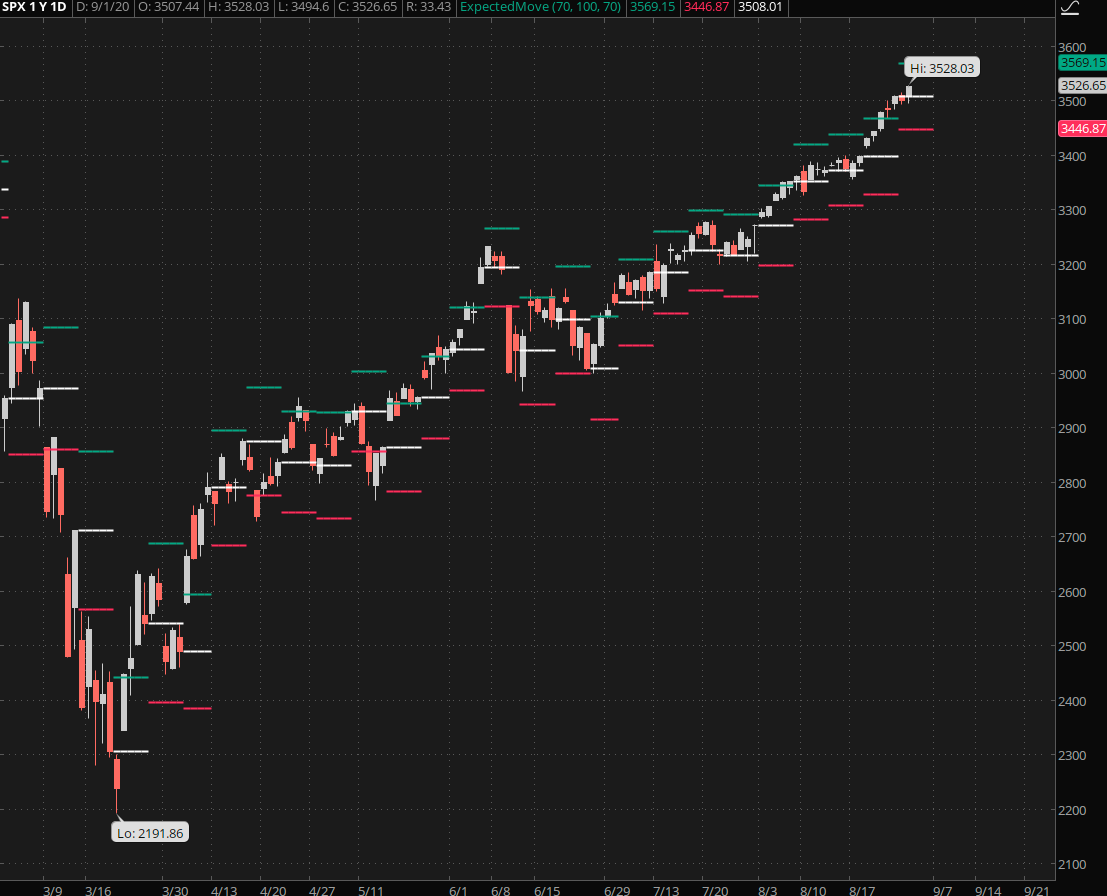

Equities continue to power higher with no apparent end in sight whilst ignoring all seasonal bias. This does not come as a huge surprise as we are in the midst of a powerful low volatility bull cycle that is partially fueled by the systematic inflation of the U.S. Dollar – long term consequences be damned. Cash may have used to be king but not now it’s everyone’s least favorite step child.

One of the main problems with self destructive habits is that you get away with it for quite a long time as most long term and irreversible consequences only begin to appear once you’ve reached the acceleration point on the exponential curve. Ask your average smoker about that – or perhaps your average Fed chairman.

Equities of course are the main beneficiaries and big tech in particular is now running on cruise control. Forgive me for posting this chart on a recurring basis but short of Bitcoin and a few low liquidity commodity contracts I have rarely seen an advance that enters vertical mode and then continues to power higher without as much as a hiccup.

The VIX has been running a bit hotter over the past few days but that’s actually not too unusual given that we continue to plot new all time highs on a weekly basis now. The only difference is that this time around our lower baseline seems to be at a hard limit around VIX 22.

[MM_Member_Decision membershipId='(2|3)’]

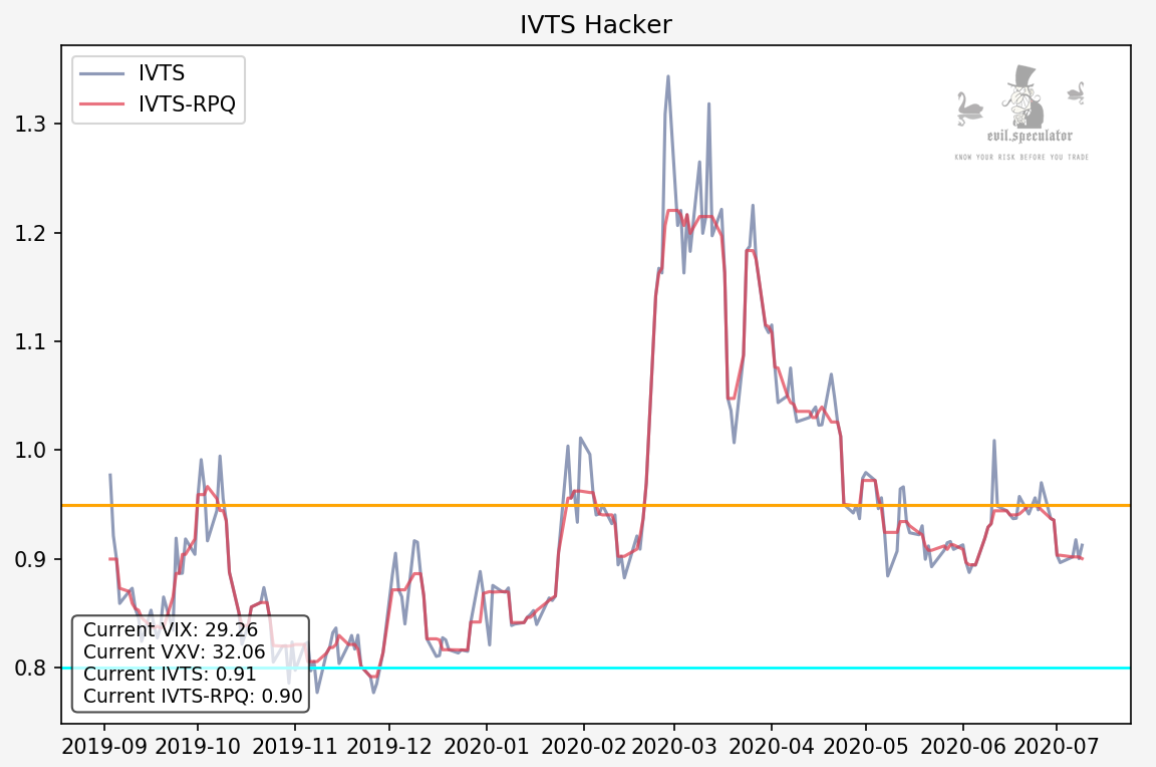

I keep expecting a similar response on the IVTS but for some reason it ain’t happening. The current reading of 0.91 is just at the cusp of where traditionally mean reversion systems start to break down, at least based on the statistics we’ve run over the past few years.

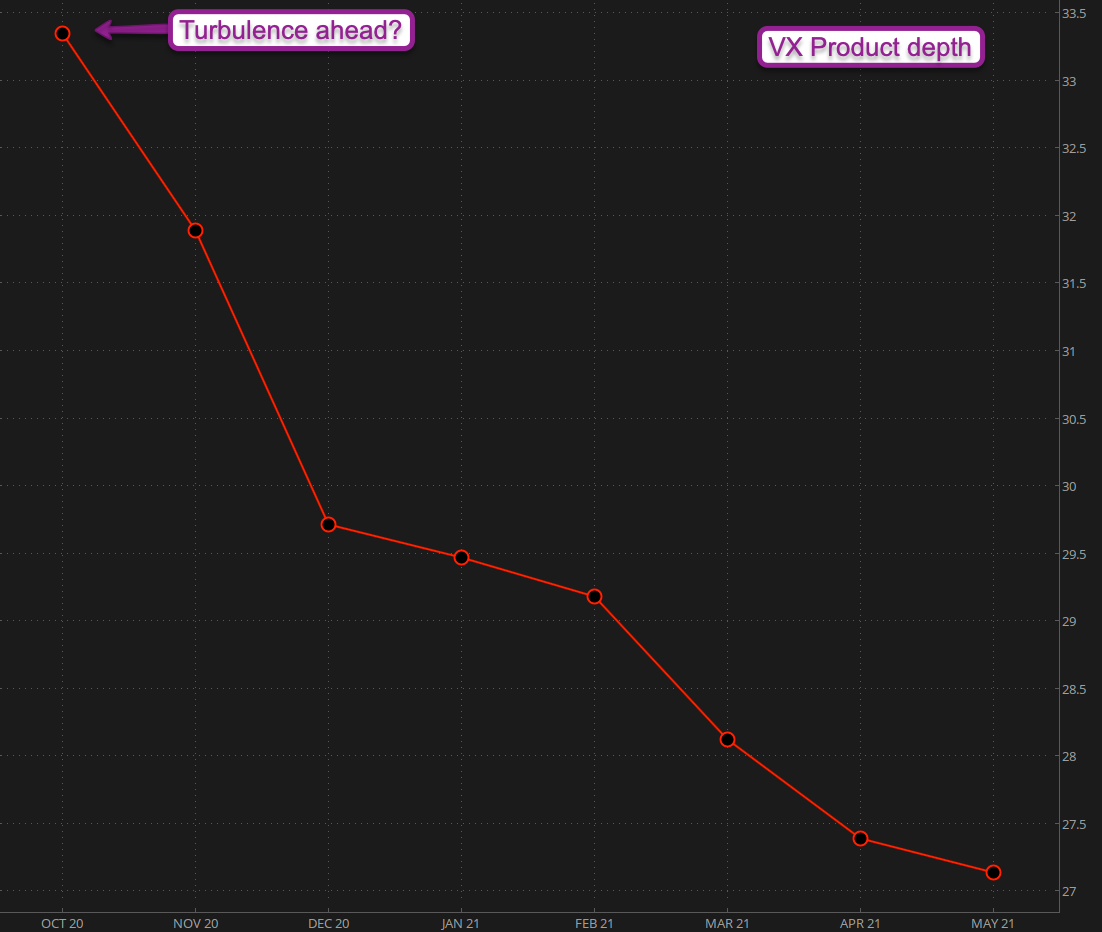

Which stands in stark contract to the rather steep backwardation we continue to see in the VX futures. I would have expected to see a bit more volatility in November, which would be reflected in the December contract.

Judging at least by the current state of affairs IV may be over priced and put holders will be sorely disappointed. Of course the month has just begun – a lot can still happen. Either way for now any downside protection you may consider (e.g. out of the money SPY or QQQ puts) will command an extra premium.

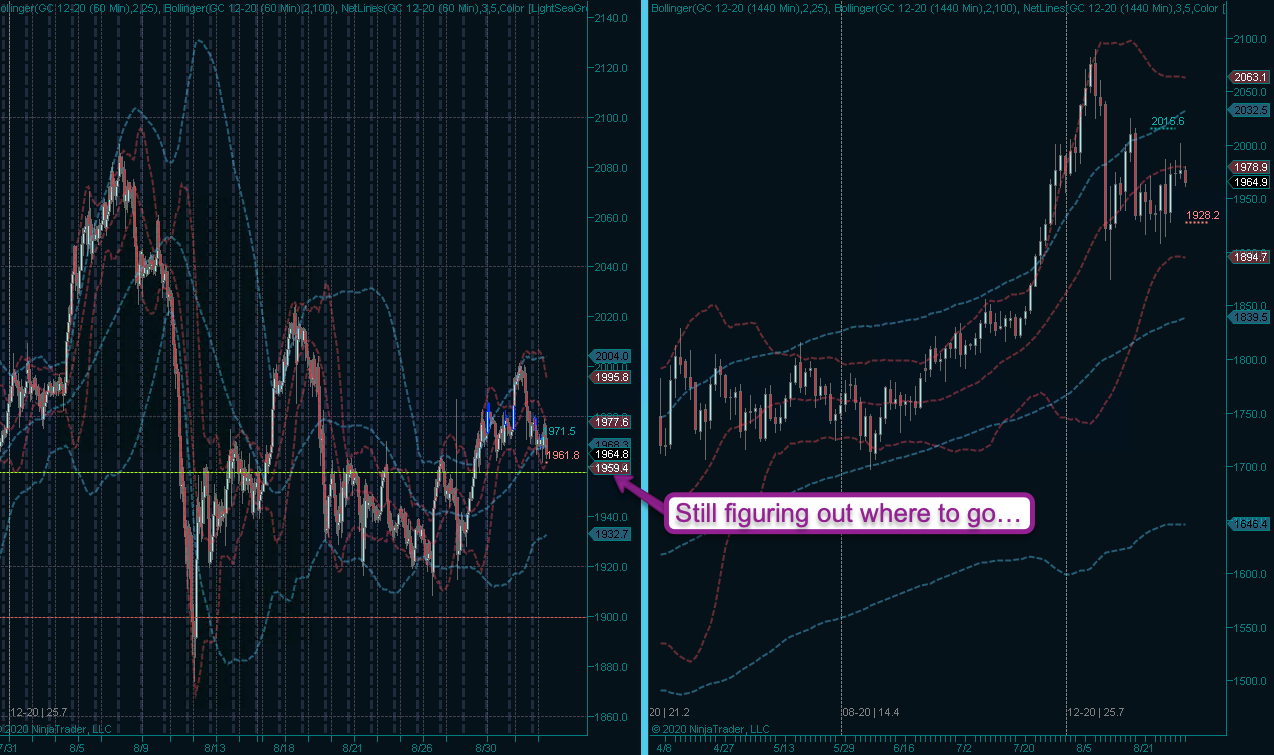

Gold has been whipsawing all over the place trying to figure out where to run. My ISL was never challenged but unless it gets out of the gate soon gravity may start dragging it lower. That said – I have seen gold do that on many occasions.

And by that I mean plot a perfect looking entry formation but then churn sideways for weeks until it suddenly takes off. I can’t promise that’s what’ll happen this time around but at least for now I don’t see any reason to exit.

[/MM_Member_Decision]

[MM_Member_Decision membershipId=’!(2|3)’]

Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]

[MM_Member_Decision isMember=’false’]

Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]