Everything but the U.S. Dollar seems to be ramping higher these days. Bitcoin is back over $19k with HODLERs projecting it to be at $30k sometime next year. The smugness in the crypto waterholes I monitor is literally oozing out of everyone’s pores.

Which is AWESOME as the big smack down is most likely just around the corner.

Having been around the block a few times and being a cantankerous old cynic in general I mused and in yesterday’s email update (make sure you’re on my list) that making money ‘should never be this easy’.

Quite on the contrary, it should feel uncertain and scary as hell every step on the way up. Remember the old aphorism ‘bull markets climb the wall of worry’?

Well that’s not exactly the sentiment I sense out there right now. It’s more like along the lines of ‘we are all f…ed so let’s make some FU money before the world falls apart.’

That’s the kind of investor sentiment that usually ends up in tears.

It’s also worth pointing out that the ‘new normal’ as they now call it has the VIX in a holding pattern near 21 while equities are scraping new all times highs on almost a daily basis.

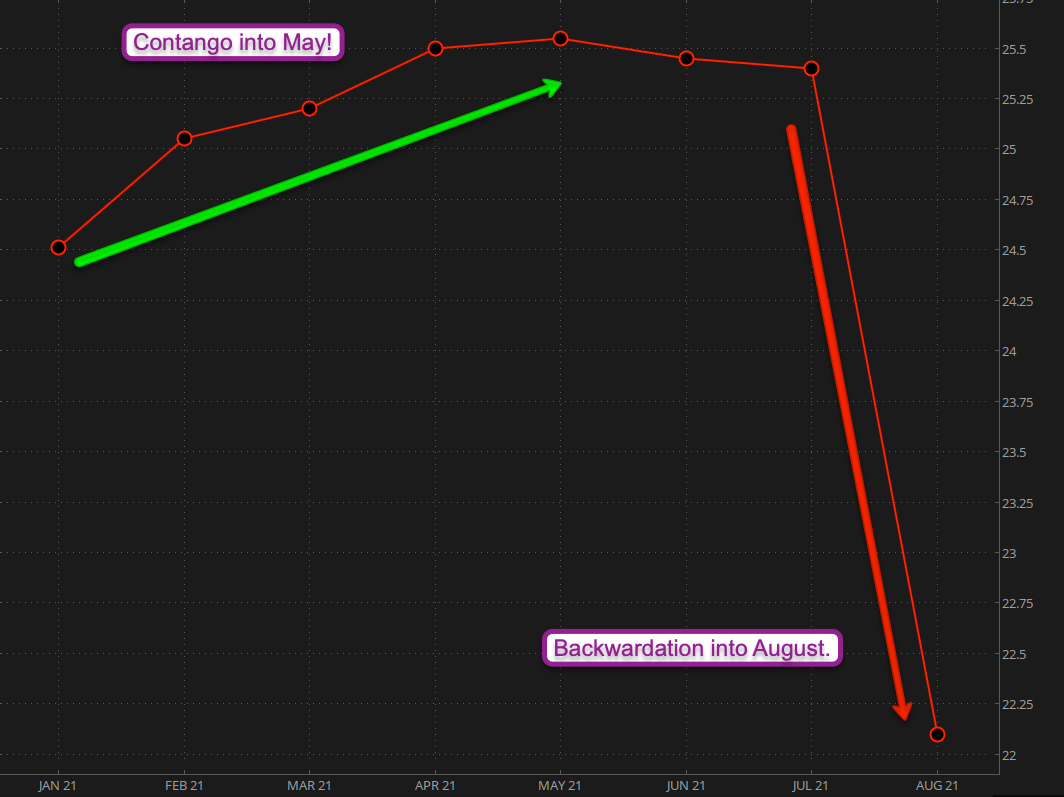

And then there’s this which henceforth should be known as the ‘long walk of 2021’. Meaning consistent contango in the VX futures all the way from January into May after which we see a flattening and then finally backwardation into August.

So what to do about it? Stupid question – turn it into coin of course!

In order to demonstrate what I have in mind let’s go back one day when I posted this chart in the email update which most likely you didn’t read and therefore missed out on a YUGE entry opportunity.

The basic take away was that we’d be seeing a pretty big move in the EUR/USD in a short order and I suggested to get positioned accordingly (either down or up). Well, I did both via my patent pending ‘hammock options strategy’.

J/K – it’s not patent pending, just a creative contraption that allows you benefit from large moves without getting killed by theta burn should it take longer than you think.

Anyway, this is the trade I took out – a backratio that printed some mighty coin just a day later when the EUR/USD unfortunately busted higher as if juiced by rocket fuel.

I say unfortunately because I happen to reside in Europe but earn in U.S. Dollars. Which means life is getting more expensive here for me on a daily basis.

But that’s neither here nor there. What matters is that I could have held this cheap little back ratio all the way into early January without losing much of my debit.

However any big moves – which were almost baked in – had the potential of printing extraordinary gains.

Such is the power of trading options.

Which is why I keep scratching my head over people who insist on guessing direction and losing large amounts of their trading capital doing it. But to each his/her own I guess.

Now having set the stage so to say let’s talk about the ‘future’ – meaning what shenanigans we can employ to profit from this big IV spike the VX futures appear to be anticipating:

[MM_Member_Decision membershipId='(2|3)’]

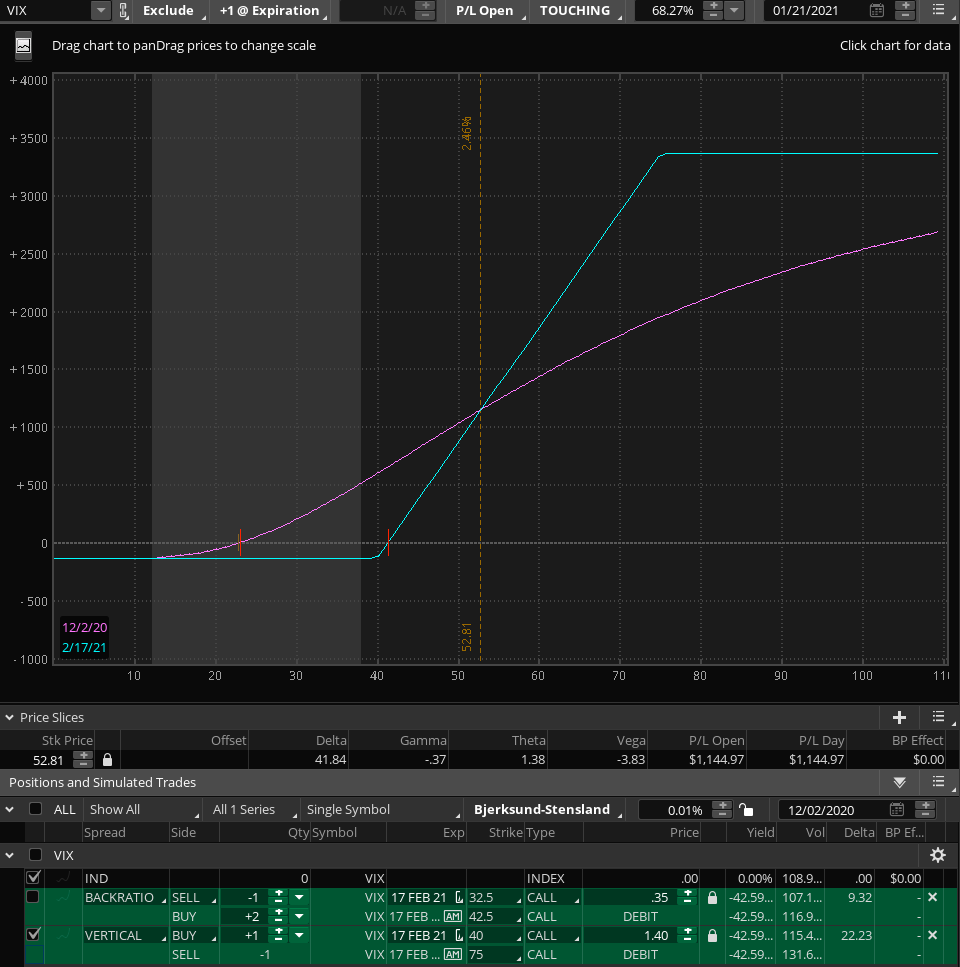

And of course it’s a call backratio again but this time on the VIX. If you have looked at my recent VIX charts then you probably recall that it seems to be forming a baseline around the 22 mark.

It’s a bit below it today but I don’t see it anywhere near 15 or below anytime soon. Especially with January coming.

The reason why I picked those strikes by the way has to do with delta as well as where it places the ‘valley of death’ which is indicated on the chart.

Now most people take these profit graphs literally and in my recent ‘Weekly Returns With Butterflies’ I actually devoted quite a bit of time to explaining why expiration graphs should largely be ignored.

Reason being is that you would sell this spread way way before ever coming close to expiration and thus it should retain quite a bit of residual value.

What’s important here is the pink line which shows the potential profit that could be made, and that does not even consider a jump in implied volatility (which yes – would also affect VIX calls – strange ain’t it?).

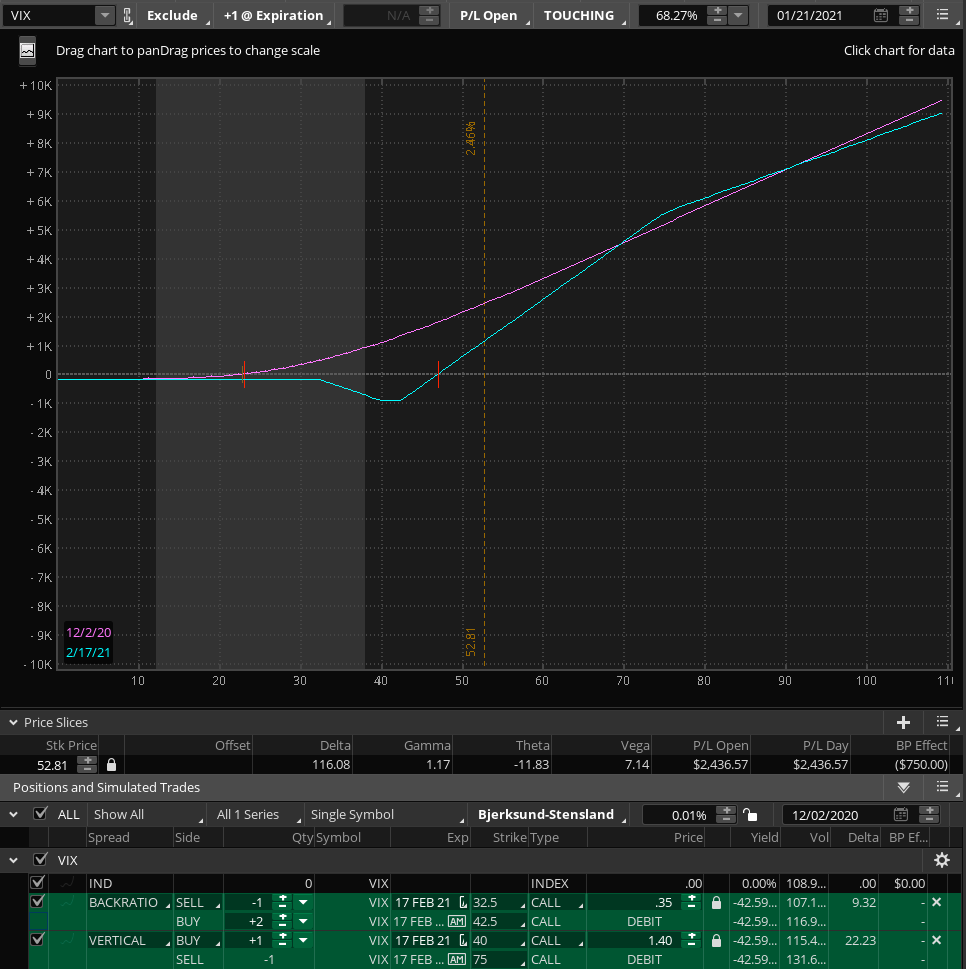

Now here’s a 2nd trade I am placing – and in this case it’s just a regular vertical which is a bit more expensive.

Why would I do such a thing? Well because it picks up a bit earlier as you can see and keeps banking coin all the way into 75.

That’s the way I like it!

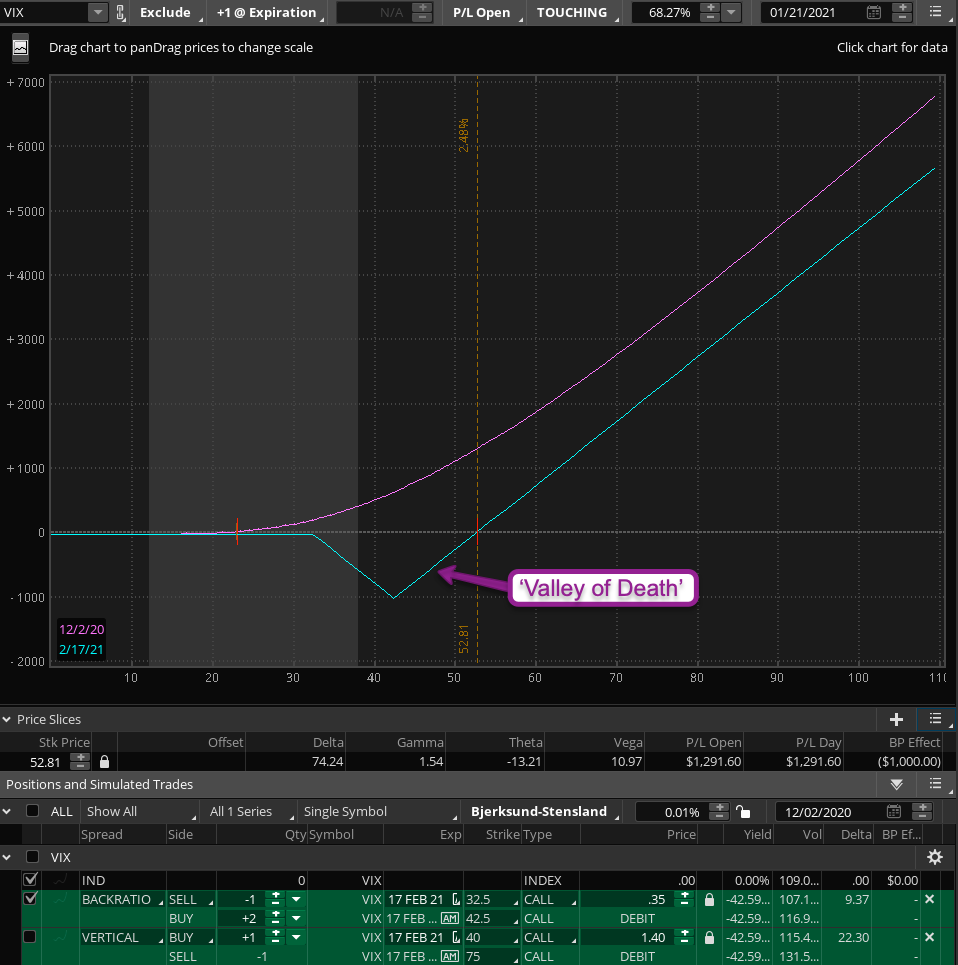

And here’s the profit curve of both combined. Yes, it’ll cost me $1.75 for both together but as you can see the ‘valley of death’ has been flattened a bit while the profit potential has increased markedly.

One single spread of each can print thousands while I only risk $175 combined. What’s not to like?

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]

By the way, speaking of trading options…

Why should you buy it?

Most option traders already know how to create and place a butterfly spread as modern platforms like ThinkOrSwim make the basic mechanics fairly easy.

What the majority of traders however do NOT know, and where most of the educational material you find on the topic fails to deliver, is how to MAXIMIZE your edge by constructing a fly that has high odds of banking any coin come expiration day.

So once again I dug deep and started producing a course that not only teaches you the basics of how to analyze and place a butterfly. Much more importantly it introduces you to a comprehensive systemic approach for trading butterflies successfully while conveying important fundamentals related to trading options that will accompany you for the remainder of your trading career.

Months of hard work culminated in the most comprehensive guide to trading butterfly spreads profitably you are going to find.

So get off the damn fence and buy it now!