We are only eight months into the year but for all intents and purposes 2020 will be remembered by future historians as a year of explosive change and implacable economic Darwinism. At no other moment in time was there ever the possibility of shutting down a nation’s entire economy – let alone a global one – due to war, disease, or any other reason. It didn’t happen during WW1, neither did it happen during WW2, the Spanish Flu in 1918, the American polio epidemic in 1916, or the Asian flu in 1957.

Of course back then our grandparents still had to rely on analog communication as well as analog trade channels with deeply rooted dependencies in the real world. In 2020 any remaining real world dependencies have been consolidated on a massive scale and are effectively controlled by a small number of large players. While COVID-19 and the resulting global economic shutdown will most likely be remembered as the most salient event of the year, what has quietly happened behind the scenes deserves a lot more attention.

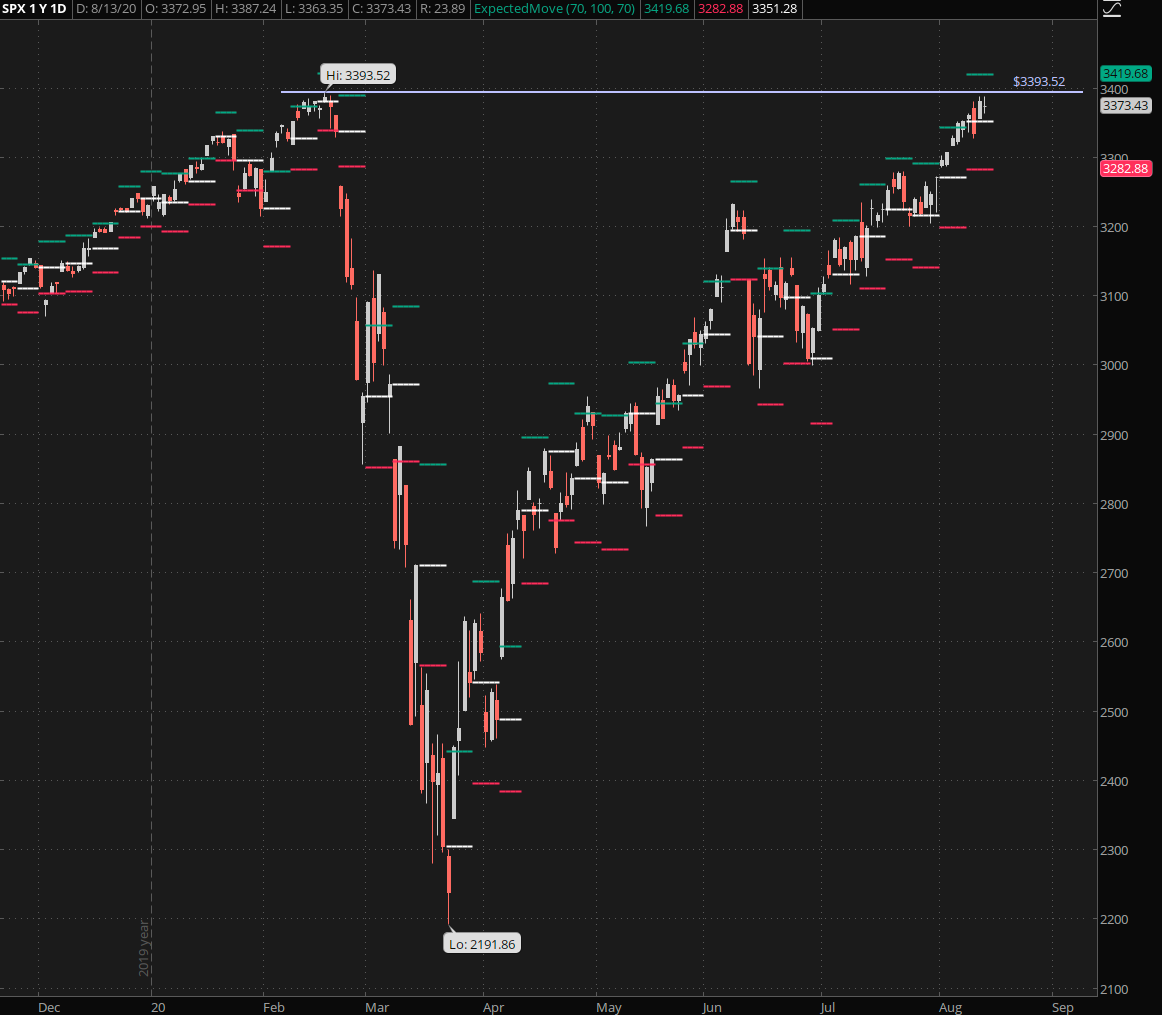

The first take away – which isn’t exactly a new lesson given the events of the past decade – is that the markets do not care at all about main street. While traditional retail, mom & pop shops, and restaurants, have been and continue to be decimated across the Western hemisphere the equity market embarked on one of the most violent rebounds in financial history.

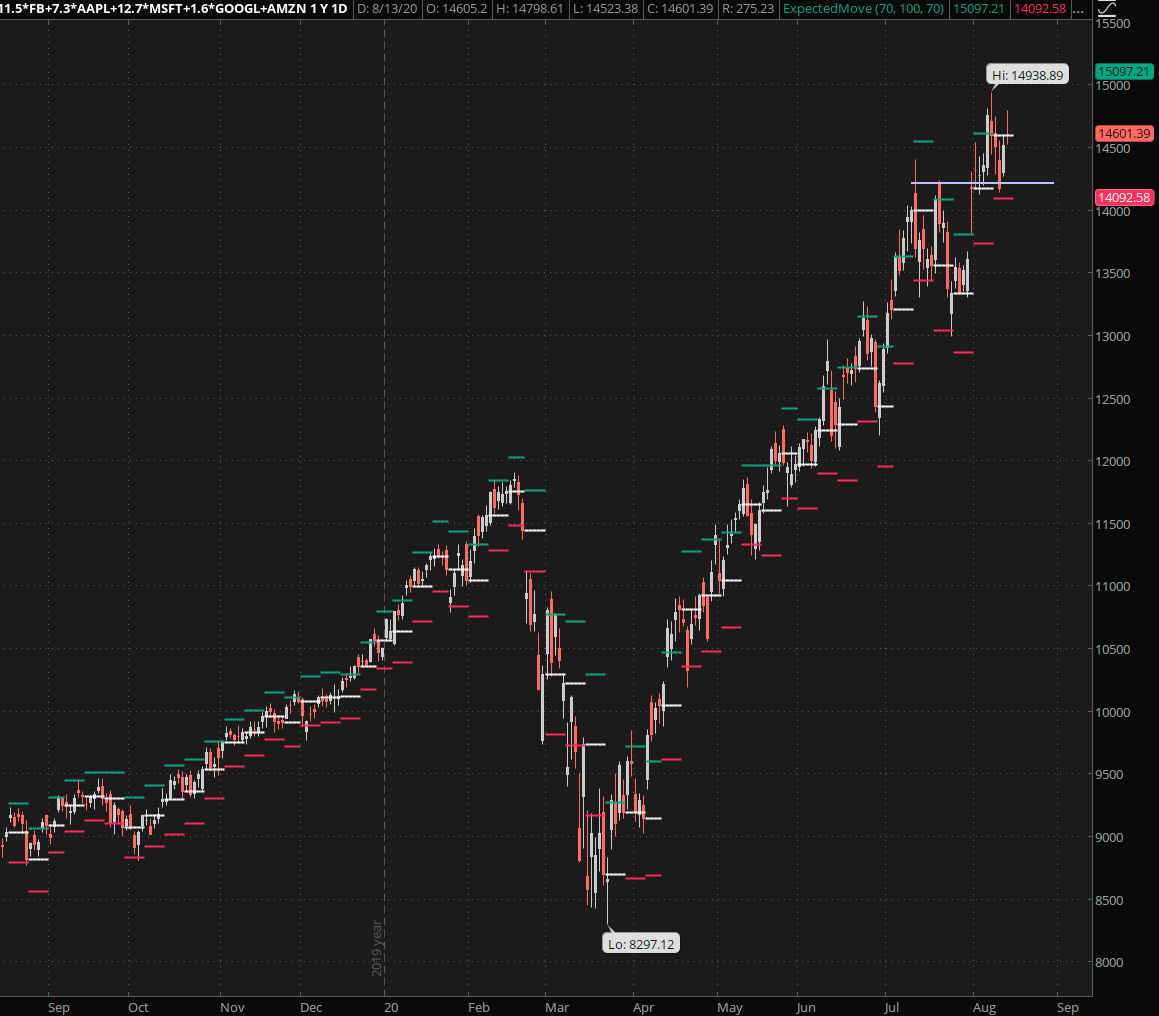

What’s even more compelling however is what – or better yet WHO – is driving all that growth. Although the tide has lifted a many boats over the past six months the main beneficiary of 2020 is big tech, and more specifically five companies: AAPL, AMZN, GOOGL, MSFT, and FB.

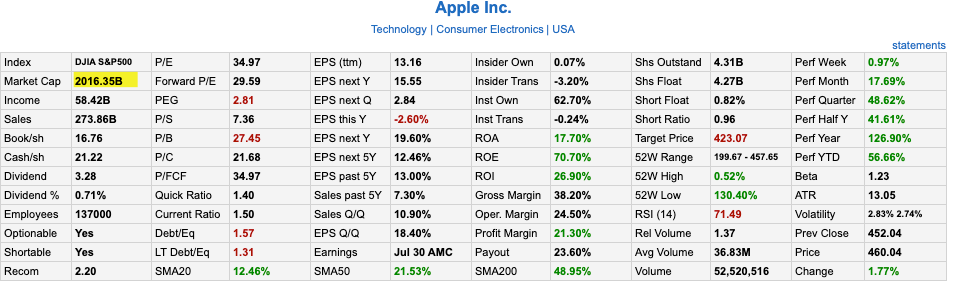

Finviz currently shows AAPL at a $2 Trillion market cap, the first company to ever claim such a gigantic valuation. I’m not sure if many of you remember my ‘big tech burning the shorts’ post but I remember writing it only a few months ago and at that time Apple’s market cap was still hovering around the $1 Trillion mark which was big news at that time.

Where will AAPL be a year from now?

[MM_Member_Decision membershipId='(2|3)’]If you’re old enough then you may remember August 7th, 1997 when Bill Gates nervously joined Steve Jobs on stage in front of a booing audience announcing Microsoft’s investment of $150 Million in Apple stock. Apple hadn’t been doing so well and although Steve was back at the helm the company found itself in major financial trouble.

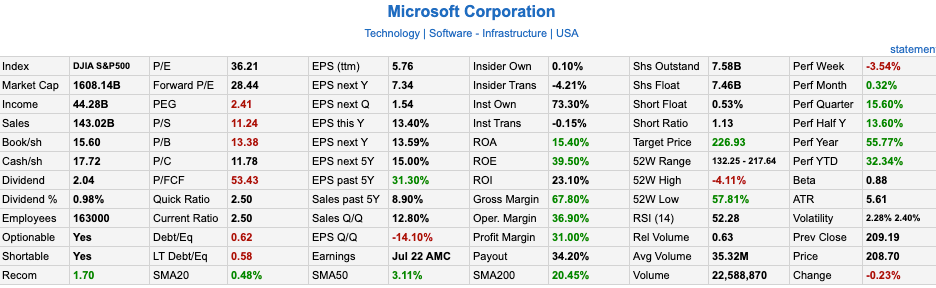

Without Bill’s investment we may have long forgotten about Apple, and most likely we would be living in a very different world today as I don’t see the smart phone revolution gripping the planet so quickly without Steve’s creative obsession. Which is why it’s almost humorous to see MSFT trail AAPL in 2020 – albeit not by much as its market cap just rose to a whopping $1.6 Trillion.

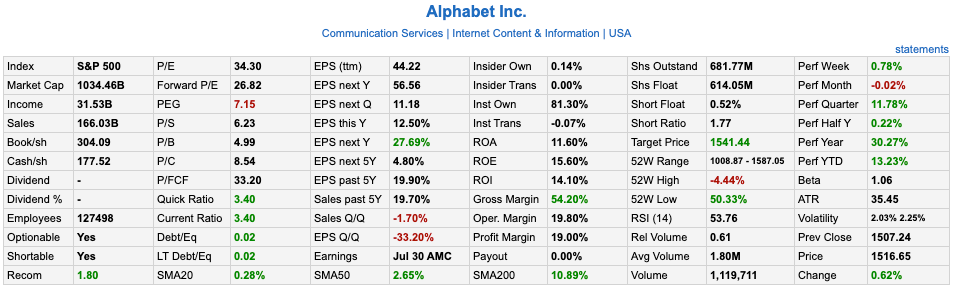

Google didn’t even exist yet back then but it’s catching up quickly with a current market cap of $1 Trillion. Not bad for a search engine that once prided itself of being ‘not evil’, a clause it quietly removed from its corporate code of conduct two years ago.

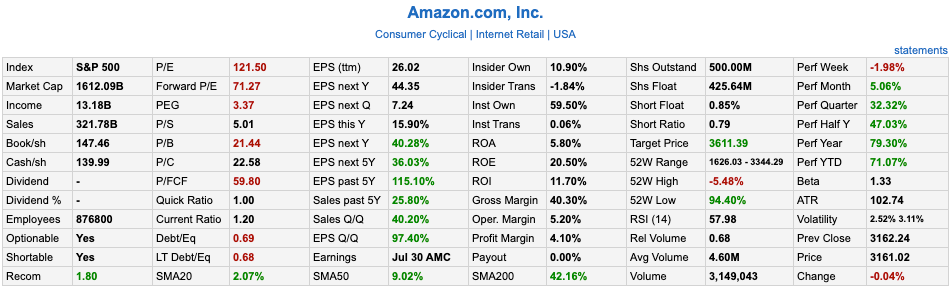

Not surprisingly COVID-19 has been manna from heaven for retail giant Amazon evidenced by a $1.6 Trillion market cap. Don’t get me wrong – traditional retail was already in big doo-doo way ahead of 2020, but the global lockdown pretty much spelled the death knell for high street vendors and mom & pop shops alike.

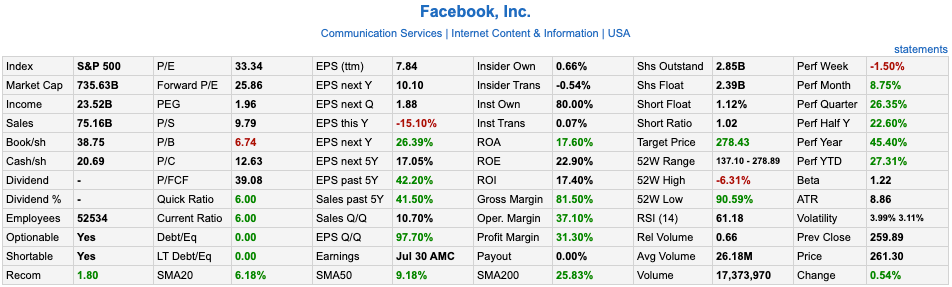

Finally here’s Facebook – controversial as ever and Zuckerberg never as much as bothered to pretend not wanting to be evil. However it’s still going strong at a market cap of $735 Billion. That ‘used’ to be considered a gigantic valuation just a year or two ago but these days FB remains stuck in the B-team.

Brave New World

The point of this post isn’t really trading related – per se – in that I may be talking about a possible edge here, short, medium, or long term. Rather it is the realization that – like it or not – we all live in a brave new world now. One dominated by mega corporations that wield almost infinite financial resources and – let’s not kid ourselves – massive influence.

I read William Gibson’s Neuromancer as a child and was fascinated as well as frightened by his dark vision. I even met the man in Austria in the late 1980s during a book signing at Ars Electronica. But not in my wildest dreams did I ever imagine I would end up living in a world of virtual megacorps where more and more aspects of life have drifted into the realm of cyberspace.

Of course as there never is such a thing as a free lunch – all that rapid growth and all those trillion Dollar valuations have come at a massive sacrifice. Main street finds itself utterly decimated and the full cost of this economic transformation has not even completely sunk in yet. 2020 in effect represents the death of traditional retail with numerous intended as well as unintended consequences.

Here in Spain the ‘Asociación Española de Gestores’ has projected that over 50% of all retail business will be wiped out by the end of the year. With no political concerns given to millions of jobs about to be lost I wonder what the long term social, economic, and cultural impact of it all will be.

And that brings me round circle and what motivated to write this post in the first place. It is my firm belief that we have reached an economic event horizon of sorts from which will be no return. Once all these small and medium businesses have been wiped out they most likely won’t ever be back.

Your mission for the weekend – should you choose to accept it – is too project yourself forward into a world where a digital economy has almost completely transplanted the vestiges of what remains of our current economic infrastructure. Big tech isn’t going anywhere – on the contrary, it now wields more power and resources than ever before. How you fit into this world will define your future and your prosperity throughout the remainder of your life.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]