The situation is increasingly turning more dicey as markets are shifting into pre-panic mode with only six days to go until an almost assured presidential election train wreck. You wouldn’t really think so just looking at the price action over the past week but under the hood pre-election hedging activity has left tell tale signs of a busy winter in the making.

I hate to sound like a broken record but with a VIX hovering at 35 you would – under normal conditions – expect more than just a tentative touch of the lower expected move threshold.

Then again, given what’s going on worldwide right now emotions run so high that a drop to SPX 3000 would probably propel the VIX to the 200 mark. We are all fragile snowflakes after all.

I promised you a jump in the VIX for several weeks now and as usual I delivered 😉

Here’s realized volatility of IV again. It’s on the move and most likely we ain’t seen nothin’ yet. Remember when I told you subs to go long vega? Well, that’s what I was talking about. Your premiums just doubled and we haven’t even moved yet.

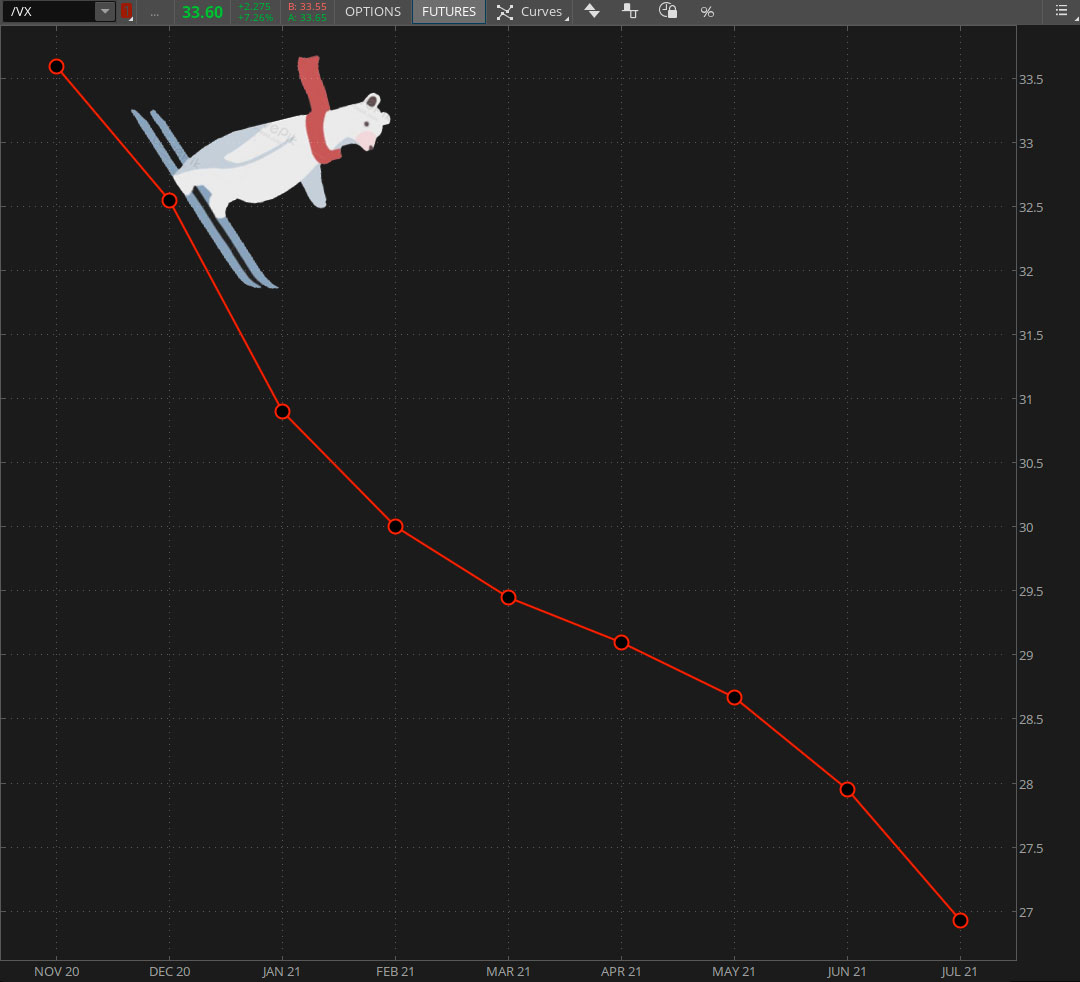

The VX futures remain in backwardation, which should be expected given anticipated forward risk. What’s fascinating and extremely worrisome is the discrepancy between the VX and what I’m seeing on the SPX option chain:

[MM_Member_Decision membershipId='(2|3)’]

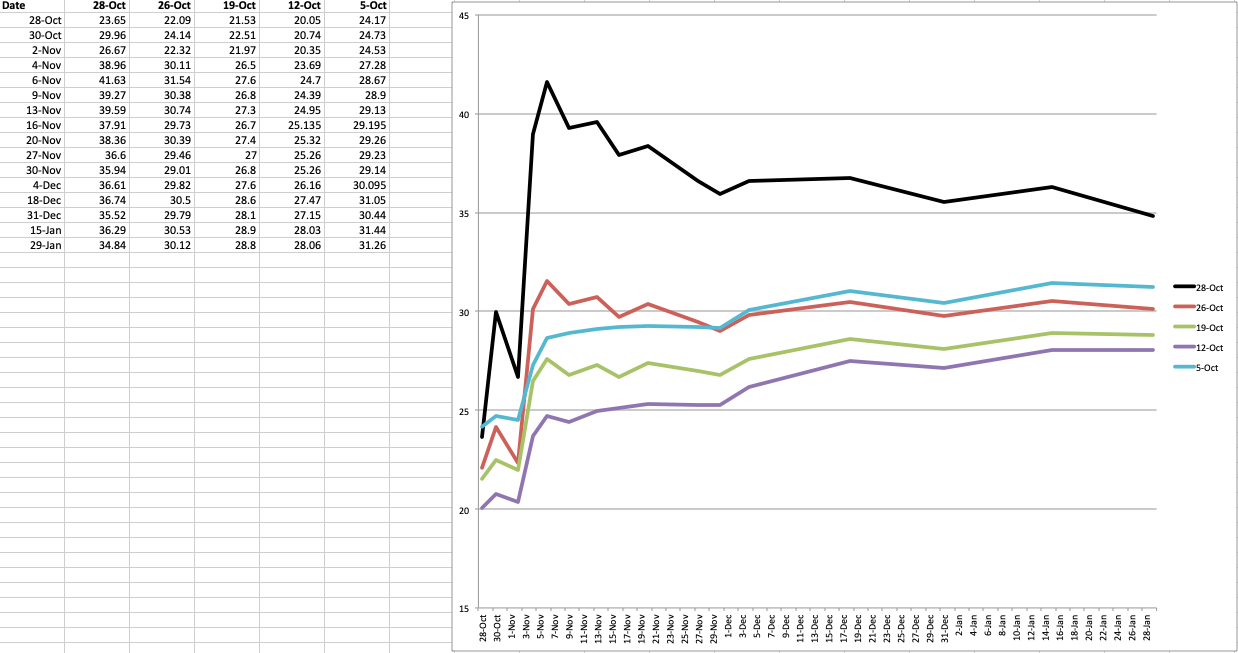

I am confident that I don’t have to explain this graph a third time to you. But alas in a nutshell these are IV readings across the SPX chain over the course of October. The black line is the most recent reading (today) and as you can tell the entire graph (all series) just jumped considerably.

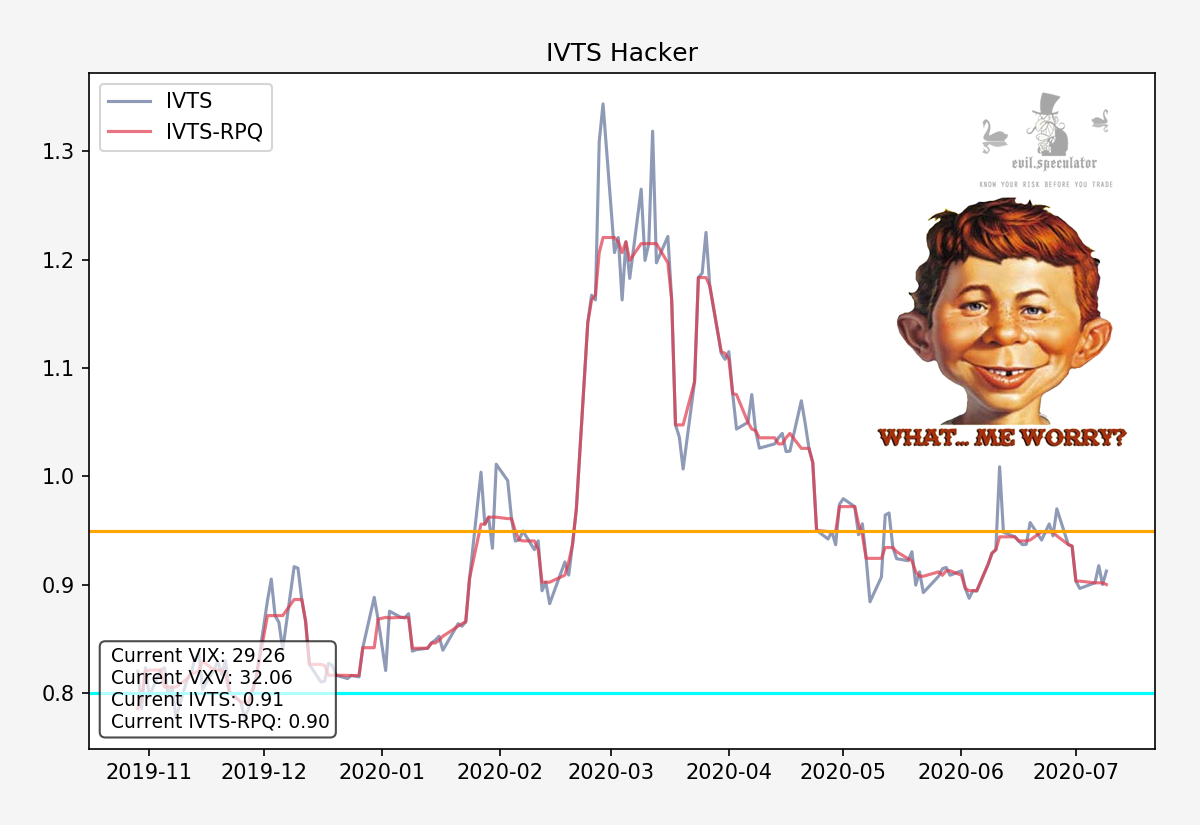

That’s probably the reason why my IVTS however remains chill as both front month and back month contracts are expecting turmoil. Let me tell you that this is not something I have ever seen, as markets rarely – if ever – anticipate several months worth of financial upheaval. We truly live in interesting times.

Now although I love the jump in the Dollar being an expat and all, but this is an early sign that asset holders may consider the USD as a possible haven to sit out the next few weeks. Yes, one or two days don’t make a trend yet but I’ll be keeping my eyes on this.

Finally a quick reminder that big tech is reporting earnings this week. Staring with the biggest dog: AMZN which reports on Thursday.

Ditto on Google.

And Facebook. Yes there are facing possible regulation and oversight post election but let’s not kid ourselves. Nobody is going to go up against several trillions in combined valuations without cutting some sort of deal. So if you are hedging pertinent bets let me burst your bubble right now.

That said I already told you how to trade this via OTM iron condors last week, so if you intend to play jump back to that post for a quick primer on how to get positioned.

It’s difficult to gauge direction but given the current environment a big enough jump or drop should produce reasonable returns. Pro tip: Don’t bet on outliers via naked options, go for the low hanging fruit. And never ever risk money on earnings plays you aren’t comfortable losing as they are low probability plays.

Happy hunting but keep it frosty.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]