Rumor has it U.S. Treasury Secretary Mnuchin wants a stable Dollar and that protecting its status as a reserve currency allegedly is the goal of the Trump administration. Unfortunately it appears that Mr. Mnuchin’s definition of ‘stable’ differs significantly from mine as the DXY has effectively entered a state of freefall over the past week.

And it may get a lot worse before it gets better. Recent CFTC reports show asset managers have added to their net long positions on the yen, the euro, the loonie, and the Swiss franc, which added fuel to a sell off that has sent the DXY tumbling by over 3% just this month.

Over the past three months the DXY has declined a whopping 5% which is heavily weighted against the EUR/USD. So while my ATM is mocking me over here in Spain all of you guys living and working stateside will most likely experience creeping price inflation all across the board, in particular when it comes to basic necessities like groceries, many of which are being imported from overseas.

The current Dollar short squeeze has sent gold into the stratosphere, which makes me very happy as I recommended long positions all the way back in early June at around GC 1740. It’s trading just below 1940 right now. You are welcome 😉

More market insights waiting below the fold for my intrepid subs:

[MM_Member_Decision membershipId='(2|3)’]

Equities didn’t go anywhere during my absence – as a matter of fact we closed almost exactly where we left off the preceding Friday. The IV-Z Score indicator on the bottom shows us reverting back to the median, indicating that fear is slowly abating.

My ‘Monsters Of Tech’ composite has dropped to a previous resistance cluster that is now acting as support. There may be great entry opportunities here if you stick to the top five symbols, e.g. FB, MSFT, GOOGL, AAPL, and AMZN – nothing else really seems to matter anymore. Neuromancer here we come.

Talking about cyberpunk – junk bonds continue to slowly creep higher and currently remain pinned below medium term resistance. A push above this would most likely lead to a rush higher toward recent highs.

Of course a reversal play is possible here but I given the prior gyrations you would have to be very patient as volatility continues to drop.

The VIX continues to bounce off the 23.5 mark which apparently is our new base. NOT exactly a low reading by historical standards, in fact anything above 15 is usually considered pre-bearish territory. Of course in 2020 nobody is ever going to truly relax.

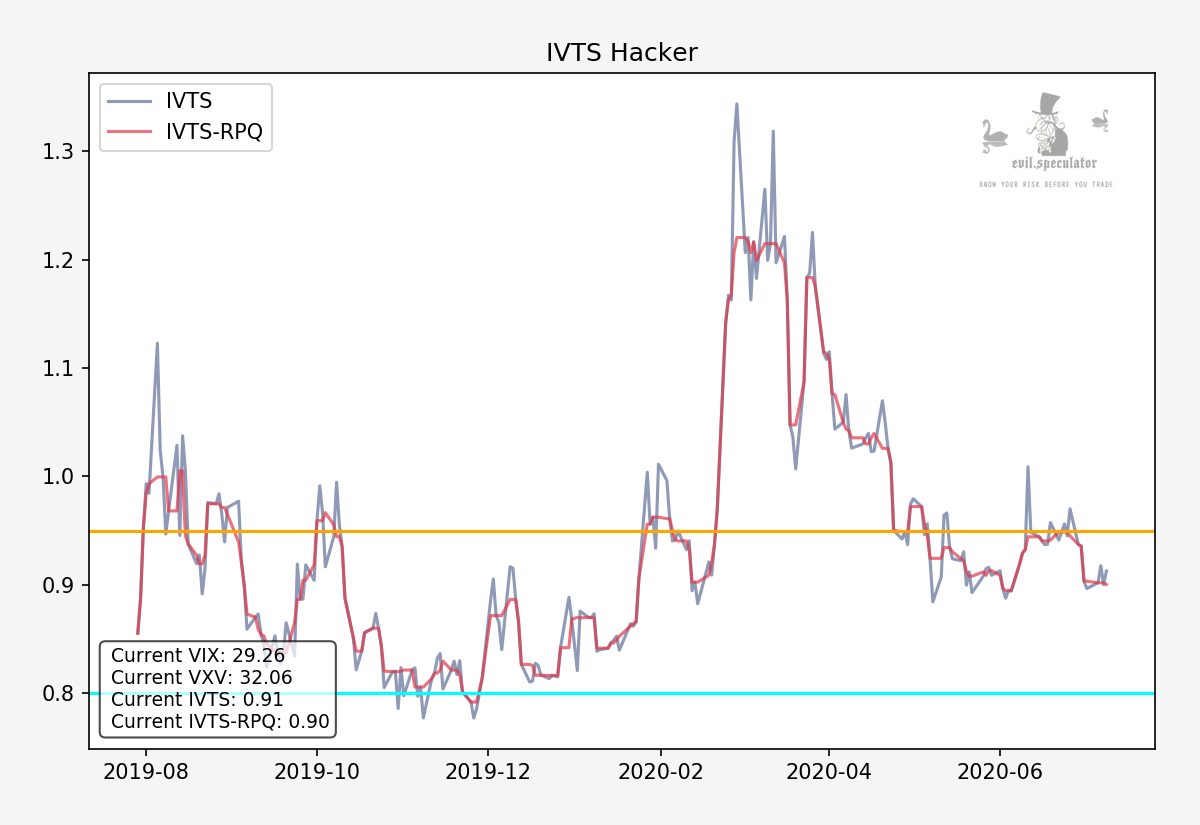

IVTS on the other hand remains in quasi normal levels – meaning no warning signs at least as of right now.

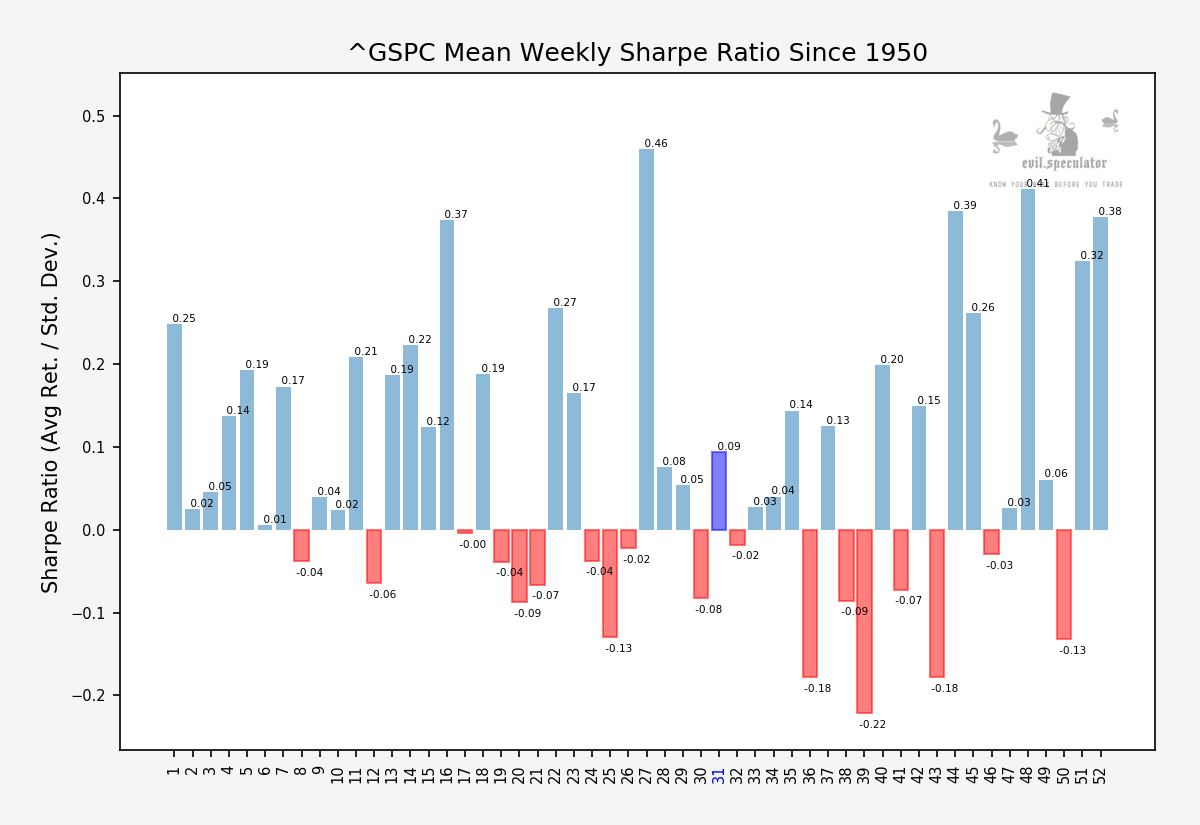

Quick run down of this week’s statistics. We are looking at a positive week here with a historic Sharpe ratio of 0.09. Nothing to write home about but I recommend we enjoy the silence before the looming storm later this fall.

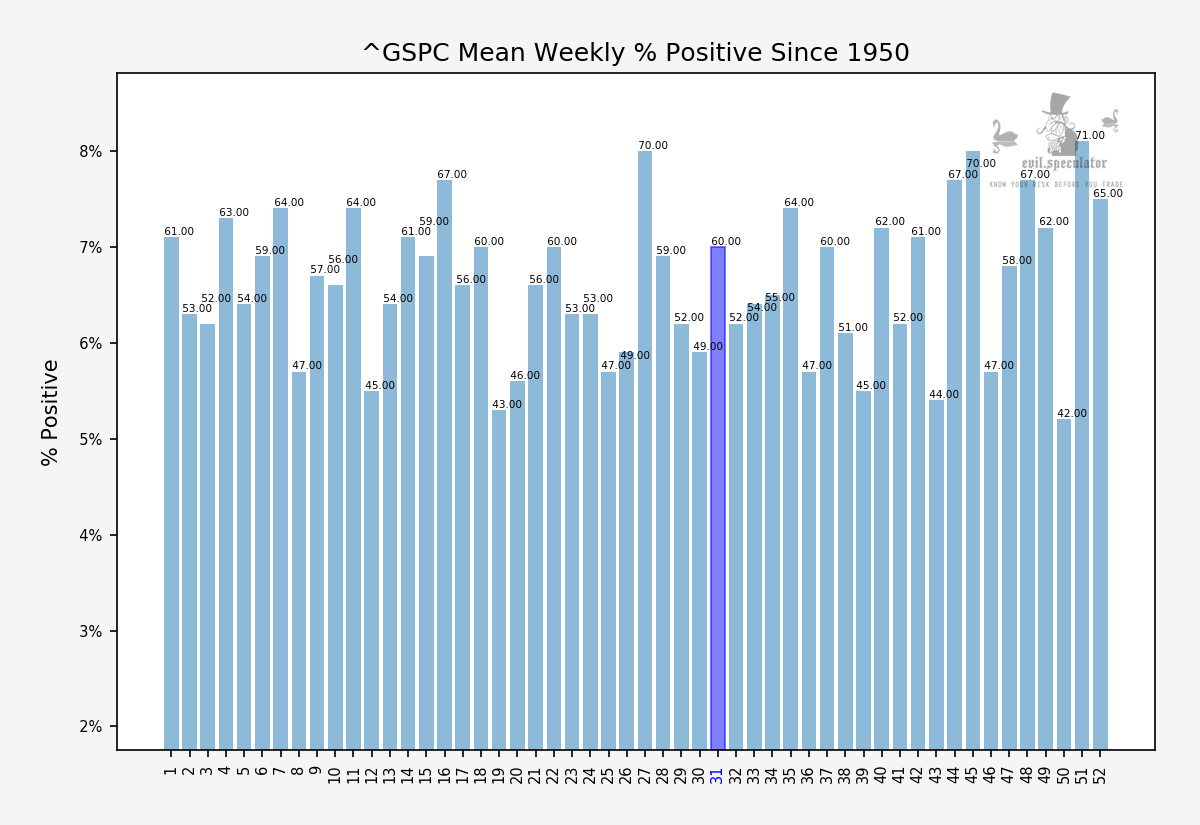

Percent positive is at 60% – hey I’d take those odds anytime.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]