Try to say that one three times in a row – heck, I tried! Anyway, it’s now ten days post election election day and we still do not have an official tally (don’t start with me!) and vote by the electoral college. The market isn’t liking this limbo situation one bit as trading whilst strapped to a chair with a Damocles sword dangling over your head isn’t exactly anyone’s definition of wholesome entertainment. Plus it seems everyone’s getting tired of the endless drama and just wants 2020 to be written off as a the year you shall never speak of again.

But you didn’t come here to be bored with political platitudes so let’s drive right into the market which is currently offering us a kick-ass money printing opportunity. Assuming you know how to read between the lines and also understand how to take advantage.

So let me illuminate you via a simple show and tell I’ve prepared for your edification. Look at the SPX over the past three weeks. Does anything stand out by any chance? Yes, there are big moves, thanks for pointing that out Sherlock.

No but that’s not what I’m referring to – it’s the fact that equity markets continue to do a horrid job of handicapping risk as evidenced by three consecutive breaches through the weekly expected move. Cue HD with his weekly derogatory remark about quant traders.

Well, those cats aren’t actually the dullest tacks in the box and may I point out that they’re not the ones pricing risk, it’s the market as a collective. Whatever the reason the fact that one half of the population is currently crying foul about a presidential election does not seem to have any bearing on the pricing of future risk.

Which is exactly where we come in but more about that later. What’s important right now is that IV is still relatively cheap and seems to have stabilized post election. This is something that has rubbed me the wrong way for the past week and I frankly smell a stinking rat here.

Not surprisingly big tech was elated about the prospect of a Biden win but it has now pulled back a little while waiting for new instructions. And that’s the big conundrum the market is experiencing right now – it may take weeks for this political train wreck to be untangled, so effectively it’s operating in limbo right now.

Now for directional traders the risk of a big swing in either direction is not a very attractive prospect as a wipe out in either direction could be extremely costly. Option traders on the other hand, especially of the professional kind live for that kind of stuff. After all done right, a big move has the potential to print bucko bucks in a short amount of time. What’s not to like?

So let me show you what the cool quant kids are currently cooking up:

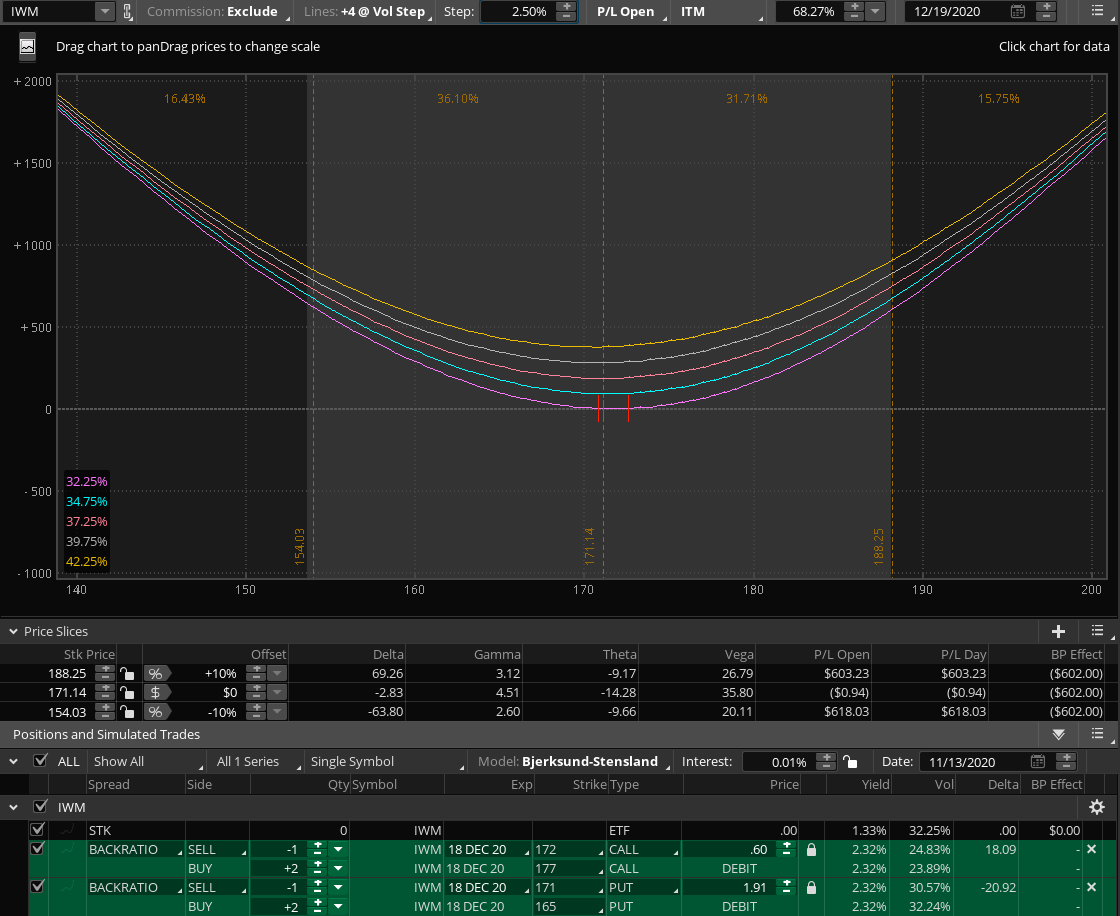

[MM_Member_Decision membershipId='(2|3)’]So this is pretty textbook. What we have here is IWM which currently ranks pretty low on its IVZ-Score despite the fact that it’s flipping and flopping like a fish on dry land. Expected move? Never heard of it!

This is the type of symbol you want. Usually fairly well behaved during normal times but as soon as there’s a chink in the market’s armor it has a tendency to go apeshit in three seconds flat.

And this is what we’re going to do about it. The basic idea is a double back ratio – one on the bullish and one on the bearish side. It’s a HV variation on my hammock trade and unfortunately explaining all the finer details would take me a long time which is why I’m planning on producing a special course about it.

For now the simple recipe is as such:

- Sell 1 ATM or near ATM option (calls with calls and puts with puts) with a delta of about 50 plus minus one or two handles.

- Buy 2 OTM options of the same series with a delta of about 35.

That’s it – this is usually a more long term trade and there are various other criteria but it would make things too complicated at this point, and I’m trying to keep things simple.

Keep in mind that you will NOT hold this trade all the way into expiration. What makes this a relatively low risk endeavor is that there will still be substantial time value in these options a week or two from now as the expiration date is December 18th.

It is possible that things drag out that far but it’s unlikely at this stage at least. Which means that even if NOTHING happens and we stay right here by December 7th (give or take a day) and barely move you will still be able to recover quite a bit of residual value.

It’s difficult to estimate but an educated guess puts us in the 30% to 40% range of the current premium by that day, unless of course the VIX drops to 20 or below which would suppress vega.

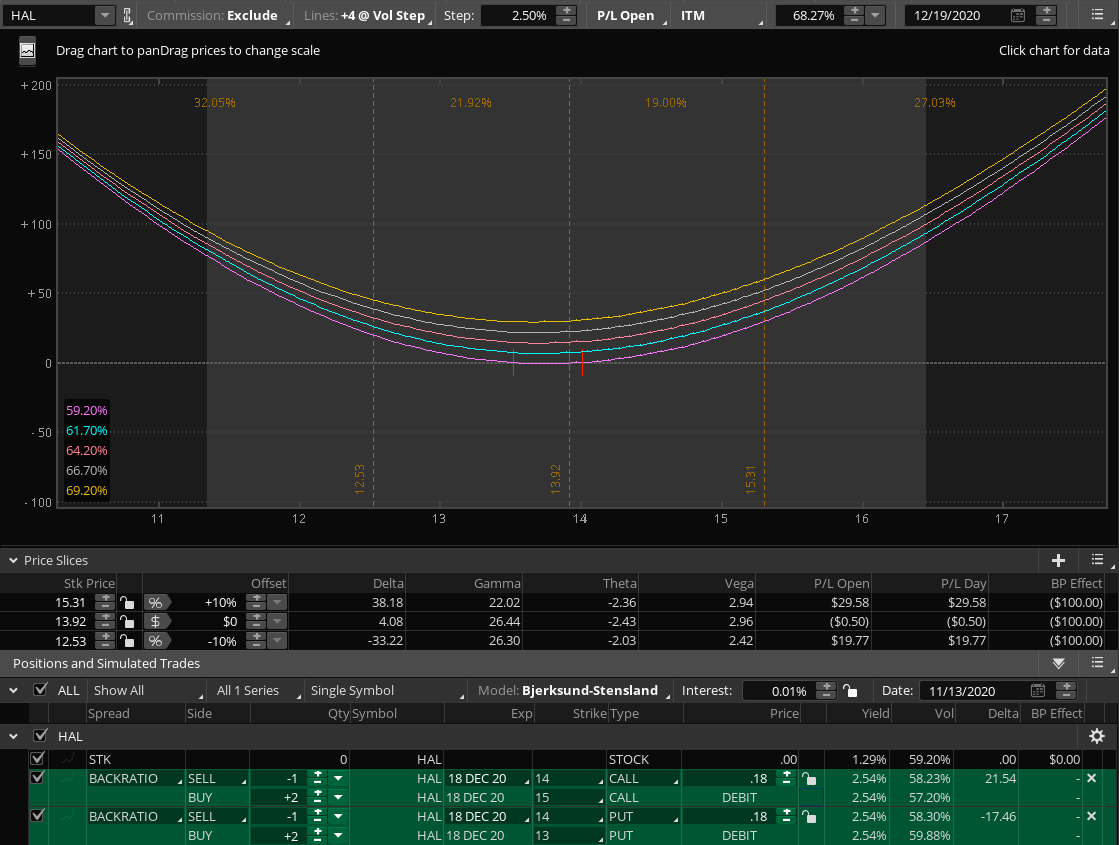

Another example is HAL – Haliburton. For whatever reason (and I have my own tin foil hat theories) HAL jumped massively after last week’s announcement and since then it’s also stuck in a waiting loop.

And here’s an example campaign based on the same criteria. Quite cheap I may add and the potential upside is substantial. Just the way we like it.

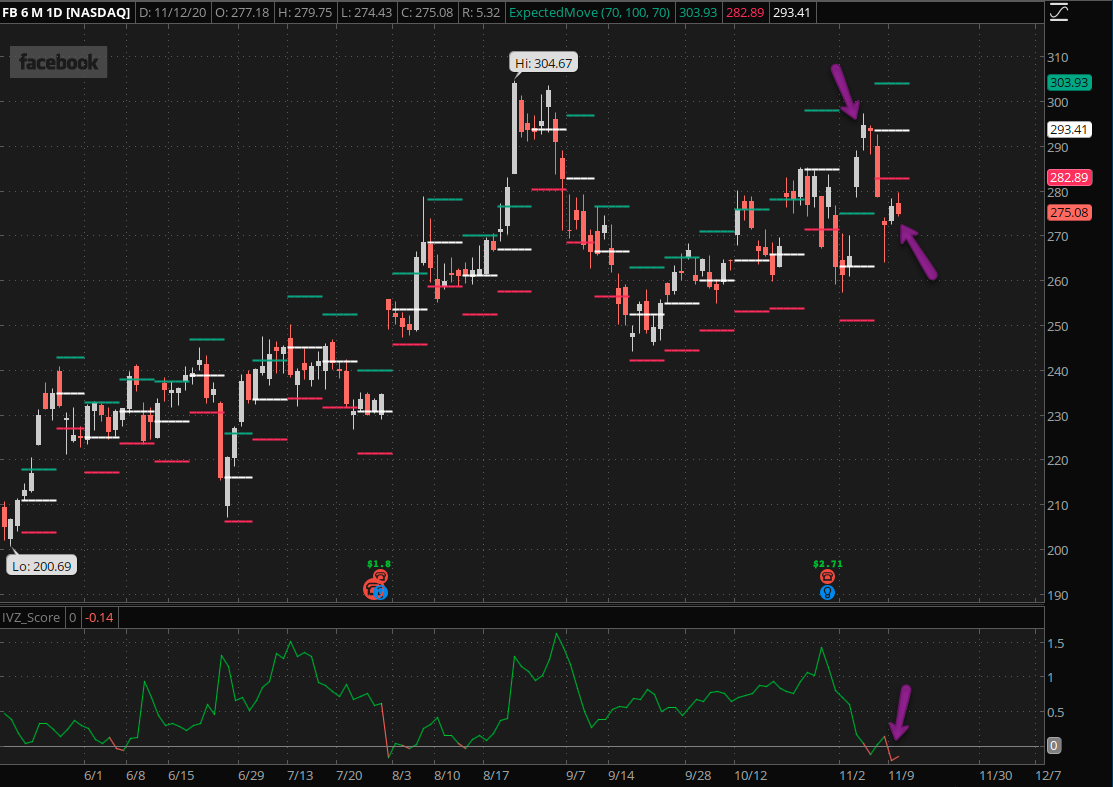

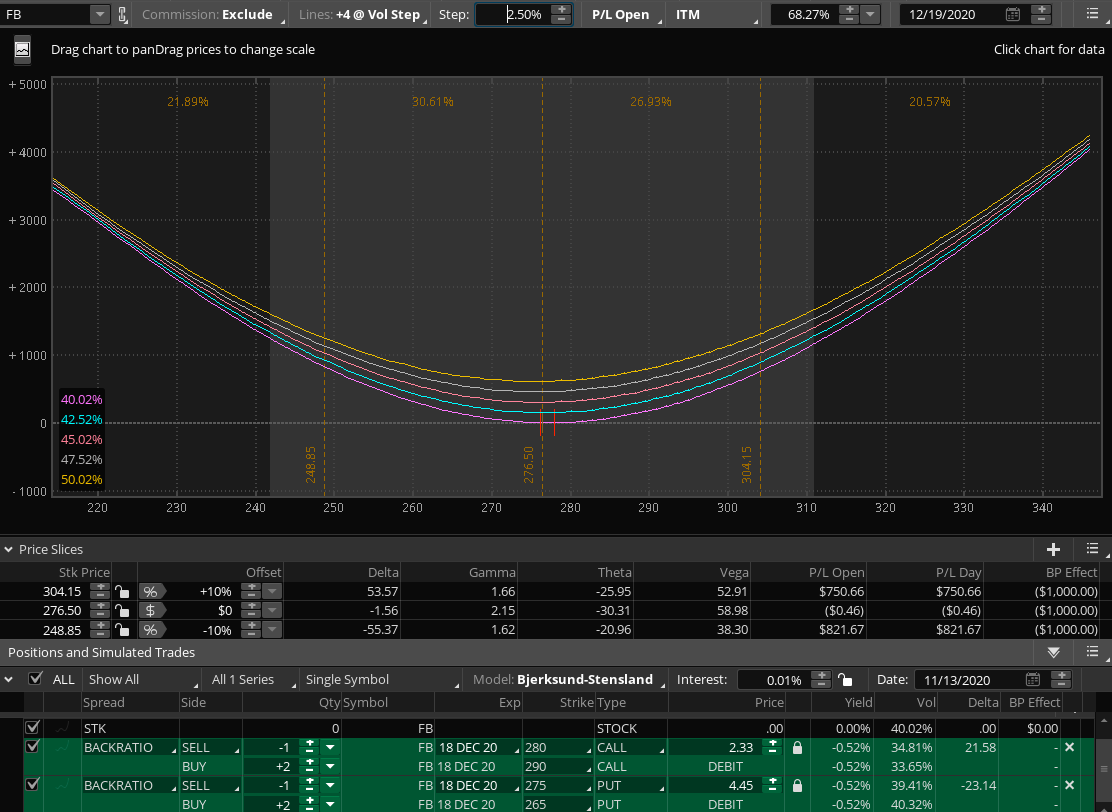

I mentioned big tech and I leave it up to you to fish for the appropriate victim. But FB most definitely is going to be one of them on my end for various reasons.

And here’s the trade. If you check those strikes you’ll see that they’ll match the mentioned criteria. This one is a bit costly and feel free to play with it a bit to lower the debit on the put side. But again, the upside potential here is YUGE in comparison and it’s worth a handful of contracts.

A Few Ground Rules

- Don’t screw around and dump these spreads at maximum three days before expiration date.

- Do not hold any of these campaigns into expiration.

- Do not leg in or out of these spreads separately. It’s cheaper and better to do it as one trade.

- Make sure you get a good fill and be prepared to wait and perhaps re-submit if necessary. Patience pays off when trading options as the spreads can vary on some symbols.

- Whatever symbols you pick make sure it has a ton of liquidity. If you have to ask, guess what – it’s not anything you want to touch with a ten foot pole.

Happy hunting but keep it frosty.

[[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]