The E-Mini futures have been advancing higher in the pre-session and we are now approaching the crucial inflection point I have been highlighting for the past few sessions. It’s probably no exaggeration to say that what happens today will most likely affect the remainder of this month going all the way into the presidential elections.

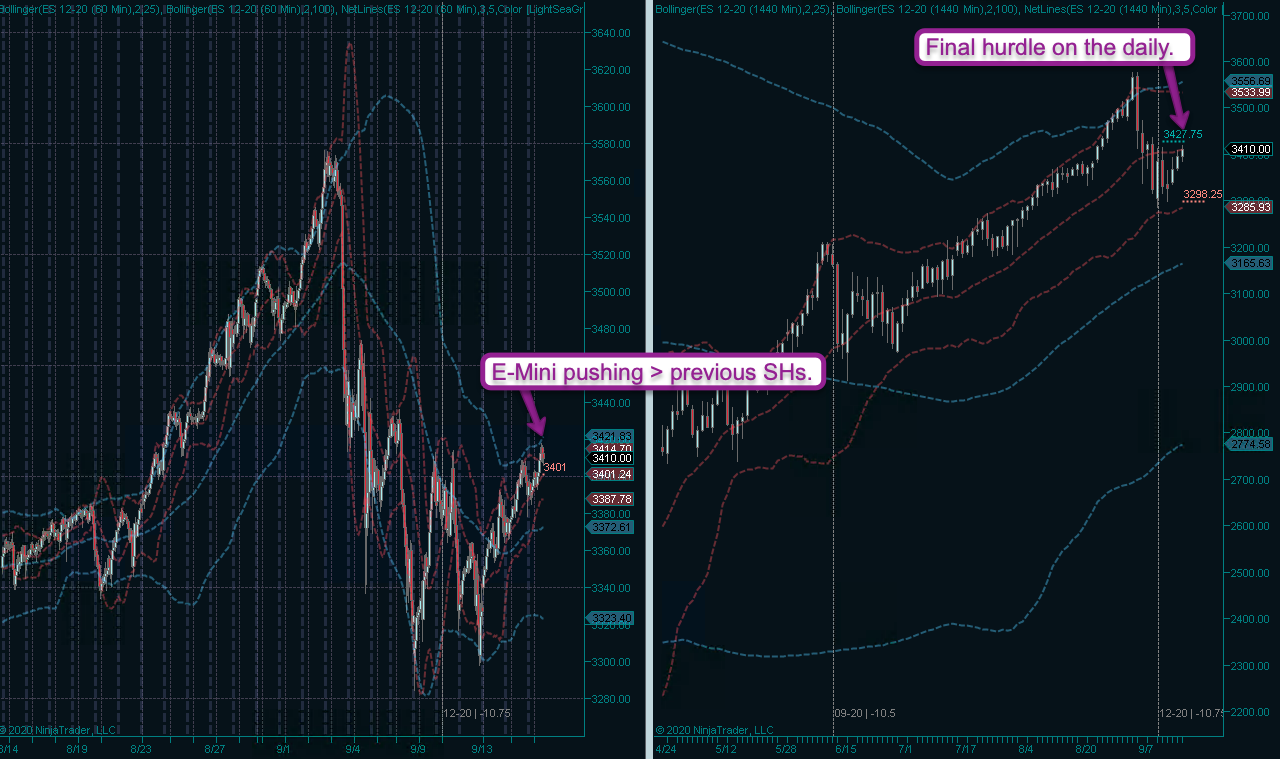

So let me paint the picture for you guys. As you can see in the left panel the futures are already trading above the previous spike highs which were painted right around the December roll over.

On the daily panel we see one more hurdle ahead delineated by my Net-Line Buy Level which basically marks last Wednesday’s spike high at ES 3427.25.

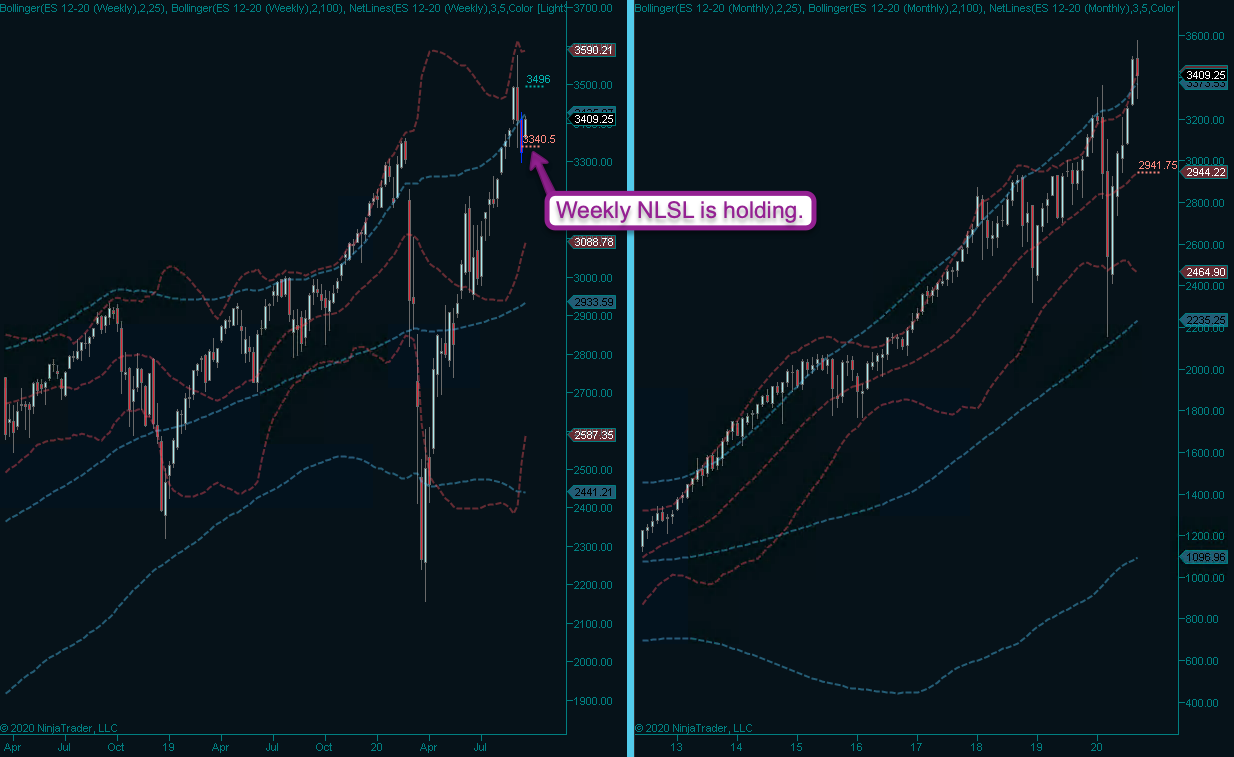

Like clockwork realized volatility exploded at the beginning of the month but has completely died down over the past two weeks. Seasonality or not – this does not work in the bears’ favor.

On a weekly basis it appears that the weekly NLSL ES 3340 and change was successfully defended.

Now let me show you what really matters in today’s session and how to plot the path ahead:

[MM_Member_Decision membershipId='(2|3)’]I keep harping on expected move and it’s not a big coincidence that my technical tresholds line up almost exactly with this week’s expected move which was at roughly 90 handles up and down on Monday.

What usually happens is either it stops right there or it breaks higher burning the shorts and then reverts back lower, sometimes even closing the week near the EM threshold.

I should point out that a break higher would squarely hand the odds back to the bulls, no matter if we see a snapback or not.

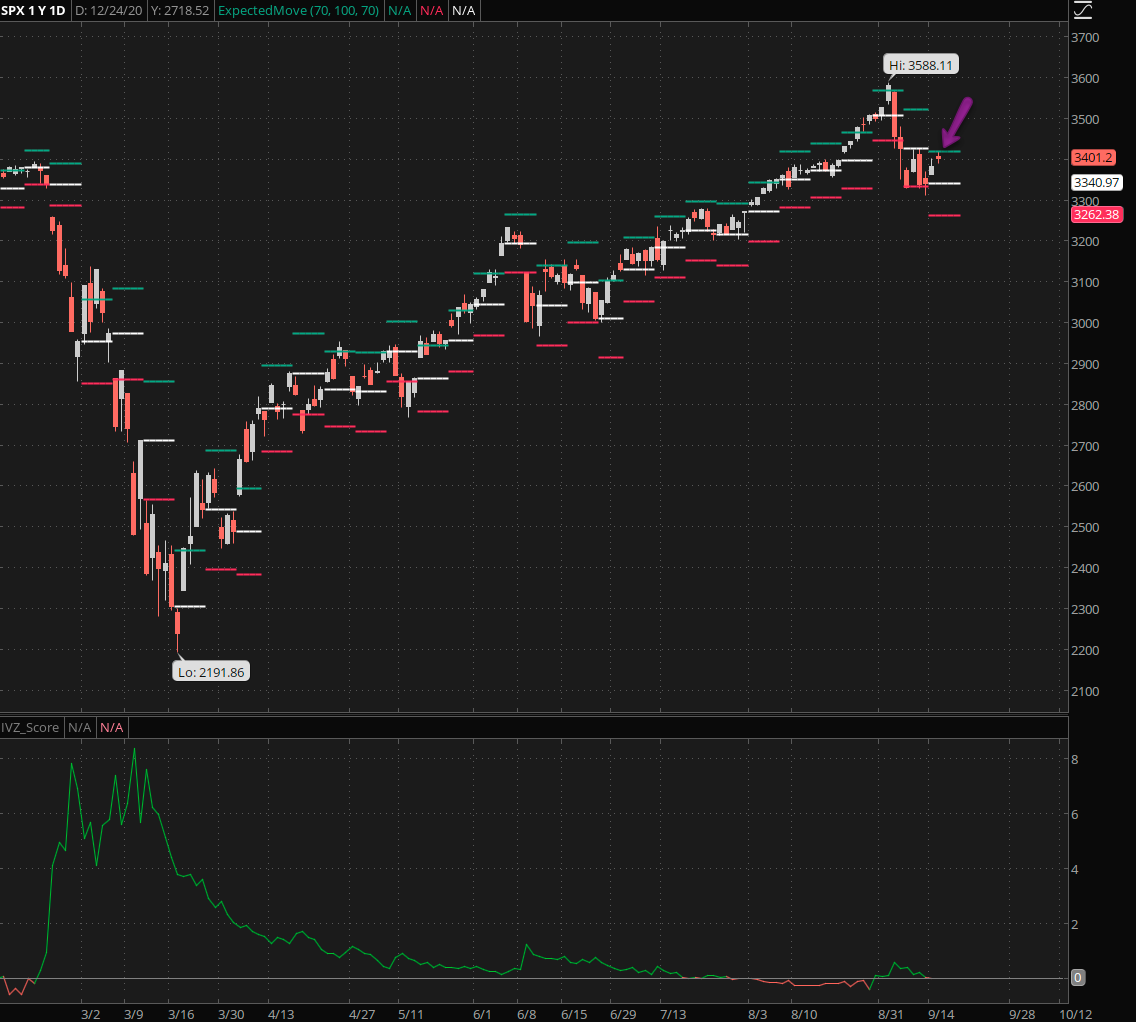

Speaking of implied volatility – it’s shriiiiinkiiiiing!!! We shouldn’t have sprinkled it with water I guess.

Now seriously speaking, IV is falling and it’s also slowing down. Once again that usually favors the bulls.

Realized vol of implied vol is falling even faster. You guessed it – this favors the bulls. Why? Because I said so.

AND because it points toward a more consistently positive perspective by market participants 😉

The only thorn in my eye in all this has been big tech. After having driven the entire marketplace for months on end it’s completely being left behind. I have seen sector rotation before but this seems very strange to me.

In fact big tech is clearly lagging the NDX and it’s not for a lack of trying either.

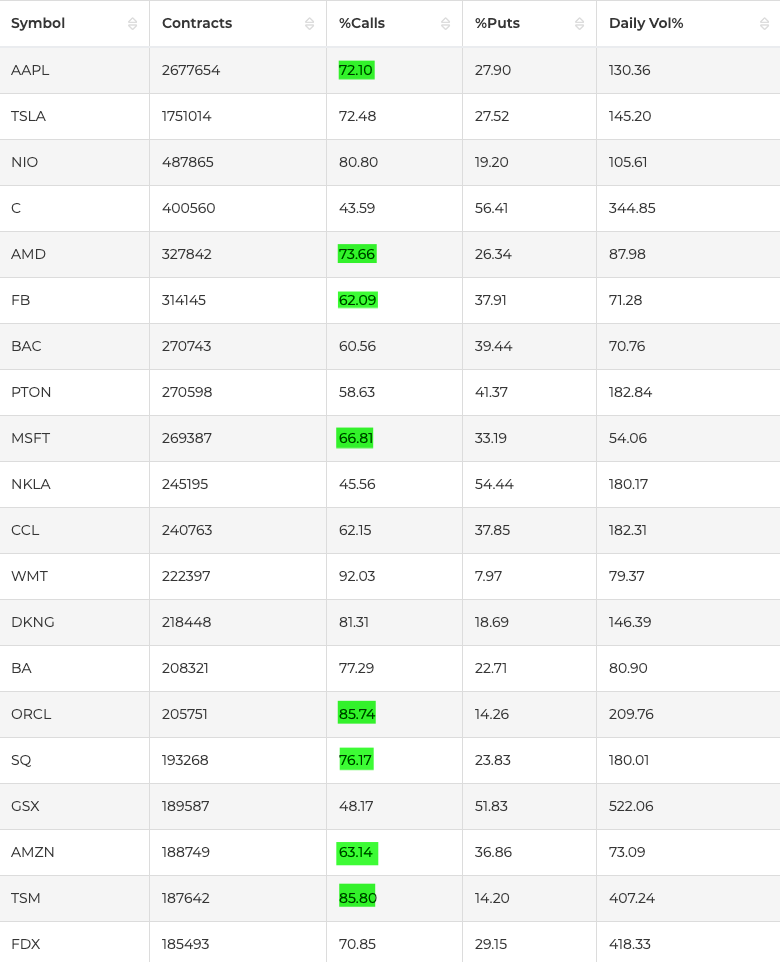

As you can see we’ve got PLENTY of call buying activity and the top 20 symbols are mostly tech or automotive related.

Not sure what’s going on there but option buyers continue to grab big tech by the bushels. At some point this ought to start moving the needle. If that happens we may see a massive short squeeze in big tech symbols.

As you recall on Monday I grabbed a few hammock spreads which also gain on a big break higher (hence the name if you look at the P&L curve). It’s still applicable today, especially since IV is dropping (meaning cheaper premiums) and most of the big names have not moved much.

If you’re bullish the monsters of tech then you can also take out a vertical spread – e.g. an I/O spread. But I don’t recommend you start buying calls as you’d get killed by the ensuing vega squeeze.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]