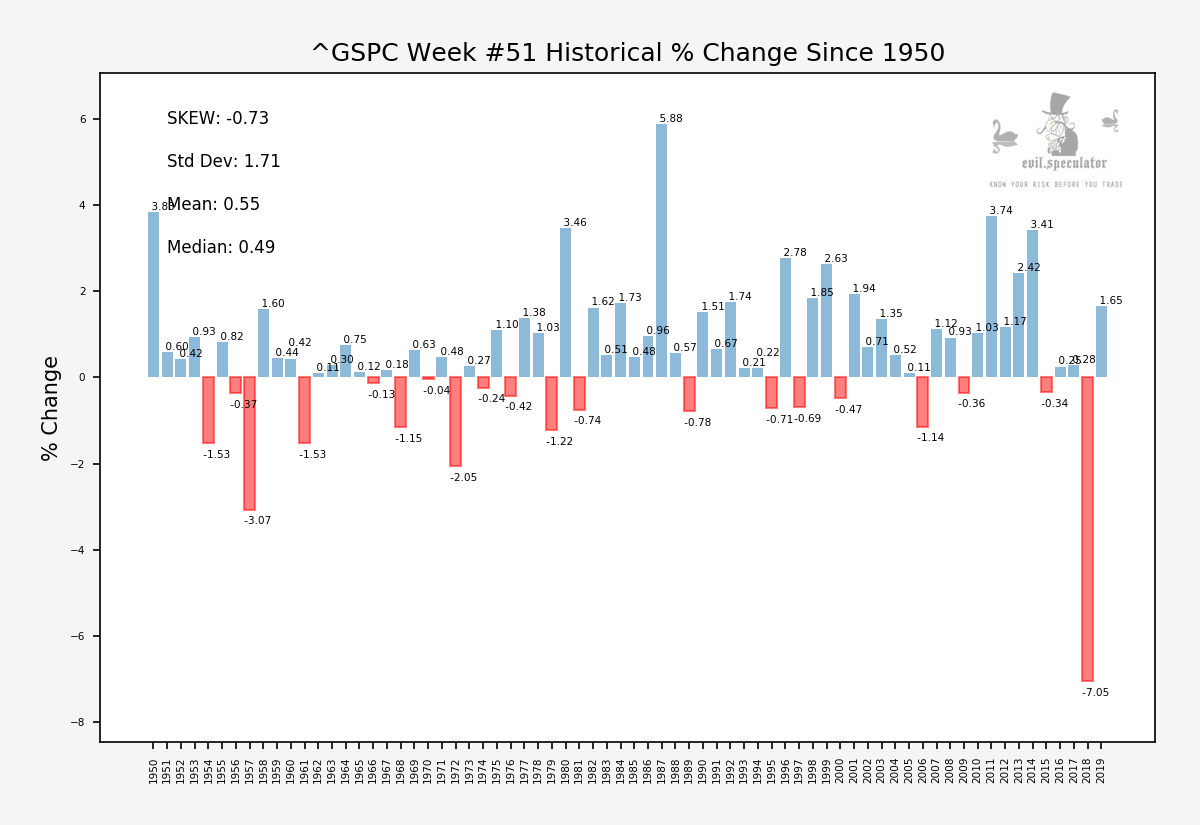

And it’s the word ‘Endspurt’ that comes to my mind every time I look at the last two columns on my weekly Sharpe ratio chart. Historically speaking week #51 (this week) is the 5th strongest earner of the year, and it is followed by week #52 which is the 4th strongest earner.

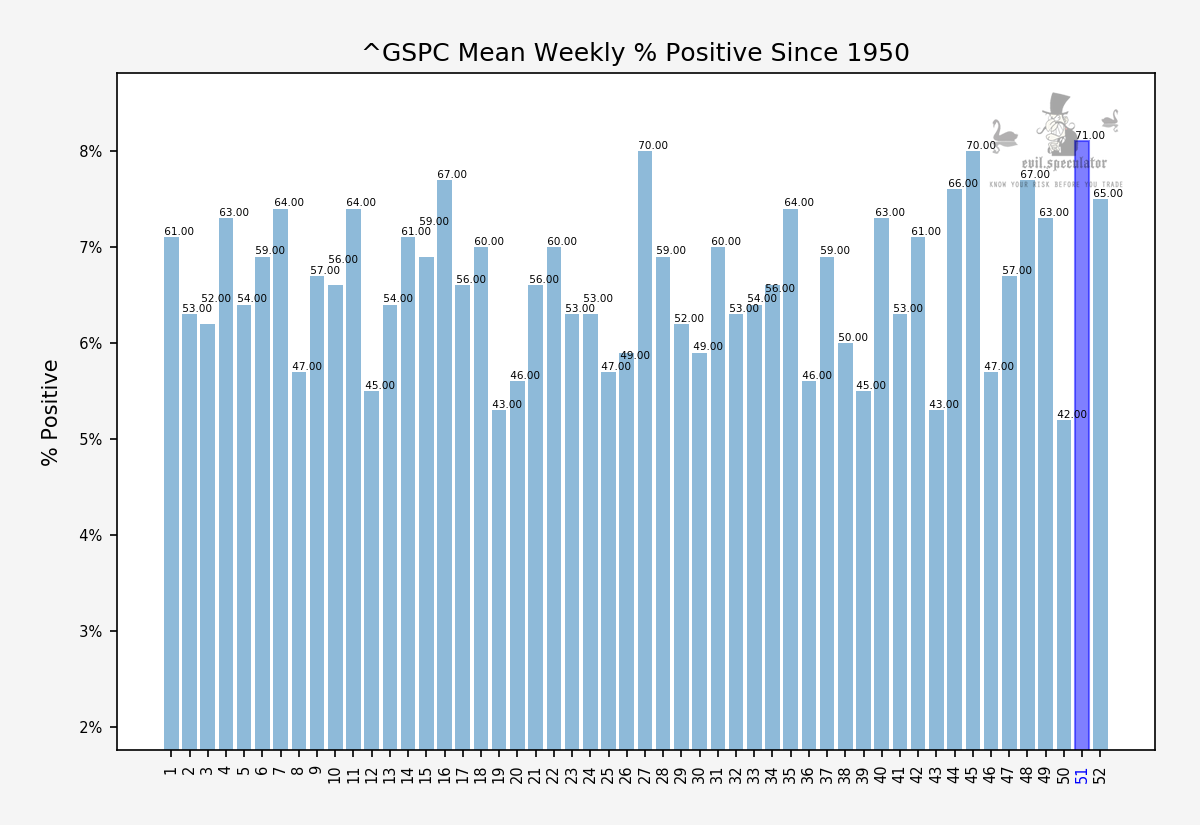

In terms of percent positive however week #51 stands as the #1 at a whopping 71%. Heck I take those odds ANY bloody day! What’s not to like?

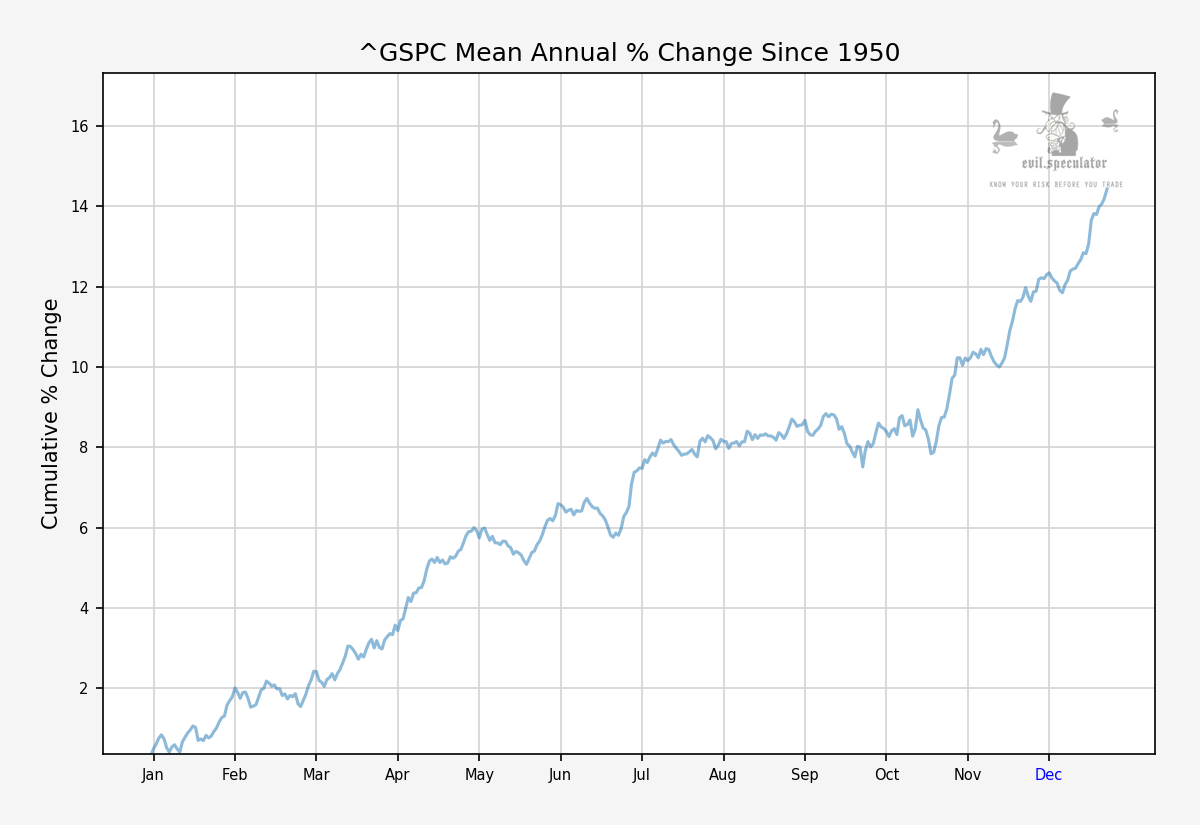

Looking at the annual percent average, which by all intents and purposes is bullish, the final weeks of the year clearly stand out as the strongest performing period. No wonder most everyone loves December despite its crappy weather.

However, as usual there are exceptions to the rule worthwhile keeping mind:

[MM_Member_Decision membershipId='(2|3)’]

Looking at the percent change graph since 1950 there is one massive candle that stands out and it’s not the 1987 rally – well that one is pretty juicy of course and I wish I had been trading that year (I certainly was old enough!).

No, what stands out is the 2018 down candle, which was a complete outlier and completely ruined that year’s Santa rally. You may remember that one as it took a lot of traders by surprise.

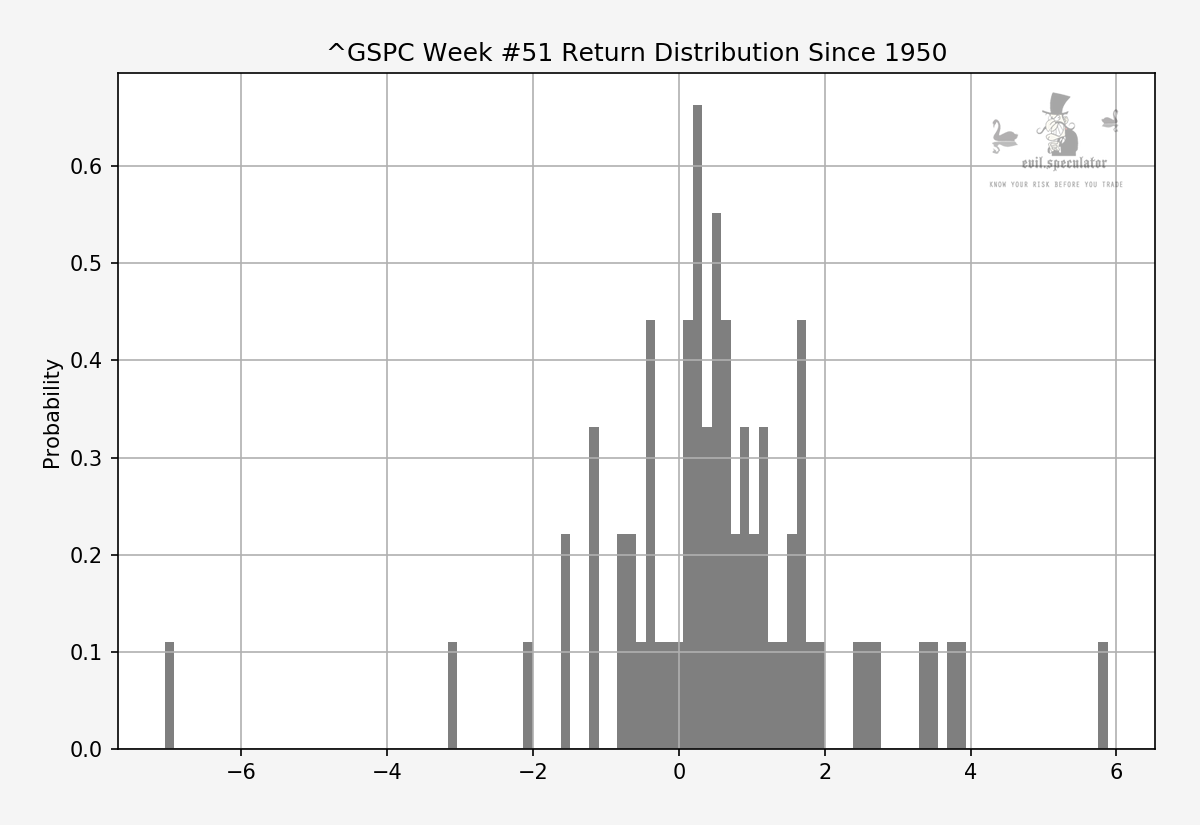

The histogram supports this – you can see that outlier sitting pretty lonely all the way to the left. But the take away IMO is that despite that massive outlier week #51 still ranks extremely strong per the historical statistics.

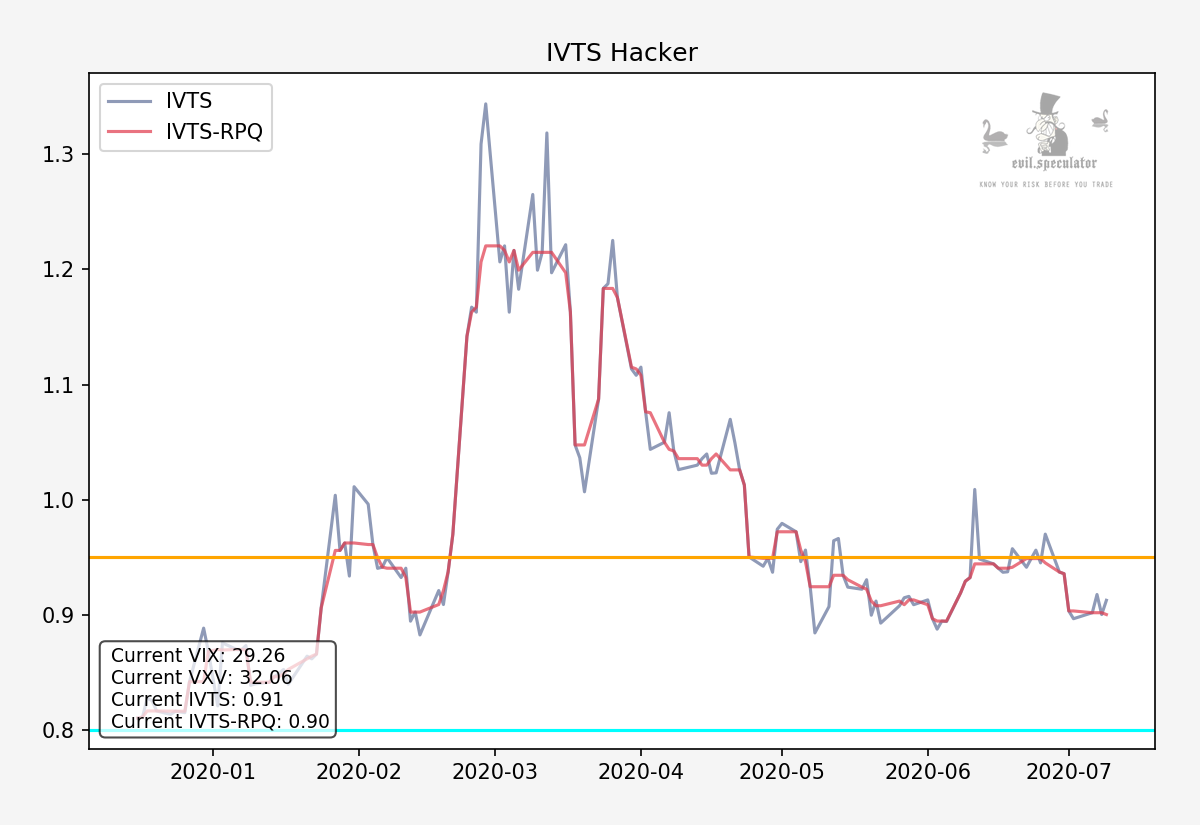

FYI – the IVTS (the implied volatility term structure) subtly hints at mean reversion in implied volatility. So if you were short last week and are still holding then this may be a good time to cash our and perhaps even consider reversing direction.

If you are long options be advised that a drop in IV this week would affect your options premiums. Also, if you are placing weekly SPY or SPX butterflies keep the seasonal dynamics in mind. This worked out very well for a good number of my subs last week 😉

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]