The Brotherhood Of Organized Market Megalomaniacs (BOOMM) has informed me that I have not been acting sufficiently nefarious as of late. Well that all ends today as market conditions have finally opened a door to claiming my well deserved share of ill-gotten gains. In somewhat related news I am currently looking for a small number of well trained minions willing to do my egregious bidding.

Alright seriously though, I am seeing certain divergences across various market sectors that do deserve additional attention. Today’s session and this week’s close will be key in getting us properly positioned for next week.

Let’s start with the SPX which is currently clinging to its lower expected move threshold near SPX 3242. A push further below today would undoubtedly trigger more selling due to short hedging activity.

The NDX in contrast has remained largely unscathed by this week’s drama, at least thus far. In fact unlike the ES futures the NQ is currently trading near last week’s close. Which is interesting giving that big tech in particular was everyone’s least favorite step child just a week ago.

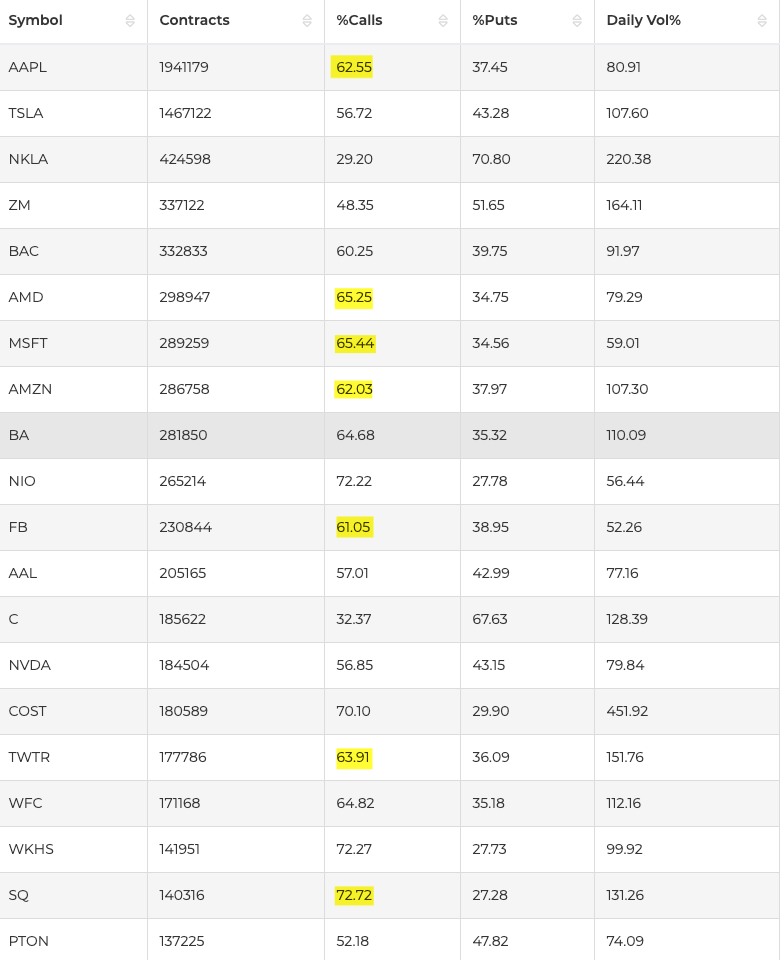

And then there is this:

[MM_Member_Decision membershipId='(2|3)’]

Well isn’t that interesting? Call buying activity continues to outweigh puts by nearly a factor of 2:1. It’s almost as if someone is expecting a bounce in the not so distant future. Not that option buyers always get it right but if they are things could accelerate rather quickly.

So let’s take a closer look at some of the big symbols in the tech sector:

Starting with the top dog, AMZN. It attempted to break out of its upper EM threshold but dropped back on Wednesday. Quite a come back though after starting the week in a rather dismal manner.

MSFT has remained inside its EM range and even tickled its upper EM threshold on Tuesday. Yes this could still resolve to the downside but unless 195 is taken out I think it has a good chance of staying near the 200 mark this week.

AAPL has also remained inside its EM range after a quick stab higher on Tuesday which failed at – you guessed it – the upper EM threshold. It really does not want to be a double digit stock again, so let’s see it can hold the line.

FB still the straggler but it has managed to hold the EM range as of right now.

GOOGL also still lagging behind. Should tech fail today this would be my go-to candidate for potential short holdings.

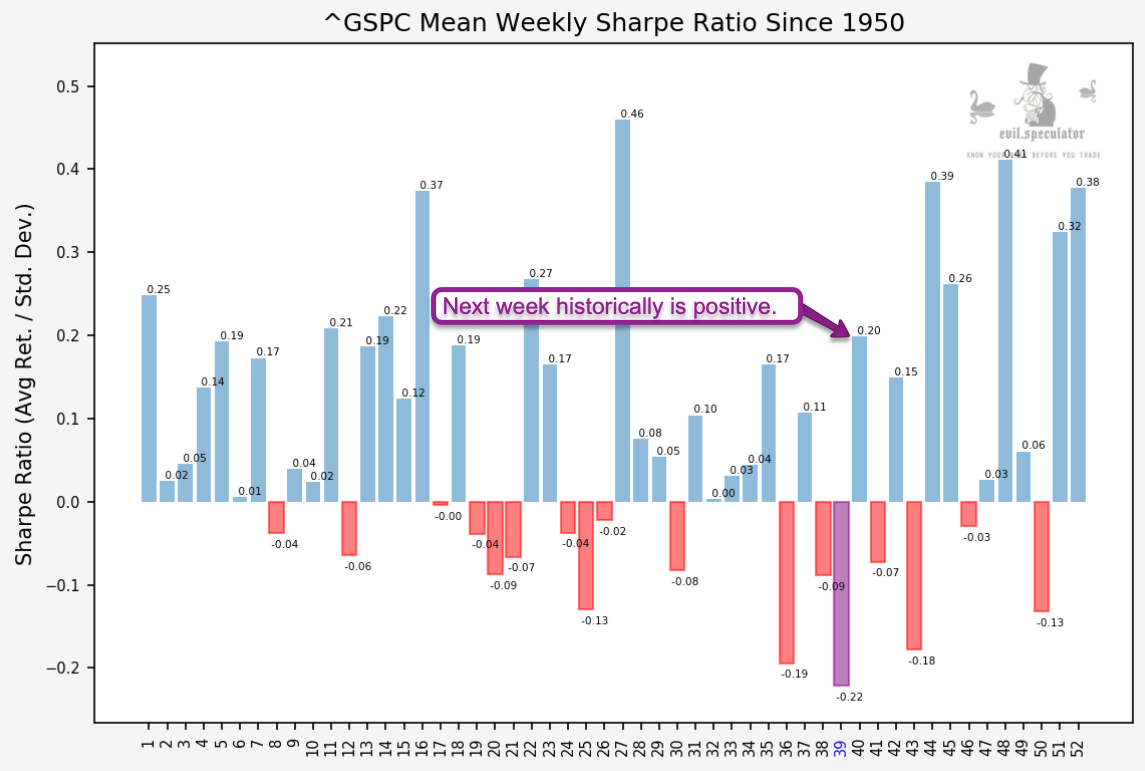

Let’s not forget that next week is supposed to be pretty positive historically speaking – it’s not a prediction of course, just seasonal bias.

Bottom Line

The potential for a bounce and perhaps even a short squeeze in tech and big tech in particular are pretty good for next week. Position yourself accordingly. On the downside I would keep an eye on GOOGL and FB in particular which are trailing the pack.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]