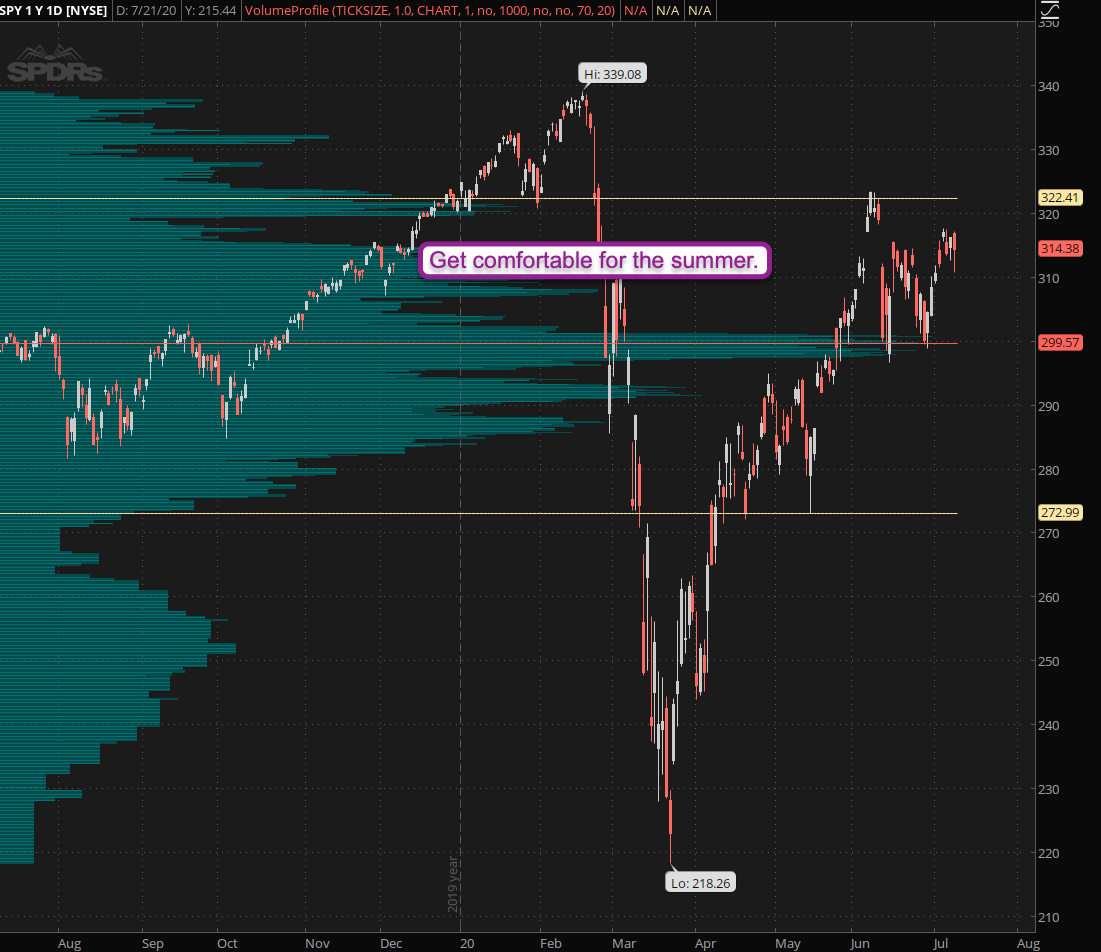

As anticipated equities have been running in circles this week and barring a major market moving event we most likely will close inside the weekly expected range. With the meat of the summer season still ahead of us the immediate implication for traders is that directional strategies will suffer – unless of course you keep betting on big tech.

To invert the old expression: One man’s purgatory is another’s heaven. Sideways tape may be veritable Kryptonite for directional or discretionary traders but it can be extremely profitable when trading volatility and time in particular via options. Which is exactly what Tony and I have been doing over the past few weeks and quite profitably so if I may say so.

That of course does not mean that volatile periods are off limits to option traders – quite on the contrary. We were selling inflated IV to hapless Robinhood ratlings over the past 2 earnings seasons and are very much looking forward to doing it again in October.

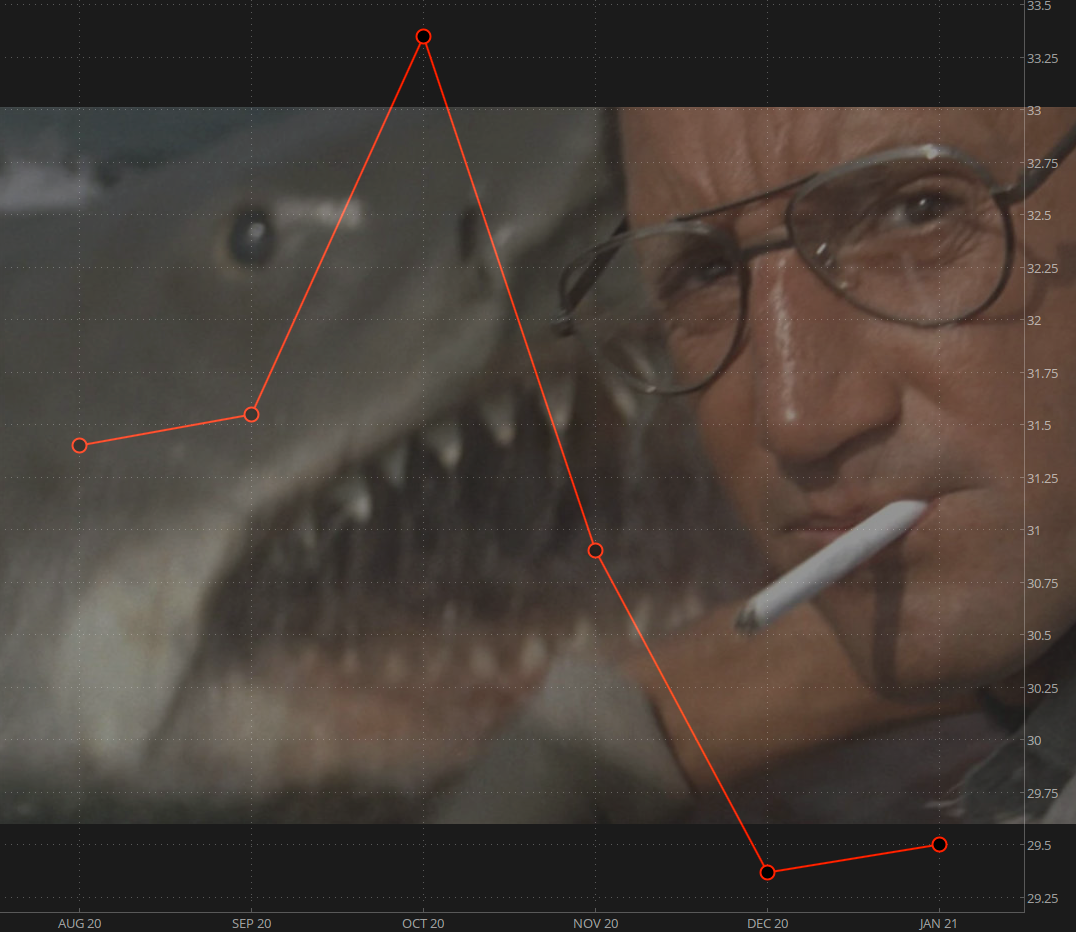

What about July? Well it’s mid summer and IV is usually more suppressed. Not surprisingly October historically shines in that department, and 2020 is no exception – quite to the contrary actually. The VX futures product depth chart continues to show us a massive fin shark formation which has us in contango until October and in backwardation until early next year.

Such drastic shifts in implied volatility will require skill and a bit of finesse to navigate. You may want to bring some harpoons, a scuba tank, and a rifle.

More market analysis and ill fated teutonic humor below the fold for my intrepid subs:

[MM_Member_Decision membershipId='(2|3)’]

I mentioned big tech which cues my composite chart that continues to rise in an exponential fashion. Except for FB each of them (MSFT, GOOG, AAPL, AMZN) is now valued at over $1 Trillion – let that sink in for a moment. Everyone and their grandmother has effectively piled into big tech.

And now imagine for a moment what happens when the game of musical chair stops.

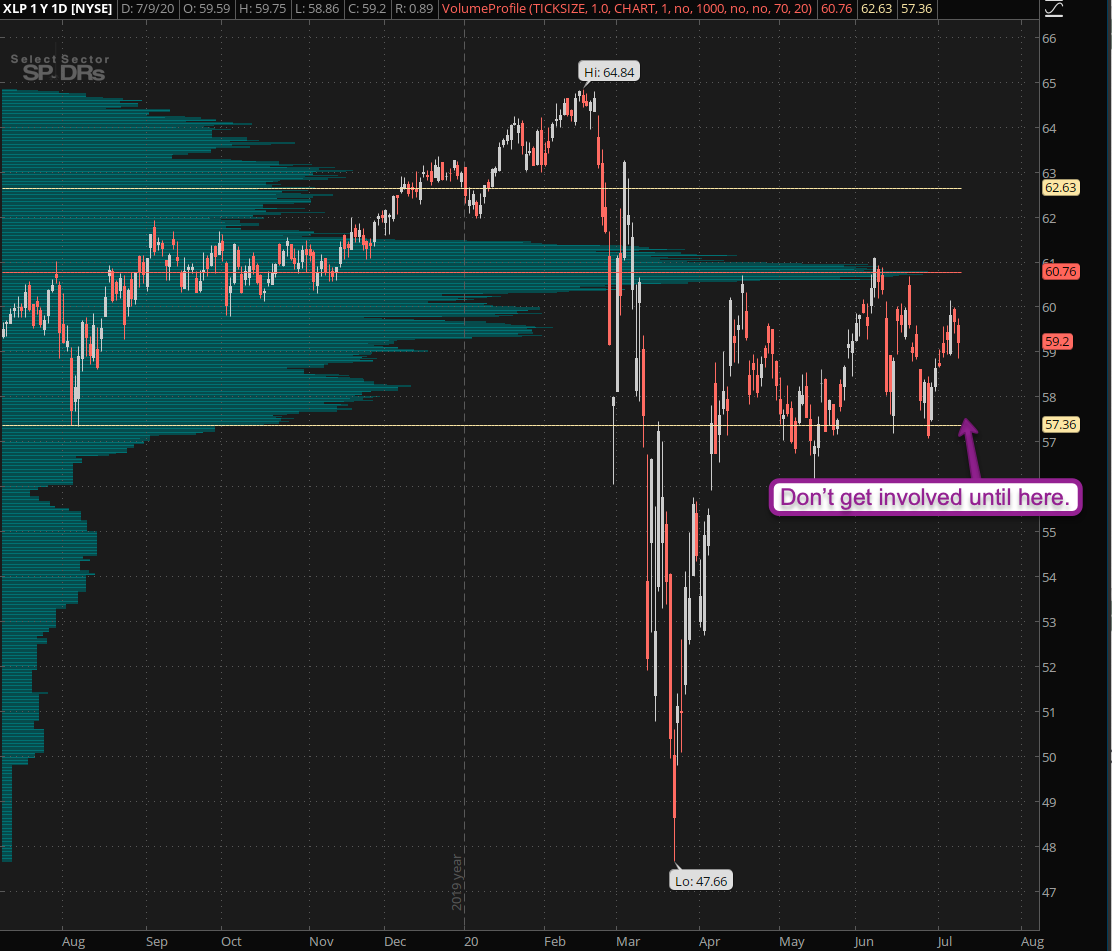

Meanwhile XLP – you know all the stuff we need and use in reality – has been treating water and I wouldn’t get involved unless we see a drop to about 57 and change. May become a good long opportunity however, especially if sector rotation starts to move against big tech.

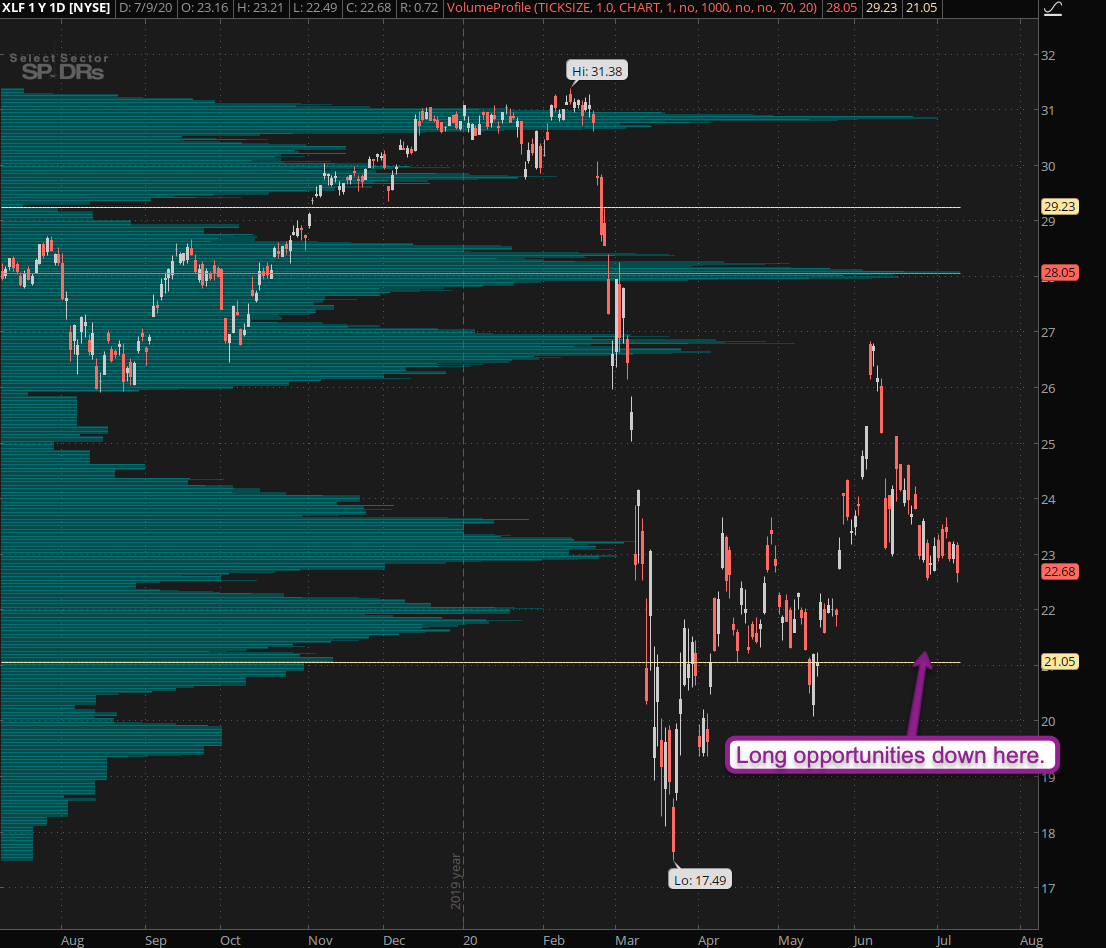

Similar story with XLF but here we are far from any buying opportunity. Unless I see a touch of 21 I’m not tempted and neither should you. It’s really strange situation we find ourselves now where a very narrow market segment basically has turned into a financial black hole that sucks in everything in its vicinity whilst dimming out everything else.

Whether main street will ever recover from this is anyone’s guess and probably not a question I should be spending to much time on given that this is a purely trading related blog. But as a trader with 20+ experience I also recognize when I see too many market participants chase the same edge.

Take another look at the VX product depth chart I posted above. Given the current market dynamics who or what do you believe would be a prime target for a big take down in October? That’s right – and shorting big tech in early fall could turn out to be one of the most profitable strategies of 2020.

But until then – patience grasshopper – all in good time.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]