The past four sessions turned into a wild ride but as of the Friday open the SPX has been getting nowhere fast and finds itself almost exactly where it started the week. This puts us in a very interesting situation for one main reason: With a monthly and a weekly contract expiring this morning, a 70 handle EM range, and quite a bit of gamma risk there is potential for a significant move today.

Plus let’s not forget that we are in one of the most volatile weeks of the year. So please take fasten your seat belt and make sure your folding trays are in their full upright position.

Now beside the potential for a squeeze in either direction the one thing I want you to pay close attention to is the IVZ-Score in the bottom panel of the chart above. If you don’t know what a Z-Score is and how it relates to implied volatility then please point your browser to my seminal post on the subject. I’d say you’ll thank me later but nobody ever does! 😉

Assuming you grasp at least the underlying concept take a glance at the Z-Score on the Spiders which have been scraping the bottom of the barrel for quite some time now.

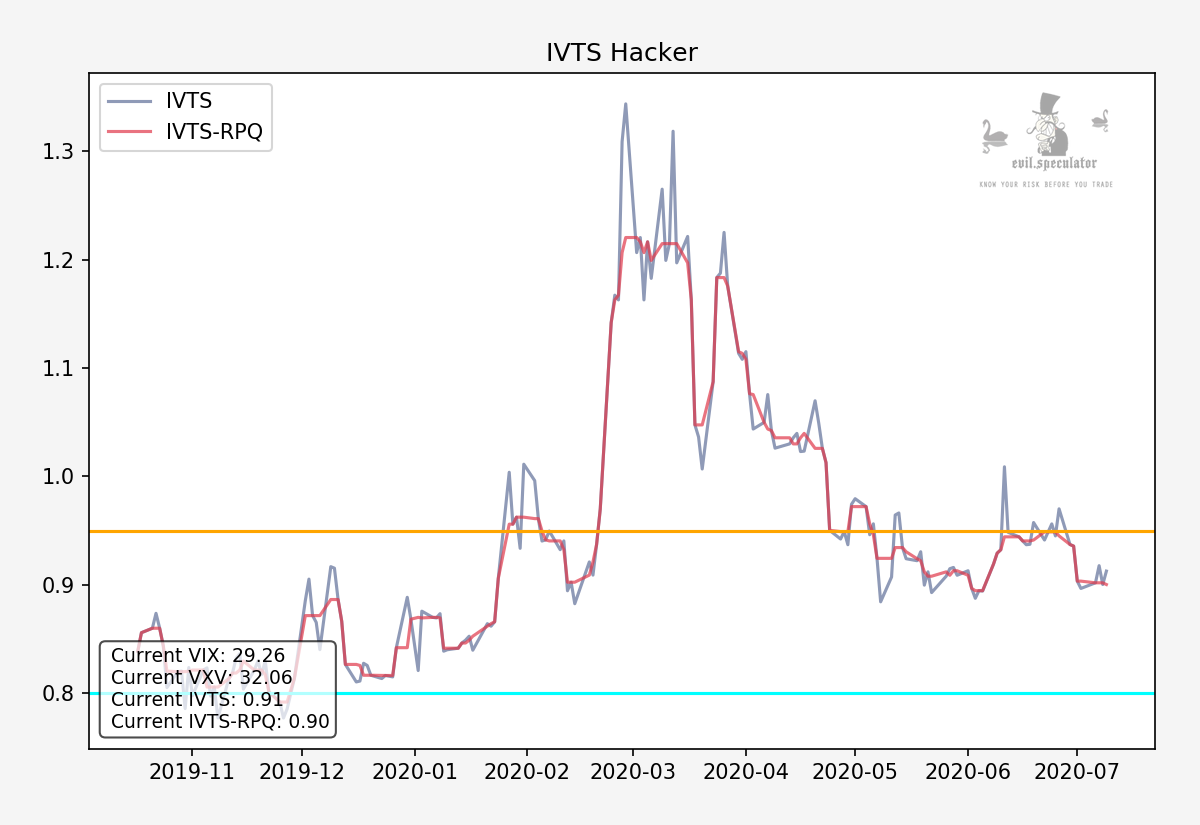

This is something I’m actually all across the board as is evidenced by the VIX, which is elevated by historical standards but rather chill in the context of what we’ve been through over the past 7 months.

The IVTS also has been running in what I would call moderate bullish mode since last May now. As we are heading straight into a presidential election the potential for much monkey business is growing by the day.

Which of course opens up an awesome trading opportunity ahead of November 3rd – if you are a sub join me below for more:

[MM_Member_Decision membershipId='(2|3)’]The general idea here is to look for symbols which have been volatile in the past but for one reason or another seem to be scoring low on their IVZ-Score. IWM most definitely fits the bill on that end which is why I’ll be using it as an example further below.

Another one is ORCL. Oh so juicy!!! It’s volatile even outside of earnings during good times. Early this year its EM may as well not have existed as it was violating it almost every single week. This then caused option sellers to become overly cautious (April though July) but then things seemed to normalize again in early fall.

Now it seems to be slowly heating up again despite the fact that we’ve had three EM breaches in the past month. Nevertheless its IV-Z score is currently at -.58 – the lowest score in the OEX.

But how did I find them? Very simple actually. All I did was to pull the OEX into a TOS watchlist and then sort it by IVZ-Score in order to extract the most underrated contenders. Clearly we’ve got a lot to work with here!

That’s all nice a dandy but how do I trade those guys? Well, I thought you’d never ask!

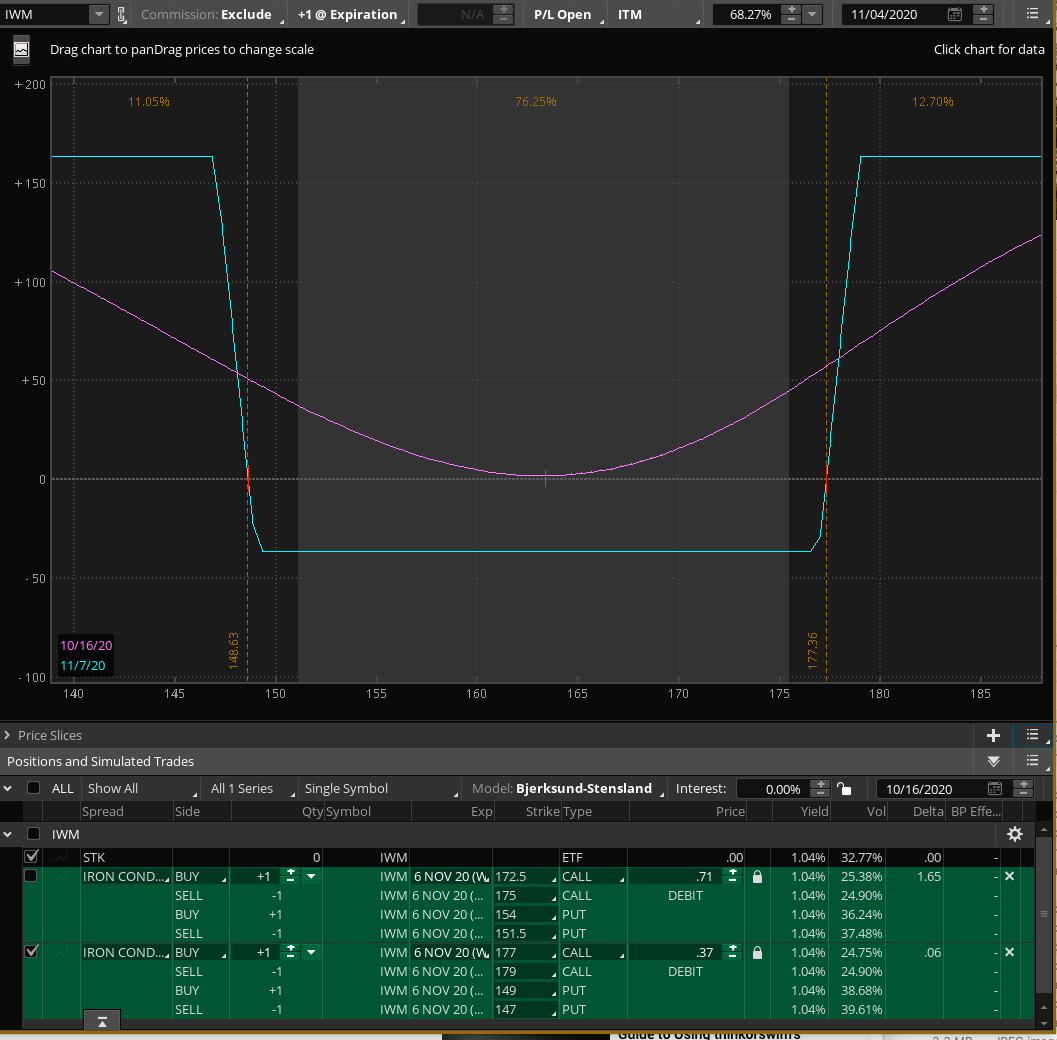

Buying far OTM iron condors that is how. I’ll actually start work on a pertinent course near Christmas but for now let me nutshell it for you:

- Buy an OTM iron condor with an expiration post the presidential elections. Here I’ve chosen Nov 6th but the 13th is just fine.

- The long legs should carry a delta of about .10 – a little less or a little more is fine.

- The short legs should be three to five strikes out but the main criteria is the probability below, so play with it.

- Probability should be around 10% to 25% max. You calculate the risk by dividing the debit by the width of the spread.

The IWM examples shown above are both permissible but I actually prefer the 147/149/179/177. YES, they are low probability Hail Mary trades but I am pretty comfortable taking them as I feel that IV is currently running to low given where we are heading.

Suffice it to say that any pertinent campaign is designed to be held until after the presidential election. However, given the recurring Hunter Biden releases already announced by Rudy Giuliani it’s quite possible that we see some big moves even ahead of the actual election. So if price pushes into my profit zone I’ll be sure to take instant possession of my ill-gotten gains.

Happy hunting but keep it frosty.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]