The weekend fears of a many retail bag holders turned into reality yesterday when last Friday’s sell off was amplified by continuation at the tail end of a lackluster low participation session. The main thought circling around in everyone’s inflamed amygdala right now is whether or not we have reached selling exhaustion or if there will be more follow through in the days and perhaps weeks to come. The short answer to that is – yes, and no.

The long answer is a bit more complicated but let me try to lay it all out for you:

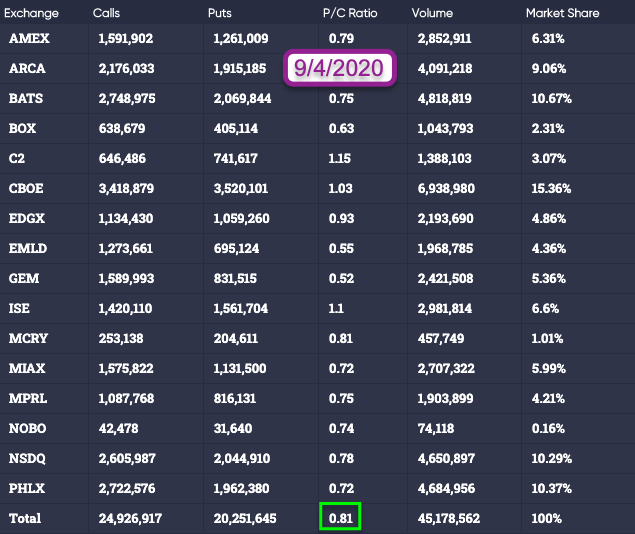

For starters here’s the put/call ratio for equities on Sept. 4th – last Friday – courtesy of the Options Clearing Corporation (OCC). Despite a rather significant sell off that hit big tech pretty hard in particular it ended up at 0.81.

I did actually check various tech related symbols, e.g. AAPL, MSFT, AMZN, etc. and the p/c ratio was a LOT more amplified, which was in line with the fact that that sector had been hit particularly hard.

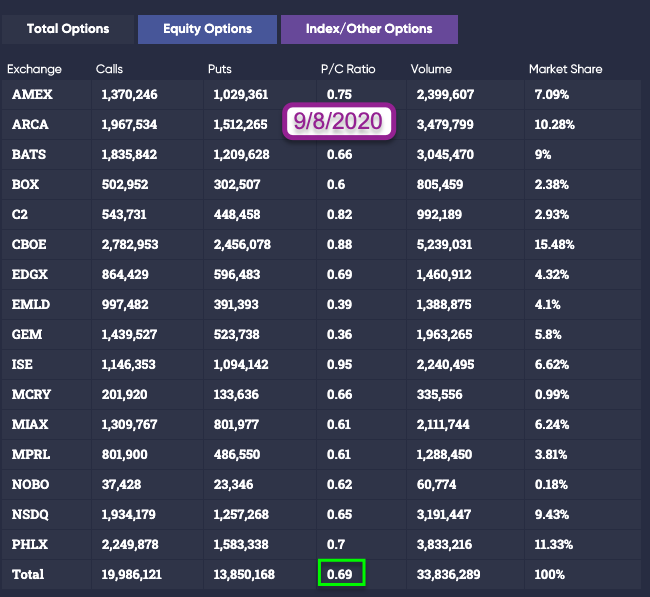

Now contrast that with the p/c ratio recorded for yesterday. Nearly 1/3 more call activity than put activity.

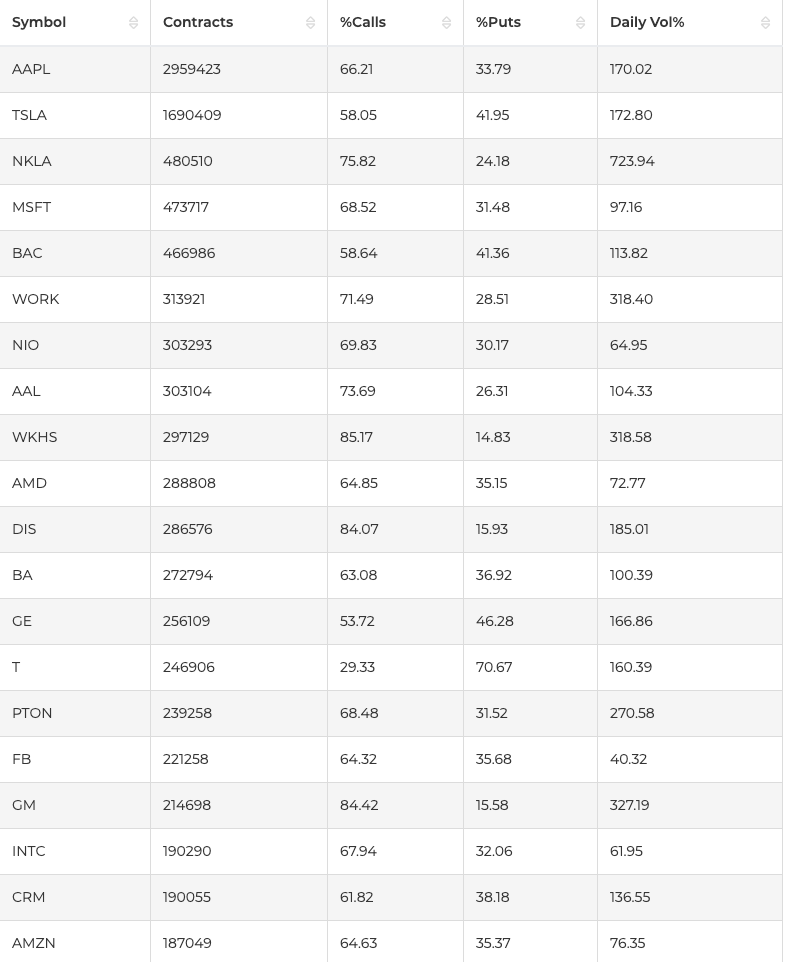

If we look at the most active symbols traded then call activity FAR outweighs put activity. Which is interesting in that almost none of these symbols have recovered. MSFT for one was closing at new lows after doubling last Friday’s losses. So what gives?

SECTOR ROTATION – that’s what. At least a blatant attempt to do so. Which may succeed, we probably know a lot more today (my old ‘follow up to the first follow up’ theory). What I do know is that less demand for put reduces the pressure on market makers (forced to provide them) to sell stock in order to offset their positive delta exposure.

If it succeeds we should see a meaningful bounce materialize either today or tomorrow. If it fails then strap on your helmets as the ensuing delta covering would trigger a veritable selling avalanche.

Now let’s look at a few interesting charts:

[MM_Member_Decision membershipId='(2|3)’]

I mentioned a low participation session in my intro and here’s why – the Zero indicator almost flatlined again yesterday, which led me to try a quick exploratory long position near VWAP. It failed, which sometimes happens, but overall picture points toward a sell-off that appears to be losing momentum.

The S&P cash bounced off its weekly lower expected move – during its first session. In my mind the SPX 3330 and the SPX 3300 mark in particular will be the Maginot lines to be defended for the remainder of this week. A close below 3300 will most likely open the flood gates.

I actually just updated my ‘monsters of tech’ composite index and had to increase the multipliers (AAPL in particular) by quite a bit. So it seems that AMZN continues to heavily dominate even among its big tech brethren. Not overly surprising given that many states continue to keep their local economies in suppression for reasons I leave up to your own imagination.

What I find particular interesting about yesterday’s session is what did not happen: And that’s any response in either gold…

… or in bonds. ‘Hello-oooh! Is this thing on?’ So if you thought that hedging positions in gold or bonds may protect you against a sudden sell off then you’re only halfway right.

The good news is that they didn’t fall as well, which indicates that few if any participants were forced to liquidate gold to cover losing stock positions.

The bad news is that, despite the recent rally in gold, participants were unable to muster enough energy to abandon its current sideways range. Which in turn hints at yet another frustrating sideways cycle for the gold bugs.

Bottom Line

On a short term basis we are nearing selling exhaustion and at least an obligatory bounce is most likely going to materialize before the end of the week. On a medium term basis however we are experiencing selling continuation during what is historically the most bullish week of September. Given that my outlook for the next few weeks is at minimum ‘not bullish’ and I may upgrade that to ‘bearish’ if the short term bounce turns out to be only lackluster.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]